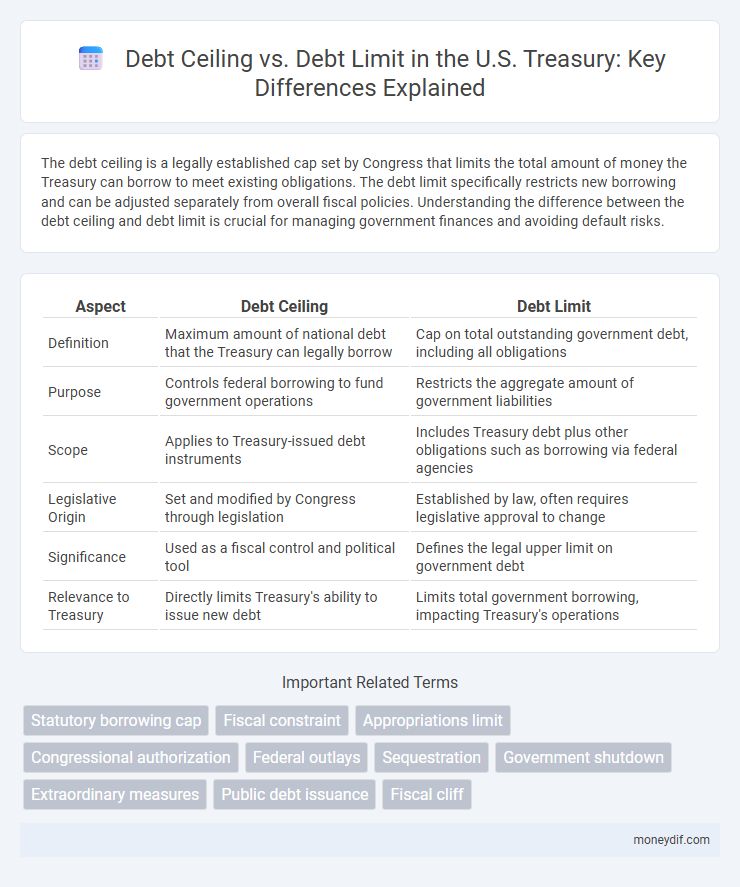

The debt ceiling is a legally established cap set by Congress that limits the total amount of money the Treasury can borrow to meet existing obligations. The debt limit specifically restricts new borrowing and can be adjusted separately from overall fiscal policies. Understanding the difference between the debt ceiling and debt limit is crucial for managing government finances and avoiding default risks.

Table of Comparison

| Aspect | Debt Ceiling | Debt Limit |

|---|---|---|

| Definition | Maximum amount of national debt that the Treasury can legally borrow | Cap on total outstanding government debt, including all obligations |

| Purpose | Controls federal borrowing to fund government operations | Restricts the aggregate amount of government liabilities |

| Scope | Applies to Treasury-issued debt instruments | Includes Treasury debt plus other obligations such as borrowing via federal agencies |

| Legislative Origin | Set and modified by Congress through legislation | Established by law, often requires legislative approval to change |

| Significance | Used as a fiscal control and political tool | Defines the legal upper limit on government debt |

| Relevance to Treasury | Directly limits Treasury's ability to issue new debt | Limits total government borrowing, impacting Treasury's operations |

Understanding the Debt Ceiling: Definition and Purpose

The debt ceiling is a statutory cap set by Congress on the total amount of money the U.S. Treasury is authorized to borrow to meet existing legal obligations, such as Social Security, interest on the national debt, and military salaries. It serves as a control mechanism to limit government debt and ensure fiscal responsibility while enabling the Treasury to manage cash flow effectively. Understanding the debt ceiling's purpose highlights its role in preventing unchecked borrowing and maintaining confidence in U.S. financial stability.

Debt Limit Explained: Key Features and Functions

The debt limit is a legal cap set by Congress on the total amount of national debt the U.S. Treasury is authorized to issue to meet existing obligations. It controls the government's borrowing capacity but does not dictate fiscal policy or spending decisions, which are determined through budget appropriations. Key features of the debt limit include preventing default on federal debt and requiring periodic congressional approval to raise the cap as necessary to finance government operations.

Historical Evolution of the Debt Ceiling

The debt ceiling originated in 1917 with the Second Liberty Bond Act to streamline government borrowing during World War I. Historically, it shifted from a fixed limit on specific debt issuances to an aggregate ceiling encompassing total federal debt, reflecting increased fiscal demands over time. Legislative changes, especially post-1980s, allowed more flexibility in managing national debt but maintained Congressional control over government borrowing authority.

Legislative Framework: Debt Ceiling vs Debt Limit

The legislative framework distinguishes the debt ceiling as a statutory cap on the total amount of national debt that the U.S. Treasury can incur, requiring congressional authorization for increases. In contrast, the debt limit often refers more broadly to restrictions set by law on specific types of debt or financial obligations, sometimes varying by statute or context. Understanding these definitions is crucial for budgetary policy and fiscal governance within the U.S. government's legislative processes.

How Debt Ceiling Affects Treasury Operations

The debt ceiling directly constrains Treasury's ability to issue new debt, limiting funds available to meet existing obligations and fund government programs. When the debt ceiling is reached, Treasury must implement extraordinary measures, which can disrupt cash management and delay payments to creditors. This constraint increases financial uncertainty and can affect the government's credit rating, impacting borrowing costs and overall fiscal stability.

Economic Impacts of Reaching the Debt Limit

Reaching the debt limit restricts the U.S. Treasury from issuing new debt to finance government operations, potentially causing delayed payments on obligations like Social Security, military salaries, and interest on existing debt. This uncertainty can increase borrowing costs as investors demand higher yields to compensate for default risks, negatively impacting economic growth. Prolonged debt ceiling impasses may lead to credit rating downgrades, reduced investor confidence, and volatility in financial markets, escalating the risk of recession.

Differences Between Debt Ceiling and Debt Limit

The debt ceiling is a legislative cap set by Congress on the total amount of money the Treasury is authorized to borrow to meet existing legal obligations, whereas the debt limit refers more broadly to any borrowing restriction imposed on the Treasury. The debt ceiling strictly limits new borrowing, while the debt limit can encompass various financial thresholds related to debt issuance. Understanding these distinctions is crucial for analyzing fiscal policy debates and government funding operations.

Policy Debates: Raising the Debt Ceiling

Raising the debt ceiling is a recurring policy debate that centers on the government's authority to borrow funds beyond the existing debt limit set by Congress. The debt ceiling acts as a statutory cap on the total amount of federal debt, whereas the debt limit refers more broadly to the maximum allowable borrowing; confusion arises as these terms are often used interchangeably. Policy discussions emphasize the economic risks of failing to raise the ceiling, which could trigger government shutdowns or default on obligations, highlighting the need for legislative action to maintain fiscal stability.

Treasury Strategies to Manage the Debt Limit

The Treasury employs strategies like prioritizing payments and utilizing extraordinary measures to manage the debt limit effectively, ensuring continued government funding without breaching the debt ceiling. By temporarily suspending investments in government funds and reassessing cash flow, the Treasury maximizes available borrowing capacity. These tactics help maintain fiscal stability while Congress negotiates adjustments to the debt limit.

Future Outlook: Reforming Debt Ceiling Mechanisms

Reforming debt ceiling mechanisms focuses on creating more flexible and sustainable fiscal policies to prevent recurring political standoffs and enhance Treasury's ability to manage national debt efficiently. Future outlook includes proposals for automatic adjustments tied to economic indicators and enhanced transparency measures to maintain market stability. These reforms aim to balance fiscal responsibility with the need for timely government funding, reducing the risk of default and boosting investor confidence.

Important Terms

Statutory borrowing cap

The statutory borrowing cap, defined by Congress, sets the legal debt ceiling that limits the total amount the U.S. Treasury can borrow to meet existing obligations, distinguishing it from broader or informal debt limit discussions.

Fiscal constraint

Fiscal constraint intensifies when the debt ceiling restricts government borrowing below the legislated debt limit, limiting public expenditure flexibility.

Appropriations limit

The appropriations limit restricts government spending based on revenue, while the debt ceiling or debt limit caps the total amount the government can borrow to meet its existing obligations.

Congressional authorization

Congressional authorization is a legal requirement that allows the federal government to borrow funds, directly impacting the debt ceiling, which is the maximum amount of debt the government is permitted to carry. The debt limit, often used interchangeably with debt ceiling, represents the cap imposed by Congress on the total outstanding federal debt, ensuring fiscal oversight and control over national borrowing.

Federal outlays

Federal outlays directly impact the debt ceiling because exceeding authorized spending mandates raising the debt limit to finance government obligations.

Sequestration

Sequestration enforces automatic federal spending cuts when the U.S. reaches its debt ceiling, ensuring compliance with the statutory debt limit imposed by Congress. This mechanism acts as a fiscal control to prevent government borrowing beyond the authorized debt limit, directly impacting budget allocations and debt management strategies.

Government shutdown

Government shutdowns often occur when Congress fails to raise the debt ceiling, which legally restricts the Treasury's ability to borrow funds, whereas the debt limit is the statutory cap on total federal borrowing authorized by Congress.

Extraordinary measures

Extraordinary measures are temporary financial actions used by the U.S. Treasury to prevent breaching the debt ceiling, which legally caps the government's total borrowing capacity, distinct from the debt limit that similarly restricts federal debt but is often used interchangeably to describe the same statutory borrowing cap.

Public debt issuance

Public debt issuance is often constrained by the debt ceiling, a statutory limit set by Congress on the total amount of debt the government can legally incur, while the debt limit refers more broadly to the authorized maximum borrowing capacity established to fund government obligations.

Fiscal cliff

The fiscal cliff refers to a situation where a combination of expiring tax cuts and across-the-board government spending cuts coincide, potentially leading to economic downturn. The debt ceiling, or debt limit, is a legal cap set by Congress on the total amount of federal debt the government can accumulate, and failure to raise it during fiscal cliff negotiations can exacerbate risks of default and economic instability.

Debt ceiling vs Debt limit Infographic

moneydif.com

moneydif.com