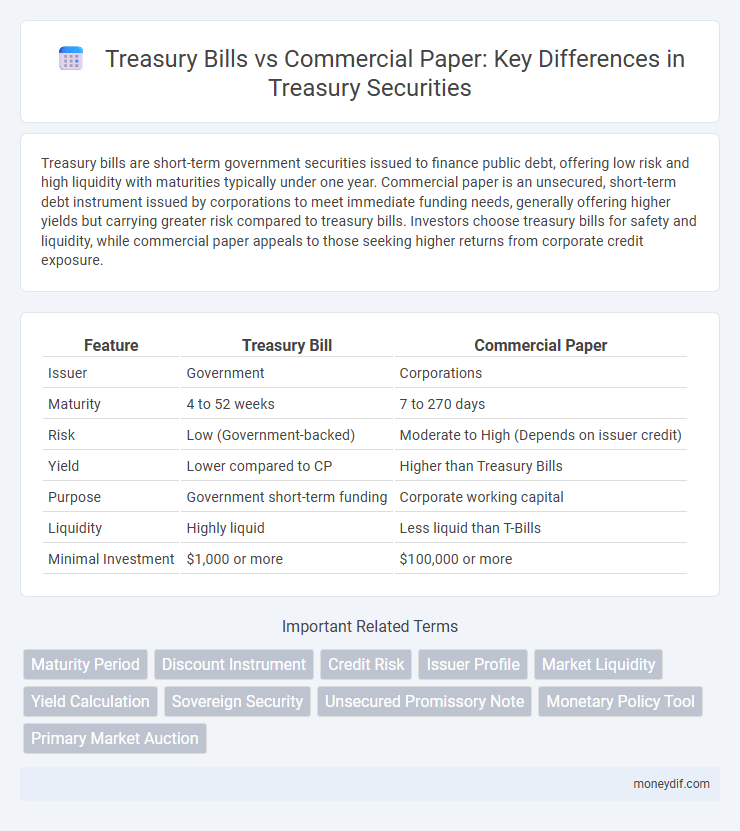

Treasury bills are short-term government securities issued to finance public debt, offering low risk and high liquidity with maturities typically under one year. Commercial paper is an unsecured, short-term debt instrument issued by corporations to meet immediate funding needs, generally offering higher yields but carrying greater risk compared to treasury bills. Investors choose treasury bills for safety and liquidity, while commercial paper appeals to those seeking higher returns from corporate credit exposure.

Table of Comparison

| Feature | Treasury Bill | Commercial Paper |

|---|---|---|

| Issuer | Government | Corporations |

| Maturity | 4 to 52 weeks | 7 to 270 days |

| Risk | Low (Government-backed) | Moderate to High (Depends on issuer credit) |

| Yield | Lower compared to CP | Higher than Treasury Bills |

| Purpose | Government short-term funding | Corporate working capital |

| Liquidity | Highly liquid | Less liquid than T-Bills |

| Minimal Investment | $1,000 or more | $100,000 or more |

Introduction to Treasury Bills and Commercial Paper

Treasury bills (T-bills) are short-term government debt securities issued to finance national debt with maturities ranging from a few days to one year, offering high liquidity and low risk due to sovereign backing. Commercial paper represents unsecured, short-term corporate debt instruments with maturities typically up to 270 days, used by companies to meet immediate funding needs and optimize working capital. Both instruments serve as crucial components in money market operations, catering to different risk profiles and issuer types.

Key Differences Between Treasury Bills and Commercial Paper

Treasury Bills (T-Bills) are short-term government securities issued to meet public financing needs with maturities typically ranging from a few days to one year, known for their low risk and high liquidity. Commercial Paper, on the other hand, is an unsecured, short-term debt instrument issued by corporations to finance operating expenses and has maturities up to 270 days, often carrying higher risk and yield compared to T-Bills. The primary distinctions lie in issuer type, credit risk, liquidity, and purpose, with T-Bills backed by government credit and Commercial Paper relying on corporate creditworthiness.

Issuers: Government vs Corporate Entities

Treasury bills (T-bills) are short-term debt securities issued exclusively by the government to finance public spending and manage liquidity, offering high safety and liquidity to investors. Commercial paper is issued by large, creditworthy corporate entities to meet short-term funding needs, typically offering higher yields due to greater credit risk compared to government-issued T-bills. The key distinction lies in the issuers: governments back Treasury bills with sovereign credit, while commercial paper depends on corporate creditworthiness.

Maturity Periods and Investment Horizons

Treasury bills typically have short maturity periods ranging from a few days up to one year, making them ideal for investors seeking low-risk, short-term investment horizons. Commercial paper generally features slightly longer maturities, typically from 1 to 270 days, catering to corporate investors aiming for medium-term liquidity solutions. Understanding the differences in maturity periods helps investors align their investment strategies with their desired timeframes and risk tolerance.

Risk Profiles and Creditworthiness

Treasury bills (T-bills) are government-issued short-term debt securities with minimal credit risk due to sovereign backing, making them one of the safest investment options in the money market. Commercial paper, issued by corporations, carries higher credit risk linked to the issuer's financial health and market conditions, requiring investors to assess the company's creditworthiness carefully. The risk profile of T-bills is significantly lower compared to commercial paper, which, while offering higher yields, demands robust credit analysis to mitigate default risk.

Yield and Return Comparison

Treasury Bills (T-Bills) generally offer lower yields compared to Commercial Paper due to their government backing and minimal credit risk. Commercial Paper typically provides higher returns as it is unsecured debt issued by corporations with varying credit ratings, reflecting greater risk. Investors seeking safety prioritize T-Bills, while those aiming for enhanced yield often opt for Commercial Paper despite potential credit risk exposure.

Issuance Process and Market Accessibility

Treasury Bills are issued through a centralized auction process conducted by the government, offering broad market accessibility to institutional and individual investors via competitive and non-competitive bids. Commercial Paper is typically issued by corporations through private placements or dealer networks, limiting accessibility primarily to institutional investors due to higher minimum investment thresholds. The streamlined auction mechanism of Treasury Bills ensures high liquidity and transparency compared to the more customized and less regulated issuance of Commercial Paper.

Regulatory Framework and Oversight

Treasury bills are government-issued securities regulated under stringent federal laws with oversight by entities such as the U.S. Department of the Treasury and the Securities and Exchange Commission (SEC), ensuring high transparency and investor protection. Commercial paper, issued by corporations, falls under the SEC's Rule 144A and Regulation S for exemptions, with less regulatory burden but significant oversight to prevent fraudulent issuance and maintain market stability. The differing regulatory frameworks reflect the risk profiles and issuer nature, with Treasury bills deemed lower risk due to explicit government backing and commercial paper subject to a broader spectrum of corporate credit risks.

Liquidity and Secondary Market Trading

Treasury Bills offer higher liquidity due to their backing by the government and active secondary market trading, enabling investors to quickly convert holdings into cash with minimal price fluctuations. Commercial Paper typically exhibits lower liquidity as it is unsecured and primarily issued by corporations with a less developed secondary market, resulting in limited trading activity and wider bid-ask spreads. The robust secondary market for Treasury Bills enhances price transparency and ease of trading, making them preferable for short-term liquidity management compared to Commercial Paper.

Suitability for Investors: Treasury Bills vs Commercial Paper

Treasury Bills offer low-risk, short-term government debt ideal for conservative investors seeking capital preservation and liquidity. Commercial Paper, issued by corporations, carries higher risk but provides higher yields suitable for investors with a greater risk tolerance and a focus on income generation. The choice depends on an investor's risk profile, investment horizon, and return expectations within the fixed-income market.

Important Terms

Maturity Period

Treasury Bills have a maturity period ranging from a few days up to one year, whereas Commercial Papers typically mature within 1 to 270 days, making Treasury Bills more suitable for ultra-short-term investments and Commercial Papers for short-term corporate funding.

Discount Instrument

Discount instruments like Treasury Bills and Commercial Papers are short-term debt securities issued at a price lower than their face value, maturing at par to provide returns through the discount. Treasury Bills are government-backed, highly liquid, and low-risk, while Commercial Papers are unsecured corporate debt with higher yields reflecting their elevated credit risk profile.

Credit Risk

Credit risk in Treasury Bills is minimal due to government backing and short maturity, whereas Commercial Paper carries higher credit risk since it depends on the issuing corporation's creditworthiness and lacks government guarantees. Investors assess credit ratings and issuer financial strength to mitigate potential default risks in Commercial Paper markets.

Issuer Profile

Issuer profiles for Treasury Bills typically involve sovereign governments with high credit ratings, while Commercial Paper issuers are usually financially strong corporations with short-term funding needs.

Market Liquidity

Market liquidity for Treasury Bills remains higher than Commercial Paper due to T-Bills' government backing, shorter maturities, and active secondary markets, facilitating rapid buying and selling with minimal price impact. Commercial Paper, typically issued by corporations with varying credit profiles, experiences lower liquidity and wider bid-ask spreads, reflecting higher risk and reduced market depth compared to the highly liquid Treasury Bill market.

Yield Calculation

Yield calculation for Treasury Bills involves discounting the purchase price from the face value over the maturity period, while Commercial Paper yield is determined using the interest rate applied to its principal amount for the short-term borrowing duration.

Sovereign Security

Sovereign security typically refers to Treasury Bills issued by governments, offering lower risk and higher liquidity compared to Commercial Paper issued by corporations.

Unsecured Promissory Note

An Unsecured Promissory Note is a written promise to pay a specific sum without collateral, often used for short-term borrowing similar to Commercial Paper, which is also unsecured but typically issued by corporations. Treasury Bills differ as they are government-backed securities with guaranteed repayment, making them less risky compared to Unsecured Promissory Notes and Commercial Paper in the credit market.

Monetary Policy Tool

Treasury bills serve as a primary monetary policy tool for central banks to regulate liquidity through short-term government debt, while commercial papers are unsecured corporate notes influencing market interest rates and credit availability.

Primary Market Auction

Primary Market Auction is a mechanism where government securities like Treasury Bills are issued at competitive bids directly to investors, ensuring transparent pricing and government borrowing efficiency. In contrast, Commercial Paper is typically sold in a negotiated market by corporations to meet short-term funding needs, relying on creditworthiness rather than auction-based pricing.

Treasury Bill vs Commercial Paper Infographic

moneydif.com

moneydif.com