Liquidity risk refers to the potential inability of an organization to meet its short-term financial obligations due to insufficient cash flow or liquid assets. Funding risk involves the challenge of obtaining adequate funds at a reasonable cost to sustain ongoing operations and refinance maturing debts. Effective treasury management requires balancing liquidity risk by maintaining sufficient liquid reserves while mitigating funding risk through diversified funding sources and strategic debt maturity planning.

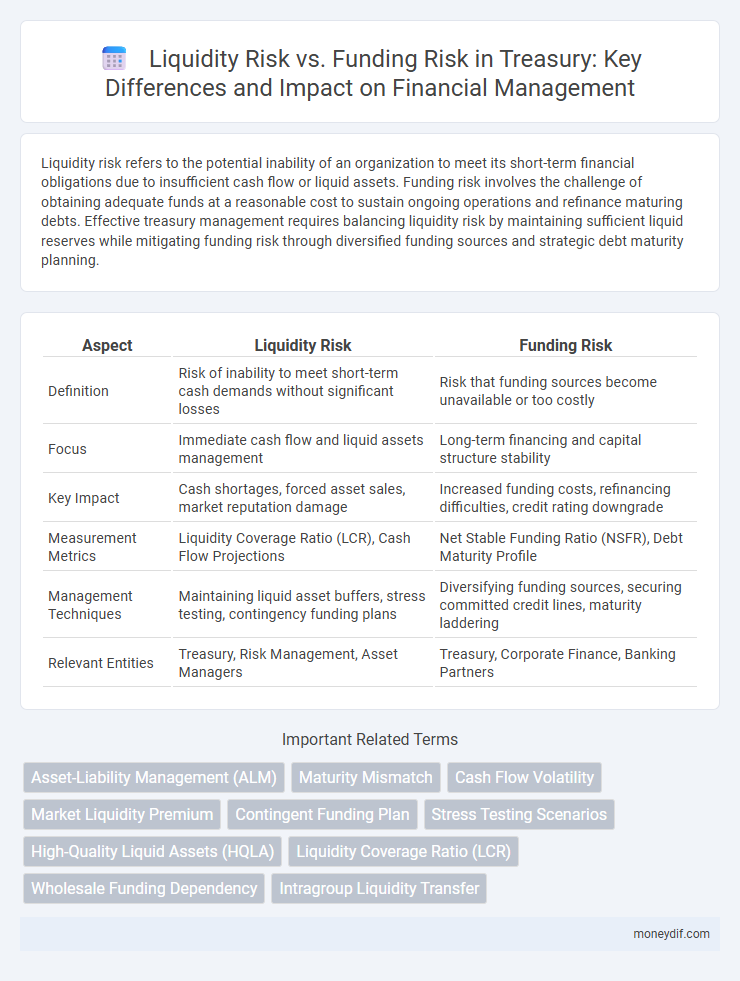

Table of Comparison

| Aspect | Liquidity Risk | Funding Risk |

|---|---|---|

| Definition | Risk of inability to meet short-term cash demands without significant losses | Risk that funding sources become unavailable or too costly |

| Focus | Immediate cash flow and liquid assets management | Long-term financing and capital structure stability |

| Key Impact | Cash shortages, forced asset sales, market reputation damage | Increased funding costs, refinancing difficulties, credit rating downgrade |

| Measurement Metrics | Liquidity Coverage Ratio (LCR), Cash Flow Projections | Net Stable Funding Ratio (NSFR), Debt Maturity Profile |

| Management Techniques | Maintaining liquid asset buffers, stress testing, contingency funding plans | Diversifying funding sources, securing committed credit lines, maturity laddering |

| Relevant Entities | Treasury, Risk Management, Asset Managers | Treasury, Corporate Finance, Banking Partners |

Understanding Liquidity Risk in Treasury Management

Liquidity risk in treasury management refers to the potential inability of an organization to meet its short-term financial obligations due to insufficient liquid assets or cash flow mismatches. Effective liquidity risk management ensures that the treasury maintains adequate cash reserves and access to credit lines to cover immediate liabilities without incurring significant losses. Monitoring liquidity ratios, stress testing cash flows, and maintaining contingency funding plans are critical components in mitigating liquidity risk and safeguarding operational stability.

Defining Funding Risk: Key Treasury Perspectives

Funding risk in treasury refers to the danger that an organization will be unable to secure sufficient capital to meet its liabilities when due, impacting operational stability. It emphasizes the challenges in accessing stable, cost-effective funding sources, especially during market stress or credit tightening. Effective funding risk management involves assessing funding diversification, maturity profiles, and contingency planning to ensure liquidity across various scenarios.

Fundamental Differences: Liquidity Risk vs. Funding Risk

Liquidity risk refers to the potential inability of a firm to meet its short-term cash flow needs without incurring significant losses, emphasizing the availability of liquid assets for immediate obligations. Funding risk pertains to the uncertainty surrounding a firm's ability to secure adequate financing or refinance existing debt under reasonable terms, focusing on the access to capital markets and stable funding sources. The fundamental difference lies in liquidity risk addressing asset convertibility for payments, while funding risk concerns the sustainability and continuity of financing.

Causes and Triggers of Liquidity Risk

Liquidity risk primarily stems from an unexpected mismatch between cash inflows and outflows, often triggered by sudden market disruptions or credit downgrades. Causes include operational failures, regulatory changes, and adverse economic conditions that constrain access to short-term funding. Stress events such as a bank run or counterparty default further exacerbate liquidity shortfalls, highlighting the critical differences between liquidity and funding risk.

Sources and Drivers of Funding Risk

Funding risk arises primarily from an institution's inability to secure stable and cost-effective funding sources, which can stem from market disruptions, credit rating downgrades, and deteriorating counterparty confidence. Key drivers include overreliance on short-term wholesale funding, concentration in a limited number of funding providers, and mismatched asset-liability durations that create refinancing pressures. Diversifying funding channels and maintaining robust contingency funding plans are essential to mitigating funding risk.

Measuring and Monitoring Treasury Liquidity Risk

Measuring and monitoring treasury liquidity risk involves assessing the firm's ability to meet short-term obligations through cash flow forecasting and liquidity gap analysis. Key metrics include the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR), which quantify available liquid assets against potential outflows and stable funding sources over time horizons. Real-time monitoring systems and stress testing scenarios enhance early detection of liquidity stress, enabling proactive management of funding mismatches and maintaining regulatory compliance.

Assessment Tools for Funding Risk in Treasury Operations

Funding risk assessment in Treasury operations relies heavily on advanced analytical tools such as cash flow forecasting models, stress testing scenarios, and liquidity coverage ratios to evaluate the sustainability of funding sources. Scenario analysis tools help predict the impact of market disruptions on funding availability, while early warning indicators monitor changes in credit spreads and counterparty creditworthiness to signal potential funding challenges. Robust funding risk metrics, including the Net Stable Funding Ratio (NSFR) and diversification metrics of funding sources, are essential for maintaining optimal liquidity and ensuring resilience against market volatility.

Strategies for Mitigating Liquidity Risk

Effective strategies for mitigating liquidity risk include maintaining diverse funding sources, establishing robust cash flow forecasting models, and holding high-quality liquid assets as a buffer. Stress testing and scenario analysis enable early identification of potential liquidity shortfalls, allowing proactive management. Implementing contingency funding plans ensures rapid access to emergency liquidity, safeguarding financial stability during market disruptions.

Funding Risk Management Techniques and Best Practices

Effective funding risk management involves diversifying funding sources to reduce reliance on unstable or single channels, thereby enhancing liquidity stability. Employing comprehensive cash flow forecasting and stress testing allows organizations to anticipate potential funding shortfalls and develop contingency funding plans. Maintaining a robust mix of short- and long-term debt, alongside establishing committed credit lines, ensures ready access to capital under varying market conditions.

Integrating Liquidity and Funding Risk within Treasury Policies

Integrating liquidity risk and funding risk within treasury policies ensures a comprehensive approach to managing short-term cash flow volatility and long-term capital structure stability. Treasury frameworks that align liquidity buffers with diversified funding sources optimize risk mitigation and enhance financial resilience. Embedding cross-functional risk metrics and stress testing within treasury governance supports proactive decision-making and regulatory compliance.

Important Terms

Asset-Liability Management (ALM)

Asset-Liability Management (ALM) focuses on balancing liquidity risk, which is the potential inability to meet short-term cash flow demands, against funding risk, the challenge of securing stable and cost-effective capital over time. Effective ALM strategies ensure that sufficient liquid assets are maintained while optimizing funding sources to minimize disruptions in cash flow and reduce financial vulnerabilities.

Maturity Mismatch

Maturity mismatch, where short-term liabilities fund long-term assets, significantly amplifies liquidity risk due to potential funding shortfalls and exacerbates funding risk by increasing reliance on unstable or volatile sources of capital.

Cash Flow Volatility

Cash flow volatility increases liquidity risk by reducing available liquid assets and intensifies funding risk by complicating access to stable financing sources.

Market Liquidity Premium

Market Liquidity Premium reflects the additional expected return investors demand for holding assets exposed to liquidity risk, which differs from funding risk that pertains to the cost and availability of capital rather than the ease of asset trading.

Contingent Funding Plan

A Contingent Funding Plan (CFP) addresses liquidity risk by outlining strategies to secure funds during liquidity shortfalls, ensuring bank stability under stress scenarios. It mitigates funding risk by identifying alternative funding sources, maturity mismatches, and capital buffers to maintain operational continuity amidst market disruptions.

Stress Testing Scenarios

Stress testing scenarios for liquidity risk focus on the bank's ability to meet short-term obligations during market disruptions, while funding risk scenarios assess the potential failure to secure stable funding sources over an extended period.

High-Quality Liquid Assets (HQLA)

High-Quality Liquid Assets (HQLA) are critical in managing liquidity risk by ensuring immediate access to cash or near-cash instruments during financial stress, thereby reducing the likelihood of forced asset sales or funding shortages. While liquidity risk focuses on the ease of converting assets to cash, funding risk pertains to the stability and reliability of funding sources, with HQLA serving as a buffer to mitigate both risks by supporting regulatory liquidity coverage ratios (LCR) and enhancing overall financial resilience.

Liquidity Coverage Ratio (LCR)

Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand short-term liquidity stress by holding high-quality liquid assets (HQLA) sufficient to cover net cash outflows over 30 days, directly addressing liquidity risk. Funding risk, however, concerns the bank's ability to secure continuous funding sources and maturity mismatches, which LCR indirectly affects by ensuring short-term resilience but requires complementary metrics like Net Stable Funding Ratio (NSFR) for long-term stability assessment.

Wholesale Funding Dependency

Wholesale funding dependency increases liquidity risk by creating reliance on external, short-term financing sources that can quickly dry up during market stress, while funding risk reflects the broader uncertainty of securing these funds at stable costs. Firms with high wholesale funding dependency face elevated vulnerability to rollover risk and sudden funding shocks, impacting their overall financial stability.

Intragroup Liquidity Transfer

Intragroup liquidity transfer mitigates liquidity risk by reallocating cash within corporate entities to meet short-term obligations, while funding risk arises when external sources are insufficient or costly to cover liquidity gaps. Effective management ensures internal capital flows reduce reliance on external funding, enhancing overall financial stability.

Liquidity Risk vs Funding Risk Infographic

moneydif.com

moneydif.com