A negative yield occurs when investors pay more for a Treasury bond than the bond will pay back at maturity, resulting in a guaranteed loss if held to term. In contrast, a zero yield means the bond's purchase price equals the amount paid at maturity, leading to no net gain or loss. Negative yields often signal economic uncertainty or deflationary expectations, while zero yields indicate a neutral return on investment.

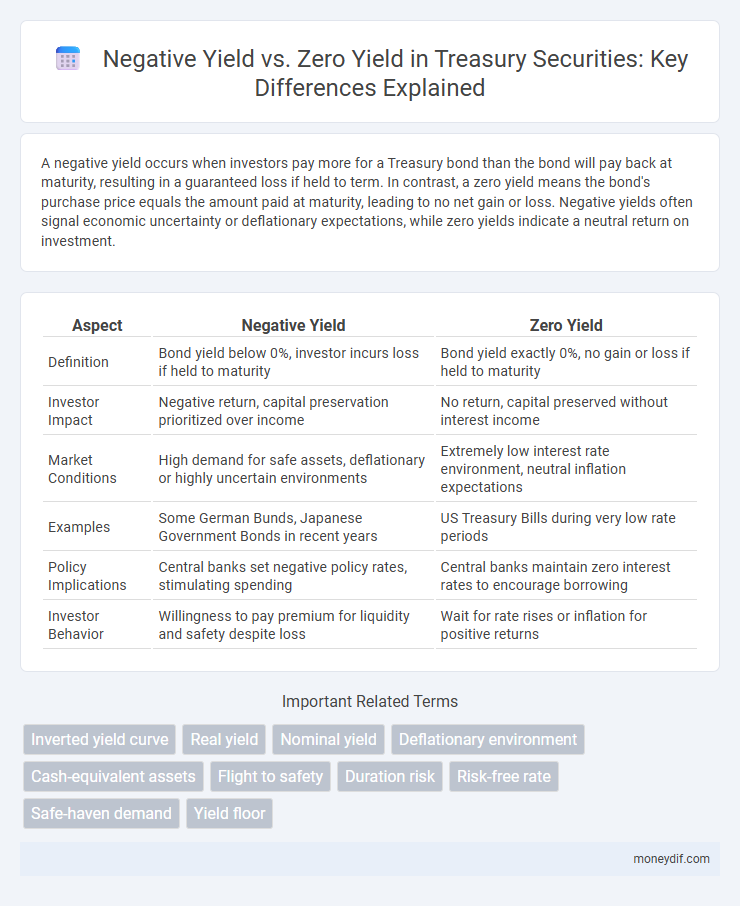

Table of Comparison

| Aspect | Negative Yield | Zero Yield |

|---|---|---|

| Definition | Bond yield below 0%, investor incurs loss if held to maturity | Bond yield exactly 0%, no gain or loss if held to maturity |

| Investor Impact | Negative return, capital preservation prioritized over income | No return, capital preserved without interest income |

| Market Conditions | High demand for safe assets, deflationary or highly uncertain environments | Extremely low interest rate environment, neutral inflation expectations |

| Examples | Some German Bunds, Japanese Government Bonds in recent years | US Treasury Bills during very low rate periods |

| Policy Implications | Central banks set negative policy rates, stimulating spending | Central banks maintain zero interest rates to encourage borrowing |

| Investor Behavior | Willingness to pay premium for liquidity and safety despite loss | Wait for rate rises or inflation for positive returns |

Understanding Treasury Yields: Negative vs Zero

Treasury yields represent the return investors receive from government debt securities, with zero yield indicating a breakeven point where investors neither gain nor lose money. Negative yields occur when investors accept a guaranteed loss, typically due to extreme risk aversion or expectations of deflation, reflecting unique market conditions. Understanding the difference between negative and zero yields is crucial for assessing economic signals and making informed investment decisions in the fixed income market.

Causes of Negative Treasury Yields

Negative Treasury yields occur when investors accept a guaranteed loss to preserve capital amid economic uncertainty or deflation expectations, often driven by aggressive central bank policies such as quantitative easing and ultra-low interest rates. Zero yields typically reflect a neutral economic outlook where demand for safe assets matches supply without significant inflation or deflation pressures. Factors like flight-to-safety behavior during market turmoil, regulatory requirements for holding government securities, and negative real interest rates also contribute to the prevalence of negative yields in Treasury securities.

Factors Leading to Zero Yield Treasuries

Zero yield Treasuries occur when the bond's coupon payments effectively offset the purchase price, resulting in no net return despite holding to maturity. Factors leading to zero yield Treasuries include elevated demand during periods of extreme risk aversion, negative real interest rates, and aggressive monetary policies such as quantitative easing that suppress benchmark yields. Market expectations of deflation or economic downturns further reinforce investor preference for zero yield bonds as safe-haven assets.

Global Economic Impact of Negative Yields

Negative yields in global Treasury markets signal investor preference for safety over returns, reflecting economic uncertainty and deflationary pressures in major economies. Unlike zero yields, which indicate neutral cost of borrowing, negative yields impose a cost on lenders, influencing capital flows and prompting central banks to implement unconventional monetary policies. This dynamic affects global investment decisions, currency valuations, and sovereign debt sustainability, shaping economic growth and financial stability worldwide.

Investor Behavior in Zero Yield Environments

In zero yield environments, investors often shift their focus toward capital preservation and seek alternative assets offering better returns or inflation protection, given the absence of nominal interest income. Unlike negative yield scenarios, where investors may accept losses for safety or liquidity, zero yield conditions encourage longer-duration holdings and increased risk tolerance to achieve positive real returns. This behavioral adjustment reflects a strategic balance between risk exposure and income generation amid minimal or non-existent yields on traditional Treasury securities.

Risks and Rewards: Negative vs Zero Yield Treasuries

Negative yield Treasuries pose the risk of guaranteed capital loss if held to maturity but offer safety and liquidity in uncertain markets. Zero yield Treasuries eliminate this loss potential while providing minimal return, appealing to risk-averse investors prioritizing principal preservation. Understanding the trade-off between negative yields' cost and zero yields' opportunity is crucial for managing portfolio risk and reward.

Policy Drivers Behind Yield Movements

Negative yields often reflect central bank policies aimed at stimulating economic growth through ultra-loose monetary policy and quantitative easing, signaling investor preference for safety over return. Zero yields typically arise when central banks maintain rates near zero to support liquidity without pushing returns into negative territory, balancing growth incentives and financial stability. Both yield scenarios are driven by macroeconomic factors including inflation expectations, GDP growth forecasts, and global risk sentiment influencing Treasury demand.

Comparative Historical Trends in Treasury Yields

Historical trends in Treasury yields reveal that negative yields emerged predominantly in the post-2010 quantitative easing era, contrasting sharply with the zero or near-zero yields prevalent during the 2008 financial crisis. Negative yields signal investor demand exceeding risk-free return expectations, often linked to deflationary pressures and unconventional monetary policies, while zero yields typically reflect central banks' emergency rate cuts to stimulate growth. Comparative analysis highlights how negative yields represent a deeper level of investor caution and market stress than zero yields, marking an unprecedented shift in Treasury market dynamics over the past two decades.

Implications for Bond Market Strategies

Negative yield bonds force investors to accept a guaranteed loss, prompting shifts toward shorter maturities and high-quality assets to preserve capital and liquidity. Zero yield securities eliminate interest income as a return source, increasing reliance on capital gains and intensifying demand for inflation-protected bonds. These yield environments drive strategic reallocations, altering risk tolerance and influencing portfolio duration decisions within the bond market.

Future Outlook: Navigating Negative and Zero Yield Periods

Navigating future Treasury markets requires understanding the implications of negative versus zero yields on investment strategies and economic expectations. Negative yields signal heightened risk aversion and potential deflationary pressures, prompting investors to prioritize capital preservation despite guaranteed losses, while zero yields suggest a stagnant but less volatile economic environment with low inflation expectations. Strategic asset allocation must adapt to these yield environments by balancing duration exposure and liquidity needs to optimize returns amid uncertain monetary policies and global economic shifts.

Important Terms

Inverted yield curve

An inverted yield curve occurs when short-term interest rates exceed long-term rates, often signaling a negative yield environment compared to zero yield benchmarks, indicating potential economic recession risks.

Real yield

Real yield represents the inflation-adjusted return on investment, crucial for assessing true profitability compared to nominal yields. Negative real yield occurs when inflation outpaces nominal returns, eroding purchasing power, while zero real yield means the investment's return only matches inflation, providing no actual gain in value.

Nominal yield

Nominal yield measures the annual return of a bond without inflation adjustment, with negative yields indicating investors pay more than the bond's face value resulting in a loss at maturity, while zero yield means the bond's coupon payments equal its purchase price, generating no real gain.

Deflationary environment

Deflationary environments often drive negative yield bonds as investors accept below-zero returns to preserve capital, contrasting with zero-yield assets that offer no real income but minimal risk.

Cash-equivalent assets

Cash-equivalent assets with negative yields erode principal value over time, whereas zero-yield assets preserve capital without generating income.

Flight to safety

Flight to safety intensifies as investors shift from negative-yielding bonds to zero-yield assets seeking capital preservation amid market uncertainty.

Duration risk

Duration risk increases as bond yields approach zero or turn negative, amplifying price sensitivity to interest rate changes. Negative yields exacerbate this risk by compressing yields below zero, causing longer duration effects and greater potential losses from even minor rate fluctuations.

Risk-free rate

Risk-free rates can turn negative during periods of economic uncertainty, signaling that investors accept guaranteed losses for safety, whereas zero yield indicates a neutral baseline with no expected gain or loss on risk-free securities.

Safe-haven demand

Safe-haven demand intensifies when negative-yielding bonds outnumber zero-yielding alternatives, as investors prioritize capital preservation over minimal returns despite guaranteed losses. The shift from zero to negative yields signals heightened market uncertainty, driving increased allocations to perceived secure assets such as government bonds from stable economies.

Yield floor

A yield floor is a financial mechanism that prevents bond yields from dropping below a specific threshold, often set at zero, to protect investors from negative yield risks. It ensures that returns do not fall into negative territory, helping stabilize fixed-income portfolios in environments where negative yields are prevalent compared to zero yield benchmarks.

Negative yield vs Zero yield Infographic

moneydif.com

moneydif.com