Reconciling items are transactions or entries that require investigation to clear discrepancies between records, often involving timing differences or errors. Outstanding items refer to transactions recorded in one account but not yet reflected in the corresponding account, such as uncashed checks or unprocessed deposits. Accurate identification and management of both reconciling and outstanding items are crucial for ensuring the accuracy of financial statements and maintaining effective cash flow control.

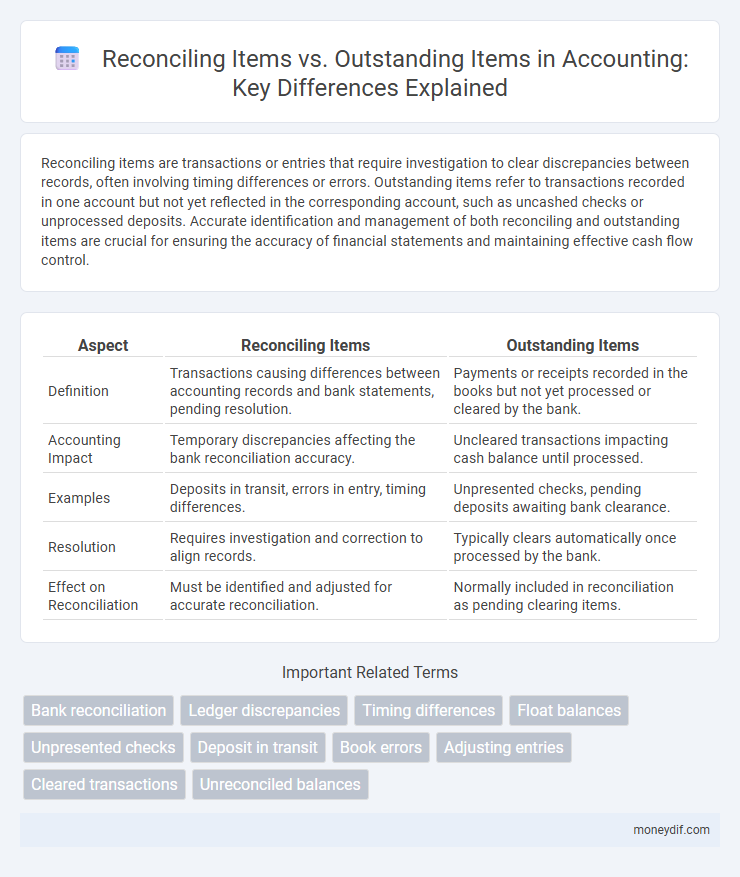

Table of Comparison

| Aspect | Reconciling Items | Outstanding Items |

|---|---|---|

| Definition | Transactions causing differences between accounting records and bank statements, pending resolution. | Payments or receipts recorded in the books but not yet processed or cleared by the bank. |

| Accounting Impact | Temporary discrepancies affecting the bank reconciliation accuracy. | Uncleared transactions impacting cash balance until processed. |

| Examples | Deposits in transit, errors in entry, timing differences. | Unpresented checks, pending deposits awaiting bank clearance. |

| Resolution | Requires investigation and correction to align records. | Typically clears automatically once processed by the bank. |

| Effect on Reconciliation | Must be identified and adjusted for accurate reconciliation. | Normally included in reconciliation as pending clearing items. |

Introduction to Reconciling and Outstanding Items

Reconciling items are discrepancies identified during the account reconciliation process that require investigation and adjustment to ensure ledger accuracy. Outstanding items represent transactions, such as unpaid checks or unrecorded deposits, that have been initiated but not yet cleared or posted in the financial records. Proper management of reconciling and outstanding items is essential for accurate cash flow reporting and maintaining reliable financial statements.

Definition of Reconciling Items

Reconciling items are discrepancies identified during the reconciliation process between accounting records and bank statements that require investigation and adjustment to ensure accuracy. These items often result from timing differences, errors, or unrecorded transactions affecting the balance agreement. Proper identification and resolution of reconciling items are crucial for maintaining financial integrity and accurate reporting.

Definition of Outstanding Items

Outstanding items refer to transactions recorded in the accounting system that have not yet been fully processed or settled, such as unpaid invoices or uncleared checks. These items impact the accuracy of financial statements by causing temporary discrepancies in account balances until they are resolved. Identifying and monitoring outstanding items is essential for accurate cash flow management and timely reconciliation of accounts.

Key Differences Between Reconciling and Outstanding Items

Reconciling items refer to discrepancies identified during the reconciliation process that must be investigated and resolved to ensure financial records match. Outstanding items are transactions, such as payments or checks, recorded but not yet cleared or processed through bank accounts. The key difference lies in reconciling items highlighting mismatches needing correction, whereas outstanding items represent legitimate delays pending clearance.

Common Examples of Reconciling Items

Common examples of reconciling items in accounting include bank service fees, outstanding checks, deposits in transit, and errors in recording transactions. These items cause discrepancies between the bank statement and the company's ledger, requiring adjustments to achieve accurate financial records. Identifying and addressing these reconciling items ensures the integrity of cash flow reporting and financial statements.

Typical Outstanding Items in Accounting

Typical outstanding items in accounting include uncashed checks, pending deposit transactions, and bank fees not yet recorded in the ledger. These items cause discrepancies between the bank statement and company records until cleared or accounted for. Proper identification and adjustment of outstanding items ensure accurate reconciliation and reliable financial reporting.

Importance of Identifying Reconciling and Outstanding Items

Accurate identification of reconciling and outstanding items is essential for maintaining reliable financial records and ensuring the integrity of account reconciliations. Reconciling items highlight discrepancies between accounting records and bank statements that require timely investigation and resolution, while outstanding items represent transactions recorded but not yet cleared, impacting cash flow visibility. Proper management of these items reduces errors, prevents fraud, and supports informed decision-making in accounting processes.

Best Practices for Managing Reconciling Items

Reconciling items require thorough investigation to identify discrepancies between ledger balances and bank statements, ensuring accurate financial records. Best practices for managing reconciling items include timely documentation, regular account reviews, and prioritizing high-value differences for swift resolution. Implementing automated reconciliation software enhances accuracy and efficiency, reducing errors associated with manual processes.

Resolving Outstanding Items in Bank Reconciliation

Resolving outstanding items in bank reconciliation involves identifying discrepancies between the bank statement and the company's ledger to ensure accurate financial records. Reconciling items are adjustments made for timing differences or errors, while outstanding items specifically refer to transactions recorded in the company's books but not yet cleared by the bank. Effective resolution requires thorough investigation of these outstanding entries, such as unprocessed checks or deposits in transit, to align recorded balances and maintain accurate cash flow tracking.

Impact of Unresolved Items on Financial Statements

Unresolved reconciling items create discrepancies between the general ledger and bank statements, leading to inaccurate cash balances reported on financial statements. Outstanding items, such as uncashed checks or deposits in transit, delay proper recognition of cash flow, affecting liquidity assessment and decision-making. Persistent unresolved items increase the risk of misstated earnings, potential audit issues, and impaired financial statement reliability.

Important Terms

Bank reconciliation

Bank reconciliation involves comparing the company's ledger with the bank statement to identify and adjust reconciling items, which are timing differences like deposits in transit or bank charges not yet recorded in the company's books. Outstanding items refer specifically to unprocessed transactions such as outstanding checks that have been issued but not yet cleared by the bank, affecting the accuracy of the cash balance.

Ledger discrepancies

Ledger discrepancies often arise when reconciling items do not match outstanding items, indicating timing differences or errors in recording transactions. Accurate identification and resolution of these discrepancies ensure the integrity of financial statements and proper cash flow management.

Timing differences

Timing differences cause reconciling items to arise when transactions are recorded in different periods between two accounting records, while outstanding items refer to transactions that have been initiated but not yet processed or cleared. Reconciling items require adjustment entries to align balances, whereas outstanding items remain pending until they are finalized or cleared in the accounting system.

Float balances

Float balances represent temporary discrepancies in cash flow due to timing differences between transactions recorded by the payer and payee. Reconciling items include these float balances as unrecorded or pending transactions during reconciliation, while outstanding items specifically refer to payments or receipts that have been issued but not yet cleared or settled.

Unpresented checks

Unpresented checks are payments issued by a company but not yet cleared by the bank, categorized as reconciling items during bank reconciliation. Outstanding items encompass all transactions, including unpresented checks, that cause temporary differences between the bank statement and the company's cash records.

Deposit in transit

Deposit in transit refers to funds received and recorded by a company but not yet reflected on the bank statement, making it a key reconciling item during bank reconciliations. Unlike outstanding items such as unpaid checks, deposits in transit increase the bank balance upon clearing and must be accurately tracked to ensure the company's cash records align with bank records.

Book errors

Book errors often cause discrepancies between reconciling items and outstanding items during bank reconciliation processes. Reconciling items represent timing differences or errors requiring adjustment in the books, while outstanding items refer to checks or deposits not yet cleared by the bank, highlighting the need for accurate error identification to maintain consistent financial records.

Adjusting entries

Adjusting entries correct discrepancies in accounting records by addressing reconciling items, such as timing differences or errors identified during bank reconciliations, ensuring accurate financial statements. Outstanding items refer to transactions like checks or payments issued but not yet cleared, requiring monitoring to maintain up-to-date account balances.

Cleared transactions

Cleared transactions represent payments or receipts that have been fully processed and matched against bank statements, serving as a key component in resolving reconciling items. Outstanding items, by contrast, are transactions recorded in accounting records but not yet cleared by the bank, often responsible for temporary discrepancies during bank reconciliations.

Unreconciled balances

Unreconciled balances arise when discrepancies exist between reconciling items, which are timing differences or errors identified during the reconciliation process, and outstanding items, which are unpaid or unprocessed transactions yet to clear the accounts. Proper identification and categorization of these items ensure accurate financial reporting and effective cash flow management.

reconciling items vs outstanding items Infographic

moneydif.com

moneydif.com