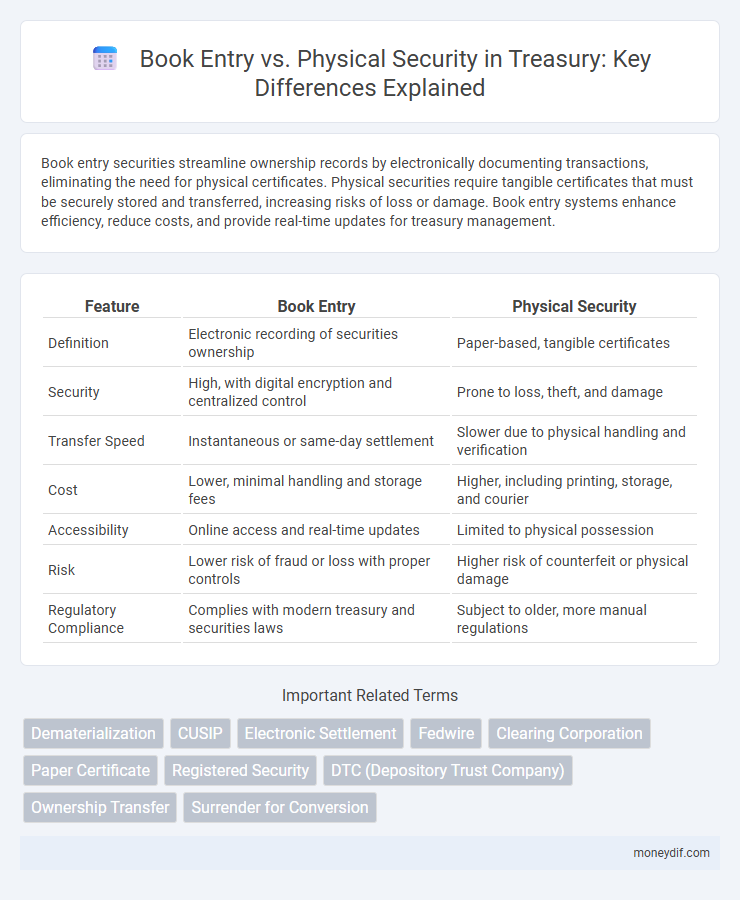

Book entry securities streamline ownership records by electronically documenting transactions, eliminating the need for physical certificates. Physical securities require tangible certificates that must be securely stored and transferred, increasing risks of loss or damage. Book entry systems enhance efficiency, reduce costs, and provide real-time updates for treasury management.

Table of Comparison

| Feature | Book Entry | Physical Security |

|---|---|---|

| Definition | Electronic recording of securities ownership | Paper-based, tangible certificates |

| Security | High, with digital encryption and centralized control | Prone to loss, theft, and damage |

| Transfer Speed | Instantaneous or same-day settlement | Slower due to physical handling and verification |

| Cost | Lower, minimal handling and storage fees | Higher, including printing, storage, and courier |

| Accessibility | Online access and real-time updates | Limited to physical possession |

| Risk | Lower risk of fraud or loss with proper controls | Higher risk of counterfeit or physical damage |

| Regulatory Compliance | Complies with modern treasury and securities laws | Subject to older, more manual regulations |

Introduction to Book Entry and Physical Securities

Book entry securities represent ownership electronically, eliminating the need for physical certificates and enabling faster, more secure transactions within treasury operations. Physical securities involve the issuance of tangible certificates, which require manual handling, storage, and transfer, increasing operational risk and administrative costs. Treasury management favors book entry systems for enhanced efficiency, reduced risk of loss or theft, and streamlined settlement processes.

Definition and Key Features of Book Entry Securities

Book entry securities are financial instruments registered electronically in an account, eliminating the need for physical certificates. They offer enhanced security, faster transaction settlement, and reduced risks of loss or theft compared to physical securities. Ownership records of book entry securities are maintained through centralized depositories or custodians, facilitating efficient transfer and recordkeeping.

Definition and Key Features of Physical Securities

Physical securities are tangible financial instruments such as stock certificates or bonds that represent ownership or creditor relations and can be physically held by investors. Key features include the need for secure storage, the risk of loss or damage, and the requirement for manual transfer or endorsement during transactions. Unlike book-entry securities, physical securities involve more administrative processes and potential delays in settlement due to their physical nature.

Historical Evolution: From Physical to Book Entry Systems

The transition from physical securities to book-entry systems revolutionized treasury operations by significantly enhancing transaction speed and security, eliminating the need for paper certificates. Historically, physical securities required manual handling and verification, increasing risks of loss, theft, and forgery. The advent of digital book-entry systems facilitated efficient electronic recording and transfer of ownership, streamlining settlement processes and reducing operational costs.

Advantages of Book Entry Securities in Treasury Operations

Book entry securities streamline treasury operations by enabling faster settlement and reducing administrative costs associated with handling physical certificates. They enhance security through electronic record-keeping, minimizing risks of loss, theft, or forgery. Integration with automated systems allows for efficient portfolio management and real-time transaction tracking, improving overall liquidity management.

Risks and Challenges of Physical Securities

Physical securities pose significant risks such as theft, loss, and damage during handling or storage, leading to potential financial losses and legal disputes. They require extensive administrative processes including manual record-keeping and verification, increasing the likelihood of errors and fraud. The challenges of physical securities also include delayed settlement times and higher costs related to secure transport and insurance compared to book-entry securities.

Regulatory Framework for Book Entry and Physical Securities

The regulatory framework for book-entry securities is governed primarily by the Uniform Commercial Code (UCC) in the United States, which facilitates electronic registration and transfers, ensuring streamlined record-keeping and reduced risks of loss or theft. Physical securities remain subject to stringent regulations under the Securities Act of 1933 and the Securities Exchange Act of 1934, requiring secure custody, documentation, and endorsements for transfer, which increases operational complexity. Regulatory bodies like the SEC and FINRA enforce compliance standards to protect investors and maintain market integrity across both book-entry and physical security transactions.

Settlement and Custody Considerations

Book entry securities facilitate faster settlement and lower custody costs by eliminating the need for physical certificate handling, reducing risks of loss or theft. Physical securities require secure storage, manual transfer processes, and increased settlement times due to physical movement and verification. Treasury operations benefit from streamlined custody with book entry systems, improving liquidity and operational efficiency.

Cost Comparison: Book Entry vs Physical Securities

Book entry securities significantly reduce costs related to printing, storage, and physical transfer compared to physical securities, which incur expenses for secure handling and transportation. The electronic nature of book entries streamlines reconciliation and settlement processes, lowering administrative overhead and minimizing the risk of loss or damage. Overall, the cost efficiency of book entry systems makes them a preferred choice for treasury operations managing large volumes of securities.

Future Trends in Treasury Security Management

Book entry securities dominate modern treasury management by reducing risks associated with physical certificates such as loss and fraud. Emerging technologies like blockchain enhance transparency and security, enabling faster settlement and real-time asset tracking in book entry systems. The shift toward digital assets and regulatory advancements drive future trends favoring seamless integration of electronic records over traditional physical security methods.

Important Terms

Dematerialization

Dematerialization enables seamless electronic transfer and storage of securities by converting physical certificates into book entry form, enhancing transaction speed, security, and reducing risks of loss or fraud.

CUSIP

CUSIP numbers uniquely identify securities in both book-entry and physical formats, ensuring streamlined tracking and settlement across financial markets. Book-entry securities eliminate the need for physical certificates by recording ownership electronically, enhancing security and reducing the risk of loss compared to traditional physical securities.

Electronic Settlement

Electronic settlement enables faster, more secure transfer of ownership through book entry records, eliminating risks and delays associated with physical security certificates.

Fedwire

Fedwire enables instant transfer of book-entry securities, eliminating the risks and delays associated with physical security certificates.

Clearing Corporation

Clearing Corporation facilitates secure and efficient settlement by transitioning physical securities into book-entry form, reducing risks and streamlining trades.

Paper Certificate

Paper certificates represent physical securities that provide tangible proof of ownership, contrasting with book-entry securities recorded electronically in custodial accounts. Physical certificates carry risks such as loss, theft, and damage, whereas book-entry systems enhance security and efficiency by enabling seamless electronic transfers and centralized recordkeeping.

Registered Security

Registered security offers enhanced ownership clarity and transfer efficiency compared to physical security by maintaining electronic book entry records that reduce risks of loss, theft, and administrative errors.

DTC (Depository Trust Company)

The Depository Trust Company (DTC) facilitates efficient securities transactions by maintaining book-entry records, which eliminate the need for physical certificates and reduce risks associated with handling paper securities. Book-entry systems at DTC centralize ownership records electronically, enabling faster settlement and enhanced security compared to traditional physical securities.

Ownership Transfer

Ownership transfer through book entry ensures faster, cost-effective, and secure transactions compared to the slower, riskier process of transferring physical securities.

Surrender for Conversion

Surrender for conversion involves exchanging physical securities for book-entry form, enhancing security and transaction efficiency by reducing the risks of loss, theft, or damage associated with physical certificates. This process streamlines ownership transfer, enabling electronic recording of securities in centralized depositories and facilitating faster settlement in financial markets.

Book Entry vs Physical Security Infographic

moneydif.com

moneydif.com