The bid-to-cover ratio measures demand for Treasury securities by comparing the total bids received to the amount offered, indicating market appetite and liquidity. A high bid-to-cover ratio signals strong investor interest, often resulting in lower stop-out yields, which represent the highest accepted yield in the auction. Monitoring these metrics helps assess Treasury auction competitiveness and interest rate expectations.

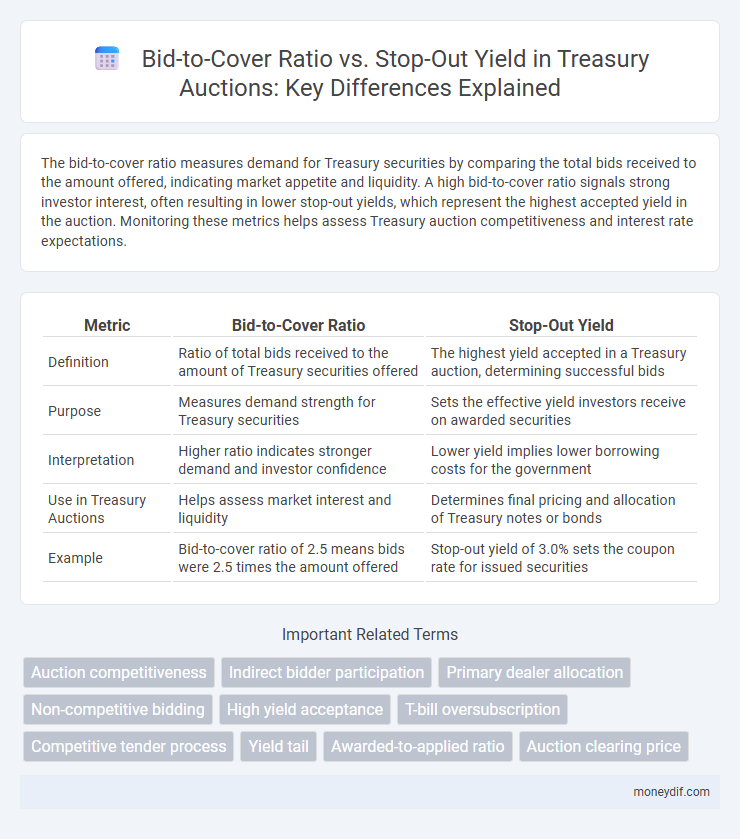

Table of Comparison

| Metric | Bid-to-Cover Ratio | Stop-Out Yield |

|---|---|---|

| Definition | Ratio of total bids received to the amount of Treasury securities offered | The highest yield accepted in a Treasury auction, determining successful bids |

| Purpose | Measures demand strength for Treasury securities | Sets the effective yield investors receive on awarded securities |

| Interpretation | Higher ratio indicates stronger demand and investor confidence | Lower yield implies lower borrowing costs for the government |

| Use in Treasury Auctions | Helps assess market interest and liquidity | Determines final pricing and allocation of Treasury notes or bonds |

| Example | Bid-to-cover ratio of 2.5 means bids were 2.5 times the amount offered | Stop-out yield of 3.0% sets the coupon rate for issued securities |

Understanding the Bid-to-Cover Ratio in Treasury Auctions

The Bid-to-Cover ratio measures the demand for Treasury securities in auctions by comparing total bids received to the amount of securities offered, reflecting investor appetite and market confidence. A higher Bid-to-Cover ratio indicates strong demand, often leading to a lower Stop-out yield, which is the highest accepted yield that clears the auction. Tracking these metrics helps investors evaluate market sentiment and predict future interest rate movements.

What Is Stop-Out Yield and Why Does It Matter?

Stop-out yield represents the highest accepted yield in a Treasury auction, signaling the minimum return investors demand for bidding success. It determines the cutoff point for successful bids, directly influencing the Treasury's borrowing costs and reflecting market demand for government debt. Understanding stop-out yield helps investors assess auction competitiveness and anticipate interest rate trends, crucial for effective portfolio management.

Bid-to-Cover Ratio vs. Stop-Out Yield: Key Differences

The Bid-to-Cover Ratio measures demand by comparing total bids to securities offered in a treasury auction, while the Stop-Out Yield indicates the highest accepted yield setting the auction cutoff price. A high Bid-to-Cover Ratio suggests strong investor interest, whereas the Stop-Out Yield reflects the cost of borrowing for the government. These metrics together provide insight into market demand and pricing dynamics for treasury securities.

How Bid-to-Cover Ratio Reflects Treasury Auction Demand

Bid-to-cover ratio measures the level of demand by comparing total bids submitted to the amount of securities offered in a Treasury auction, indicating investor appetite and confidence in government debt. A higher bid-to-cover ratio signals strong demand and often corresponds to lower stop-out yields, as competitive bidding drives prices up and yields down. This relationship highlights the importance of the bid-to-cover ratio as a key indicator of market sentiment and the effectiveness of Treasury debt issuance.

Interpreting Stop-Out Yield in Government Debt Issuance

Stop-out yield in government debt issuance represents the highest accepted yield at which Treasury securities are allocated during an auction, directly influencing the auction's bid-to-cover ratio. A lower stop-out yield compared to previous auctions indicates strong demand and a potentially high bid-to-cover ratio, signaling investor confidence in the government's creditworthiness. Monitoring the relationship between stop-out yield and bid-to-cover ratio provides critical insights into market sentiment, debt cost, and potential refinancing risks.

Factors Influencing Bid-to-Cover Ratio and Stop-Out Yield

The bid-to-cover ratio and stop-out yield are influenced by factors such as prevailing interest rates, market liquidity, and investor demand for Treasury securities. Higher demand for bonds typically raises the bid-to-cover ratio while lowering the stop-out yield, reflecting strong competition among bidders. Economic indicators, Federal Reserve policies, and geopolitical events also significantly impact these auction metrics by shaping investor expectations and risk appetite.

Impact of Bid-to-Cover Ratio on Treasury Market Sentiment

The bid-to-cover ratio directly influences Treasury market sentiment by signaling investor demand intensity for government securities; a higher ratio typically reflects robust demand and confidence in the Treasury auction. This heightened demand often leads to a lower stop-out yield, indicating cheaper borrowing costs for the government and stronger market optimism. Conversely, a low bid-to-cover ratio may signal weaker demand, resulting in higher stop-out yields and increased market uncertainty.

The Relationship Between Bid-to-Cover Ratio and Stop-Out Yield

The bid-to-cover ratio measures demand intensity in Treasury auctions, indicating the ratio of total bids received to the amount offered, while the stop-out yield represents the highest yield accepted in the auction. A higher bid-to-cover ratio generally correlates with a lower stop-out yield, reflecting stronger investor appetite and confidence, which drives yields down. Conversely, a lower bid-to-cover ratio often signals weaker demand, resulting in a higher stop-out yield as the Treasury must offer more attractive rates to attract buyers.

Historical Trends in Bid-to-Cover Ratios and Treasury Yields

Historical trends in bid-to-cover ratios reveal investor demand strength for U.S. Treasury securities, often rising during economic uncertainty and driving competitive auctions. Stop-out yields closely correlate with bid-to-cover ratios, where higher demand typically suppresses yields due to increased bidding pressure. Analysis over multiple decades shows an inverse relationship, with bid-to-cover ratios peaking during low-yield environments and falling when yields rise amid tightening monetary policy.

How Investors Use Bid-to-Cover and Stop-Out Yield for Strategy

Investors analyze the bid-to-cover ratio to gauge demand strength in Treasury auctions, where a higher ratio indicates robust investor interest and potential price stability. Stop-out yield, representing the highest accepted yield, helps investors assess the cutoff yield level that determines successful bids, influencing their expectations for future yield movements. By combining these metrics, investors strategically position their bids to optimize returns and manage risk in volatile interest rate environments.

Important Terms

Auction competitiveness

Auction competitiveness is strongly influenced by the bid-to-cover ratio, which measures demand by dividing total bids by the amount offered; a higher ratio typically signals robust investor interest and tighter stop-out yields. Conversely, lower stop-out yields indicate strong competition among bidders, as aggressive bidding drives yields down, reflecting heightened market confidence in the underlying securities.

Indirect bidder participation

Indirect bidder participation significantly influences the bid-to-cover ratio by increasing demand and driving competitive bidding, which typically lowers the stop-out yield. Higher bid-to-cover ratios, fueled by robust indirect bidding, signal strong market confidence and often result in a more favorable stop-out yield for issuers.

Primary dealer allocation

Primary dealer allocation is heavily influenced by the bid-to-cover ratio, which reflects demand intensity for government securities, while the stop-out yield represents the highest yield accepted in the auction, determining the cost of borrowing for the government. A high bid-to-cover ratio often signals strong investor confidence, potentially leading to lower stop-out yields, whereas a lower ratio can result in higher stop-out yields, affecting primary dealers' allocation volumes and pricing strategies.

Non-competitive bidding

Non-competitive bidding allows investors to participate in treasury auctions without specifying a yield, accepting the stop-out yield determined by competitive bids, which directly influences the bid-to-cover ratio--a key indicator of demand intensity. A higher bid-to-cover ratio typically reflects strong investor interest and can lead to a lower stop-out yield, signaling cost-effective government borrowing conditions.

High yield acceptance

High yield acceptance inversely correlates with the bid-to-cover ratio, as a higher bid-to-cover ratio indicates stronger demand, resulting in a lower stop-out yield due to increased competition among bidders. The stop-out yield, representing the highest yield accepted, declines when bid-to-cover ratios rise, reflecting reduced issuer borrowing costs in high demand auctions.

T-bill oversubscription

T-bill oversubscription occurs when demand exceeds supply, reflected in a high bid-to-cover ratio indicating strong investor appetite, while the stop-out yield represents the highest accepted yield in the auction; a high bid-to-cover ratio typically correlates with a lower stop-out yield due to competitive bidding. Monitoring the interplay between bid-to-cover ratios and stop-out yields provides insights into market sentiment and liquidity preferences for short-term government securities.

Competitive tender process

A competitive tender process uses the bid-to-cover ratio to measure demand intensity while the stop-out yield determines the highest accepted bid rate, together optimizing auction pricing efficiency.

Yield tail

Yield tail occurs when the stop-out yield exceeds the average yield implied by the bid-to-cover ratio, signaling weaker demand and higher borrowing costs in debt auctions.

Awarded-to-applied ratio

The awarded-to-applied ratio measures the proportion of bids accepted relative to total bids submitted, influencing the bid-to-cover ratio which reflects demand in treasury auctions, while the stop-out yield marks the highest accepted yield, indicating market interest and pricing. A lower awarded-to-applied ratio combined with a high bid-to-cover ratio typically signals strong investor competition with stringent acceptance criteria, affecting the stop-out yield's level in government security auctions.

Auction clearing price

Auction clearing price reflects the price at which the quantity of securities offered matches investor demand, directly impacting the stop-out yield as it determines the highest accepted yield. A higher bid-to-cover ratio indicates stronger demand, often leading to a lower stop-out yield and a higher auction clearing price, signaling increased market confidence.

Bid-to-cover ratio vs Stop-out yield Infographic

moneydif.com

moneydif.com