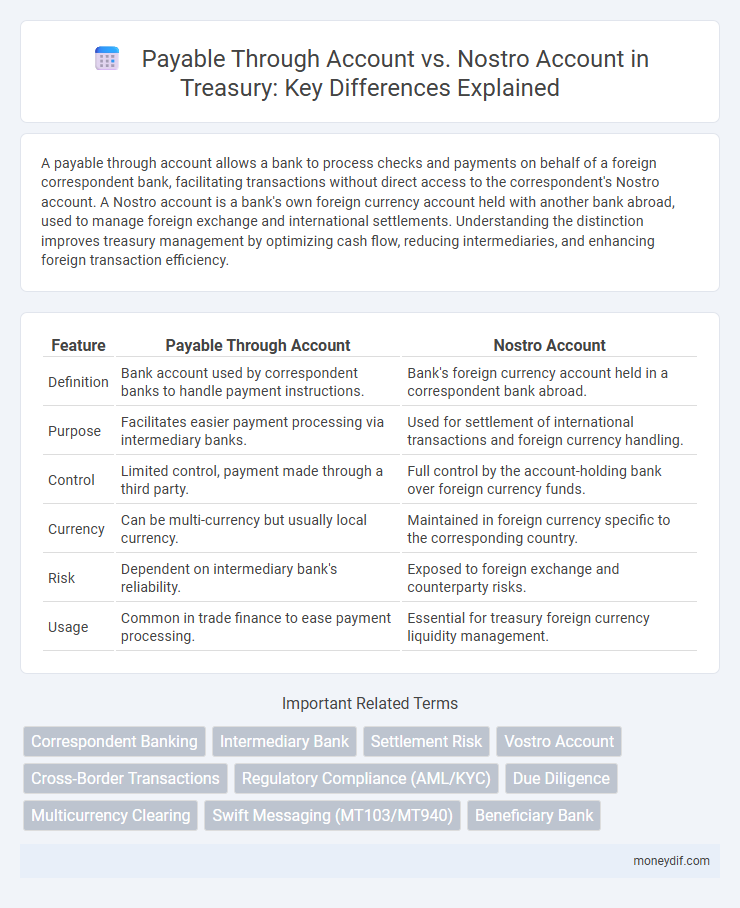

A payable through account allows a bank to process checks and payments on behalf of a foreign correspondent bank, facilitating transactions without direct access to the correspondent's Nostro account. A Nostro account is a bank's own foreign currency account held with another bank abroad, used to manage foreign exchange and international settlements. Understanding the distinction improves treasury management by optimizing cash flow, reducing intermediaries, and enhancing foreign transaction efficiency.

Table of Comparison

| Feature | Payable Through Account | Nostro Account |

|---|---|---|

| Definition | Bank account used by correspondent banks to handle payment instructions. | Bank's foreign currency account held in a correspondent bank abroad. |

| Purpose | Facilitates easier payment processing via intermediary banks. | Used for settlement of international transactions and foreign currency handling. |

| Control | Limited control, payment made through a third party. | Full control by the account-holding bank over foreign currency funds. |

| Currency | Can be multi-currency but usually local currency. | Maintained in foreign currency specific to the corresponding country. |

| Risk | Dependent on intermediary bank's reliability. | Exposed to foreign exchange and counterparty risks. |

| Usage | Common in trade finance to ease payment processing. | Essential for treasury foreign currency liquidity management. |

Overview of Payable Through Account vs Nostro Account

A Payable Through Account (PTA) allows domestic banks to process foreign currency transactions on behalf of correspondent banks, facilitating easier access to international funds without direct foreign banking relationships. Nostro accounts are foreign currency accounts held by a domestic bank in a correspondent bank abroad, enabling direct control and settlement of cross-border payments. PTAs simplify foreign transactions for clients, while Nostro accounts provide banks with greater liquidity management and real-time transaction capabilities in foreign currencies.

Definition and Key Features of Payable Through Account

A Payable Through Account (PTA) is a bank account maintained by a foreign bank with a correspondent bank, allowing the foreign bank's clients to transact directly in the correspondent's country without opening a local account. Key features include enabling clients to make and receive payments in local currency, facilitating trade finance by supporting import-export transactions, and providing easier access to foreign banking services while maintaining regulatory compliance. Unlike Nostro accounts, which represent a bank's foreign currency holdings with another bank, PTAs serve as a transactional bridge for foreign customers to interact with the correspondent bank's network.

Definition and Key Features of Nostro Account

A Nostro account is a bank account held by a domestic bank in a foreign currency at another bank, facilitating international transactions and currency exchange. Key features include enabling cross-border payments, maintaining foreign currency balances, and simplifying reconciliation of foreign transactions. Unlike a payable-through account, which is an intermediary account where a correspondent bank processes payments on behalf of another bank, a Nostro account specifically represents funds the home bank holds abroad.

Differences Between Payable Through Account and Nostro Account

Payable Through Accounts enable direct payment access for foreign banks' clients in correspondent banks, facilitating cross-border transactions without maintaining a foreign currency account. Nostro Accounts are maintained by a bank in a foreign currency with a correspondent bank, providing a record of that bank's funds held abroad. The primary distinction lies in operational usage: Payable Through Accounts offer transactional convenience for clients, whereas Nostro Accounts serve as the bank's foreign currency ledger for settlement and liquidity management.

Use Cases in International Treasury Operations

Payable through accounts facilitate efficient processing of foreign currency payments by allowing beneficiaries to access funds through intermediary banks, streamlining cross-border transactions without needing a direct account with the remitting bank. Nostro accounts are critical for international treasury operations as they hold foreign currency deposits maintained by a domestic bank in a correspondent bank abroad, enabling real-time settlement and foreign exchange management. Using payable through accounts reduces transaction costs and complexity for payments, while Nostro accounts provide precise control over liquidity and facilitate reconciliation in multi-currency treasury management.

Regulatory Considerations and Compliance

Regulatory considerations for payable through accounts (PTAs) require stringent due diligence and monitoring to prevent money laundering and ensure transparency, as funds pass through intermediary banks without clearly defined beneficiary accounts. Nostro accounts, directly held by a bank in a foreign currency with a correspondent bank, are subject to comprehensive compliance checks including foreign exchange regulations, anti-money laundering (AML) laws, and sanctions screening to align with international financial standards. Both account types demand robust reporting and audit trails to satisfy regulatory bodies and maintain cross-border transactional integrity.

Risk Management in Payable Through and Nostro Accounts

Payable Through Accounts (PTAs) expose banks to higher operational and credit risks due to limited transparency and control over underlying transactions, increasing the potential for fraud and money laundering. Nostro Accounts offer enhanced risk management by providing direct access and real-time monitoring of foreign currency holdings, ensuring better compliance and accurate reconciliation. Effective risk mitigation in treasury operations depends on leveraging Nostro accounts to minimize counterparty exposure and strengthen due diligence processes in cross-border payments.

Cost Implications and Fee Structures

Payable through accounts often result in higher transaction costs due to intermediary bank charges and longer clearing times, impacting liquidity management and overall treasury expenses. Nostro accounts streamline cross-border payments by holding foreign currency directly, reducing correspondent bank fees and enabling faster settlements, which lowers operational costs. Treasury professionals must weigh these fee structures carefully to optimize cost efficiency while ensuring timely fund availability in international transactions.

Impact on Cash Management and Liquidity

Payable through accounts enable smoother local currency payments without the need for multiple foreign currency conversions, improving cash flow predictability and reducing liquidity risks. Nostro accounts provide real-time visibility into foreign currency balances held with correspondent banks, facilitating precise liquidity management and optimizing cash reserves across multiple currencies. Efficient use of both Payable through and Nostro accounts enhances overall treasury cash management by balancing transaction speed with accurate liquidity forecasting.

Best Practices for Treasury Professionals

Payable through accounts facilitate efficient cross-border payments by allowing beneficiaries to access funds through intermediary banks, minimizing delays and ensuring seamless settlement. Nostro accounts provide treasury professionals with real-time visibility of foreign currency balances, enabling accurate cash flow management and risk mitigation. Best practices include regularly reconciling Nostro accounts to prevent discrepancies and leveraging payable through accounts to optimize payment routing and reduce transaction costs.

Important Terms

Correspondent Banking

Correspondent banking involves maintaining Nostro accounts, which are foreign currency accounts held by a bank in another bank, enabling cross-border transactions and settlement; Payable Through Accounts (PTA) allow foreign banks to extend their services via local banks, facilitating direct customer transactions without the need to open multiple Nostro accounts. Nostro accounts provide precise control over foreign currency holdings and settlement, while PTAs enhance accessibility and convenience for clients conducting international payments through correspondent banking relationships.

Intermediary Bank

An intermediary bank facilitates transactions between the originating and beneficiary banks, often used in payable-through accounts where funds pass through a third bank before reaching the final beneficiary. Nostro accounts are bank accounts held by one bank in another bank's currency, providing a direct means for settlement and reducing reliance on intermediary banks for cross-border payments.

Settlement Risk

Settlement risk increases in payable-through accounts due to indirect control over funds compared to the direct ownership and monitoring available with Nostro accounts, impacting transaction security and reconciliation efficiency.

Vostro Account

A Vostro account is a bank account held by a foreign bank in the domestic currency of the host bank, facilitating payments and settlements between correspondent banks. Payable through accounts enable foreign banks to access the host bank's branch network for customer transactions, while Nostro accounts represent a bank's holdings in a foreign currency held by another bank, providing a mirror relationship to Vostro accounts.

Cross-Border Transactions

Cross-border transactions utilize payable through accounts to simplify correspondent banking, while Nostro accounts enable banks to hold foreign currency funds directly for seamless international settlements.

Regulatory Compliance (AML/KYC)

Regulatory compliance in Anti-Money Laundering (AML) and Know Your Customer (KYC) processes mandates thorough verification of parties involved in Payable Through Accounts (PTA) versus Nostro accounts to prevent illicit transactions. Financial institutions must ensure transparency and adherence to cross-border transaction regulations by monitoring PTA arrangements carefully, as these accounts can pose higher risks of money laundering compared to direct Nostro account operations.

Due Diligence

Due diligence in managing payables through account versus Nostro account involves thorough verification of transaction details, ensuring accurate reconciliation and compliance with banking regulations to prevent fraud and errors. Effective monitoring of Nostro accounts provides real-time insights into foreign currency transactions, while payables through account require precise tracking of payable ledgers to maintain liquidity and operational efficiency.

Multicurrency Clearing

Multicurrency clearing enables efficient settlement of cross-border transactions by utilizing payable through accounts to streamline correspondent banking processes while nostro accounts provide banks with real-time foreign currency balances for accurate reconciliation.

Swift Messaging (MT103/MT940)

Swift Messaging MT103 facilitates customer credit transfers using the Payable Through Account for indirect payment instructions, while MT940 provides detailed Nostro Account statements for bank reconciliation and transaction tracking.

Beneficiary Bank

A Beneficiary Bank processes incoming payments and credits funds to the recipient's account, often using a Payable Through Account (PTA) to facilitate transactions via an intermediary bank, while a Nostro Account is maintained by a bank in a foreign bank's currency to manage cross-border settlements and liquidity. Payable Through Accounts enhance transaction efficiency by allowing beneficiary banks to access funds through authorized correspondent banks, whereas Nostro Accounts provide direct control over foreign currency funds, crucial for international trade and banking operations.

Payable through account vs Nostro account Infographic

moneydif.com

moneydif.com