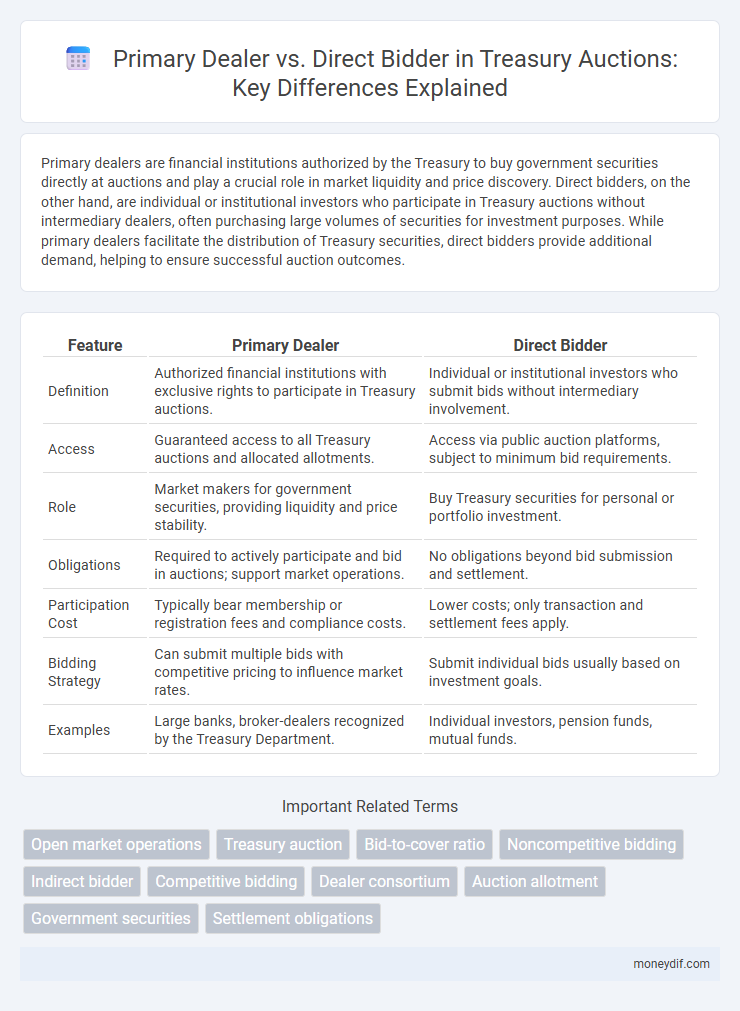

Primary dealers are financial institutions authorized by the Treasury to buy government securities directly at auctions and play a crucial role in market liquidity and price discovery. Direct bidders, on the other hand, are individual or institutional investors who participate in Treasury auctions without intermediary dealers, often purchasing large volumes of securities for investment purposes. While primary dealers facilitate the distribution of Treasury securities, direct bidders provide additional demand, helping to ensure successful auction outcomes.

Table of Comparison

| Feature | Primary Dealer | Direct Bidder |

|---|---|---|

| Definition | Authorized financial institutions with exclusive rights to participate in Treasury auctions. | Individual or institutional investors who submit bids without intermediary involvement. |

| Access | Guaranteed access to all Treasury auctions and allocated allotments. | Access via public auction platforms, subject to minimum bid requirements. |

| Role | Market makers for government securities, providing liquidity and price stability. | Buy Treasury securities for personal or portfolio investment. |

| Obligations | Required to actively participate and bid in auctions; support market operations. | No obligations beyond bid submission and settlement. |

| Participation Cost | Typically bear membership or registration fees and compliance costs. | Lower costs; only transaction and settlement fees apply. |

| Bidding Strategy | Can submit multiple bids with competitive pricing to influence market rates. | Submit individual bids usually based on investment goals. |

| Examples | Large banks, broker-dealers recognized by the Treasury Department. | Individual investors, pension funds, mutual funds. |

Overview of Treasury Securities Allocation

Primary dealers serve as intermediaries in Treasury securities allocation, submitting competitive bids and ensuring market liquidity through consistent participation in Treasury auctions. Direct bidders, including institutional investors and foreign governments, access Treasury securities by submitting bids directly to the Treasury Department, often without intermediaries. The Treasury allocates securities based on bid prices and amounts, balancing distribution between primary dealers' market-making role and direct bidders' investment strategies.

Who Are Primary Dealers?

Primary dealers are financial institutions authorized by the U.S. Department of the Treasury to buy government securities directly in the primary market and participate actively in Treasury auctions. These dealers play a critical role in ensuring market liquidity and facilitating the smooth distribution of Treasury debt by both purchasing large volumes and making markets for Treasury securities. Unlike direct bidders who are individual or institutional investors purchasing Treasury securities without intermediary dealers, primary dealers provide essential underwriting and market-making services that support Treasury financing operations.

Understanding Direct Bidders

Direct bidders participate in Treasury auctions without intermediaries, submitting competitive or non-competitive bids directly to the Treasury Department. Unlike primary dealers who act as intermediaries with market-making responsibilities, direct bidders include institutional investors and individuals seeking to purchase government securities straight from the source. Their involvement enhances auction transparency and broadens investor participation, contributing to efficient price discovery in the Treasury market.

Primary Dealer: Role and Responsibilities

Primary dealers play a critical role in the U.S. Treasury market by acting as exclusive trading counterparts of the Federal Reserve Bank of New York, ensuring liquidity and stability in government securities. They are obligated to participate actively in Treasury auctions, submit competitive bids, and promote efficient distribution of Treasury debt to investors. These dealers also provide market intelligence to the Treasury and Federal Reserve, facilitating monetary policy implementation and market functioning.

Direct Bidders: Key Characteristics

Direct bidders participate in Treasury auctions by submitting competitive bids without intermediaries, allowing them to purchase securities at specified prices or yields. They often represent institutional investors, such as mutual funds and pension funds, seeking to acquire Treasury bills, notes, or bonds directly from the U.S. Department of the Treasury. Direct bidding enhances market transparency and efficiency by reducing reliance on primary dealers, promoting broader participation in government debt issuance.

Auction Process: Primary Dealer vs Direct Bidder

Primary dealers participate actively in the Treasury auction process by submitting competitive bids and supporting market liquidity, often obligated to bid to ensure smooth issuance. Direct bidders, typically institutional investors, submit bids independently without the intermediary role, purchasing securities directly from the Treasury without market-making duties. The auction process differentiates primary dealers as mandatory participants driving price discovery, while direct bidders engage flexibly based on investment strategies.

Advantages of Primary Dealers

Primary dealers enjoy privileged access to Treasury auctions, enabling them to consistently purchase large volumes of government securities. They benefit from exclusive market-making roles, which provide enhanced liquidity and facilitate smoother distribution of Treasury debt to a wide investor base. Their close relationship with the Federal Reserve allows for critical insights and early information on monetary policy, offering strategic advantages in market positioning.

Benefits and Limitations for Direct Bidders

Direct bidders in Treasury auctions benefit from the ability to participate without intermediaries, offering greater control over bidding strategies and potentially lower costs by avoiding dealer fees. However, direct bidders face limitations such as restricted access to large allocations typically favored by primary dealers and the necessity to meet strict registration and compliance requirements, which can be resource-intensive. Furthermore, direct bidding requires a comprehensive understanding of auction mechanics and the Treasury market, presenting barriers for smaller or less experienced investors.

Market Impact: Primary Dealers vs Direct Bidders

Primary dealers play a critical role in Treasury auctions by providing liquidity and stability to the market, often making large-scale purchases that facilitate smooth distribution of government debt. Direct bidders, typically institutional investors, can influence demand but usually have less market impact due to smaller transaction volumes and less frequent participation. The consistent purchasing activity of primary dealers helps maintain orderly price discovery and reduces volatility during auction settlement periods.

Implications for Treasury Market Participants

Primary dealers act as intermediaries between the Treasury and market participants, facilitating liquidity and price discovery in government securities auctions, while direct bidders submit competitive bids without intermediary involvement. This distinction impacts market access, with primary dealers often receiving allotments facilitating market stability and direct bidders potentially facing higher barriers to entry. Treasury market participants must navigate these roles to optimize auction participation strategies and improve portfolio diversification.

Important Terms

Open market operations

Open market operations involve central banks transacting primarily with primary dealers, who are authorized intermediaries, while direct bidders participate independently without intermediary status.

Treasury auction

In a Treasury auction, primary dealers act as authorized participants who submit bids on behalf of themselves and clients, ensuring liquidity and price discovery, while direct bidders participate independently without intermediaries, often representing large institutional investors seeking direct access to government securities. The dynamic between primary dealers and direct bidders influences auction competitiveness, pricing, and the overall distribution of Treasury securities in the market.

Bid-to-cover ratio

The bid-to-cover ratio measures demand in Treasury auctions, indicating how many bids exceed the available securities; primary dealers typically influence this ratio by submitting larger, more consistent bids compared to direct bidders, who often participate sporadically and with varying bid sizes. A higher bid-to-cover ratio driven by active primary dealer involvement suggests strong market confidence and liquidity, whereas lower ratios with more direct bidder participation may signal cautious demand or market uncertainty.

Noncompetitive bidding

Noncompetitive bidding allows direct bidders to submit bids at the yield determined by competitive primary dealers during Treasury auctions, ensuring allocation without specifying yield while primary dealers actively participate by setting prices.

Indirect bidder

An indirect bidder participates in auctions through a primary dealer who acts as an intermediary, whereas a direct bidder submits bids independently without involving a primary dealer.

Competitive bidding

Competitive bidding in government securities involves primary dealers who have preferential market access and obligations, while direct bidders participate without intermediary roles, affecting their bidding strategies and transaction costs.

Dealer consortium

A dealer consortium pools resources from multiple primary dealers to increase bidding power in government securities auctions, contrasting with a direct bidder who participates individually without intermediary support. Primary dealers are authorized participants in the auction process with obligations to support market liquidity, while direct bidders may include institutional investors engaging independently without the dealer consortium's collective influence.

Auction allotment

Auction allotment in government securities distinguishes between primary dealers and direct bidders by allocating a predetermined portion of the issue to primary dealers to ensure market liquidity, while direct bidders compete for the remaining quota based on bid price and quantity. Primary dealers often receive preferential allotment terms reflecting their role in market-making and underwriting, whereas direct bidders are subject to competitive bidding outcomes without guaranteed allotment.

Government securities

Primary dealers play a crucial role in the government securities market by acting as intermediaries authorized to bid directly in primary auctions, ensuring liquidity and facilitating price discovery. Direct bidders participate in these auctions without intermediary involvement, often institutional investors seeking to acquire government securities straight from the issuer at competitive yields.

Settlement obligations

Settlement obligations for primary dealers involve mandatory daily delivery and payment of government securities in auction transactions, while direct bidders typically have settlement requirements determined by the auction rules without the ongoing obligations imposed on primary dealers.

Primary dealer vs Direct bidder Infographic

moneydif.com

moneydif.com