Earned revenue reflects income generated from goods or services that have been delivered or performed, representing actual earnings recognized in the accounting period. Unearned revenue, often recorded as a liability, arises when payment is received before goods or services are provided, requiring recognition only when the delivery obligation is fulfilled. Distinguishing between earned and unearned revenue ensures accurate financial reporting and compliance with revenue recognition principles.

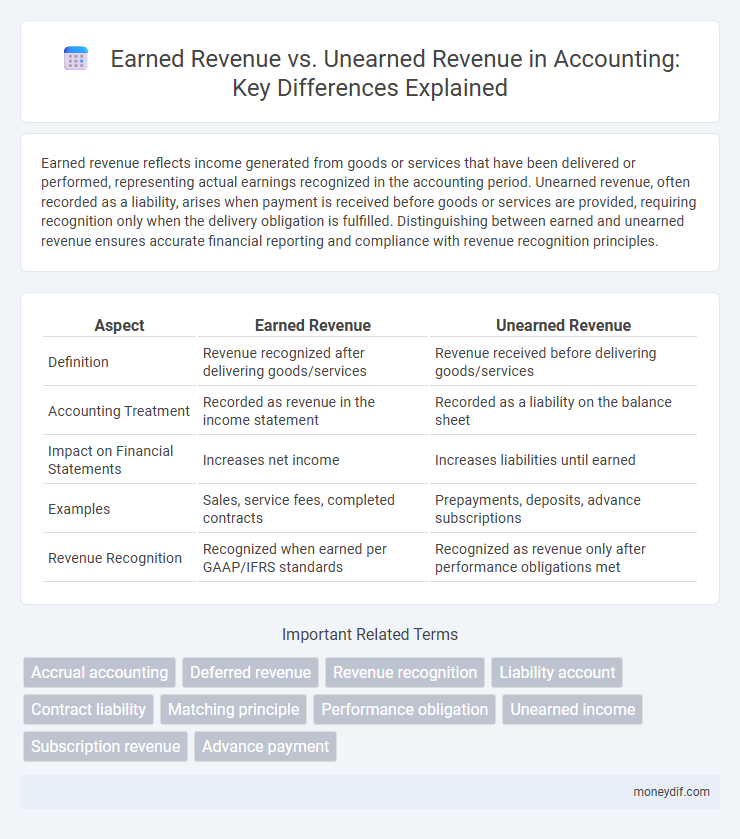

Table of Comparison

| Aspect | Earned Revenue | Unearned Revenue |

|---|---|---|

| Definition | Revenue recognized after delivering goods/services | Revenue received before delivering goods/services |

| Accounting Treatment | Recorded as revenue in the income statement | Recorded as a liability on the balance sheet |

| Impact on Financial Statements | Increases net income | Increases liabilities until earned |

| Examples | Sales, service fees, completed contracts | Prepayments, deposits, advance subscriptions |

| Revenue Recognition | Recognized when earned per GAAP/IFRS standards | Recognized as revenue only after performance obligations met |

Introduction to Earned and Unearned Revenue

Earned revenue represents income a company has realized by delivering goods or services to customers, reflecting completed performance obligations. Unearned revenue, also known as deferred revenue, refers to payments received in advance before the company fulfills its contractual duties, classifying it as a liability on the balance sheet. Understanding the distinction between earned and unearned revenue is essential for accurate financial reporting and compliance with revenue recognition standards such as ASC 606 or IFRS 15.

Defining Earned Revenue in Accounting

Earned revenue in accounting represents the income a company has recognized after delivering goods or services to customers, fulfilling its performance obligations under revenue recognition standards such as ASC 606 or IFRS 15. It is recorded on the income statement as revenue once earned, distinguishing it from unearned revenue, which is recorded as a liability until the service or product is provided. Accurate recognition of earned revenue ensures compliance with accounting principles and provides stakeholders with a clear view of the company's financial performance.

Understanding Unearned Revenue

Unearned revenue represents payments received by a company for goods or services that have not yet been delivered or performed, creating a liability on the balance sheet. It is recognized as a liability because the company owes the customer the product or service in the future, distinguishing it from earned revenue, which is recorded only after delivery. Proper management of unearned revenue ensures accurate financial reporting and compliance with revenue recognition standards such as ASC 606.

Key Differences Between Earned and Unearned Revenue

Earned revenue is the income recognized when goods or services have been delivered or performed, reflecting actual business activities, whereas unearned revenue represents payments received before services are provided or goods are delivered, classified as a liability on the balance sheet. Earned revenue increases the company's revenue and profit accounts immediately, while unearned revenue remains a liability until the earning process is complete. Accurate differentiation impacts financial reporting, revenue recognition, and compliance with accounting standards such as GAAP and IFRS.

Recognition Criteria for Earned Revenue

Earned revenue is recognized when the seller has fulfilled its performance obligations by delivering goods or services to the customer, ensuring transfer of control. Revenue recognition requires evidence of a binding agreement, determinable transaction price, and reasonable assurance of payment collection. The timing follows the criteria outlined in accounting standards such as IFRS 15 or ASC 606, emphasizing the completion of earning activities rather than receipt of cash.

Accounting Treatment for Unearned Revenue

Unearned revenue is recorded as a liability on the balance sheet because it represents funds received before the service or product delivery. During the accounting period, revenue recognition occurs when the company fulfills its performance obligation, reducing the unearned revenue and increasing earned revenue. Accurate treatment of unearned revenue ensures compliance with the revenue recognition principle under GAAP or IFRS standards.

Impact on Financial Statements

Earned revenue increases assets and equity on the balance sheet while boosting net income on the income statement, reflecting completed transactions. Unearned revenue appears as a liability on the balance sheet, representing obligations to deliver goods or services, and does not affect net income until earned. Proper recognition of earned versus unearned revenue ensures accurate financial position and performance reporting in accordance with revenue recognition principles.

Common Examples of Earned and Unearned Revenue

Earned revenue commonly includes sales income from delivered products, fees for completed services, and interest received on investments. Unearned revenue often arises from advance payments such as subscription fees collected before service delivery, deposits for future projects, or gift cards not yet redeemed. Recognizing these examples helps accurately manage revenue streams and comply with accounting standards like GAAP and IFRS.

Compliance and Reporting Standards

Earned revenue complies with Generally Accepted Accounting Principles (GAAP) by recognizing income only when services are delivered or goods are transferred, ensuring accurate financial reporting. Unearned revenue, recorded as a liability under GAAP and IFRS, represents payments received before fulfillment of obligations, requiring careful deferral to maintain compliance. Proper distinction between earned and unearned revenue supports transparent financial statements and adherence to revenue recognition standards such as ASC 606.

Importance in Financial Analysis and Decision-Making

Earned revenue reflects actual income generated from delivered goods or services, providing accurate insights into a company's operational performance. Unearned revenue represents advance payments and liabilities, highlighting future obligations that impact cash flow and financial stability. Distinguishing between these revenue types is crucial for precise financial analysis and informed decision-making regarding profitability and resource allocation.

Important Terms

Accrual accounting

Accrual accounting recognizes earned revenue when goods or services are delivered, regardless of cash receipt, ensuring financial statements reflect true business performance. Unearned revenue represents payments received in advance and is recorded as a liability until revenue is earned, aligning income recognition with service fulfillment.

Deferred revenue

Deferred revenue represents payments received for goods or services not yet delivered, classified as unearned revenue on the balance sheet until the revenue is officially earned. Once the goods or services are provided, deferred revenue transitions to earned revenue, reflecting the company's recognized income during the accounting period.

Revenue recognition

Revenue recognition principles require businesses to record earned revenue when goods or services are delivered, reflecting actual earnings, while unearned revenue represents payments received in advance for products or services yet to be provided, classified as a liability on the balance sheet. Accurate differentiation between earned and unearned revenue ensures compliance with accounting standards such as GAAP and IFRS, preventing revenue misstatement and enhancing financial reporting transparency.

Liability account

Liability accounts related to revenue include unearned revenue, representing payments received before services are delivered, which must be recognized as earned revenue only when the corresponding services or goods are provided. Earned revenue increases equity and is reported on the income statement, while unearned revenue remains a liability on the balance sheet until earned.

Contract liability

Contract liability represents the obligation a company has to deliver goods or services for which it has already received payment, classifying the related income as unearned revenue until fulfillment. Earned revenue is recognized only after the company satisfies its performance obligations, converting contract liability into recognized income on the financial statements.

Matching principle

The matching principle requires recognizing expenses in the same period as the earned revenue they help generate, ensuring accurate financial reporting. Unearned revenue represents cash received before services are performed, while earned revenue is recorded once the service or product delivery is completed.

Performance obligation

Performance obligations represent the specific promises a company makes to transfer goods or services to a customer, and revenue is recognized as these obligations are satisfied. Earned revenue corresponds to fulfilled performance obligations, while unearned revenue reflects payments received before those obligations are completed.

Unearned income

Unearned income represents funds received before delivering goods or services, classified as unearned revenue and recorded as a liability on the balance sheet. In contrast, earned revenue reflects income generated from completed sales or services, recognized as revenue on the income statement once the performance obligation is fulfilled.

Subscription revenue

Subscription revenue is recognized as earned revenue over the subscription period as services or products are delivered, while unearned revenue represents the advance payments received before the service or product fulfillment. Accurate accounting of subscription revenue ensures financial statements reflect the true economic activity by matching revenue recognition with the delivery timeline of the subscription benefits.

Advance payment

Advance payment represents cash received before revenue is earned, classifying it as unearned revenue, which is recorded as a liability on the balance sheet until the related goods or services are delivered. Once the company fulfills its obligations, the unearned revenue is recognized as earned revenue on the income statement, reflecting the actual performance of the contracted service or product delivery.

earned revenue vs unearned revenue Infographic

moneydif.com

moneydif.com