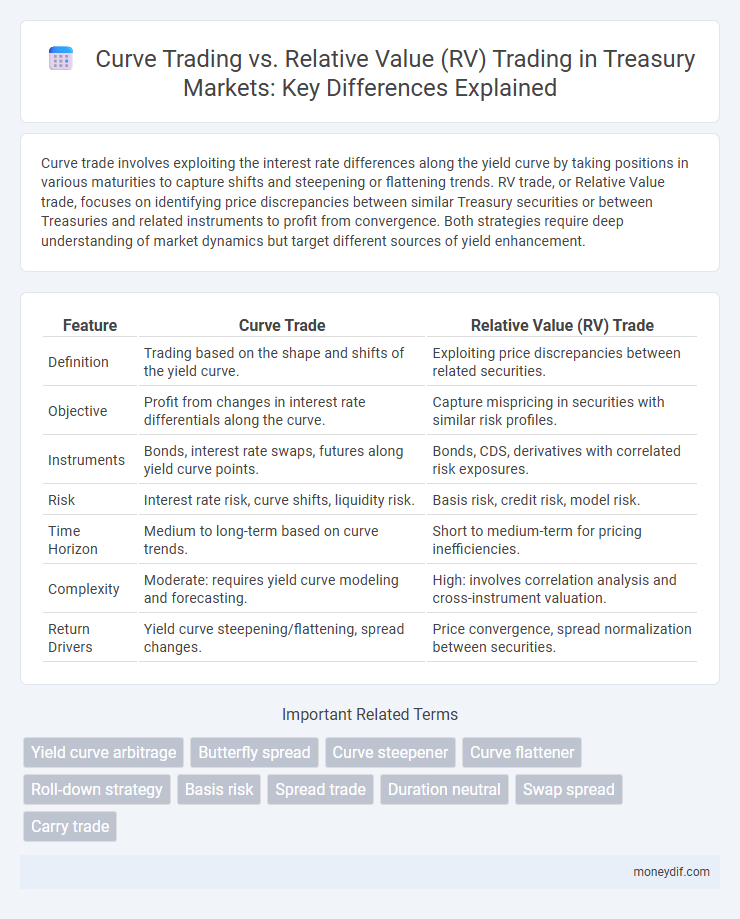

Curve trade involves exploiting the interest rate differences along the yield curve by taking positions in various maturities to capture shifts and steepening or flattening trends. RV trade, or Relative Value trade, focuses on identifying price discrepancies between similar Treasury securities or between Treasuries and related instruments to profit from convergence. Both strategies require deep understanding of market dynamics but target different sources of yield enhancement.

Table of Comparison

| Feature | Curve Trade | Relative Value (RV) Trade |

|---|---|---|

| Definition | Trading based on the shape and shifts of the yield curve. | Exploiting price discrepancies between related securities. |

| Objective | Profit from changes in interest rate differentials along the curve. | Capture mispricing in securities with similar risk profiles. |

| Instruments | Bonds, interest rate swaps, futures along yield curve points. | Bonds, CDS, derivatives with correlated risk exposures. |

| Risk | Interest rate risk, curve shifts, liquidity risk. | Basis risk, credit risk, model risk. |

| Time Horizon | Medium to long-term based on curve trends. | Short to medium-term for pricing inefficiencies. |

| Complexity | Moderate: requires yield curve modeling and forecasting. | High: involves correlation analysis and cross-instrument valuation. |

| Return Drivers | Yield curve steepening/flattening, spread changes. | Price convergence, spread normalization between securities. |

Introduction to Treasury Curve and Relative Value Trading

Treasury Curve trading involves analyzing the yield differences across maturities to capitalize on anticipated shifts in the interest rate environment, focusing on the shape and movement of the yield curve. Relative Value (RV) trading compares Treasury securities with similar maturities or credit qualities to identify mispricings and exploit arbitrage opportunities. Both strategies rely heavily on understanding term structure dynamics, liquidity conditions, and macroeconomic indicators to optimize returns while managing risk.

Defining Curve Trades in the Treasury Market

Curve trades in the Treasury market involve exploiting pricing inefficiencies along the yield curve by simultaneously buying and selling Treasuries with different maturities. These trades capitalize on anticipated shifts in the yield spread between short-, intermediate-, and long-term bonds to generate profit while minimizing exposure to overall interest rate movements. Curve trades differ from relative value (RV) trades, which focus on price discrepancies between comparable securities rather than changes along the curve.

Understanding Relative Value (RV) Trades in Treasuries

Relative Value (RV) trades in Treasuries involve exploiting price discrepancies between related securities to capture risk-adjusted returns, often comparing on-the-run versus off-the-run bonds or different maturities within the yield curve. Curve trades, a subset of RV strategies, specifically target anticipated shifts in the Treasury yield curve shape by simultaneously buying and selling maturities to benefit from expected changes in the spread. Understanding these dynamics requires analyzing factors like interest rate expectations, supply-demand imbalances, and market liquidity to identify mispricings and optimize portfolio positioning.

Key Differences Between Curve Trades and RV Trades

Curve trades primarily involve exploiting yield curve movements and shape changes across different maturities to capture interest rate risk premia, emphasizing duration and convexity dynamics. Relative Value (RV) trades focus on identifying mispricings between closely related securities or benchmarks, leveraging discrepancy in spreads or basis for arbitrage opportunities. Curve trades depend heavily on macroeconomic expectations and central bank policies, while RV trades rely on market inefficiencies, liquidity anomalies, and credit risk differentials.

Instruments Used in Curve vs. Relative Value Treasury Strategies

Curve trade strategies primarily utilize on-the-run and off-the-run Treasury securities to exploit yield differences along the yield curve, often incorporating Treasury futures and interest rate swaps for hedging and leverage. Relative Value (RV) trades involve comparing similar Treasury instruments, such as coupon bonds with comparable maturities or Treasury Inflation-Protected Securities (TIPS) versus nominal Treasuries, to identify mispricings, using options and bond futures to enhance position precision. Both strategies rely heavily on government securities but differ in instrument selection based on yield curve positioning versus relative price deviations.

Risk Management in Curve and RV Trading

Risk management in Curve trading prioritizes yield curve positioning and interest rate sensitivity, utilizing duration and convexity measures to mitigate rate volatility impact. RV trading risk management involves monitoring spread relationships between instruments, ensuring tight correlation and basis risk controls to prevent divergence losses. Effective frameworks integrate real-time market data and scenario analysis to optimize capital allocation and hedge effectiveness in both strategies.

Market Conditions Favoring Curve Trades vs. RV Trades

Curve trades tend to outperform in stable interest rate environments where yield curve shapes present clear opportunities for exploiting maturity differentials, particularly during periods of low volatility and predictable monetary policy. RV trades excel when market inefficiencies or mispricings occur between closely related securities, often benefiting from dislocations caused by sudden shifts in credit spreads or liquidity constraints. Treasury market conditions marked by steady economic data and well-anchored inflation expectations favor curve trading strategies, while heightened uncertainty and transient anomalies support RV trading approaches.

Performance Metrics in Curve and RV Treasury Trading

Curve trading in Treasury markets emphasizes exploiting yield differences along the maturity spectrum, with performance metrics primarily focused on yield curve steepness and curvature shifts. Relative Value (RV) trading targets mispricings between different Treasury securities, with key metrics including spread convergence, basis risk, and Sharpe ratio to assess risk-adjusted returns. Both strategies utilize duration, convexity, and P&L attribution to optimize risk management and enhance portfolio performance.

Implementation Challenges for Curve and RV Strategies

Curve trade implementation faces challenges such as accurately modeling interest rate curves, managing liquidity constraints, and handling the sensitivity to small shifts in yield spreads. RV (Relative Value) strategies struggle with identifying true mispricings amid market noise, ensuring execution efficiency, and mitigating risks linked to converging or diverging asset prices. Both approaches require sophisticated risk management systems to address volatility and correlation risks inherent in treasury instruments.

Future Trends in Treasury Curve and Relative Value Trading

Treasury curve trade strategies are expected to evolve with increased volatility and shifting interest rate policies, emphasizing dynamic duration management and yield curve steepening plays. Relative Value trading will likely integrate advanced quantitative models and AI-driven analytics to exploit subtle pricing inefficiencies across Treasury securities and derivatives. Market participants should anticipate greater integration of cross-asset signals and real-time data to enhance precision in both curve positioning and relative value arbitrage.

Important Terms

Yield curve arbitrage

Yield curve arbitrage exploits pricing inefficiencies between different maturities on the same bond issuer's curve, focusing on interest rate movements and the shape of the yield curve to generate profits. Curve trades analyze systematic shifts in the yield curve, while relative value (RV) trades identify mispricings between similar securities or sectors, emphasizing valuation divergence rather than directional curve changes.

Butterfly spread

Butterfly spread strategies optimize yield curve arbitrage by exploiting mispricings in interest rate differentials, whereas relative value trades focus on identifying pricing discrepancies between correlated assets or instruments.

Curve steepener

Curve steepener strategies focus on profiting from widening yield spreads by exploiting anticipated changes in interest rate differentials, whereas curve trades prioritize directional moves along the yield curve and relative value trades emphasize pricing inefficiencies between correlated instruments.

Curve flattener

Curve flattener strategies in Curve trade focus on profiting from yield curve shape changes by narrowing spreads between long- and short-term rates, contrasting with Relative Value (RV) trades that exploit pricing inefficiencies between correlated fixed income instruments.

Roll-down strategy

The roll-down strategy in curve trading captures yield gains by exploiting the natural price appreciation as bonds approach maturity, whereas relative value (RV) trading focuses on identifying pricing inefficiencies between related securities to generate arbitrage profits.

Basis risk

Basis risk in curve trading arises from discrepancies between the actual yield curve movements and modeled expectations, while relative value (RV) trading aims to exploit pricing inefficiencies between related instruments, minimizing exposure to basis risk.

Spread trade

Spread trade exploits price differences between related assets, with curve trade focusing on yield curve arbitrage across maturities while RV (Relative Value) trade targets discrepancies between similar securities to capture profit from mispricing.

Duration neutral

Duration neutral strategies balance interest rate risk by offsetting long and short positions, making them distinct from Curve trades that exploit yield curve shifts and RV trades that capitalize on pricing inefficiencies between related securities.

Swap spread

Swap spread reflects the difference between swap rates and Treasury yields, serving as a key indicator in curve trades focused on interest rate movements, while relative value (RV) trades exploit inefficiencies between swap spreads and other securities to capture arbitrage opportunities.

Carry trade

Carry trade involves borrowing at low interest rates and investing in assets with higher yields to capture the interest rate differential, often optimized through Curve trade strategies that exploit yield curve anomalies. Relative Value (RV) trade, by contrast, focuses on identifying mispricings between related financial instruments, emphasizing price convergence rather than interest rate differentials.

Curve trade vs RV (Relative Value) trade Infographic

moneydif.com

moneydif.com