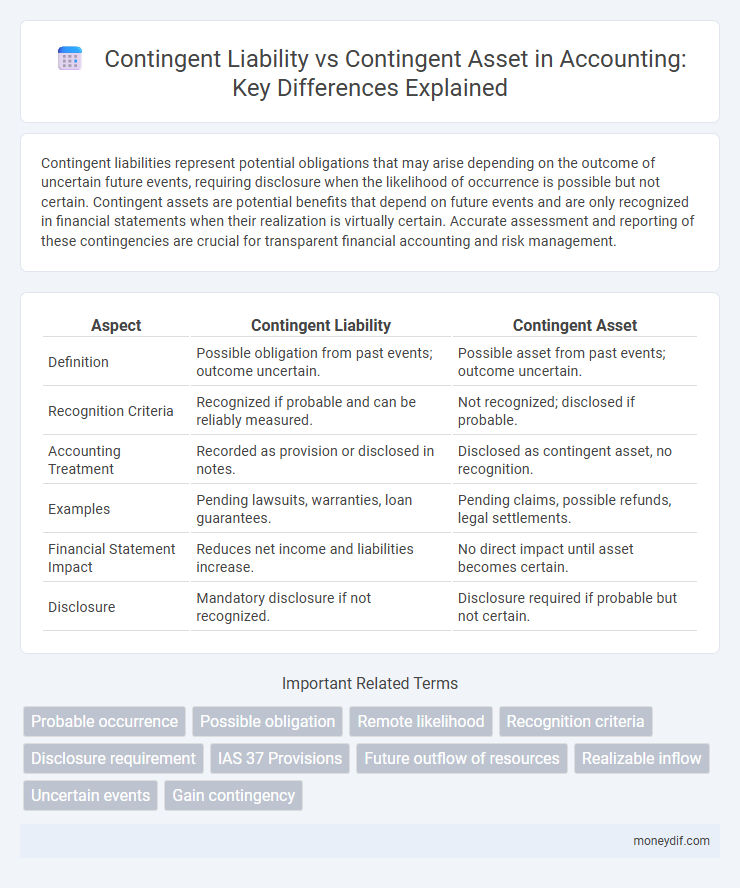

Contingent liabilities represent potential obligations that may arise depending on the outcome of uncertain future events, requiring disclosure when the likelihood of occurrence is possible but not certain. Contingent assets are potential benefits that depend on future events and are only recognized in financial statements when their realization is virtually certain. Accurate assessment and reporting of these contingencies are crucial for transparent financial accounting and risk management.

Table of Comparison

| Aspect | Contingent Liability | Contingent Asset |

|---|---|---|

| Definition | Possible obligation from past events; outcome uncertain. | Possible asset from past events; outcome uncertain. |

| Recognition Criteria | Recognized if probable and can be reliably measured. | Not recognized; disclosed if probable. |

| Accounting Treatment | Recorded as provision or disclosed in notes. | Disclosed as contingent asset, no recognition. |

| Examples | Pending lawsuits, warranties, loan guarantees. | Pending claims, possible refunds, legal settlements. |

| Financial Statement Impact | Reduces net income and liabilities increase. | No direct impact until asset becomes certain. |

| Disclosure | Mandatory disclosure if not recognized. | Disclosure required if probable but not certain. |

Understanding Contingent Liabilities and Contingent Assets

Contingent liabilities represent potential obligations that may arise depending on the outcome of a future event, such as lawsuits or warranty claims, and require disclosure in financial statements when the likelihood is probable and the amount can be reasonably estimated. Contingent assets involve potential economic benefits contingent on uncertain future events, like pending litigation outcomes expected to result in gains, but are generally not recognized until realization is virtually certain. Accurate differentiation and disclosure of contingent liabilities and contingent assets are essential for transparent financial reporting and risk assessment under accounting standards like IFRS and GAAP.

Key Definitions: Contingent Liability vs. Contingent Asset

A contingent liability refers to a potential obligation that may arise from past events, depending on the outcome of uncertain future circumstances, and must be recognized if it is probable and the amount can be reasonably estimated. In contrast, a contingent asset represents a possible financial gain that arises from past events and whose realization depends on uncertain future events not fully within the company's control, typically disclosed only when the realization is probable. Understanding these definitions is crucial for accurate financial reporting and compliance with accounting standards such as IAS 37 or ASC 450.

Recognition Criteria Under Accounting Standards

Contingent liabilities require recognition in financial statements when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation and the amount can be reliably estimated, as per IFRS IAS 37. Contingent assets are not recognized until it becomes virtually certain that an inflow of economic benefits will occur, ensuring conservative financial reporting. The distinction in recognition criteria impacts the timing and presentation of these items, influencing risk assessment and financial transparency under accounting standards.

Measurement and Valuation Methods

Contingent liabilities are measured using the best estimate of the expenditure required to settle the obligation, often involving probability-weighted outcomes and discounted cash flows when uncertainty and timing are material. Contingent assets are not recognized until realization is virtually certain but are disclosed if the inflow of economic benefits is probable, with measurement reflecting expected recoverable amount on occurrence. Both require continuous reassessment under IAS 37 standards to ensure valuations reflect current conditions and likelihoods.

Examples of Contingent Liabilities

Contingent liabilities include potential obligations such as pending lawsuits, product warranty claims, and environmental cleanup costs that depend on future events. These liabilities are recorded when it is probable that a loss will occur and the amount can be reasonably estimated. Unlike contingent assets, which are possible gains arising from uncertain future events, contingent liabilities represent potential financial risks that companies must disclose to ensure transparent financial reporting.

Illustrative Cases of Contingent Assets

Contingent assets arise from possible gains dependent on future events, such as pending litigation where a company expects favorable judgment, or a tax refund claim under review by authorities. For example, a business anticipating compensation from an insurance claim after property damage represents a contingent asset that is not recognized until realization is virtually certain. These cases highlight the importance of disclosure in financial statements to inform users of potential economic benefits without inflating current asset values.

Disclosure Requirements in Financial Statements

Contingent liabilities require disclosure in financial statements when the possibility of an outflow of resources is more than remote but less than probable, with the amount either reasonably estimated or described qualitatively if not estimable. Contingent assets are disclosed only when the inflow of economic benefits is probable, ensuring investors receive information on potential gains without overstating assets. Proper disclosure of these elements follows accounting standards such as IFRS IAS 37 and US GAAP ASC 450, enhancing transparency and decision-making for stakeholders.

Impact on Financial Position and Performance

Contingent liabilities represent potential obligations that may negatively affect a company's financial position if realized, leading to increased liabilities and reduced net income. Contingent assets, conversely, indicate possible inflows that can strengthen financial performance and equity but are not recognized until realization is virtually certain. Accurate disclosure of both ensures transparency in financial statements and aids stakeholders in assessing future risks and benefits.

Legal and Regulatory Considerations

Contingent liabilities involve potential obligations arising from past events, with outcomes dependent on future uncertainties, often requiring disclosure under accounting standards like IFRS and GAAP to ensure transparency and legal compliance. In contrast, contingent assets represent possible economic benefits contingent on uncertain future events and usually are not recognized until realization is virtually certain, reflecting conservative regulatory policies to prevent overstatement of financial position. Compliance with legal frameworks mandates clear assessment and reporting of these contingencies, influencing corporate risk management and stakeholder decision-making.

Best Practices for Managing Contingent Items

Best practices for managing contingent liabilities and contingent assets include maintaining accurate documentation and regularly updating risk assessments based on current financial and legal information. Implementing robust internal controls and involving cross-functional teams such as finance, legal, and audit ensures timely identification and appropriate disclosure in financial statements. Leveraging advanced accounting software enhances tracking and reporting efficiency, ensuring compliance with relevant accounting standards like IFRS and GAAP.

Important Terms

Probable occurrence

Probable occurrence in contingent liabilities indicates a likely future outflow of resources resulting from past events, necessitating recognition or disclosure under accounting standards like IAS 37; in contrast, probable occurrence in contingent assets implies a likely inflow of economic benefits but is only disclosed to avoid misleading financial statement users, as recognition is not permitted until realization is virtually certain. This distinction ensures accurate financial reporting by appropriately reflecting potential risks and benefits without overstating assets or liabilities.

Possible obligation

Possible obligations classify contingent liabilities, representing potential future outflows dependent on uncertain events, whereas contingent assets involve possible inflows that are uncertain and not recognized until realization is virtually certain under accounting standards. Recognition and disclosure requirements differ, with contingent liabilities reported as provisions when probable and measurable, while contingent assets are only disclosed unless their realization is virtually certain.

Remote likelihood

Remote likelihood in contingent liabilities refers to the low probability that a future obligation will result in an outflow of resources, leading to no recognition in financial statements but disclosure may be required. In contrast, contingent assets with a remote likelihood of realization are neither recognized nor disclosed, as their occurrence is considered highly uncertain and unlikely to provide economic benefits.

Recognition criteria

Recognition criteria for contingent liabilities require a probable outflow of resources embodying economic benefits and a reliable estimate of the obligation, whereas contingent assets are recognized only when the inflow of economic benefits is virtually certain. Contingent liabilities are disclosed unless the possibility of an outflow is remote, while contingent assets are typically disclosed when their realization is probable but not recognized to avoid overstating financial position.

Disclosure requirement

Disclosure requirements mandate that contingent liabilities be disclosed in financial statements unless the possibility of an outflow of resources is remote, while contingent assets are disclosed only when the probability of an inflow of economic benefits is virtually certain. Contingent liabilities require detailed notes to ensure transparency about potential obligations, whereas contingent assets are generally disclosed to avoid misleading stakeholders about probable gains.

IAS 37 Provisions

IAS 37 defines provisions as present obligations arising from past events, whereas contingent liabilities are possible obligations that depend on uncertain future events, not recognized in financial statements but disclosed unless remote. Contingent assets represent potential economic benefits dependent on future events, and are only disclosed when inflows are probable, avoiding recognition until realization is virtually certain.

Future outflow of resources

Future outflow of resources linked to contingent liabilities represents potential obligations dependent on uncertain events, requiring recognition or disclosure in financial statements when probability and estimability criteria are met. Contingent assets imply possible inflows of resources from uncertain events, recognized only when realization is virtually certain, highlighting their asymmetrical treatment in accounting standards.

Realizable inflow

Realizable inflow refers to the expected economic benefits that a company anticipates receiving, which impacts the classification of contingent liabilities and contingent assets under accounting standards. Contingent assets represent potential inflows that are probable and can be measured reliably, whereas contingent liabilities involve possible outflows dependent on future events, with realizable inflow highlighting the likelihood and measurement criteria influencing their recognition and disclosure.

Uncertain events

Uncertain events related to contingent liabilities involve potential future obligations dependent on the outcome of specific events, whereas contingent assets pertain to possible future economic benefits contingent on uncertain occurrences. Both require careful assessment under accounting standards to determine recognition, measurement, and disclosure in financial statements.

Gain contingency

Gain contingency represents a potential financial benefit contingent on future events, contrasting with contingent liabilities that involve possible losses or obligations. Accounting standards require recognizing gain contingencies only when realization is virtually certain, whereas contingent liabilities must be recorded when the loss is probable and estimable.

contingent liability vs contingent asset Infographic

moneydif.com

moneydif.com