Reopening a Treasury security involves issuing additional amounts of an existing bond, which helps maintain consistent benchmark yields and enhances liquidity in the market. A new issue, on the other hand, introduces a completely new security with unique maturities and coupon rates, providing fresh options for investors and expanding the Treasury yield curve. Choosing between reopening and new issuance depends on factors such as market demand, debt management strategy, and investor appetite.

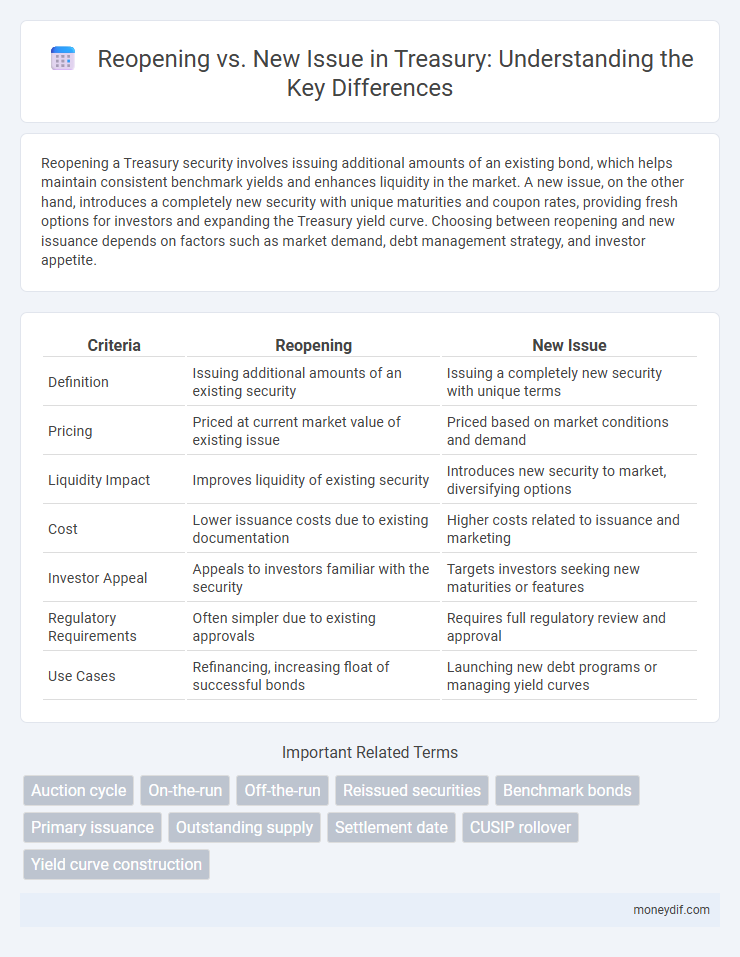

Table of Comparison

| Criteria | Reopening | New Issue |

|---|---|---|

| Definition | Issuing additional amounts of an existing security | Issuing a completely new security with unique terms |

| Pricing | Priced at current market value of existing issue | Priced based on market conditions and demand |

| Liquidity Impact | Improves liquidity of existing security | Introduces new security to market, diversifying options |

| Cost | Lower issuance costs due to existing documentation | Higher costs related to issuance and marketing |

| Investor Appeal | Appeals to investors familiar with the security | Targets investors seeking new maturities or features |

| Regulatory Requirements | Often simpler due to existing approvals | Requires full regulatory review and approval |

| Use Cases | Refinancing, increasing float of successful bonds | Launching new debt programs or managing yield curves |

Introduction to Treasury Securities

Reopening Treasury securities involves issuing additional amounts of an existing bond to increase its outstanding supply, which helps maintain market liquidity and benchmark yields. New issues, by contrast, introduce entirely new securities with unique maturities and coupon rates, expanding the range of investment options. Both methods play crucial roles in government debt management and influence interest rate benchmarks in financial markets.

Defining “Reopening” in Treasury Markets

Reopening in Treasury markets refers to issuing additional amounts of an existing government security, maintaining the same maturity date and coupon rate as the original issue. This process increases liquidity and depth in the secondary market while avoiding the administrative costs associated with a completely new issuance. New issues, by contrast, introduce securities with different maturities or coupon structures, expanding the range of available maturities and investment options for market participants.

Understanding “New Issue” Treasury Offerings

New issue Treasury offerings refer to debt securities issued directly by the U.S. Department of the Treasury to finance government operations and manage public debt, typically through auctions. These securities include Treasury bills, notes, and bonds, each with distinct maturities and interest structures, attracting investors seeking government-backed returns. Understanding new issues is crucial for market participants to gauge supply dynamics and investment opportunities compared to reopening existing Treasury securities.

Key Differences Between Reopening and New Issue

Reopening refers to issuing additional bonds under an existing security with the same maturity date and coupon rate, enhancing liquidity without changing original terms. New issues involve creating entirely new securities with distinct terms, maturities, and coupon rates, attracting new investors and expanding the market base. Treasury reopening typically benefits market efficiency by increasing trading volume, while new issues diversify the debt portfolio and adjust funding strategies.

Advantages of Treasury Reopening

Treasury reopening offers enhanced liquidity by increasing the outstanding amount of existing securities, making them more attractive to a broader investor base. It reduces issuance costs and administrative burdens compared to launching a new issue, streamlining the debt management process. Furthermore, reopening allows for better price discovery and benchmark stability by deepening the existing yield curve.

Benefits of New Issue Treasuries

New issue Treasuries provide investors with the advantage of acquiring securities at the initial offering yield, often resulting in more favorable pricing compared to reopening existing issues. These new issues enhance market liquidity by expanding the supply of government debt with diverse maturities and terms. Furthermore, new issues incorporate current market conditions and updated risk premiums, offering more accurate alignment with investor expectations and economic forecasts.

Market Impact: Reopening vs New Issue

Reopening an existing Treasury security typically enhances liquidity by expanding the outstanding supply of a familiar benchmark, leading to more efficient price discovery and tighter bid-ask spreads. In contrast, a new issue introduces fresh supply and establishes a new benchmark, which may temporarily increase market volatility and require investors to assess yield curves afresh. Market impact favors reopenings for stabilizing yields, while new issues play a critical role in responding to funding needs and diversifying Treasury offerings.

Investor Considerations: Which to Choose?

Investors weigh reopening and new Treasury issues by assessing liquidity, yield, and market demand; reopenings often provide better liquidity with established pricing, while new issues may offer fresher maturities and potentially higher yields. Portfolio diversification and alignment with investment horizons influence the choice, as reopening allows scaling existing positions whereas new issues introduce new benchmarks. Monitoring Federal Reserve actions and auction results helps investors optimize Treasury allocations within fixed-income strategies.

Recent Trends in Treasury Reopenings and New Issues

Recent trends in Treasury reopenings indicate increased issuance of reopening securities to address market demand and improve liquidity in existing maturities. New issues are focused on tapping fresh investor interest, especially with the introduction of longer-dated Treasury bonds catering to current interest rate environments. Market participants show a preference for reopenings due to their established benchmarks and tighter bid-ask spreads, while new issues attract strategic investment targeting diversification and yield optimization.

Conclusion: Strategic Use of Reopening and New Issue Treasuries

Reopening existing Treasury securities allows issuers to tap into established benchmarks with proven liquidity, enhancing market stability and investor confidence. New issue Treasuries provide opportunities to tailor maturities and size to meet specific funding needs or market conditions. Combining both strategies optimizes debt management by balancing cost-efficiency, investor demand, and market flexibility.

Important Terms

Auction cycle

The auction cycle impacts Treasury securities by determining when reopening existing issues or introducing new issues occurs, influencing liquidity and investor demand. Reopening an auction adds more supply to an existing security, maintaining benchmark status, while new issue auctions create fresh securities that can diversify maturities and yield curves.

On-the-run

On-the-run Treasury securities typically exhibit higher liquidity and tighter spreads compared to reopening issues or new issues due to their benchmark status in the secondary market.

Off-the-run

Off-the-run bonds typically trade at a discount compared to the on-the-run issues due to lower liquidity and demand when a new issue or reopening of the benchmark security occurs, impacting price and yield spreads. Reopening an existing bond issue increases its outstanding supply, potentially enhancing liquidity relative to introducing a completely new off-the-run security, which may face wider bid-ask spreads and reduced market interest.

Reissued securities

Reissued securities involve reopening an existing security issue by offering additional units of the same bond or stock, which typically benefits from the original issue's established pricing and market acceptance. New issues, by contrast, introduce entirely new securities with distinct terms and require fresh underwriting, often resulting in higher issuance costs and investor risk.

Benchmark bonds

Benchmark bonds issued during market reopening typically offer lower yields compared to entirely new issues due to established pricing benchmarks and investor confidence.

Primary issuance

Primary issuance involves either reopening an existing security to raise additional capital or creating a new issue to introduce a fresh instrument to the market.

Outstanding supply

Outstanding supply refers to the total amount of securities currently held by investors and available in the market, playing a crucial role in liquidity and price stability during a reopening versus a new issue. In a reopening, additional securities are offered from an existing issue, increasing the outstanding supply without creating a new security, whereas a new issue introduces entirely new securities, expanding the overall market supply and potentially impacting demand dynamics more significantly.

Settlement date

Settlement date determines the timing of fund transfer, with reopening issues sharing the original issue's settlement conventions while new issues follow standard settlement cycles.

CUSIP rollover

CUSIP rollover applies the same identifier to reopened bond issues, distinguishing them from new issues by maintaining consistent tracking and settlement across multiple reopenings.

Yield curve construction

Yield curve construction reflects market expectations, where reopening of existing bond issues often offers clearer liquidity and pricing signals compared to new issues, impacting curve accuracy and depth.

Reopening vs New issue Infographic

moneydif.com

moneydif.com