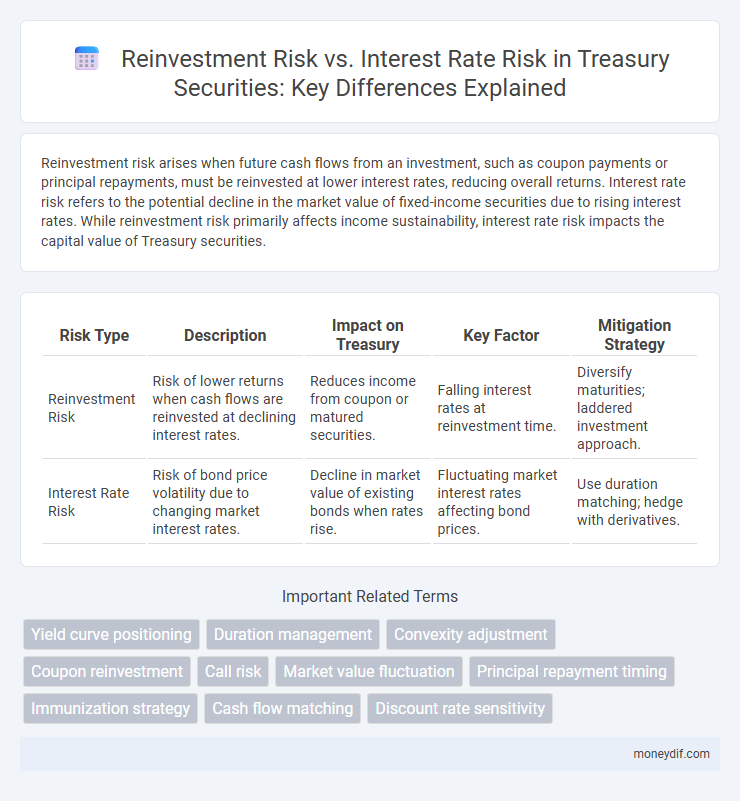

Reinvestment risk arises when future cash flows from an investment, such as coupon payments or principal repayments, must be reinvested at lower interest rates, reducing overall returns. Interest rate risk refers to the potential decline in the market value of fixed-income securities due to rising interest rates. While reinvestment risk primarily affects income sustainability, interest rate risk impacts the capital value of Treasury securities.

Table of Comparison

| Risk Type | Description | Impact on Treasury | Key Factor | Mitigation Strategy |

|---|---|---|---|---|

| Reinvestment Risk | Risk of lower returns when cash flows are reinvested at declining interest rates. | Reduces income from coupon or matured securities. | Falling interest rates at reinvestment time. | Diversify maturities; laddered investment approach. |

| Interest Rate Risk | Risk of bond price volatility due to changing market interest rates. | Decline in market value of existing bonds when rates rise. | Fluctuating market interest rates affecting bond prices. | Use duration matching; hedge with derivatives. |

Understanding Reinvestment Risk in Treasury Management

Reinvestment risk in treasury management arises when cash flows from maturing securities must be reinvested at lower interest rates, potentially reducing overall portfolio returns. This risk is especially significant in a declining interest rate environment, impacting projected income and cash flow stability. Effective treasury strategies incorporate diversification and laddering of maturities to mitigate reinvestment risk and balance interest rate exposure.

What is Interest Rate Risk? An Overview for Treasurers

Interest rate risk refers to the potential for investment losses due to fluctuations in interest rates, impacting the value of fixed-income securities and borrowing costs. Treasurers must understand how rising rates can decrease bond prices and increase financing expenses, affecting cash flow and liquidity management. Effective interest rate risk management involves monitoring rate trends and employing strategies like duration matching and hedging to mitigate potential adverse effects on the treasury portfolio.

Key Differences: Reinvestment Risk vs Interest Rate Risk

Reinvestment risk arises when interest income or principal repayments are reinvested at lower interest rates, potentially reducing overall returns. Interest rate risk refers to the impact of fluctuating market interest rates on the value of fixed-income securities, causing price volatility. While reinvestment risk affects cash flow and yield on future investments, interest rate risk primarily influences the current market value of existing bonds and securities.

Impact of Reinvestment Risk on Treasury Portfolios

Reinvestment risk significantly impacts Treasury portfolios by exposing investors to the possibility that cash flows received from maturing securities must be reinvested at lower interest rates, thereby reducing overall portfolio yields. This risk becomes more pronounced in declining interest rate environments, causing a mismatch between expected returns and actual reinvestment income. Managing reinvestment risk requires strategic allocation and laddering of maturities within Treasury holdings to stabilize income and preserve capital value.

Interest Rate Movements and Treasury Bond Valuations

Interest rate movements inversely affect Treasury bond valuations, causing bond prices to fall as yields rise and vice versa. Reinvestment risk arises when coupon payments are reinvested at lower interest rates, reducing overall returns. Interest rate risk directly impacts the market value of Treasury bonds, making duration a critical measure for assessing sensitivity to rate fluctuations.

Strategies to Mitigate Reinvestment Risk

Implementing laddered bond portfolios spreads maturity dates to reduce the impact of reinvestment risk by ensuring periodic reinvestment opportunities at varying interest rates. Utilizing floating rate notes helps align coupon payments with prevailing market rates, minimizing the risk of reinvesting at lower yields. Incorporating callable bonds with embedded options requires careful analysis to manage the uncertainty of early redemption that can exacerbate reinvestment risk.

Hedging Techniques Against Interest Rate Risk

Hedging techniques against interest rate risk primarily include interest rate swaps, futures, and options, which enable treasurers to stabilize cash flows and protect bond portfolios from rate fluctuations. Utilizing interest rate swaps allows conversion of variable-rate debt to fixed-rate debt, effectively mitigating exposure to rising rates. Futures and options provide flexibility to hedge anticipated rate movements, reducing reinvestment risk by locking in favorable yields on short-term investments.

Real-world Examples of Reinvestment and Interest Rate Risks

Reinvestment risk occurs when cash flows from bonds or other fixed-income securities are reinvested at lower interest rates, as seen during the post-2008 financial crisis when investors faced declining rates and reduced yields. Interest rate risk involves the potential loss in bond value due to rising interest rates, exemplified by the Federal Reserve's rate hikes in 2015-2018, which led to falling bond prices across portfolios. Corporations managing treasury functions must balance these risks by diversifying maturities and employing hedging strategies to stabilize returns amid fluctuating rates.

Assessing Risk Exposure in Treasury Operations

Reinvestment risk in treasury operations arises when cash flows from maturing investments must be reinvested at lower interest rates, diminishing future income. Interest rate risk involves potential losses due to fluctuations in market interest rates affecting the valuation of fixed-income securities held. Effective assessment of risk exposure requires analyzing the timing of cash flows, bond durations, and prevailing economic conditions to balance portfolio stability against income variability.

Best Practices for Managing Treasury Risks

Effective treasury risk management involves balancing reinvestment risk and interest rate risk through diversification of maturity profiles and active monitoring of market conditions. Utilizing a mix of fixed and floating rate instruments helps mitigate exposure to fluctuating interest rates and reduces reinvestment uncertainty. Implementing hedging strategies, such as interest rate swaps or forward rate agreements, supports maintaining stable cash flows and protecting portfolio value.

Important Terms

Yield curve positioning

Yield curve positioning strategically balances reinvestment risk and interest rate risk by adjusting portfolio durations to optimize returns amid fluctuating interest rates.

Duration management

Duration management balances reinvestment risk and interest rate risk by adjusting bond portfolio sensitivity to interest rate changes to optimize returns and minimize potential losses.

Convexity adjustment

Convexity adjustment quantifies the impact of non-linear changes in bond prices due to interest rate fluctuations, directly influencing reinvestment risk by affecting the variability of reinvested cash flows. Interest rate risk arises from changes in market rates affecting bond prices, while convexity adjustment refines duration measures to better capture price sensitivity and reduce misestimation of risks associated with reinvestment and interest rate shifts.

Coupon reinvestment

Coupon reinvestment risk arises when declining interest rates force investors to reinvest bond coupons at lower yields, contrasting with interest rate risk which impacts the bond's market value due to fluctuating rates.

Call risk

Call risk occurs when a bond issuer redeems the bond before maturity, often as interest rates decline, forcing investors to reinvest at lower rates, thereby linking it closely to reinvestment risk. Unlike interest rate risk, which affects bond prices inversely with interest rate changes, call risk specifically impacts return by curtailing expected coupon payments and accelerating principal repayment.

Market value fluctuation

Market value fluctuation is primarily influenced by interest rate risk, while reinvestment risk affects the returns when cash flows are reinvested at uncertain future interest rates.

Principal repayment timing

Principal repayment timing critically influences reinvestment risk by determining how soon funds must be reinvested at potentially lower interest rates while mitigating interest rate risk by reducing exposure to fluctuating rates over time.

Immunization strategy

A targeted immunization strategy balances reinvestment risk and interest rate risk by matching asset durations to liability durations, minimizing portfolio sensitivity to interest rate fluctuations.

Cash flow matching

Cash flow matching reduces reinvestment risk by aligning asset cash inflows precisely with liability outflows, ensuring funds are available without needing to reinvest at uncertain interest rates. This strategy minimizes exposure to interest rate risk by locking in predetermined cash flows, eliminating dependency on fluctuating market rates for future liabilities.

Discount rate sensitivity

Discount rate sensitivity reveals how changes in interest rates impact bond prices, influencing reinvestment risk by altering the returns on periodic coupon payments while affecting interest rate risk through fluctuations in the bond's overall market value.

Reinvestment risk vs Interest rate risk Infographic

moneydif.com

moneydif.com