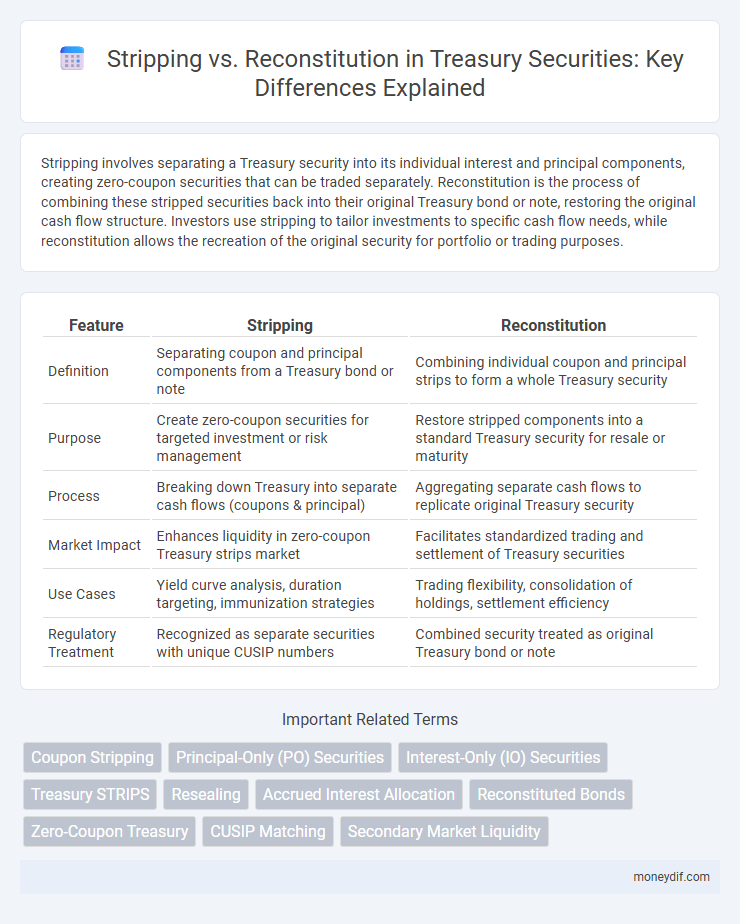

Stripping involves separating a Treasury security into its individual interest and principal components, creating zero-coupon securities that can be traded separately. Reconstitution is the process of combining these stripped securities back into their original Treasury bond or note, restoring the original cash flow structure. Investors use stripping to tailor investments to specific cash flow needs, while reconstitution allows the recreation of the original security for portfolio or trading purposes.

Table of Comparison

| Feature | Stripping | Reconstitution |

|---|---|---|

| Definition | Separating coupon and principal components from a Treasury bond or note | Combining individual coupon and principal strips to form a whole Treasury security |

| Purpose | Create zero-coupon securities for targeted investment or risk management | Restore stripped components into a standard Treasury security for resale or maturity |

| Process | Breaking down Treasury into separate cash flows (coupons & principal) | Aggregating separate cash flows to replicate original Treasury security |

| Market Impact | Enhances liquidity in zero-coupon Treasury strips market | Facilitates standardized trading and settlement of Treasury securities |

| Use Cases | Yield curve analysis, duration targeting, immunization strategies | Trading flexibility, consolidation of holdings, settlement efficiency |

| Regulatory Treatment | Recognized as separate securities with unique CUSIP numbers | Combined security treated as original Treasury bond or note |

Understanding Treasury Security Stripping

Treasury security stripping involves separating the principal and interest payments of a Treasury bond into individual zero-coupon securities called separate trading of registered interest and principal of securities (STRIPS). This process allows investors to purchase and trade the bond's components independently, providing greater flexibility in managing cash flows and interest rate risk. Reconstitution is the reverse, combining STRIPS back into the original Treasury bond, facilitating liquidity and marketability.

What is Treasury Reconstitution?

Treasury reconstitution is the process of restoring stripped Treasury securities to their original form by recombining principal and interest components previously separated during stripping. This enables investors to hold or trade the security as a whole, reflecting the original Treasury bond or note with its combined cash flows. Reconstitution is essential for maintaining liquidity and flexibility in Treasury securities trading and management.

Key Differences Between Stripping and Reconstitution

Stripping involves separating a bond into its individual interest and principal components, creating zero-coupon securities, while reconstitution combines stripped components back into the original bond. Stripped securities trade at discounts reflecting the present value of future payments, whereas reconstitution restores the bond's full coupon and principal structure for standard trading. Key differences include liquidity, pricing mechanics, and investor objectives, with stripping appealing to investors seeking fixed maturity payments and reconstitution serving those preferring traditional bond cash flows.

Process of Stripping Treasury Securities

Stripping Treasury securities involves separating the coupon payments and the principal from a whole bond, creating zero-coupon securities known as separate trading of registered interest and principal securities (STRIPS). This process transforms standard Treasury coupons into distinct interest-only and principal-only components, facilitating targeted investment strategies and cash flow management. By converting cash flows into zero-coupon instruments, investors can benefit from precise duration matching and tax planning opportunities.

Steps in the Reconstitution of Treasuries

Reconstitution of Treasuries involves combining previously stripped coupons and principal components back into a fully assembled Treasury security. The steps include verifying the eligibility and authenticity of the stripped securities, calculating accrued interest, and delivering the requisite principal and coupon strips to the Treasury or clearinghouse. This process restores the bond to its original form, enabling standard trading and settlement within the Treasury securities market.

Market Participants in Stripping and Reconstitution

Market participants in stripping and reconstitution include institutional investors, treasury managers, and bond traders who utilize these techniques to enhance portfolio flexibility and manage interest rate risk. Stripping involves separating a bond into its individual interest and principal components, creating zero-coupon securities that appeal to investors seeking specific cash flows or duration profiles. Reconstitution reverses this process by recombining stripped securities, allowing participants to restore original bond characteristics and optimize liquidity or hedging strategies.

Pricing Implications of STRIPS vs Reconstituted Bonds

STRIPS, or Separate Trading of Registered Interest and Principal of Securities, trade as zero-coupon bonds, causing their pricing to reflect solely the present value of future payments discounted at prevailing interest rates. Reconstituted bonds combine these strips back into their original coupon-bearing form, with prices influenced by accrued interest and market demand for coupon cash flows. The pricing differential arises because STRIPS eliminate reinvestment risk and coupon reinvestment assumptions present in reconstituted bonds, often leading to higher yield volatility for STRIPS compared to reconstituted instruments.

Regulatory Considerations for STRIPS and Reconstitution

Regulatory considerations for STRIPS and reconstitution focus on compliance with securities laws, including SEC regulations and IRS tax treatment of zero-coupon bonds. STRIPS are subject to specific registration requirements and reporting obligations under the Securities Act, while reconstitution involves ensuring proper record-keeping and documentation to maintain tax-exempt status for Treasury securities. Both processes require adherence to anti-fraud provisions and accurate disclosure to safeguard market transparency and investor protection.

Risks and Benefits: Stripping vs Reconstitution

Stripping Treasury securities separates coupons from the principal, creating zero-coupon bonds that eliminate reinvestment risk but increase price volatility and interest rate sensitivity. Reconstitution combines these stripped securities back into a single bond, restoring coupon payments and stabilizing cash flows while exposing investors to reinvestment risk. Stripping benefits investors seeking predictable lump-sum payments, whereas reconstitution favors those prioritizing consistent income streams and reduced price fluctuations.

Impact on Treasury Market Liquidity and Efficiency

Stripping Treasury securities creates zero-coupon bonds that can improve market liquidity by offering a wider range of maturities and risk profiles, attracting diverse investors. Reconstitution merges these stripped securities back into standard coupons, enhancing price discovery and reducing fragmentation, which boosts overall market efficiency. This dynamic process balances supply and demand, optimizing Treasury market functioning and facilitating smoother issuance and trading activities.

Important Terms

Coupon Stripping

Coupon stripping separates bond coupons from the principal to create zero-coupon securities, while reconstitution combines these stripped components back into the original bond structure.

Principal-Only (PO) Securities

Principal-Only (PO) securities represent stripped mortgage-backed securities that separate and pay only the principal component, allowing investors to focus on principal cash flows detached from interest payments, while reconstitution combines these stripped components back into a full mortgage-backed security.

Interest-Only (IO) Securities

Interest-Only (IO) securities are created by stripping the interest payments from a pool of mortgage-backed securities, allowing investors to receive cash flows solely from interest components. Reconstitution involves combining these stripped IO and Principal-Only (PO) securities back into the original mortgage-backed security, restoring the full payment stream.

Treasury STRIPS

Treasury STRIPS are zero-coupon securities created by separating the principal and interest components of Treasury bonds through stripping, while reconstitution reverses this process by combining stripped components back into a full coupon-bearing bond.

Resealing

Resealing in lipid bilayers involves restoring membrane integrity by balancing the effects of stripping, which removes damaged components, and reconstitution, which incorporates functional molecules to recover membrane functionality.

Accrued Interest Allocation

Accrued interest allocation in stripping involves separating bond coupons from the principal to create zero-coupon securities, while reconstitution combines these components back into the original bond, optimizing cash flow and yield management.

Reconstituted Bonds

Reconstituted bonds result from combining stripped coupons and principal securities back into a single bond, reversing the process of stripping to restore the original bond's cash flows.

Zero-Coupon Treasury

Zero-Coupon Treasury securities result from stripping interest payments and principal from standard Treasury bonds into separate, non-interest-bearing components that can be sold individually, allowing investors to target specific cash flows. Reconstitution reverses this process by combining stripped securities back into the original coupon-bearing bond, facilitating liquidity and portfolio management in the fixed-income market.

CUSIP Matching

CUSIP matching ensures accurate identification of securities during stripping and reconstitution processes by aligning unique CUSIP identifiers to maintain portfolio integrity and prevent settlement errors.

Secondary Market Liquidity

Secondary market liquidity improves significantly as stripping enables trading of individual bond components while reconstitution allows investors to combine strips back into original securities, enhancing market efficiency and price discovery.

Stripping vs Reconstitution Infographic

moneydif.com

moneydif.com