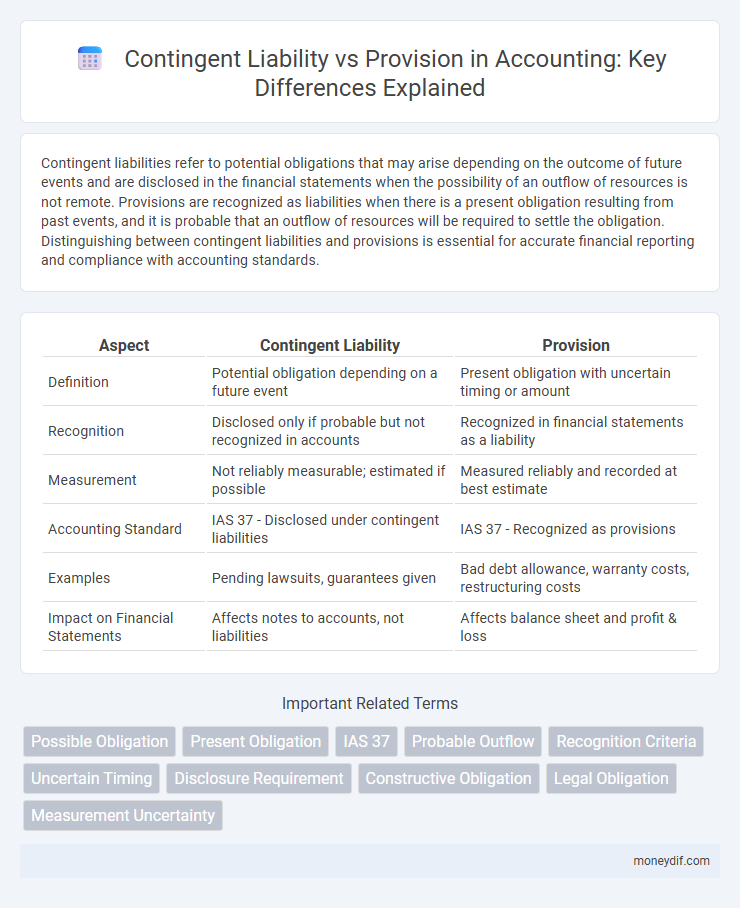

Contingent liabilities refer to potential obligations that may arise depending on the outcome of future events and are disclosed in the financial statements when the possibility of an outflow of resources is not remote. Provisions are recognized as liabilities when there is a present obligation resulting from past events, and it is probable that an outflow of resources will be required to settle the obligation. Distinguishing between contingent liabilities and provisions is essential for accurate financial reporting and compliance with accounting standards.

Table of Comparison

| Aspect | Contingent Liability | Provision |

|---|---|---|

| Definition | Potential obligation depending on a future event | Present obligation with uncertain timing or amount |

| Recognition | Disclosed only if probable but not recognized in accounts | Recognized in financial statements as a liability |

| Measurement | Not reliably measurable; estimated if possible | Measured reliably and recorded at best estimate |

| Accounting Standard | IAS 37 - Disclosed under contingent liabilities | IAS 37 - Recognized as provisions |

| Examples | Pending lawsuits, guarantees given | Bad debt allowance, warranty costs, restructuring costs |

| Impact on Financial Statements | Affects notes to accounts, not liabilities | Affects balance sheet and profit & loss |

Understanding Contingent Liabilities

Contingent liabilities represent potential obligations that depend on the outcome of future events, whereas provisions are recognized liabilities with a probable outflow of resources and can be estimated reliably. Understanding contingent liabilities requires assessing the likelihood of the event and the ability to measure the potential loss, often disclosed in financial statement notes if the obligation is possible but not certain. Accurate evaluation distinguishes contingent liabilities from provisions, impacting financial reporting transparency and compliance with accounting standards like IAS 37.

Defining Provisions in Accounting

Provisions in accounting refer to liabilities of uncertain timing or amount that are recognized when a company has a present obligation arising from past events, and it is probable that an outflow of resources will be required to settle the obligation. Unlike contingent liabilities, provisions are recorded in the financial statements as they meet the criteria of probability and reliability in measurement. Examples include warranties, restructuring costs, and legal disputes where management can reliably estimate the potential loss.

Key Differences: Contingent Liability vs Provision

Contingent liability refers to a potential obligation that may arise depending on the outcome of a future event, whereas a provision is a recognized liability with a probable outflow of resources and reliable estimate of the amount. Provisions are recorded in the financial statements as a liability and expense, while contingent liabilities are disclosed in the notes unless the possibility of an outflow is remote. Key differences also include timing and certainty, with provisions being more certain and measurable compared to contingent liabilities' dependence on unresolved conditions.

Recognition Criteria for Provisions

Provisions are recognized in accounting when there is a present obligation resulting from a past event, it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. Contingent liabilities, on the other hand, are possible obligations that depend on the occurrence of uncertain future events and are not recognized in the financial statements but disclosed unless the possibility of an outflow of resources is remote. The key recognition criteria for provisions emphasize the likelihood of an outflow and the ability to measure the obligation reliably, differentiating them from contingent liabilities which lack these definitive recognition benchmarks.

When to Disclose Contingent Liabilities

Contingent liabilities must be disclosed in the financial statements when there is a reasonable possibility that a future event will confirm the liability and the amount can be reasonably estimated, but the obligation is not yet certain. Provisions, on the other hand, represent present obligations arising from past events and are recognized on the balance sheet when it is probable that an outflow of resources will be required. Disclosure of contingent liabilities ensures transparency about potential financial risks, complying with accounting standards such as IAS 37 and US GAAP ASC 450.

Measurement and Valuation Methods

Contingent liabilities are measured based on the probability of an outflow and a reliable estimate of the amount, often disclosed in financial statement notes without recognition. Provisions require a present obligation with a probable outflow of resources, measured at the best estimate of the expenditure needed to settle the obligation, usually using expected value or most likely amount methods. Valuation of provisions involves discounting future cash flows when the effect of time value of money is material, whereas contingent liabilities typically do not require such discounting.

Impact on Financial Statements

Contingent liabilities represent potential obligations dependent on future events, and they are disclosed in the financial statement notes without affecting the balance sheet until realized. Provisions, recognized as liabilities on the balance sheet, directly reduce net income through expense recognition, impacting key financial ratios such as current liabilities and profitability. Accurate classification ensures compliance with accounting standards like IFRS and GAAP, influencing stakeholders' assessment of a company's financial health.

Real-World Examples: Provisions vs Contingent Liabilities

Provisions in accounting refer to liabilities of uncertain timing or amount, such as warranty claims or restructuring costs, recognized when a present obligation exists and a reliable estimate can be made. Contingent liabilities, like pending lawsuits or environmental fines, are potential obligations that depend on the outcome of future events and are disclosed in financial statements unless the likelihood of occurrence is remote. Real-world examples illustrate provisions impacting balance sheets through estimated expenses, while contingent liabilities highlight potential risks presented in notes without immediate financial impact.

Relevant Accounting Standards (IAS 37/AS 29)

IAS 37 and AS 29 provide clear guidelines distinguishing contingent liabilities from provisions, where provisions are recognized when a present obligation arises from past events and a reliable estimate of outflow can be made. Contingent liabilities, under these standards, are possible obligations dependent on future events or present obligations where the outflow is not probable or cannot be reliably measured, and thus are disclosed but not recognized in financial statements. The emphasis on these standards ensures consistent accounting treatment to enhance comparability and reliability of financial reporting.

Best Practices for Reporting and Disclosure

Best practices for reporting contingent liabilities and provisions emphasize clear classification and transparent disclosure in financial statements to ensure stakeholders accurately assess potential financial risks. Contingent liabilities should be disclosed in notes when the outcome is uncertain but potentially material, while provisions require recognition on the balance sheet when there is a probable obligation with a reliably estimable amount. Consistent application of International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) improves comparability and credibility in financial reporting.

Important Terms

Possible Obligation

Possible obligations are potential obligations that depend on future events, classified as contingent liabilities if their occurrence is uncertain and not recognized in financial statements. Provisions represent present obligations arising from past events with probable outflows and reliable estimations, thus recognized as liabilities on the balance sheet.

Present Obligation

A present obligation arises from a past event that requires an outflow of resources, distinguishing it from a contingent liability which depends on uncertain future events and is disclosed only if probable. Provisions are recognized for present obligations when a reliable estimate can be made, whereas contingent liabilities remain off-balance sheet until the outflow becomes probable and measurable.

IAS 37

IAS 37 requires entities to recognize a provision when a present obligation arises from a past event, and it is probable that an outflow of resources will be required to settle the obligation, while contingent liabilities are disclosed but not recognized because their existence depends on uncertain future events. Provisions must be measured reliably and reflect the best estimate of the expenditure needed to settle the obligation, whereas contingent liabilities remain off-balance sheet until they become probable and measurable.

Probable Outflow

Probable outflow under contingent liabilities refers to a potential financial obligation that is likely to result in an outflow of resources but lacks certainty, whereas a provision is recognized when a present obligation exists with a probable outflow and a reliable estimate can be made. Provisions are recorded as liabilities on the balance sheet, while contingent liabilities are disclosed in the notes unless the outflow is remote.

Recognition Criteria

Recognition criteria for contingent liabilities require that a possible obligation depends on uncertain future events, and it is not recognized in financial statements but disclosed if the likelihood is more than remote. Provisions are recognized when there is a present obligation arising from past events, probable outflow of resources, and a reliable estimate can be made.

Uncertain Timing

Uncertain timing in contingent liabilities arises when it is unclear if or when an outflow of resources will occur, contrasting with provisions where the timing and amount of the liability are both reliably estimated and recognized in financial statements. Contingent liabilities depend on future events beyond the entity's control, while provisions address present obligations with uncertain timing but measurable impact.

Disclosure Requirement

Disclosure requirements mandate that contingent liabilities must be reported in the financial statement notes if the potential obligation is possible but not probable, whereas provisions are recognized in the balance sheet when an outflow of resources is probable and can be reliably estimated. IFRS IAS 37 specifically governs the recognition and disclosure of provisions and contingent liabilities to ensure transparency and relevance in financial reporting.

Constructive Obligation

Constructive obligation arises from an entity's established practices, published policies, or specific statements creating a valid expectation that it will discharge certain responsibilities, leading to a probable outflow of resources and an obligation to recognize a provision. Contingent liabilities differ as they represent possible obligations dependent on future uncertain events, requiring disclosure only unless the outflow is probable and can be reliably estimated, triggering provision recognition.

Legal Obligation

Legal obligations create a present duty enforceable by law, distinguishing provisions, which are recognized liabilities with a probable outflow of resources, from contingent liabilities that represent possible obligations depending on uncertain future events. Provisions require reliable estimates and recognition in financial statements, whereas contingent liabilities are disclosed unless the outflow of resources is remote.

Measurement Uncertainty

Measurement uncertainty in contingent liabilities arises from the unpredictable nature of future events, making it difficult to estimate the financial impact reliably, whereas provisions involve recognized liabilities with more certain measurement parameters due to clearer evidence and obligation. Understanding the degree of uncertainty is crucial for accurate financial reporting and compliance with accounting standards like IAS 37, ensuring the appropriate classification between contingent liabilities and provisions.

contingent liability vs provision Infographic

moneydif.com

moneydif.com