Internal audit involves ongoing evaluations conducted by employees to assess risk management, control processes, and compliance within an organization, providing management with insights for improving operations. External audit is an independent examination performed by outside auditors to verify the accuracy and fairness of financial statements, ensuring regulatory compliance and enhancing stakeholder confidence. Both audits play crucial roles in strengthening corporate governance and financial accountability.

Table of Comparison

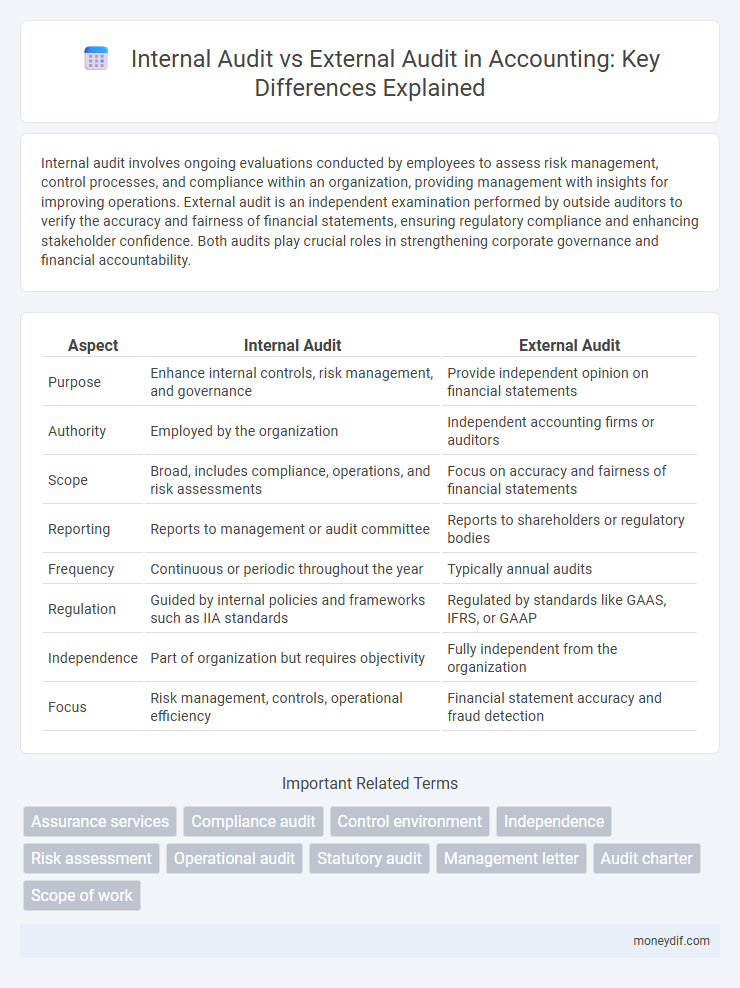

| Aspect | Internal Audit | External Audit |

|---|---|---|

| Purpose | Enhance internal controls, risk management, and governance | Provide independent opinion on financial statements |

| Authority | Employed by the organization | Independent accounting firms or auditors |

| Scope | Broad, includes compliance, operations, and risk assessments | Focus on accuracy and fairness of financial statements |

| Reporting | Reports to management or audit committee | Reports to shareholders or regulatory bodies |

| Frequency | Continuous or periodic throughout the year | Typically annual audits |

| Regulation | Guided by internal policies and frameworks such as IIA standards | Regulated by standards like GAAS, IFRS, or GAAP |

| Independence | Part of organization but requires objectivity | Fully independent from the organization |

| Focus | Risk management, controls, operational efficiency | Financial statement accuracy and fraud detection |

Introduction to Internal and External Audits

Internal audits are conducted by a company's own staff to evaluate risk management, control, and governance processes systematically, ensuring compliance with internal policies. External audits are performed by independent auditors who assess the accuracy and fairness of financial statements in accordance with accounting standards such as GAAP or IFRS. Both audits play crucial roles in enhancing organizational transparency, with internal audits focusing on operational efficiency and external audits providing assurance to stakeholders.

Key Differences Between Internal and External Audits

Internal audits are conducted by an organization's own staff to evaluate and improve risk management, control, and governance processes, focusing primarily on operational effectiveness and compliance. External audits are performed by independent third-party firms to provide an unbiased opinion on the accuracy and fairness of financial statements, ensuring compliance with accounting standards and regulatory requirements. Key differences include scope, with internal audits addressing internal controls and processes, while external audits emphasize financial statement verification and public accountability.

Objectives of Internal Audit

Internal audit aims to evaluate and improve the effectiveness of risk management, control, and governance processes within an organization. It ensures compliance with internal policies and regulatory requirements, enhancing operational efficiency and safeguarding assets. Internal auditors provide management with actionable insights to strengthen internal controls and mitigate potential risks.

Objectives of External Audit

The primary objectives of an external audit include providing an independent opinion on the accuracy and fairness of an organization's financial statements, ensuring compliance with applicable accounting standards and regulations, and enhancing stakeholder confidence by verifying financial transparency. External auditors assess the risk of material misstatement, detect potential fraud, and evaluate internal controls to support the integrity of financial reporting. Their objective is to deliver assurance to shareholders, creditors, and regulators regarding the reliability of the company's financial information.

Scope and Coverage Comparison

Internal audit provides continuous, broad coverage focusing on risk management, internal controls, and operational efficiency within the organization. External audit offers periodic, specific evaluations aimed at verifying the accuracy and fairness of financial statements for stakeholders. Internal audit's scope is expansive and ongoing, while external audit's scope is narrower and primarily concerned with compliance and financial reporting accuracy.

Roles and Responsibilities of Auditors

Internal auditors evaluate and improve the effectiveness of risk management, control, and governance processes within an organization, ensuring compliance and operational efficiency. External auditors provide independent assurance by examining financial statements to verify accuracy and adherence to accounting standards and regulatory requirements. Both roles require strong analytical skills, but internal auditors focus on ongoing internal controls, while external auditors emphasize financial reporting integrity for external stakeholders.

Reporting Structure and Communication

Internal audit reports directly to the organization's audit committee or senior management, ensuring continuous feedback and alignment with internal controls and risk management strategies. External audit communicates primarily with shareholders and regulatory bodies, delivering independent assessments to uphold transparency and compliance. Clear delineation in reporting structure enhances objective evaluation and effective communication throughout the audit process.

Regulatory and Compliance Requirements

Internal audits focus on ensuring that a company's operations comply with internal policies and regulatory requirements, facilitating ongoing risk management and internal controls assessment. External audits provide an independent evaluation of financial statements' accuracy and compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), addressing stakeholders' trust and legal obligations. Regulatory bodies such as the SEC, PCAOB, and SOX mandate specific compliance standards that external audits must meet, while internal audits support adherence to these regulations throughout an organization.

Benefits of Internal and External Audits

Internal audits enhance organizational controls by identifying process inefficiencies and ensuring compliance with company policies, thereby mitigating risks early. External audits provide an independent assessment of financial statements, boosting stakeholder confidence and satisfying regulatory requirements. Both audits collectively improve transparency, strengthen governance, and support informed decision-making within the organization.

Choosing Between Internal and External Audit

Choosing between internal and external audit depends on the organization's specific needs for control and assurance. Internal audits provide ongoing evaluation of risk management and internal controls, improving operational efficiency and compliance. External audits offer independent verification of financial statements, ensuring transparency and credibility for stakeholders and regulatory bodies.

Important Terms

Assurance services

Assurance services in internal audit focus on evaluating and improving an organization's risk management, control, and governance processes, providing management with insights for operational efficiency. External audit assurance primarily involves independent verification of financial statements to assure stakeholders of their accuracy and compliance with regulatory standards.

Compliance audit

Compliance audits evaluate adherence to laws, regulations, and internal policies, with internal audits focusing on ongoing risk management and process improvements within the organization, while external audits provide independent assurance to stakeholders about regulatory compliance and financial reporting accuracy. Internal audit teams typically conduct periodic reviews aligned with organizational objectives, whereas external auditors follow standardized frameworks and legal requirements to deliver unbiased opinions.

Control environment

The control environment establishes the foundation for effective internal auditing by setting organizational standards, ethics, and governance practices, enabling internal auditors to assess risk management and operational efficiency. External audits evaluate the control environment's design and effectiveness to determine its impact on the reliability of financial reporting and compliance with regulatory requirements.

Independence

Independence is critical in both internal and external audits to ensure unbiased and objective evaluations; internal auditors maintain organizational independence by reporting to the audit committee or board, while external auditors derive independence through separation from client management and adherence to regulatory standards. This distinction safeguards audit integrity, promotes stakeholder confidence, and supports accurate financial reporting.

Risk assessment

Risk assessment in internal audit focuses on identifying and evaluating risks within an organization's processes to improve governance, risk management, and internal controls. External audit risk assessment emphasizes assessing the risk of material misstatement in financial statements to provide assurance to stakeholders on the accuracy and reliability of financial reporting.

Operational audit

Operational audit focuses on evaluating the efficiency and effectiveness of internal processes, mainly conducted by internal audit teams to improve organizational performance. External audit, by contrast, primarily verifies financial statements for accuracy and compliance, providing assurance to stakeholders outside the organization.

Statutory audit

Statutory audit is a mandatory examination of financial statements conducted by an external audit firm to ensure compliance with legal and regulatory requirements. Internal audit, performed by an organization's own staff, focuses on evaluating internal controls and operational efficiency, while external audit provides an independent validation of financial accuracy and legal adherence.

Management letter

A management letter is a formal document issued by external auditors highlighting internal control weaknesses and recommendations for improvement, based on their audit findings. Internal audit departments provide continuous monitoring and internal assessments, but management letters primarily reflect external auditors' independent evaluation of financial statements and compliance risks.

Audit charter

An audit charter formally defines the scope, authority, and responsibilities of the internal audit function, ensuring alignment with organizational objectives and regulatory requirements. In contrast, external audits operate independently with an audit charter established by external regulations or stakeholders, focusing primarily on financial statement accuracy and compliance.

Scope of work

The scope of internal audit focuses on evaluating and improving the effectiveness of risk management, control, and governance processes within an organization, often covering operational, financial, and compliance areas. External audit primarily concentrates on providing an independent opinion on the fairness and accuracy of financial statements, ensuring compliance with accounting standards and regulatory requirements.

internal audit vs external audit Infographic

moneydif.com

moneydif.com