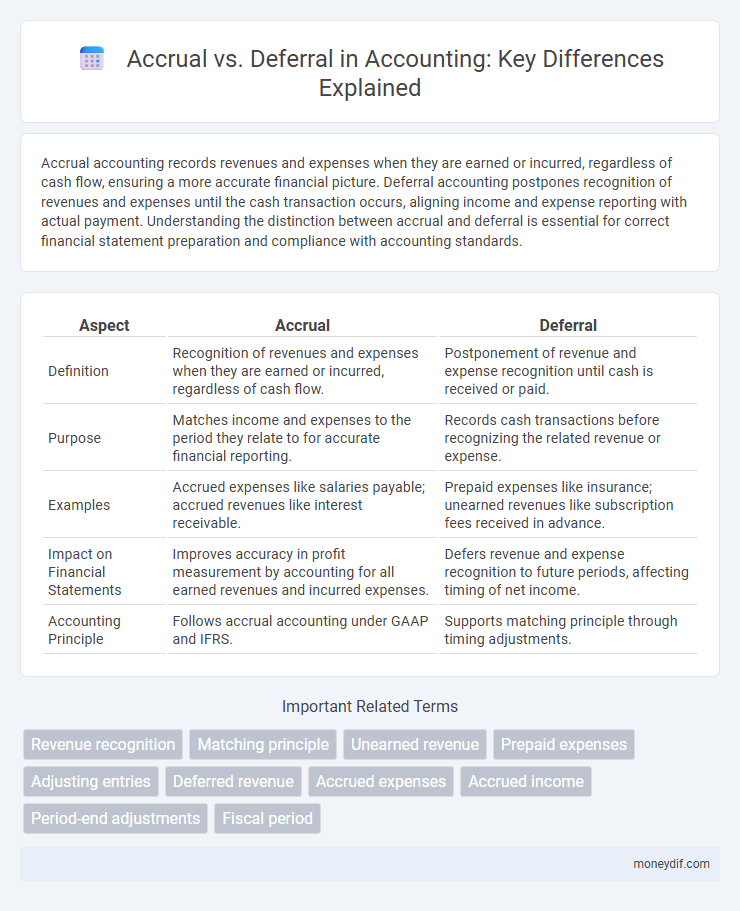

Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, ensuring a more accurate financial picture. Deferral accounting postpones recognition of revenues and expenses until the cash transaction occurs, aligning income and expense reporting with actual payment. Understanding the distinction between accrual and deferral is essential for correct financial statement preparation and compliance with accounting standards.

Table of Comparison

| Aspect | Accrual | Deferral |

|---|---|---|

| Definition | Recognition of revenues and expenses when they are earned or incurred, regardless of cash flow. | Postponement of revenue and expense recognition until cash is received or paid. |

| Purpose | Matches income and expenses to the period they relate to for accurate financial reporting. | Records cash transactions before recognizing the related revenue or expense. |

| Examples | Accrued expenses like salaries payable; accrued revenues like interest receivable. | Prepaid expenses like insurance; unearned revenues like subscription fees received in advance. |

| Impact on Financial Statements | Improves accuracy in profit measurement by accounting for all earned revenues and incurred expenses. | Defers revenue and expense recognition to future periods, affecting timing of net income. |

| Accounting Principle | Follows accrual accounting under GAAP and IFRS. | Supports matching principle through timing adjustments. |

Understanding Accrual and Deferral Concepts

Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring financial statements reflect the true economic activity. Deferrals postpone recognition of revenues or expenses to future periods when the related cash transactions occur, maintaining accurate matching of income and costs. Mastery of accrual and deferral concepts is essential for precise financial reporting and compliance with accounting standards like GAAP and IFRS.

Key Differences Between Accruals and Deferrals

Accruals recognize revenues and expenses when they are incurred, regardless of cash flow timing, while deferrals record cash transactions before recognizing related revenues or expenses. Key differences include timing: accrual accounting matches income and expenses to the period earned or incurred, whereas deferrals delay recognition to future periods. Accruals typically involve accrued expenses and accrued revenues, whereas deferrals encompass prepaid expenses and unearned revenues.

Importance of Accruals in Financial Reporting

Accruals are critical in financial reporting as they ensure that revenues and expenses are recognized in the period they occur, maintaining the matching principle of accounting. This practice provides a more accurate financial picture by capturing economic events regardless of cash flow timing, enhancing decision-making for investors and stakeholders. Proper accrual accounting improves compliance with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), fostering transparency and reliability in financial statements.

The Role of Deferrals in Accurate Accounting

Deferrals play a crucial role in accurate accounting by ensuring expenses and revenues are recorded in the correct accounting periods, aligning with the matching principle. By postponing recognition of cash flows until services or goods are delivered, deferrals provide a clear and precise financial picture, preventing distortions in profit measurement. Common deferrals include prepaid expenses and unearned revenues, which adjust the timing of income statement and balance sheet reporting for enhanced financial accuracy.

Common Examples of Accruals and Deferrals

Common examples of accruals in accounting include accrued revenues such as services performed but not yet billed, and accrued expenses like wages earned by employees but unpaid at the end of an accounting period. Deferrals typically involve prepaid expenses, such as rent paid in advance, and unearned revenues where cash is received before services are delivered. These transactions ensure financial statements accurately reflect the timing of economic events, adhering to the matching principle under accrual accounting.

Impact of Accruals vs. Deferrals on Financial Statements

Accruals increase reported revenues and expenses by recognizing earned income and incurred costs within the accounting period, improving the accuracy of financial statements. Deferrals postpone recognition of revenues and expenses, resulting in initially understated income and expenses that adjust over future periods. The proper application of accruals and deferrals ensures compliance with the matching principle and presents a true financial position.

Accrual and Deferral Adjusting Entries Explained

Accrual adjusting entries record revenues earned and expenses incurred that have not yet been cash-received or cash-paid, ensuring financial statements reflect the true economic activity within the accounting period. Deferral adjusting entries postpone the recognition of revenues or expenses until cash is actually received or paid, aligning income and expenses with the periods they affect. Together, accruals and deferrals maintain accurate matching of revenues and expenses according to the accrual basis of accounting.

Accruals and Deferrals: Benefits and Challenges

Accruals enable precise matching of revenues and expenses within the accounting period, enhancing financial accuracy and compliance with GAAP, while deferrals improve cash flow management by postponing revenue recognition or expense reporting. Accrual accounting fosters timely financial insights essential for informed decision-making, but it can complicate cash flow analysis due to recognizing transactions before cash exchanges. Deferrals simplify cash flow forecasting but may delay expense recognition, potentially obscuring true financial performance during interim periods.

Best Practices for Managing Accruals and Deferrals

Effectively managing accruals and deferrals requires precise documentation and timely recognition aligned with Generally Accepted Accounting Principles (GAAP). Implementing automated accounting systems enhances accuracy in tracking accrued expenses and deferred revenues, reducing the risk of financial misstatements. Regular reconciliations and communication with department heads ensure accruals and deferrals reflect true financial positions, supporting informed decision-making and compliance.

Frequently Asked Questions on Accruals and Deferrals

Accruals record revenues and expenses when they are earned or incurred, regardless of cash flow timing, ensuring accurate financial statements under the matching principle. Deferrals involve postponing recognition of cash receipts or payments until the related revenue or expense is realized, commonly seen in prepaid expenses and unearned revenues. Frequently asked questions address how accruals affect income reporting periods and the impact of deferrals on cash flow timing and financial analysis.

Important Terms

Revenue recognition

Revenue recognition follows accrual accounting by recording income when earned regardless of cash receipt, whereas deferral delays revenue recognition until cash is received or obligations are fulfilled.

Matching principle

The matching principle in accounting requires expenses to be recorded in the same period as the revenues they help generate, using accrual accounting to recognize expenses and revenues when incurred or earned rather than when cash is exchanged, differing from deferral which postpones expense or revenue recognition to a future period.

Unearned revenue

Unearned revenue represents a deferral in accrual accounting, where cash is received before services are performed or goods are delivered, requiring recognition as a liability until earned.

Prepaid expenses

Prepaid expenses represent deferred costs recorded as assets on the balance sheet until they are incurred, illustrating the deferral concept in accrual accounting.

Adjusting entries

Adjusting entries for accrual recognize revenues and expenses when earned or incurred, while deferral entries postpone recognition until cash is received or paid.

Deferred revenue

Deferred revenue represents cash received in advance for goods or services, requiring deferral under accrual accounting to recognize revenue only when earned.

Accrued expenses

Accrued expenses represent liabilities for goods or services received but not yet paid, reflecting the accrual basis of accounting that recognizes expenses when incurred regardless of payment timing. This contrasts with deferrals, which delay expense or revenue recognition until cash is exchanged, ensuring accurate matching of financial activity within accounting periods.

Accrued income

Accrued income represents revenue earned but not yet received, highlighting an accrual accounting principle where income is recorded when earned rather than when cash is received, in contrast to deferrals which postpone revenue or expense recognition until cash transactions occur.

Period-end adjustments

Period-end adjustments ensure accurate financial reporting by recording accruals for expenses and revenues earned but not yet paid or received, and deferrals to recognize cash received or paid in advance during the correct accounting periods. Accurate accrual and deferral adjustments prevent misstated earnings and liabilities, enhancing compliance with GAAP and IFRS standards.

Fiscal period

Fiscal period accounting distinguishes accruals, which recognize revenues and expenses when incurred, from deferrals, which postpone recognition until cash is exchanged within the same fiscal period.

accrual vs deferral Infographic

moneydif.com

moneydif.com