Current assets include cash, accounts receivable, and inventory, which are expected to be converted to cash or used within one year. Non-current assets consist of property, plant, equipment, and intangible assets recorded on the balance sheet for long-term use beyond one year. Understanding the distinction between current and non-current assets is crucial for assessing a company's liquidity and long-term financial stability.

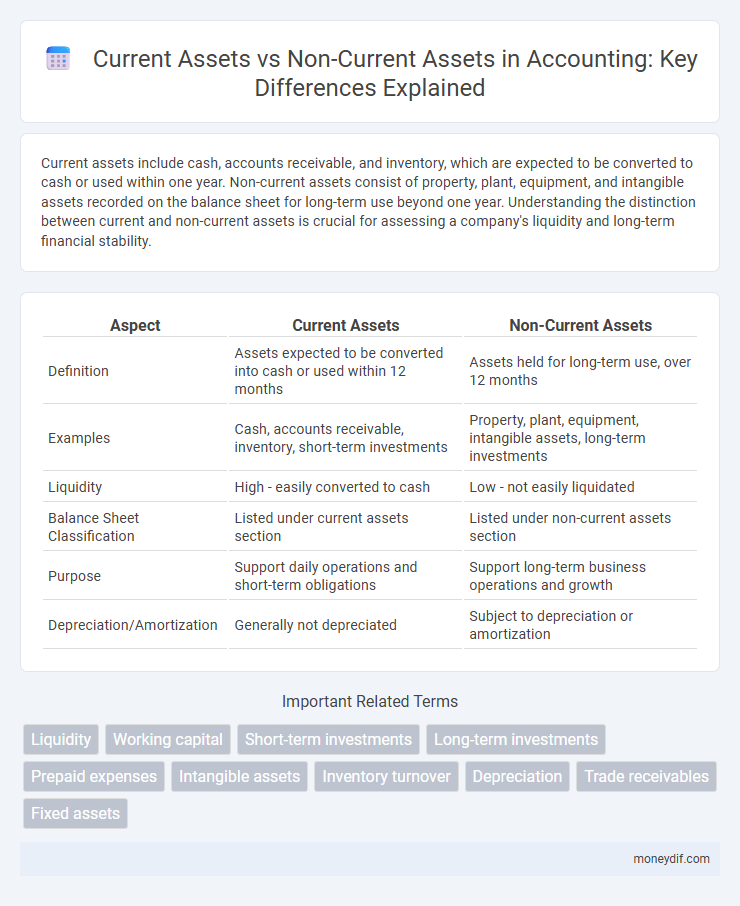

Table of Comparison

| Aspect | Current Assets | Non-Current Assets |

|---|---|---|

| Definition | Assets expected to be converted into cash or used within 12 months | Assets held for long-term use, over 12 months |

| Examples | Cash, accounts receivable, inventory, short-term investments | Property, plant, equipment, intangible assets, long-term investments |

| Liquidity | High - easily converted to cash | Low - not easily liquidated |

| Balance Sheet Classification | Listed under current assets section | Listed under non-current assets section |

| Purpose | Support daily operations and short-term obligations | Support long-term business operations and growth |

| Depreciation/Amortization | Generally not depreciated | Subject to depreciation or amortization |

Definition of Current Assets

Current assets are assets expected to be converted into cash or used up within one fiscal year or operating cycle, whichever is longer; they include cash, accounts receivable, inventory, and prepaid expenses. These assets are critical for managing daily business operations and maintaining liquidity. Proper classification of current assets ensures accurate assessment of a company's short-term financial health and working capital.

Definition of Non-Current Assets

Non-current assets, also known as long-term assets, are resources owned by a company that are expected to provide economic benefits beyond one fiscal year. These assets include property, plant, equipment, intangible assets, and long-term investments, distinguishing them from current assets, which are liquid or expected to be converted to cash within a year. Proper classification of non-current assets is essential for accurate financial reporting and asset management in accounting.

Key Differences Between Current and Non-Current Assets

Current assets include cash, accounts receivable, and inventory, which are expected to be converted into cash within one year, providing liquidity for day-to-day operations. Non-current assets, such as property, plant, equipment, and intangible assets, are long-term investments used over multiple accounting periods for generating revenue. The key difference lies in their liquidity and purpose, with current assets supporting short-term financial stability and non-current assets contributing to long-term growth.

Examples of Current Assets

Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments, all of which are expected to be converted into cash or used within one year. These assets provide liquidity to meet ongoing operational expenses and short-term obligations. Current assets differ from non-current assets, such as property, plant, and equipment, which are held for long-term use.

Examples of Non-Current Assets

Non-current assets include property, plant, and equipment (PP&E), long-term investments, intangible assets such as patents and trademarks, and goodwill. These assets are not expected to be converted into cash within one year and are crucial for long-term business operations and value generation. Examples of non-current assets also encompass land, buildings, machinery, and leasehold improvements that support company growth and production capacity.

Importance of Asset Classification in Accounting

Accurate classification of current assets and non-current assets is crucial for assessing a company's liquidity and long-term financial stability. Current assets, such as cash, receivables, and inventory, provide insight into short-term operational efficiency, while non-current assets like property, plant, and equipment reflect investment in future growth. Proper asset classification improves financial reporting accuracy, aids in regulatory compliance, and facilitates better decision-making for stakeholders.

Impact on Financial Statements

Current assets, such as cash, accounts receivable, and inventory, directly influence a company's liquidity and working capital, reflecting short-term financial health on the balance sheet. Non-current assets, including property, plant, and equipment, impact long-term financial stability and depreciation expenses, affecting both the balance sheet and income statement over multiple periods. The classification between current and non-current assets is crucial for stakeholders to assess operational efficiency, solvency, and investment potential.

Asset Liquidity and Business Operations

Current assets, including cash, accounts receivable, and inventory, offer high asset liquidity, enabling businesses to quickly cover short-term liabilities and support daily operations efficiently. Non-current assets such as property, plant, and equipment provide long-term value but are less liquid, impacting the company's ability to rapidly generate cash. Effective management of both asset types ensures balanced liquidity and operational stability within financial strategies.

How to Record Current and Non-Current Assets

Record current assets by listing them on the balance sheet under short-term assets, including cash, accounts receivable, and inventory, which are expected to be converted into cash or used within one year. Non-current assets, such as property, plant, equipment, and intangible assets, are recorded separately as long-term assets, reflecting their extended use beyond a fiscal year. Proper classification ensures accurate financial reporting and aids in asset management by distinguishing liquidity and investment horizons.

Common Mistakes in Asset Classification

Common mistakes in asset classification often include misclassifying non-current assets, such as equipment or land, as current assets, which can inflate a company's liquidity ratios inaccurately. Another frequent error is failing to reclassify assets that change their expected realization period, such as inventory held longer than a year remaining under current assets instead of non-current. Inaccurate classification of receivables expected beyond one year can distort financial statements and lead to poor decision-making by stakeholders.

Important Terms

Liquidity

Liquidity measures a company's ability to meet short-term obligations using current assets, which are cash or assets expected to be converted into cash within one year. Non-current assets, such as property, plant, and equipment, are less liquid and play a minimal role in immediate liquidity assessment.

Working capital

Working capital represents the difference between current assets, such as cash, inventory, and receivables, and current liabilities, reflecting a company's short-term liquidity and operational efficiency. Non-current assets like property, plant, and equipment are excluded from working capital calculations as they are not readily convertible to cash within a fiscal year.

Short-term investments

Short-term investments are classified as current assets because they are expected to be converted into cash within one year or the operating cycle, whichever is longer. In contrast, non-current assets include long-term investments held beyond one year, reflecting a longer-term commitment of resources on the balance sheet.

Long-term investments

Long-term investments are classified as non-current assets on the balance sheet because they are intended to be held for more than one year, unlike current assets, which are expected to be converted into cash or used within a year. These investments include securities, real estate, or subsidiaries, providing strategic growth opportunities and financial stability beyond the operating cycle.

Prepaid expenses

Prepaid expenses categorized under current assets represent payments made for goods or services to be received within one year or the operating cycle, whichever is longer. When prepaid expenses extend beyond one year, they are classified as non-current assets, reflecting long-term benefits or services prepaid in advance.

Intangible assets

Intangible assets, including patents, trademarks, and goodwill, are classified as non-current assets due to their long-term usage and value contribution beyond one fiscal year. Unlike current assets such as cash, inventory, or accounts receivable, intangible assets are not easily liquidated and provide sustained competitive advantages over time.

Inventory turnover

Inventory turnover measures how efficiently a company converts inventory into sales, primarily impacting current assets by reflecting the liquidity of stock within a fiscal period. Non-current assets like machinery or property do not directly influence inventory turnover but support long-term production capacity and operational efficiency.

Depreciation

Depreciation primarily applies to non-current assets such as machinery, buildings, and equipment, reflecting the allocation of their cost over useful life to account for wear and obsolescence. Current assets like inventory and cash do not undergo depreciation as they are expected to be converted into cash or consumed within a normal operating cycle.

Trade receivables

Trade receivables classified under current assets represent amounts expected to be collected within one year, reflecting the company's short-term liquidity. When trade receivables extend beyond one year, they are categorized as non-current assets, indicating longer-term credit arrangements and impacting the firm's asset structure and cash flow timing.

Fixed assets

Fixed assets, classified as non-current assets, represent long-term tangible property such as machinery, buildings, and land used in business operations, contrasting with current assets like cash, inventory, and receivables that are expected to be converted into cash within one year. Non-current assets provide sustainable value and operational capacity, while current assets focus on liquidity and short-term financial health.

current assets vs non-current assets Infographic

moneydif.com

moneydif.com