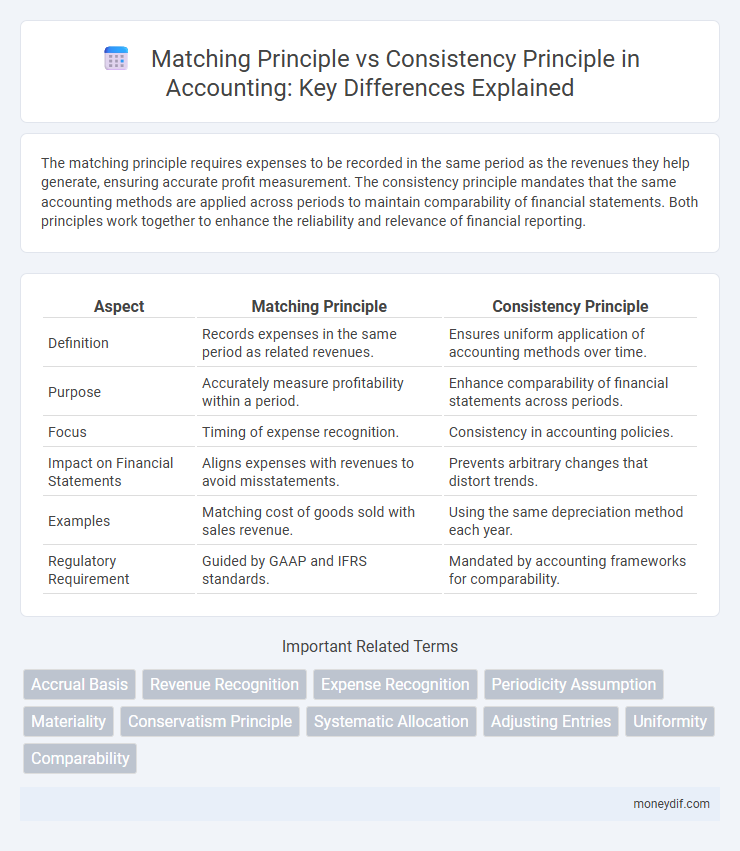

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. The consistency principle mandates that the same accounting methods are applied across periods to maintain comparability of financial statements. Both principles work together to enhance the reliability and relevance of financial reporting.

Table of Comparison

| Aspect | Matching Principle | Consistency Principle |

|---|---|---|

| Definition | Records expenses in the same period as related revenues. | Ensures uniform application of accounting methods over time. |

| Purpose | Accurately measure profitability within a period. | Enhance comparability of financial statements across periods. |

| Focus | Timing of expense recognition. | Consistency in accounting policies. |

| Impact on Financial Statements | Aligns expenses with revenues to avoid misstatements. | Prevents arbitrary changes that distort trends. |

| Examples | Matching cost of goods sold with sales revenue. | Using the same depreciation method each year. |

| Regulatory Requirement | Guided by GAAP and IFRS standards. | Mandated by accounting frameworks for comparability. |

Understanding the Matching Principle in Accounting

The matching principle in accounting requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. This principle enhances financial statement reliability by aligning costs directly with related income, providing a clear view of business performance. It contrasts with the consistency principle, which emphasizes using the same accounting methods across periods for comparability.

Overview of the Consistency Principle

The consistency principle mandates that businesses apply the same accounting methods and policies from period to period to ensure comparability of financial statements. This principle helps stakeholders analyze trends and make informed decisions by preventing arbitrary changes in accounting practices. Adhering to the consistency principle enhances reliability and transparency in financial reporting, complementing but distinct from the matching principle.

Key Differences Between Matching and Consistency Principles

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement, while the consistency principle mandates the use of the same accounting methods and policies across periods to allow comparability of financial statements. Matching principle focuses on timing alignment between expenses and revenues, whereas consistency principle emphasizes uniformity in accounting practices over time. Together, these principles enhance the reliability and relevance of financial reporting in accounting.

Importance of the Matching Principle in Financial Reporting

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, providing accurate measurement of profitability. Adherence to this principle enhances the reliability of financial statements by aligning costs with corresponding revenues within the reporting period. This alignment is crucial for stakeholders to assess a company's true financial performance and make informed decisions.

The Role of Consistency Principle in Financial Statements

The consistency principle ensures that financial statements are prepared using the same accounting methods and policies from period to period, enabling comparability and reliability in financial reporting. This principle supports stakeholders in making informed decisions by maintaining uniformity in revenue recognition, expense matching, and asset valuation. Adhering to the consistency principle enhances transparency and prevents manipulation, thereby reinforcing the integrity of financial statements.

Practical Examples: Matching Principle Applied

The matching principle requires expenses to be recognized in the same period as the related revenues, such as recording depreciation expense monthly to match the revenue generated by the use of fixed assets. In contrast, the consistency principle mandates applying the same accounting methods over time, ensuring comparability, like consistently using the straight-line method for asset depreciation. Practical application of the matching principle includes accruing utilities expense in the month they are incurred, even if the bill is paid later, to reflect accurate financial performance.

Case Studies: Consistency Principle in Real-Life Scenarios

In real-life accounting scenarios, the consistency principle ensures that businesses apply the same accounting methods across periods to provide comparability in financial statements, as illustrated by retail companies consistently using the same inventory valuation method year after year. Case studies reveal how deviations from this principle, such as switching from FIFO to LIFO without disclosure, can mislead stakeholders and affect the reliability of financial data. Maintaining consistency supports accurate performance analysis and helps investors and regulators make informed decisions based on stable accounting practices.

Challenges and Limitations of Both Principles

The matching principle faces challenges in accurately aligning expenses with revenues when timing discrepancies arise or when estimating liabilities, leading to potential distortions in financial statements. The consistency principle may limit flexibility, as strict adherence to the same accounting methods can hinder adaptation to new standards or better practices, causing comparability issues over time. Both principles require judgment and can introduce subjectivity, increasing the risk of errors or manipulation in financial reporting.

Impact on Stakeholder Decision-Making

The matching principle ensures expenses are recorded in the same period as related revenues, providing stakeholders with accurate profitability insights for informed investment and lending decisions. The consistency principle guarantees uniform accounting methods across periods, enabling stakeholders to compare financial statements reliably and assess trends or performance changes effectively. Together, these principles enhance transparency and trust in financial reporting, crucial for stakeholder confidence and strategic decision-making.

Ensuring Compliance: Best Practices for Accountants

The matching principle requires accountants to record expenses in the same period as the revenues they help generate, ensuring accurate financial reporting. The consistency principle mandates the uniform application of accounting methods across periods to maintain comparability of financial statements. Adhering to these principles supports compliance with Generally Accepted Accounting Principles (GAAP) and enhances the reliability of financial disclosures.

Important Terms

Accrual Basis

The accrual basis of accounting records revenues and expenses when they are earned or incurred, aligning with the matching principle by ensuring expenses are recognized in the same period as related revenues. It also supports the consistency principle by requiring uniform application of accounting methods over time to provide comparable financial statements.

Revenue Recognition

Revenue recognition follows the matching principle by aligning revenue with the associated expenses incurred to generate it within the same accounting period, ensuring accurate profit measurement. The consistency principle ensures that the chosen revenue recognition methods are applied uniformly across periods, enabling reliable comparison of financial statements.

Expense Recognition

Expense recognition under the matching principle requires aligning expenses with the revenues they help generate within the same accounting period to ensure accurate profit measurement. The consistency principle mandates that the same accounting methods for recognizing expenses are applied consistently across periods, enhancing comparability and reliability of financial statements.

Periodicity Assumption

The Periodicity Assumption requires financial reporting to divide economic activities into specific time periods, ensuring revenues and expenses are recognized within the same period according to the Matching Principle. Consistency Principle mandates applying accounting methods uniformly across periods, enhancing comparability and reliability of periodic financial statements.

Materiality

Materiality determines the significance of financial information that must be reported, guiding the application of the matching principle by ensuring expenses are recognized in the same period as related revenues only when the amounts are material. The consistency principle requires uniform accounting methods across periods but allows changes if materiality justifies a modification for more accurate financial reporting.

Conservatism Principle

The Conservatism Principle mandates that accountants avoid overestimating income or assets, ensuring liabilities and expenses are recorded promptly, which complements the Matching Principle by aligning expenses with related revenues in the same period. The Consistency Principle requires the use of uniform accounting methods across periods, supporting reliable application of the Matching Principle while ensuring conservative financial reporting practices remain stable over time.

Systematic Allocation

Systematic allocation ensures expenses are matched with the revenues they help generate, aligning with the matching principle to provide accurate profit measurement. This method also supports the consistency principle by applying uniform expense recognition processes across accounting periods, enhancing comparability and reliability of financial statements.

Adjusting Entries

Adjusting entries ensure that revenues and expenses are recorded in the period they occur, directly supporting the matching principle by aligning income and related costs. These adjustments also uphold the consistency principle by applying uniform accounting methods across periods, enabling reliable financial comparison.

Uniformity

Uniformity in accounting ensures that financial statements are prepared using consistent methods, aligning closely with the matching principle which mandates that expenses be recognized in the same period as the revenues they help generate. This principle supports comparability over time, reinforcing the consistency principle by requiring that once an accounting method is adopted, it should be applied uniformly across reporting periods unless a change is justified and disclosed.

Comparability

Comparability in accounting is enhanced by the matching principle, which ensures expenses are recognized in the same period as related revenues, providing a clear basis for comparing financial performance across periods. The consistency principle supports comparability by requiring the use of the same accounting methods over time, allowing stakeholders to reliably analyze trends and make informed decisions.

matching principle vs consistency principle Infographic

moneydif.com

moneydif.com