Trade receivables represent amounts owed to a company by customers resulting from the sale of goods or services in the ordinary course of business, reflecting core operational revenue. Non-trade receivables arise from transactions outside the primary business activities, such as loans to employees or tax refunds, and are typically less frequent and less predictable. Distinguishing between these receivables is crucial for accurate financial reporting and cash flow management, impacting liquidity analysis and credit risk assessment.

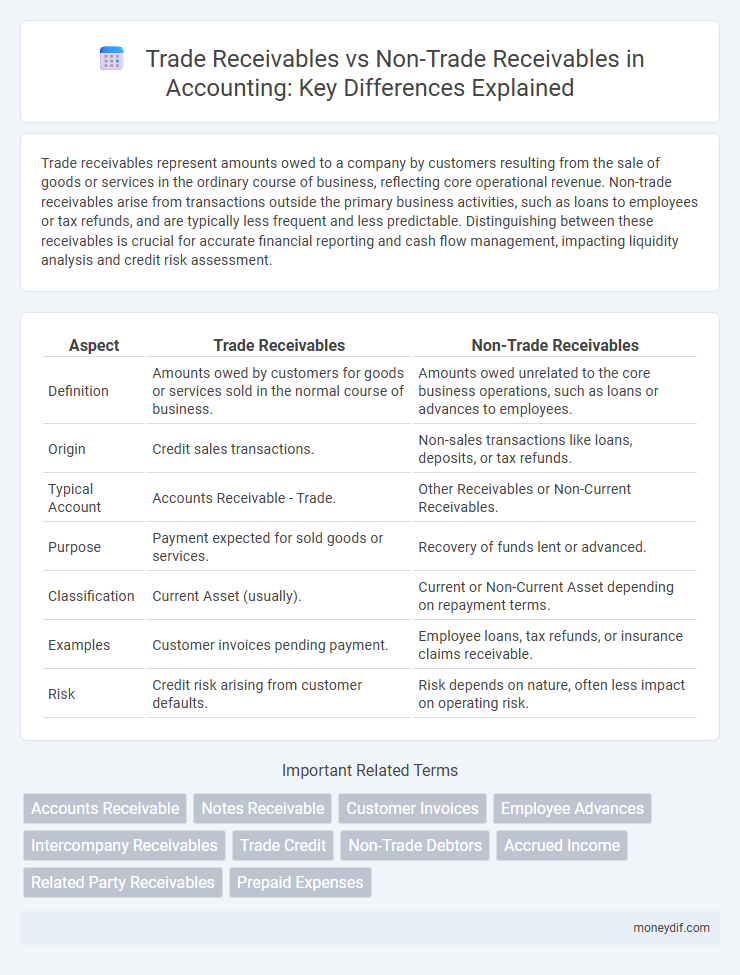

Table of Comparison

| Aspect | Trade Receivables | Non-Trade Receivables |

|---|---|---|

| Definition | Amounts owed by customers for goods or services sold in the normal course of business. | Amounts owed unrelated to the core business operations, such as loans or advances to employees. |

| Origin | Credit sales transactions. | Non-sales transactions like loans, deposits, or tax refunds. |

| Typical Account | Accounts Receivable - Trade. | Other Receivables or Non-Current Receivables. |

| Purpose | Payment expected for sold goods or services. | Recovery of funds lent or advanced. |

| Classification | Current Asset (usually). | Current or Non-Current Asset depending on repayment terms. |

| Examples | Customer invoices pending payment. | Employee loans, tax refunds, or insurance claims receivable. |

| Risk | Credit risk arising from customer defaults. | Risk depends on nature, often less impact on operating risk. |

Introduction to Receivables in Accounting

Trade receivables represent amounts owed to a business from customers for goods or services delivered on credit, forming a core component of current assets on the balance sheet. Non-trade receivables include amounts due from sources other than customers, such as advances, loans to employees, or tax refunds, often classified separately due to their differing nature and collectibility. Accurate classification and management of these receivables enhance financial reporting, liquidity analysis, and credit risk assessment in accounting practices.

Definition of Trade Receivables

Trade receivables represent amounts owed to a company by its customers for goods sold or services rendered as part of its core business operations. These receivables arise from credit sales and are classified as current assets on the balance sheet. In contrast, non-trade receivables include amounts due from non-customers or transactions outside the primary business activities, such as advances to employees or tax refunds.

Definition of Non-Trade Receivables

Non-trade receivables are amounts owed to a company that do not arise from its primary business sales activities, including security deposits, tax refunds, and advances to employees. These receivables differ from trade receivables, which represent customer payments due for goods or services sold on credit. Proper classification of non-trade receivables is essential for accurate financial reporting and effective working capital management.

Key Differences Between Trade and Non-Trade Receivables

Trade receivables represent amounts owed by customers for goods or services delivered as part of the company's core operations, typically recorded as accounts receivable and expected to be collected within the normal credit terms. Non-trade receivables include amounts due from non-customers, such as advances, loans to employees, or tax refunds, often having longer or undefined collection periods and not arising from the primary business activities. The key difference lies in their origin, with trade receivables directly related to sales revenue and non-trade receivables arising from ancillary or incidental transactions unrelated to sales.

Examples of Trade Receivables

Trade receivables primarily include outstanding invoices from customers for goods sold or services rendered on credit, such as sales made to wholesalers or direct clients. Examples consist of accounts receivable from regular business transactions like product sales, service fees, and installment payments. These receivables differ from non-trade receivables, which arise from non-operational sources such as loans to employees or tax refunds.

Examples of Non-Trade Receivables

Non-trade receivables include amounts owed to a company that arise outside its primary business operations, such as advances to employees, tax refunds receivable, or insurance claim settlements. These receivables differ from trade receivables, which specifically relate to credit sales of goods or services to customers. Tracking non-trade receivables separately ensures more accurate financial reporting and cash flow management.

Recognition and Measurement of Receivables

Trade receivables are recognized when a company delivers goods or services and records the amount owed by customers as an asset at the transaction price, reflecting expected cash inflows. Non-trade receivables arise from transactions outside core operations, such as loans to employees or tax refunds, and are measured at amortized cost or fair value depending on their nature. Both types require assessment for impairment based on expected credit losses to ensure accurate financial reporting.

Impact on Financial Statements

Trade receivables, arising from core business sales, directly impact the balance sheet by representing expected cash inflows and influence the income statement through revenue recognition. Non-trade receivables, such as advances or loans to employees, appear separately on the balance sheet and typically do not affect operating income. Accurate classification and valuation of these receivables are essential for reliable financial reporting and analysis of a company's liquidity and operational efficiency.

Managing Trade vs Non-Trade Receivables

Managing trade receivables involves closely monitoring customer invoices arising from the sale of goods or services to ensure timely collection and maintain cash flow stability. Non-trade receivables, such as advances to employees or tax refunds, require separate tracking and reconciliation to prevent misclassification and financial discrepancies. Effective management of both types improves overall working capital efficiency and reduces the risk of bad debts.

Common Challenges in Receivables Accounting

Trade receivables often face challenges such as credit risk assessment, timely collection, and accurate revenue recognition, while non-trade receivables require stringent monitoring to prevent misclassification and ensure proper valuation. Both types demand robust internal controls to manage discrepancies and reduce the risk of bad debts impacting financial statements. Effective receivables accounting hinges on comprehensive aging analysis, consistent policy application, and compliance with relevant accounting standards.

Important Terms

Accounts Receivable

Accounts receivable represents amounts due from customers for goods or services delivered, with trade receivables arising directly from core business operations and non-trade receivables stemming from ancillary transactions such as loans or advances. Accurate classification between trade and non-trade receivables enhances financial analysis by clarifying cash flow sources and credit risk profiles.

Notes Receivable

Notes receivable represent written promises for payment, distinguished from trade receivables which arise directly from sales of goods or services, while non-trade receivables typically originate from transactions unrelated to the core business operations. These financial instruments often carry explicit terms including interest, maturity dates, and legal enforceability, enhancing their reliability compared to ordinary trade receivables.

Customer Invoices

Customer invoices primarily generate trade receivables, which represent amounts owed by customers for goods or services sold in the ordinary course of business. Non-trade receivables arise from transactions unrelated to core operations, such as advances, loans to employees, or tax refunds, and are recorded separately from trade receivables in financial statements.

Employee Advances

Employee advances classified under non-trade receivables represent short-term loans or payments made to employees outside the core business transactions, contrasting with trade receivables which arise from credit sales to customers. Accurate differentiation between trade and non-trade receivables ensures precise financial reporting and effective working capital management.

Intercompany Receivables

Intercompany receivables consist of amounts owed between affiliated entities, classified as trade receivables when arising from the sale of goods or services and non-trade receivables when related to loans, advances, or other financial transactions. Accurate distinction between trade and non-trade intercompany receivables is essential for consolidated financial reporting and compliance with accounting standards such as IFRS and US GAAP.

Trade Credit

Trade credit represents a short-term financing arrangement where businesses allow customers to purchase goods or services on account, creating trade receivables that are directly tied to core operating activities; non-trade receivables, by contrast, arise from transactions outside normal operations, such as advances to employees or insurance claims. Trade receivables impact working capital management and cash flow forecasting more significantly than non-trade receivables, which are typically less liquid and less predictable in repayment.

Non-Trade Debtors

Non-trade debtors represent amounts owed to a business from non-operational activities, distinct from trade receivables which arise from primary sales of goods or services. Non-trade receivables often include loans to employees, advances, or other miscellaneous receivables not directly linked to the core trading operations.

Accrued Income

Accrued income related to trade receivables arises from revenue earned through the company's primary business activities, such as sales of goods or services, whereas non-trade receivables represent accrued income from secondary activities like interest, rent, or dividends. Trade receivables are recorded as current assets and directly impact working capital, while non-trade receivables may have varied terms and are classified depending on their realization period.

Related Party Receivables

Related Party Receivables encompass amounts owed by affiliated entities and are classified into trade receivables, arising from normal business transactions, and non-trade receivables, which include loans, advances, or other financial dealings unrelated to regular sales activities. Distinguishing these categories impacts financial reporting and risk assessment by clarifying the nature of intercompany balances and ensuring accurate revenue recognition and credit management.

Prepaid Expenses

Prepaid expenses represent payments made in advance for goods or services to be received in the future, distinct from trade receivables which arise from credit sales in normal business operations, while non-trade receivables typically involve amounts owed outside of core sales activities such as employee advances or tax refunds. Accurate classification of prepaid expenses, trade receivables, and non-trade receivables is essential for financial reporting and cash flow management, ensuring proper matching of revenues and expenses.

trade receivables vs non-trade receivables Infographic

moneydif.com

moneydif.com