Interim reporting provides timely financial information on a quarterly or monthly basis, enabling stakeholders to assess the company's performance and make informed decisions throughout the fiscal year. Annual reporting delivers a comprehensive overview of the entire financial year, including detailed disclosures, audited financial statements, and management analysis. Both reporting types ensure transparency and regulatory compliance, but interim reports emphasize immediacy while annual reports offer thoroughness.

Table of Comparison

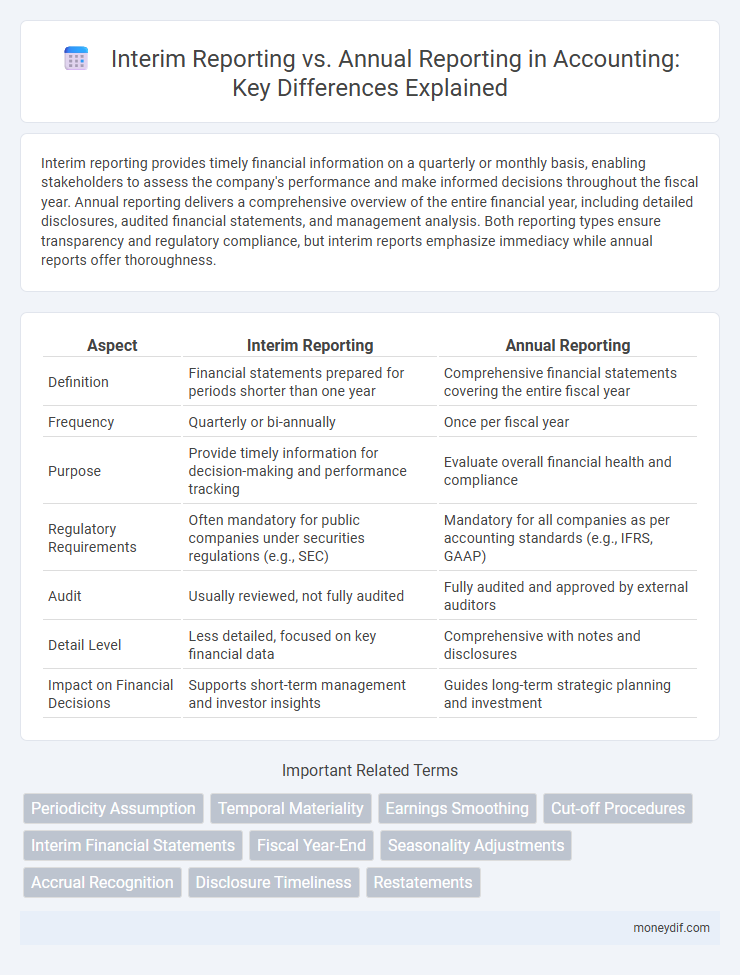

| Aspect | Interim Reporting | Annual Reporting |

|---|---|---|

| Definition | Financial statements prepared for periods shorter than one year | Comprehensive financial statements covering the entire fiscal year |

| Frequency | Quarterly or bi-annually | Once per fiscal year |

| Purpose | Provide timely information for decision-making and performance tracking | Evaluate overall financial health and compliance |

| Regulatory Requirements | Often mandatory for public companies under securities regulations (e.g., SEC) | Mandatory for all companies as per accounting standards (e.g., IFRS, GAAP) |

| Audit | Usually reviewed, not fully audited | Fully audited and approved by external auditors |

| Detail Level | Less detailed, focused on key financial data | Comprehensive with notes and disclosures |

| Impact on Financial Decisions | Supports short-term management and investor insights | Guides long-term strategic planning and investment |

Definition of Interim Reporting and Annual Reporting

Interim reporting consists of financial statements issued for periods shorter than a full fiscal year, typically quarterly or semi-annually, providing timely insights into a company's financial performance and position. Annual reporting encompasses comprehensive financial statements prepared once per fiscal year, including audited accounts, management discussions, and disclosures that reflect the company's overall financial health. Both interim and annual reports adhere to accounting standards such as IFRS or GAAP to ensure accuracy and consistency in financial communication.

Key Objectives of Interim and Annual Reports

Interim reports aim to provide timely financial information for decision-making, emphasizing liquidity, performance trends, and short-term financial positions. Annual reports focus on comprehensive analysis, presenting audited financial statements, long-term financial health, and management's discussion on strategic goals. Both report types ensure transparency but differ in scope, frequency, and detail to meet stakeholder needs.

Regulatory Requirements for Interim vs Annual Reporting

Interim reporting mandates compliance with specific regulatory frameworks such as IAS 34, requiring condensed financial statements and disclosures at least semi-annually to provide timely updates for stakeholders. Annual reporting adheres to comprehensive standards outlined in IFRS or GAAP, demanding full financial statements, detailed notes, and auditor's reports to ensure transparency and accuracy over the fiscal year. Regulatory authorities prioritize interim reports for ongoing market supervision, while annual reports fulfill statutory obligations for complete financial performance evaluation.

Frequency and Timing of Reporting

Interim reporting occurs quarterly or semi-annually, providing timely insights into a company's financial performance throughout the year. Annual reporting is prepared once per fiscal year, offering a comprehensive overview of the entire year's financial position. The increased frequency of interim reports supports more frequent decision-making and market assessment, while annual reports comply with regulatory mandates and annual audit requirements.

Components of Interim vs Annual Financial Statements

Interim financial statements typically include condensed versions of the balance sheet, income statement, and cash flow statement, focusing on key performance indicators for a shorter reporting period. Annual financial statements provide comprehensive details, including full notes, management discussion, and analysis, as well as auditor's reports, reflecting a complete fiscal year's financial position. The level of disclosure in interim reports is less extensive than in annual reports, emphasizing timely updates over detailed explanations.

Recognition and Measurement Differences

Interim reporting involves recognizing revenues and expenses based on estimates and partial period data, leading to adjustments in subsequent periods, whereas annual reporting employs finalized figures reflecting the complete accounting period. Measurement in interim reports often relies on a practical expedient approach, using cost or fair value estimates due to incomplete information, while annual reports utilize fully verified and audited data to ensure accuracy. These differences impact the timing and precision of financial statement presentation, affecting investor decision-making and regulatory compliance.

Disclosure Requirements: Interim vs Annual

Interim reporting requires less extensive disclosure compared to annual reporting, primarily focusing on significant events and changes since the last annual report to provide timely financial updates. Annual reporting mandates comprehensive disclosure of financial statements, accounting policies, risk management, and detailed notes to ensure full transparency for stakeholders over the entire fiscal year. Regulatory frameworks such as IFRS and GAAP specify these differences to balance relevance and materiality in interim versus annual disclosures.

Impact on Financial Decision-Making

Interim reporting provides timely financial information, enabling stakeholders to make quicker decisions and respond promptly to market changes. Annual reporting offers comprehensive and detailed data, supporting long-term strategic planning and regulatory compliance. The combination of both enhances financial transparency and improves the accuracy of performance assessments.

Benefits and Limitations of Interim and Annual Reporting

Interim reporting offers timely financial information, enabling management and investors to make quicker decisions, but it may lack the comprehensive detail and audit rigor found in annual reporting. Annual reporting provides a full fiscal overview with audited accuracy and detailed notes, enhancing transparency and regulatory compliance, yet it may delay crucial insights due to its less frequent publication. The frequency of interim reports improves responsiveness to market changes, while the depth of annual reports supports thorough performance analysis and long-term strategic planning.

Best Practices for Effective Financial Reporting

Interim reporting requires timely, accurate financial data to support decision-making within shorter periods, emphasizing streamlined processes and real-time data integration. Annual reporting focuses on comprehensive, audited financial statements that comply with regulatory standards and provide a holistic view of the company's financial health. Best practices include consistent application of accounting policies, robust internal controls, and clear disclosure to enhance transparency and stakeholder trust.

Important Terms

Periodicity Assumption

The periodicity assumption dictates that financial statements are prepared for specific intervals, such as interim periods or annual cycles, enabling timely evaluation of a company's performance. Interim reporting relies on this principle to provide concise, accurate financial data within a shorter timespan compared to comprehensive annual reporting, facilitating more frequent decision-making.

Temporal Materiality

Temporal materiality assesses the relevance of financial information based on reporting periods, highlighting that certain data may be material in interim reports but not in annual reports due to time-sensitive events or changes. This concept ensures that interim reporting captures significant fluctuations or events impacting stakeholders' decisions, while annual reporting provides a comprehensive overview reflecting long-term financial performance.

Earnings Smoothing

Earnings smoothing involves managing reported profits to present consistent financial performance, which can be more challenging during interim reporting due to shorter periods and increased volatility compared to annual reporting. Interim reports often prompt management to adjust earnings more strategically to meet quarterly expectations, while annual reports provide a broader timeframe for reflecting true economic conditions and reducing earnings manipulation.

Cut-off Procedures

Cut-off procedures ensure transactions are recorded in the correct reporting period, critical for both interim and annual reporting to maintain accurate financial statements. In interim reporting, cut-off focuses on timely recognition of revenues and expenses within shorter periods, while annual reporting requires comprehensive validation of cut-off to support overall financial statement integrity.

Interim Financial Statements

Interim financial statements provide a snapshot of a company's financial position and performance for periods shorter than a full fiscal year, typically quarterly or semi-annually, offering timely information for decision-making and regulatory compliance. These statements differ from annual reporting by focusing on more frequent updates with less extensive disclosures, enabling stakeholders to assess ongoing business trends, liquidity, and operational efficiency without waiting for year-end results.

Fiscal Year-End

Fiscal year-end marks the cutoff date for annual reporting, where comprehensive financial statements are prepared to provide a full-year overview of a company's performance. Interim reporting occurs at designated periods within the fiscal year, offering segmented financial insights that aid investors and management in timely decision-making and performance tracking.

Seasonality Adjustments

Seasonality adjustments in interim reporting address fluctuations in revenue, expenses, and cash flows that vary predictably within a fiscal year, ensuring comparability with annual financial statements. These adjustments refine financial metrics by normalizing periodic data to prevent misleading conclusions that arise from typical seasonal business cycles.

Accrual Recognition

Accrual recognition ensures revenues and expenses are recorded when earned or incurred, providing accurate financial positions in both interim and annual reporting. Interim reports require precise accruals to reflect financial performance within shorter periods, whereas annual reporting consolidates these accruals to present comprehensive yearly results.

Disclosure Timeliness

Disclosure timeliness is critical in interim reporting as it ensures stakeholders receive up-to-date financial information within a few months of the reporting period, enhancing decision-making accuracy. In contrast, annual reporting provides comprehensive data but with a longer delay, which may reduce its relevance for timely investment and operational decisions.

Restatements

Restatements in financial reporting occur when errors in interim reports are corrected in subsequent filings, ensuring consistency and accuracy before annual reporting. Comparing interim reporting to annual reporting, restatements highlight the importance of diligent financial review processes within shorter reporting periods to avoid material misstatements in year-end statements.

interim reporting vs annual reporting Infographic

moneydif.com

moneydif.com