Revaluation surplus arises from the increase in the carrying amount of a fixed asset after a revaluation, reflecting unrealized gains that are not distributed as dividends. Retained earnings represent accumulated net income retained in the business after dividends are paid, available for reinvestment or debt repayment. Unlike retained earnings, revaluation surplus is typically recorded in other comprehensive income and cannot be used to cover losses or pay dividends directly.

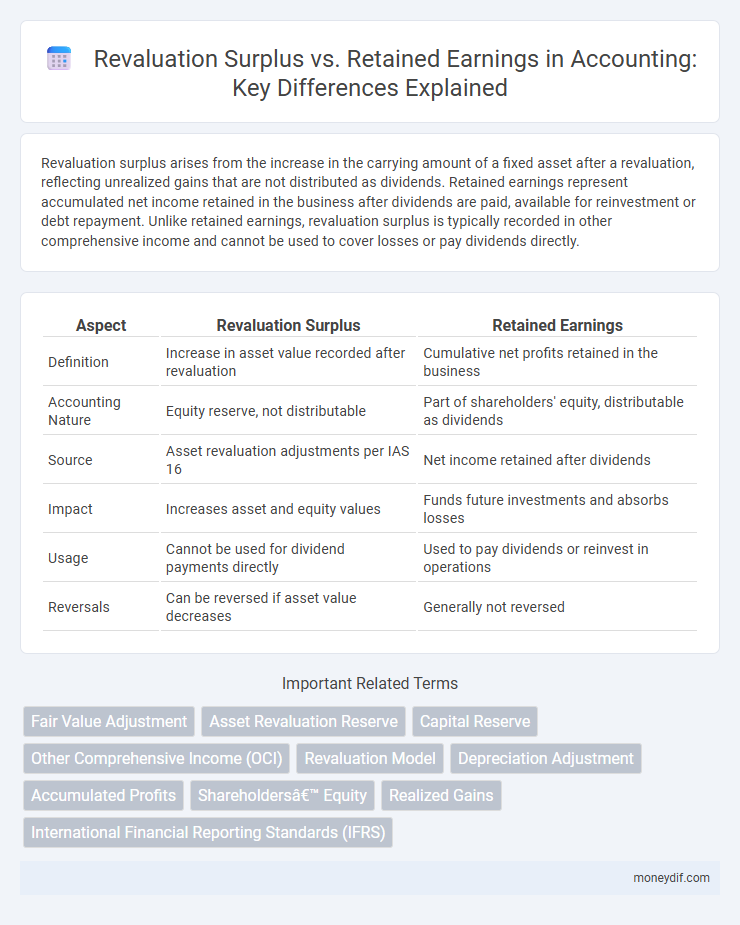

Table of Comparison

| Aspect | Revaluation Surplus | Retained Earnings |

|---|---|---|

| Definition | Increase in asset value recorded after revaluation | Cumulative net profits retained in the business |

| Accounting Nature | Equity reserve, not distributable | Part of shareholders' equity, distributable as dividends |

| Source | Asset revaluation adjustments per IAS 16 | Net income retained after dividends |

| Impact | Increases asset and equity values | Funds future investments and absorbs losses |

| Usage | Cannot be used for dividend payments directly | Used to pay dividends or reinvest in operations |

| Reversals | Can be reversed if asset value decreases | Generally not reversed |

Introduction to Revaluation Surplus and Retained Earnings

Revaluation surplus represents the increase in asset value recorded after revaluing fixed assets, reflecting their current fair market value rather than historical cost. Retained earnings denote accumulated net income retained in the company after dividend payouts, serving as a source for reinvestment or debt reduction. Both are critical equity components, with revaluation surplus affecting asset valuation and retained earnings reflecting operational profitability.

Definition and Key Concepts

Revaluation surplus represents the increase in an asset's carrying amount due to a revaluation, recorded directly in equity under other comprehensive income, without affecting retained earnings. Retained earnings comprise accumulated net income minus dividends, reflecting profits available for reinvestment or distribution. Unlike retained earnings, revaluation surplus is not distributable as dividends and remains in equity until realized through disposal or impairment.

Recognition in Financial Statements

Revaluation surplus is recognized in the other comprehensive income section and presented within equity under revaluation reserves, reflecting increases in asset values without affecting profit or loss. Retained earnings represent accumulated net income, adjusted for dividends and prior-period corrections, directly impacting the profit or loss statement and overall equity. The distinction ensures that revaluation gains do not distort current earnings, maintaining clarity in financial performance reporting.

Accounting Standards Overview

Revaluation surplus arises when an asset's carrying amount is increased to its fair value according to IAS 16 or IAS 38, reflecting unrealized gains that are recorded directly in equity but excluded from retained earnings. Retained earnings represent accumulated net profits after dividends, governed by frameworks like IFRS and GAAP, serving as distributable reserves for business operations or dividends. Accounting standards require careful differentiation between these equity components to ensure accurate financial reporting and compliance with disclosure requirements.

Revaluation Surplus: Purpose and Calculation

Revaluation surplus represents the increased value of fixed assets after revaluation, recorded under equity but separate from retained earnings, reflecting unrealized gains that are not distributable as dividends. The purpose of revaluation surplus is to update the asset's book value to fair market value, ensuring more accurate financial statements and improving the company's balance sheet strength. Calculation involves comparing the revalued asset's fair value to its carrying amount, with the difference credited to revaluation surplus, adjusting accumulated depreciation proportionally to the asset's new carrying amount.

Retained Earnings: Sources and Importance

Retained earnings represent the accumulated net income a company retains after distributing dividends, serving as a crucial internal source of financing for growth and debt reduction. Unlike revaluation surplus, which arises from periodic adjustments in asset values and is recorded in other comprehensive income, retained earnings reflect operational profitability and cash flow generation. Maintaining strong retained earnings ensures long-term financial stability, supports dividend payments, and enables reinvestment without relying on external funding.

Impact on Equity Section

Revaluation surplus increases the equity section by reflecting the upward adjustment of asset values without affecting retained earnings, thereby enhancing the other components of equity. Retained earnings represent accumulated profits after dividends, directly influencing the equity through net income and dividend distributions. The revaluation surplus is presented separately in equity under other comprehensive income, while retained earnings remain the primary source of distributable profits within shareholder equity.

Transfer and Utilization Rules

Revaluation surplus is a component of equity arising from the upward revaluation of fixed assets and cannot be distributed as dividends until realized through asset disposal. Transfer rules allow revaluation surplus to be transferred to retained earnings only when the related asset is derecognized or impaired. Utilization of retained earnings is unrestricted for dividend distribution, whereas revaluation surplus usage is strictly limited by accounting standards to ensure capital maintenance.

Practical Examples and Case Studies

Revaluation surplus arises when an asset's carrying amount is increased to its fair value, such as a property revaluation that boosts the asset value on the balance sheet without impacting retained earnings directly. For instance, a company revaluing land from $500,000 to $700,000 records a $200,000 revaluation surplus under equity, preserving retained earnings for accumulated operational profits. Case studies often illustrate that revaluation surpluses can improve financial ratios and borrowing capacity without altering distributable profits reflected in retained earnings.

Key Differences and Reporting Implications

Revaluation surplus arises from the upward adjustment of asset values on the balance sheet, reflecting fair market value increases, whereas retained earnings represent accumulated net profits retained in the business after dividends. Revaluation surplus is reported in the equity section separately and is not distributable as dividends, while retained earnings form a core part of shareholders' equity and can be distributed. The revaluation surplus impacts deferred tax liabilities and depreciation calculations, creating distinct reporting implications from retained earnings, which primarily influence dividend policy and internal financing.

Important Terms

Fair Value Adjustment

Fair Value Adjustment impacts the revaluation surplus by reflecting changes in the asset's market value, with increases credited to revaluation surplus and decreases deducted from it, while any impairment losses bypass the surplus and directly affect retained earnings. Revaluation surplus represents unrealized gains under equity, whereas retained earnings capture realized profits and losses, including fair value adjustments that impair asset values beyond revaluation reserves.

Asset Revaluation Reserve

Asset Revaluation Reserve (ARR) represents the increase in asset value recorded during revaluation, captured as a separate equity reserve rather than affecting retained earnings directly. Unlike retained earnings, which are accumulated profits available for distribution, the revaluation surplus in ARR reflects unrealized gains and remains part of equity until realized through sale or impairment.

Capital Reserve

Capital reserve arises from revaluation surplus during asset revaluation, representing unrealized gains that are not distributable as dividends, unlike retained earnings which consist of accumulated net profits available for dividend distribution. Revaluation surplus increases capital reserve through adjustments in asset values, ensuring that only realized profits are reflected in retained earnings for financial reporting and dividend purposes.

Other Comprehensive Income (OCI)

Other Comprehensive Income (OCI) includes items like revaluation surplus, which arises from adjusting asset values above their carrying amounts without affecting retained earnings until realized. Unlike retained earnings, which reflect accumulated profits and losses, OCI components such as revaluation surplus are reported separately to provide a clearer picture of a company's financial performance and equity changes.

Revaluation Model

The Revaluation Model allows companies to adjust the carrying amount of property, plant, and equipment to fair value, leading to a revaluation surplus recorded in equity, separate from retained earnings. This revaluation surplus reflects unrealized gains and can be transferred to retained earnings only upon asset disposal or derecognition, ensuring that realized gains impact profit and loss while unrealized ones enhance equity stability.

Depreciation Adjustment

Depreciation adjustment impacts the allocation between revaluation surplus and retained earnings by recalculating the asset's depreciable base post-revaluation, often leading to a reduction in future depreciation expense charged to retained earnings. This adjustment ensures that the carrying amount of the asset and accumulated depreciation reflect fair value changes, preserving the accuracy of both revaluation surplus and retained earnings in financial statements.

Accumulated Profits

Accumulated profits represent the total net income retained in a company after dividend payments, forming the basis of retained earnings on the balance sheet. Revaluation surplus arises from adjustments to asset values and is recorded separately in equity, indicating unrealized gains that do not affect accumulated profits or retained earnings directly.

Shareholders’ Equity

Shareholders' equity reflects the net value owned by shareholders, comprising components such as revaluation surplus and retained earnings, where revaluation surplus arises from upward adjustments of asset values without impacting income statements, while retained earnings represent cumulative net income minus dividends, directly influencing distributable profits. The revaluation surplus enhances equity through unrealized gains on asset reappraisals, whereas retained earnings indicate the company's reinvested profits available for dividends or growth initiatives.

Realized Gains

Realized gains arise when asset sales exceed their carrying amounts, directly impacting retained earnings by increasing available profits for distribution. Revaluation surplus represents unrealized gains recorded in equity from asset revaluations and does not affect retained earnings until those gains are realized through disposal or impairment.

International Financial Reporting Standards (IFRS)

International Financial Reporting Standards (IFRS) require companies to recognize revaluation surplus in equity under other comprehensive income, distinct from retained earnings which represent accumulated profits from operations. The revaluation surplus arises from increases in asset fair values and cannot be distributed as dividends, while retained earnings are available for distribution after dividend declarations and reflect the company's cumulative net income less any distributions.

revaluation surplus vs retained earnings Infographic

moneydif.com

moneydif.com