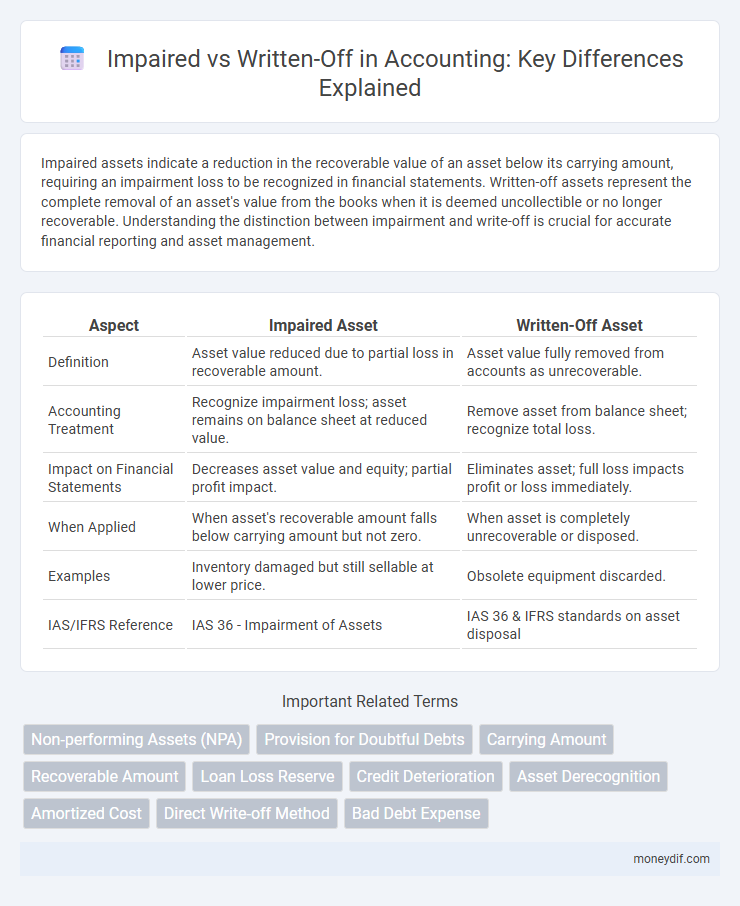

Impaired assets indicate a reduction in the recoverable value of an asset below its carrying amount, requiring an impairment loss to be recognized in financial statements. Written-off assets represent the complete removal of an asset's value from the books when it is deemed uncollectible or no longer recoverable. Understanding the distinction between impairment and write-off is crucial for accurate financial reporting and asset management.

Table of Comparison

| Aspect | Impaired Asset | Written-Off Asset |

|---|---|---|

| Definition | Asset value reduced due to partial loss in recoverable amount. | Asset value fully removed from accounts as unrecoverable. |

| Accounting Treatment | Recognize impairment loss; asset remains on balance sheet at reduced value. | Remove asset from balance sheet; recognize total loss. |

| Impact on Financial Statements | Decreases asset value and equity; partial profit impact. | Eliminates asset; full loss impacts profit or loss immediately. |

| When Applied | When asset's recoverable amount falls below carrying amount but not zero. | When asset is completely unrecoverable or disposed. |

| Examples | Inventory damaged but still sellable at lower price. | Obsolete equipment discarded. |

| IAS/IFRS Reference | IAS 36 - Impairment of Assets | IAS 36 & IFRS standards on asset disposal |

Understanding Impairment and Write-Off in Accounting

Impairment in accounting refers to a reduction in the recoverable value of an asset below its carrying amount on the balance sheet, reflecting a decline in economic benefit. A write-off occurs when the impaired asset's value is formally removed from the accounting records, typically because it is deemed uncollectible or no longer usable. Understanding the distinction between impairment and write-off is crucial for accurate financial reporting and compliance with accounting standards such as IFRS and GAAP.

Key Definitions: Impaired Assets vs Written-Off Assets

Impaired assets refer to assets whose carrying amount exceeds their recoverable amount, indicating a decline in value due to factors like damage, obsolescence, or market changes. Written-off assets are those removed entirely from the accounting records because they have no recoverable value or benefit, reflecting a complete loss. The key difference lies in impairment indicating partial loss in asset value, whereas write-off signifies total asset devaluation and removal from balance sheets.

Accounting Standards Governing Impairment and Write-Off

Accounting standards such as IFRS IAS 36 and US GAAP ASC 360 establish guidelines for recognizing and measuring impaired assets versus write-offs. Impairment occurs when the carrying amount of an asset exceeds its recoverable amount, requiring an impairment loss to be recorded, while write-offs involve fully removing an asset or receivable deemed uncollectible from the books. Proper application of these standards ensures accurate financial reporting and asset valuation.

Causes and Indicators of Asset Impairment

Asset impairment occurs when the carrying amount of an asset exceeds its recoverable amount due to physical damage, obsolescence, decline in market value, or adverse legal changes. Indicators include a significant decrease in market value, changes in the manner of asset use, or evidence of physical deterioration. Written-off assets represent those deemed uncollectible or worthless, often identified after impairment tests confirm no recoverable value remains.

Recognition and Measurement of Impaired Assets

Impaired assets are recognized when the carrying amount exceeds the recoverable amount, requiring an immediate measurement adjustment to reflect the lower value. The impairment loss is measured as the difference between the asset's carrying amount and its recoverable amount, which is the higher of fair value less costs to sell and value in use. Written-off assets occur when impairment losses have been fully recognized and the asset's carrying amount is reduced to zero, removing it from the balance sheet.

Write-Off Process: When and How it Occurs

The write-off process occurs when an asset or receivable is deemed uncollectible or has lost all value, leading to its removal from the balance sheet. This typically happens after exhaustive collection efforts fail, or when the cost of recovery exceeds the asset's benefit. Accounting standards require documenting the write-off with appropriate approvals and adjusting the financial statements to reflect the loss accurately.

Financial Reporting Implications: Impairment vs Write-Off

Impairment in financial reporting requires recognizing a reduction in the recoverable amount of an asset, which affects the carrying value on the balance sheet and influences future depreciation or amortization expenses. A write-off eliminates the asset's carrying amount entirely, reflecting a permanent loss that directly impacts net income in the period recognized. Understanding the distinction ensures accurate financial statements, compliance with accounting standards such as IFRS and GAAP, and appropriate disclosure of asset value adjustments.

Impact on Financial Statements and Ratios

Impaired assets reduce the carrying value on the balance sheet, leading to recognition of an impairment loss on the income statement, which decreases net income and equity. Written-off assets are fully removed from the balance sheet, eliminating both the asset value and any associated allowance, causing a direct impact on total assets and potentially distorting liquidity and solvency ratios. These adjustments affect key financial ratios such as return on assets (ROA), debt-to-equity ratio, and current ratio, influencing stakeholder assessments of financial health and performance.

Disclosure Requirements for Impairment and Write-Off

Disclosure requirements for impairment must include the nature and carrying amount of impaired assets, the events leading to the impairment, and the method used to determine recoverable amounts. Write-offs require disclosure of the amount written off, the reasons for the write-off, and any impact on financial statements. Both impairments and write-offs should be clearly reported separately in the notes to provide transparency and aid stakeholders in assessing asset valuation.

Best Practices for Managing Impaired and Written-Off Assets

Regularly assess asset valuations using IFRS and GAAP guidelines to identify impairments accurately and ensure timely recognition of losses. Maintain detailed documentation of impairment indicators and management decisions to support transparency and audit readiness. Implement a consistent policy for writing off assets after exhaustive recovery efforts, aligning with company financial controls to avoid misstated asset balances.

Important Terms

Non-performing Assets (NPA)

Non-performing Assets (NPAs) represent loans or advances for which the borrower has stopped making interest or principal repayments for 90 days or more, indicating impaired financial health and reduced recoverability. Impaired assets refer to NPAs showing signs of diminished value, while written-off assets are those formally removed from the bank's balance sheet after being deemed unrecoverable, reflecting a loss realization.

Provision for Doubtful Debts

Provision for Doubtful Debts represents the estimated amount of receivables unlikely to be collected, reflecting impairment losses recognized in the financial statements; impaired debts remain on the balance sheet with a corresponding allowance, whereas written-off debts are removed from accounts when recovery is deemed impossible. Accurately distinguishing between impaired and written-off debts ensures compliance with accounting standards such as IFRS 9, enhancing the reliability of financial reporting.

Carrying Amount

The carrying amount represents the book value of an asset on the balance sheet, which is adjusted downward through impairment when the asset's recoverable amount falls below its carrying value due to diminished utility or market conditions. When an asset is written off, its carrying amount is reduced to zero, reflecting a complete loss in value and removal from the financial statements.

Recoverable Amount

The recoverable amount represents the higher value between an asset's fair value less costs to sell and its value in use, serving as a key measurement in impairment testing. When an impairment loss reduces the asset's carrying amount to below its recoverable amount, the loss is recognized, whereas a written-off asset signifies a complete derecognition when the asset's carrying amount is reduced to zero due to irrecoverable impairment.

Loan Loss Reserve

Loan Loss Reserve represents the estimated amount set aside to cover potential losses on impaired loans, which are loans exhibiting signs of credit quality deterioration but not yet written off. When loans are written off, the corresponding amount is deducted directly from the Loan Loss Reserve, reflecting the actual realization of credit losses.

Credit Deterioration

Credit deterioration occurs when the borrower's financial condition worsens, leading to impaired assets that exhibit a high risk of default but remain on the balance sheet. Written-off loans represent the final stage of credit deterioration, where impaired assets are removed from accounting records due to uncollectibility, reflecting a confirmed loss for the lender.

Asset Derecognition

Asset derecognition occurs when an impaired asset is removed from the balance sheet due to a significant decline in its recoverable value, while an asset write-off involves completely eliminating the asset's carrying amount after it is deemed unrecoverable or worthless. Impairment reduces the asset's book value to its recoverable amount, whereas a write-off fully derecognizes the asset, reflecting a realized loss in financial statements.

Amortized Cost

Amortized cost measures the value of a financial asset after accounting for interest, amortization, and credit losses, providing a more accurate reflection of its recoverable amount than the face value. Impaired assets show a decline in value due to expected credit losses without complete derecognition, whereas written-off assets are fully removed from the balance sheet when recovery is deemed impossible.

Direct Write-off Method

The Direct Write-off Method records bad debt expense only when an account is deemed uncollectible, distinguishing impaired receivables, which indicate a reduced recoverable amount, from written-off accounts that are removed entirely from the balance sheet. This approach contrasts with the allowance method by directly impacting income statements upon write-off without estimating losses in advance.

Bad Debt Expense

Bad debt expense reflects estimated losses from accounts receivable that are unlikely to be collected, recognized when receivables become impaired but not yet written off. Once specific accounts are deemed uncollectible, they are written off, removing both the receivable and the related allowance from the balance sheet.

impaired vs written-off Infographic

moneydif.com

moneydif.com