A trial balance is an internal accounting report that lists all ledger accounts and their debit or credit balances to ensure the books are mathematically accurate, serving as a preliminary check. A balance sheet is a formal financial statement summarizing a company's assets, liabilities, and equity at a specific point in time, providing a snapshot of financial position. The trial balance helps prepare the balance sheet but does not provide the detailed financial position that the balance sheet presents.

Table of Comparison

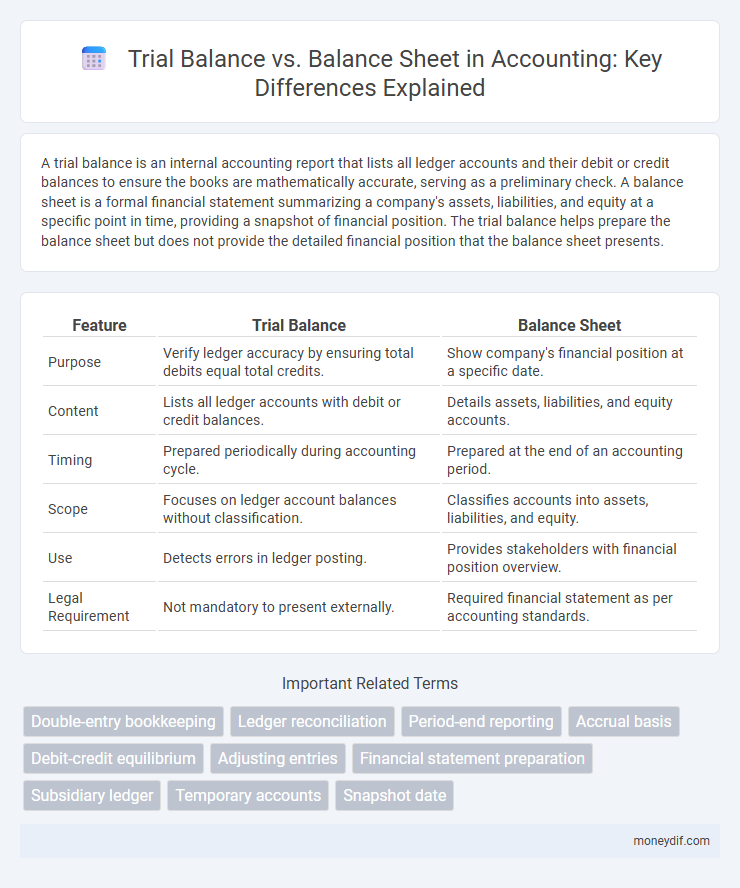

| Feature | Trial Balance | Balance Sheet |

|---|---|---|

| Purpose | Verify ledger accuracy by ensuring total debits equal total credits. | Show company's financial position at a specific date. |

| Content | Lists all ledger accounts with debit or credit balances. | Details assets, liabilities, and equity accounts. |

| Timing | Prepared periodically during accounting cycle. | Prepared at the end of an accounting period. |

| Scope | Focuses on ledger account balances without classification. | Classifies accounts into assets, liabilities, and equity. |

| Use | Detects errors in ledger posting. | Provides stakeholders with financial position overview. |

| Legal Requirement | Not mandatory to present externally. | Required financial statement as per accounting standards. |

Understanding the Trial Balance

The trial balance is a crucial accounting report that lists all general ledger account balances to verify that total debits equal total credits, ensuring the ledger's accuracy. It serves as a preliminary step before preparing financial statements, helping identify any discrepancies or errors in journal entries. Unlike the balance sheet, which presents a snapshot of assets, liabilities, and equity at a specific date, the trial balance is primarily used for internal verification and adjustment purposes.

What is a Balance Sheet?

A balance sheet is a financial statement that presents a company's assets, liabilities, and shareholders' equity at a specific point in time, providing a snapshot of its financial position. It follows the accounting equation: Assets = Liabilities + Equity, ensuring that all resources and obligations are accurately recorded. Unlike a trial balance, which lists all ledger accounts and balances to verify ledger accuracy, the balance sheet summarizes these balances into categories to assess financial health and liquidity.

Key Differences Between Trial Balance and Balance Sheet

A trial balance is an internal accounting report listing all ledger account balances to verify that total debits equal total credits, ensuring the accuracy of journal entries. A balance sheet is a financial statement summarizing a company's assets, liabilities, and equity at a specific date, providing a snapshot of financial position. Unlike the trial balance, the balance sheet follows accounting standards and presents only finalized figures relevant for external stakeholders.

Purpose of Trial Balance in Accounting

The purpose of a trial balance in accounting is to ensure the ledger accounts are mathematically accurate by verifying that total debits equal total credits. It serves as an internal control tool to detect errors before preparing the balance sheet. A trial balance provides a snapshot of all account balances, facilitating the transition to financial statements like the balance sheet.

Role of Balance Sheet in Financial Reporting

The balance sheet provides a comprehensive snapshot of a company's financial position by detailing assets, liabilities, and shareholders' equity at a specific point in time. Unlike the trial balance, which is an internal document used to verify ledger accuracy, the balance sheet is a critical financial statement used by investors, creditors, and regulators for decision-making. Its role in financial reporting is to ensure transparency and assess financial health, facilitating accountability and strategic planning.

Components of a Trial Balance

A trial balance includes components such as debit and credit balances for accounts like assets, liabilities, equity, revenues, and expenses, ensuring that total debits equal total credits. It serves as an internal accounting tool to verify ledger accuracy before financial statements are prepared. Unlike the balance sheet, which presents a snapshot of financial position, the trial balance is primarily used for error detection and ledger reconciliation.

Components of a Balance Sheet

A balance sheet consists of three main components: assets, liabilities, and shareholders' equity, each providing a snapshot of a company's financial position at a specific point in time. Assets are categorized as current or non-current, highlighting resources owned by the business, while liabilities include current and long-term obligations. Shareholders' equity represents the residual interest in the company after deducting liabilities from assets, distinguishing the balance sheet from a trial balance, which lists all ledger accounts without reflecting financial positions.

Timing and Preparation of Trial Balance vs Balance Sheet

The trial balance is prepared periodically, often monthly or quarterly, to ensure that total debits equal total credits before financial statements are finalized. The balance sheet is generated at the end of an accounting period, typically annually, providing a snapshot of a company's financial position, including assets, liabilities, and equity. Accurate preparation of the trial balance is essential for compiling a reliable balance sheet and adhering to accounting standards.

Limitations of Trial Balance and Balance Sheet

Trial balance has limitations such as not detecting errors of omission, errors of principle, or compensating errors, which can lead to inaccurate financial records despite balancing totals. Balance sheets, while providing a snapshot of a company's financial position, do not reflect non-financial factors, contingent liabilities, or the fair market value of assets, potentially misrepresenting true financial health. Both documents require supplementary analyses and adjustments for comprehensive financial accuracy and decision-making.

Importance of Both Statements in Financial Analysis

Trial balance ensures the accuracy of ledger accounts by verifying that total debits equal total credits, serving as a crucial checkpoint before preparing financial statements. Balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and equity, which are essential for assessing liquidity and solvency. Both statements play complementary roles in financial analysis, with trial balance confirming transactional accuracy and balance sheet offering insights into financial health and stability.

Important Terms

Double-entry bookkeeping

Double-entry bookkeeping ensures every financial transaction affects at least two accounts, maintaining the accounting equation's balance, which is verified through the trial balance by comparing total debits and credits. The balance sheet then uses this verified data to present a company's financial position by detailing assets, liabilities, and equity at a specific point in time.

Ledger reconciliation

Ledger reconciliation involves systematically matching the balances recorded in the ledger accounts with the totals presented in the trial balance to ensure data accuracy and detect discrepancies. This process confirms that the trial balance figures align with the balance sheet accounts, facilitating accurate financial reporting and maintaining the integrity of financial statements.

Period-end reporting

Period-end reporting requires a thorough reconciliation between the trial balance and the balance sheet to ensure accuracy in financial statements. Discrepancies in account balances during this process highlight errors or omissions that must be corrected before finalizing the period's financial position.

Accrual basis

Accrual basis accounting records revenues and expenses when they are earned or incurred, ensuring that the trial balance reflects all accrued items before adjustments. This method provides more accurate data for preparing the balance sheet, as it includes accrued assets and liabilities that affect financial position.

Debit-credit equilibrium

Debit-credit equilibrium ensures that total debits equal total credits in the trial balance, confirming the accuracy of ledger entries before preparing financial statements. This equilibrium underpins the balance sheet by verifying that assets, liabilities, and equity accounts reflect a balanced financial position.

Adjusting entries

Adjusting entries ensure that revenues and expenses are recorded in the correct accounting period, thereby aligning the trial balance figures with the true financial position reflected in the balance sheet. These adjustments update asset, liability, and equity accounts to accurately present financial statements in accordance with accrual accounting principles.

Financial statement preparation

Financial statement preparation involves converting the trial balance data into formal reports such as the balance sheet, which summarizes a company's assets, liabilities, and equity at a specific point in time. The trial balance ensures that total debits equal total credits, serving as a foundational step to verify accuracy before compiling the balance sheet for stakeholders.

Subsidiary ledger

A subsidiary ledger provides detailed account information that supports the control accounts reported in the trial balance, ensuring accuracy and completeness in financial data. Unlike the trial balance that summarizes all ledger balances, the balance sheet consolidates these figures to present a snapshot of a company's financial position at a specific date.

Temporary accounts

Temporary accounts, including revenues, expenses, and dividends, are closed at the end of an accounting period and do not appear on the balance sheet but are reflected in the trial balance to ensure ledger accuracy. These accounts reset to zero for the next period, allowing the balance sheet to show only permanent accounts such as assets, liabilities, and equity.

Snapshot date

The snapshot date serves as the specific point in time at which the trial balance is prepared, capturing all account balances before adjustments, while the balance sheet reflects the company's financial position as of the same date but after adjustments, presenting an accurate summary of assets, liabilities, and equity. Ensuring consistency between the trial balance date and the balance sheet date is critical for accurate financial reporting and analysis.

trial balance vs balance sheet Infographic

moneydif.com

moneydif.com