Single-entry accounting records each financial transaction as a single entry, suitable for small businesses with straightforward finances. Double-entry accounting tracks every transaction in two accounts, debiting one and crediting another, ensuring accuracy and a balanced ledger. This method provides a comprehensive view of financial health and facilitates error detection.

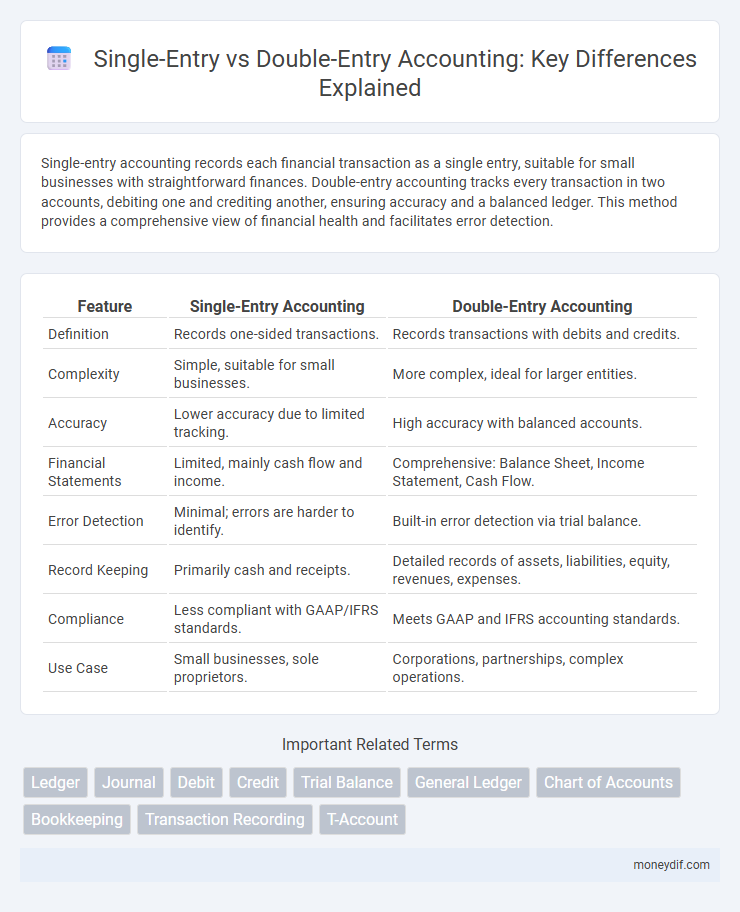

Table of Comparison

| Feature | Single-Entry Accounting | Double-Entry Accounting |

|---|---|---|

| Definition | Records one-sided transactions. | Records transactions with debits and credits. |

| Complexity | Simple, suitable for small businesses. | More complex, ideal for larger entities. |

| Accuracy | Lower accuracy due to limited tracking. | High accuracy with balanced accounts. |

| Financial Statements | Limited, mainly cash flow and income. | Comprehensive: Balance Sheet, Income Statement, Cash Flow. |

| Error Detection | Minimal; errors are harder to identify. | Built-in error detection via trial balance. |

| Record Keeping | Primarily cash and receipts. | Detailed records of assets, liabilities, equity, revenues, expenses. |

| Compliance | Less compliant with GAAP/IFRS standards. | Meets GAAP and IFRS accounting standards. |

| Use Case | Small businesses, sole proprietors. | Corporations, partnerships, complex operations. |

Introduction to Single-Entry and Double-Entry Accounting

Single-entry accounting records each financial transaction as a single entry in a ledger, typically tracking cash inflows and outflows for small businesses or personal finances. Double-entry accounting uses a dual-entry system where every transaction affects at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. This method provides enhanced accuracy and comprehensive financial reporting essential for larger businesses and compliance requirements.

Key Principles of Single-Entry Accounting

Single-entry accounting is based on the key principle of recording each transaction as a single entry, typically in a cash book or ledger, tracking only one side of the transaction. This method emphasizes simplicity and is commonly used by small businesses and sole proprietors for cash flow management. It does not provide a complete view of financial health, lacking the dual-sided consistency and error-checking features inherent in double-entry accounting.

Key Principles of Double-Entry Accounting

Double-entry accounting is based on the principle that every financial transaction affects at least two accounts, ensuring the accounting equation (Assets = Liabilities + Equity) remains balanced. Each entry involves a debit and a corresponding credit, providing a comprehensive and accurate record of financial activity. This system enhances error detection and financial reporting reliability, making it essential for accurate bookkeeping and financial analysis.

Differences Between Single-Entry and Double-Entry Systems

Single-entry accounting records each financial transaction as a single entry, mainly tracking cash flow and simple income or expenses, making it suitable for small businesses or personal finances. Double-entry accounting involves recording every transaction twice, as both debit and credit, ensuring balanced ledgers and providing a comprehensive view of assets, liabilities, equity, income, and expenses. This systematic approach in double-entry enhances error detection, financial accuracy, and detailed reporting compared to the limited scope of single-entry systems.

Advantages of Single-Entry Accounting

Single-entry accounting offers simplicity and ease of use, making it ideal for small businesses or sole proprietors with straightforward transactions. This method requires less time and lower costs for maintaining records compared to double-entry systems. It allows quick tracking of cash flow and basic financial positions without the complexity of balancing accounts.

Advantages of Double-Entry Accounting

Double-entry accounting provides a comprehensive and accurate financial record by recording each transaction in two accounts, ensuring the accounting equation remains balanced. This system facilitates easier error detection, enhances financial transparency, and supports detailed financial analysis and reporting. Businesses gain improved control over their finances with double-entry bookkeeping, aiding in better decision-making and compliance with accounting standards.

Limitations of Single-Entry Accounting

Single-entry accounting lacks the ability to track assets and liabilities comprehensively, resulting in incomplete financial records that hinder accurate financial analysis. It does not provide a systematic way to detect errors or fraud, reducing the reliability of financial statements. This method is unsuitable for businesses requiring detailed financial reporting or compliance with accounting standards such as GAAP or IFRS.

Limitations of Double-Entry Accounting

Double-entry accounting requires recording every transaction twice, increasing complexity and the potential for data entry errors. It demands more time and resources for bookkeeping compared to single-entry systems, making it less suitable for small businesses with simple financial activities. Additionally, double-entry accounting may not capture non-financial information critical for strategic decision-making.

Choosing the Right Accounting System for Your Business

Selecting the appropriate accounting system depends on business complexity and financial management needs. Single-entry accounting suits small businesses with straightforward transactions, offering simplicity and lower costs, while double-entry accounting provides a comprehensive record by tracking debits and credits, ideal for larger operations requiring detailed financial accuracy. Implementing double-entry systems enhances error detection and compliance, supporting informed decision-making and scalable growth.

Summary: Which System Suits Your Needs?

Single-entry accounting suits small businesses with simple transactions and limited financial reporting needs, offering ease of use and minimal record-keeping. Double-entry accounting, required by most larger businesses and GAAP standards, ensures accuracy through balanced debits and credits, providing comprehensive financial statements and error detection. Choosing the right system depends on the complexity of your business operations, regulatory requirements, and the level of financial insight needed for informed decision-making.

Important Terms

Ledger

Ledger systems track financial transactions by recording entries in a single-entry or double-entry format; single-entry ledgers capture each transaction as one entry, often used in simpler accounting methods, while double-entry ledgers record every transaction twice, as both a debit and a credit, ensuring balanced accounts and more accurate financial reporting. Double-entry ledgers are essential for detecting errors and fraud, providing a comprehensive view of asset, liability, and equity changes in business accounting.

Journal

Single-entry journals record transactions in a straightforward, chronological manner focused on either income or expenses, suitable for small businesses with simple accounting needs. Double-entry journals capture each transaction with equal debit and credit entries, ensuring balanced accounts and providing a comprehensive financial overview essential for accurate bookkeeping and auditing.

Debit

Debit in single-entry bookkeeping records only the inflow of cash or increased assets without balancing credits, simplifying transaction tracking for sole proprietors. In double-entry accounting, every debit entry must have a corresponding credit, ensuring balanced accounts and providing a comprehensive financial overview.

Credit

Credit in accounting represents an entry on the right side of a ledger, increasing liabilities, equity, or revenue accounts in double-entry bookkeeping, whereas in single-entry systems, credits are less distinctly tracked due to the simpler recording of transactions. Double-entry accounting ensures every credit has a corresponding debit to maintain financial balance, enhancing accuracy and fraud detection compared to the single-entry method's limited transaction detail.

Trial Balance

A trial balance is a key accounting report used to verify the equality of debit and credit balances in a double-entry bookkeeping system, ensuring accurate financial records. In contrast, single-entry accounting lacks a built-in trial balance because it records only one side of each transaction, making error detection more difficult.

General Ledger

General Ledger functions as the central repository for all accounting transactions, supporting both single-entry and double-entry bookkeeping methods to record financial data. In single-entry systems, each transaction is logged as a single entry, while double-entry systems require matching debit and credit entries to maintain balanced accounts and enhance accuracy.

Chart of Accounts

The Chart of Accounts is a structured listing of all accounts used in an organization's accounting system, essential for organizing financial transactions in both single-entry and double-entry bookkeeping. In single-entry systems, it typically reflects a simplified format focused on income and expenses, while in double-entry systems, it supports balanced ledger entries by categorizing assets, liabilities, equity, revenues, and expenses.

Bookkeeping

Single-entry bookkeeping records financial transactions in a single ledger, ideal for small businesses with simple finances, while double-entry bookkeeping tracks each transaction with corresponding debit and credit entries, ensuring accuracy and facilitating comprehensive financial analysis. Double-entry systems provide a clearer audit trail and better financial statement preparation, making them essential for larger businesses and those requiring detailed accounting records.

Transaction Recording

Transaction recording in accounting involves capturing financial events using either single-entry or double-entry systems; single-entry records each transaction once, focusing on cash flow and simplicity, while double-entry requires recording transactions in two or more accounts, ensuring balanced debits and credits for greater accuracy and error detection. Double-entry accounting supports comprehensive financial statements and is essential for businesses requiring detailed tracking of assets, liabilities, equity, income, and expenses.

T-Account

A T-account visually represents individual accounts in accounting, clearly distinguishing debits on the left and credits on the right, which is essential for understanding the double-entry system where every transaction affects at least two accounts. In contrast, single-entry bookkeeping records transactions as individual entries without corresponding debits and credits, making T-accounts less applicable for accurate financial tracking.

single-entry vs double-entry Infographic

moneydif.com

moneydif.com