Tap issuance allows governments or corporations to raise additional funds by reopening an existing bond issue, providing flexibility and cost efficiency compared to launching a completely new bond. Syndicated issuance involves a group of banks underwriting and distributing a new bond issue, offering broader market access and shared risk among participants. Tap issuance is typically faster and less complex, while syndicated issuance can attract wider investor participation and potentially achieve better pricing.

Table of Comparison

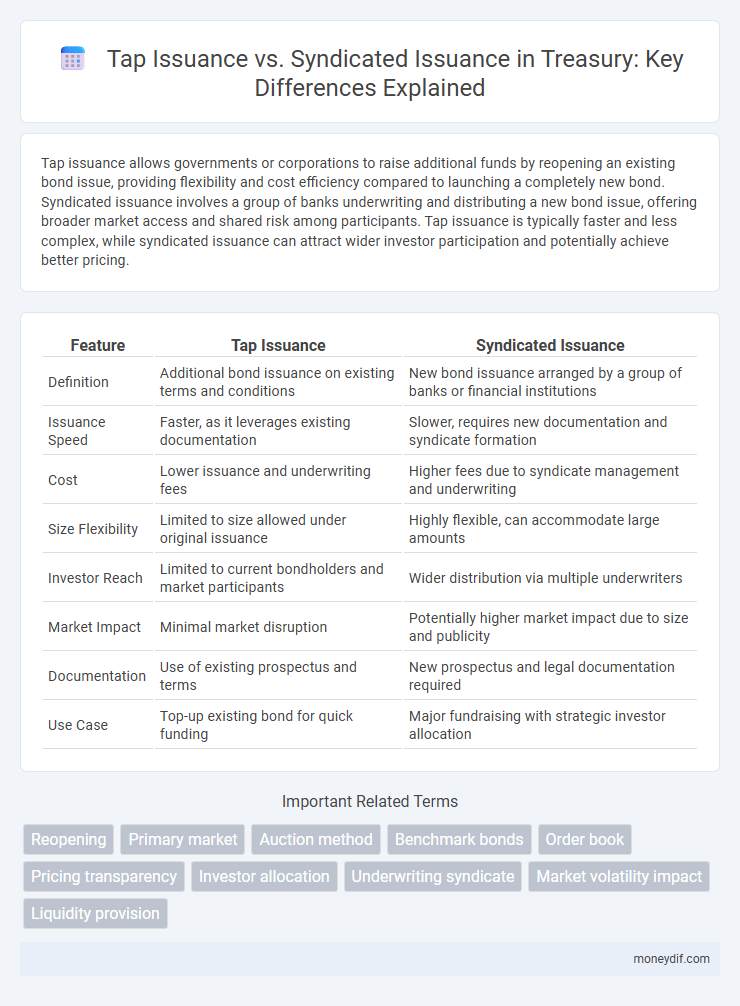

| Feature | Tap Issuance | Syndicated Issuance |

|---|---|---|

| Definition | Additional bond issuance on existing terms and conditions | New bond issuance arranged by a group of banks or financial institutions |

| Issuance Speed | Faster, as it leverages existing documentation | Slower, requires new documentation and syndicate formation |

| Cost | Lower issuance and underwriting fees | Higher fees due to syndicate management and underwriting |

| Size Flexibility | Limited to size allowed under original issuance | Highly flexible, can accommodate large amounts |

| Investor Reach | Limited to current bondholders and market participants | Wider distribution via multiple underwriters |

| Market Impact | Minimal market disruption | Potentially higher market impact due to size and publicity |

| Documentation | Use of existing prospectus and terms | New prospectus and legal documentation required |

| Use Case | Top-up existing bond for quick funding | Major fundraising with strategic investor allocation |

Overview of Treasury Debt Issuance Methods

Treasury debt issuance methods primarily include Tap issuance and Syndicated issuance, each serving distinct liquidity and market demand needs. Tap issuance involves reopening existing bonds to raise additional funds without a new auction, enhancing flexibility and cost-effectiveness for debt management. Syndicated issuance entails placing new bond issues through a group of underwriters, optimizing distribution and pricing in capital markets while catering to investor appetite and issuance size.

Defining Tap Issuance in Treasury Markets

Tap issuance refers to a method in treasury markets where additional debt securities are issued on top of an existing bond series without creating a new issue, allowing issuers to raise funds flexibly and efficiently. This contrasts with syndicated issuance, which involves a group of underwriters selling a new bond issue to investors at one time. Tap issuance enhances liquidity by increasing the outstanding volume of an existing bond, thus optimizing market absorption and reducing issuance costs.

Understanding Syndicated Issuance for Government Bonds

Syndicated issuance of government bonds involves multiple financial institutions working together to underwrite and distribute large bond offerings, ensuring a broad investor base and enhanced market liquidity. This method contrasts with tap issuance, where additional bonds are issued into an existing series, allowing for incremental financing without reintroducing the security to the market. Understanding syndicated issuance is crucial for governments aiming to efficiently raise substantial capital while managing pricing risk and ensuring successful allocation across diverse institutional investors.

Key Differences Between Tap and Syndicated Issuance

Tap issuance allows governments to reopen existing bond issues, enabling incremental borrowing without launching a new security, which enhances pricing efficiency and liquidity. Syndicated issuance involves a group of underwriters marketing a new bond issue, providing broader distribution and diversified risk but often incurring higher issuance costs and longer execution times. Tap issuances offer flexibility for quick funding needs, while syndicated issuances provide access to a wider investor base and typically support larger funding amounts.

Liquidity Implications: Tap vs Syndication

Tap issuance enhances liquidity by allowing issuers to raise additional funds incrementally on existing bond tranches without reopening a full syndication process, leading to more flexible and timely access to capital markets. Syndicated issuance involves a consortium of banks underwriting a new bond offering, which can generate immediate large-scale liquidity but typically requires longer lead times and higher transaction costs. The choice between tap and syndicated issuance impacts liquidity management strategies, with taps favoring continuous market presence and syndications catering to substantial funding needs in a single transaction.

Impact on Primary Market Participants

Tap issuance offers primary market participants quicker access to additional bonds without the need for a new issuance process, enhancing liquidity and reducing underwriting fees. Syndicated issuance involves a consortium of banks managing the entire issuance, providing broader distribution and price discovery but at higher transaction costs and longer execution times. The choice between tap and syndicated issuance impacts investor demand, market depth, and overall cost efficiency in government debt management.

Cost Efficiency: Comparing Tap and Syndicated Approaches

Tap issuance offers greater cost efficiency by allowing issuers to access additional funds through incremental tranches without incurring the high underwriting fees typical of syndicated loans. Syndicated issuance involves multiple financial institutions sharing underwriting risk, leading to higher upfront costs including arrangement and distribution fees. Consequently, tap issues minimize expenses through streamlined process and reduced reliance on intermediaries, making them favorable for issuers seeking flexible and lower-cost capital raising options.

Flexibility and Timing Considerations

Tap issuance offers greater flexibility by allowing issuers to raise additional capital incrementally after the initial offering, adapting to market conditions without the need for a full reissuance. Syndicated issuance involves a coordinated underwriting process with multiple banks, typically requiring fixed timing and larger, one-time capital raising events. Timing considerations favor tap issuance for opportunistic funding windows, while syndicated issuance suits predetermined financing schedules and larger funding needs.

Transparency and Market Signaling Effects

Tap issuance offers enhanced transparency by allowing continuous pricing updates and volume disclosures, fostering real-time market information flow. Syndicated issuance provides strong market signaling by involving multiple underwriters, signaling issuer credit quality and demand strength. Both methods impact investor perception, but tap issuance supports dynamic transparency, while syndicated issuance emphasizes coordinated market confidence.

Choosing the Right Issuance Method for Treasury Operations

Tap issuance allows treasuries to efficiently raise capital incrementally by tapping into an existing bond issue, offering flexibility and cost savings through reduced underwriting fees. Syndicated issuance involves multiple underwriters distributing a new bond issuance, providing broad market access and potentially larger funding amounts, suitable for complex or large-scale financing needs. Selecting the right issuance method depends on the treasury's capital requirements, market conditions, and the desired level of investor diversification.

Important Terms

Reopening

Reopening tap issuance allows issuers to raise additional funds on an existing bond issue efficiently, while syndicated issuance involves a group of underwriters marketing a new bond issue to investors, often resulting in broader distribution and diverse investor participation.

Primary market

Primary market transactions in debt or equity securities involve Tap issuance, which allows issuers to raise additional capital by re-opening an existing security issue without creating a new security series, enhancing liquidity and price stability. Syndicated issuance, conversely, entails multiple investment banks underwriting and distributing a new security jointly, facilitating large-scale capital raising and risk diversification among underwriters.

Auction method

The auction method in tap issuance allows additional securities to be offered to the market at prevailing prices, promoting price discovery and liquidity, whereas syndicated issuance involves a group of underwriters who coordinate the sale of a new bond issue at a fixed price, minimizing market risk for the issuer. Tap issuance via auctions is more flexible and responsive to market demand, while syndicated issuance provides greater underwriting certainty and marketing support for large-scale debt offerings.

Benchmark bonds

Benchmark bonds issued through tapped issuance allow governments to raise additional funds by re-opening existing bonds without launching new securities, whereas syndicated issuance involves a group of underwriters distributing a new bond to investors, often resulting in higher liquidity and pricing efficiency.

Order book

Order book depth and investor demand typically vary between Tap issuance, which supplements an existing bond issue, and Syndicated issuance, where a new bond is launched with coordinated underwriting.

Pricing transparency

Pricing transparency in tap issuance is higher compared to syndicated issuance due to the public nature and continuous pricing of tap issues, allowing investors to observe market-driven price adjustments in real-time. Syndicated issuance involves negotiated pricing among underwriters and large investors, often limiting immediate visibility into pricing dynamics and reducing transparency.

Investor allocation

Investor allocation in Tap issuance typically offers pro-rata access to additional debt for existing investors, while Syndicated issuance involves distributing new securities to a broader investor base through underwriters, enhancing diversification and market reach.

Underwriting syndicate

Underwriting syndicates efficiently distribute risk and capital during syndicated issuances, while Tap issuances typically involve additional tranches of securities sold incrementally without forming a new syndicate.

Market volatility impact

Market volatility significantly influences the pricing and investor appetite between tap issuance and syndicated issuance, with tap issuances often favored during unstable periods due to their flexibility and ability to price closer to market conditions. Syndicated issuances, conversely, may face higher underwriting costs and pricing discounts, reflecting increased risk premiums demanded by investors amid volatility.

Liquidity provision

Liquidity provision in Tap issuance allows continuous capital raising by reopening an existing bond issuance, maintaining secondary market liquidity and reducing issuance costs. Syndicated issuance involves multiple underwriters distributing a new bond issue, enhancing initial liquidity through broad investor access but often incurring higher underwriting fees.

Tap issuance vs Syndicated issuance Infographic

moneydif.com

moneydif.com