Monetary items are assets and liabilities with fixed or determinable amounts of money, such as cash, receivables, and payables, whereas non-monetary items include assets like inventory, property, and equipment that do not have a fixed monetary value. Monetary items are subject to foreign currency translation adjustments and inflation effects, impacting financial statements differently than non-monetary items. Proper classification between monetary and non-monetary items is essential for accurate financial reporting and compliance with accounting standards.

Table of Comparison

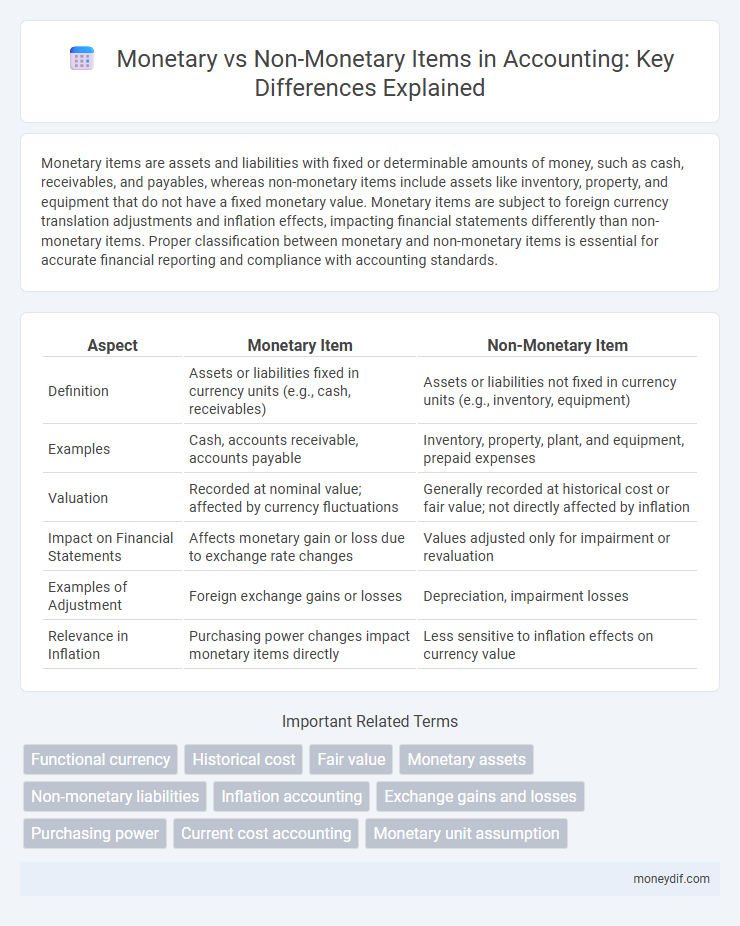

| Aspect | Monetary Item | Non-Monetary Item |

|---|---|---|

| Definition | Assets or liabilities fixed in currency units (e.g., cash, receivables) | Assets or liabilities not fixed in currency units (e.g., inventory, equipment) |

| Examples | Cash, accounts receivable, accounts payable | Inventory, property, plant, and equipment, prepaid expenses |

| Valuation | Recorded at nominal value; affected by currency fluctuations | Generally recorded at historical cost or fair value; not directly affected by inflation |

| Impact on Financial Statements | Affects monetary gain or loss due to exchange rate changes | Values adjusted only for impairment or revaluation |

| Examples of Adjustment | Foreign exchange gains or losses | Depreciation, impairment losses |

| Relevance in Inflation | Purchasing power changes impact monetary items directly | Less sensitive to inflation effects on currency value |

Definition of Monetary Items

Monetary items are assets or liabilities with a fixed or determinable amount of money, such as cash, receivables, and payables, which are measured in terms of currency units. These items maintain their value over time and are subject to foreign exchange fluctuations under accounting standards like IAS 21. In contrast, non-monetary items include assets like inventory and property, plant, and equipment, which are valued based on cost or fair value rather than fixed monetary amounts.

Definition of Non-Monetary Items

Non-monetary items are assets or liabilities that do not represent a fixed or determinable amount of money and typically include inventory, property, plant, equipment, and intangible assets such as patents or goodwill. Unlike monetary items, non-monetary items are not subject to constant value changes due to currency fluctuations since their value is often based on market conditions or historical cost. Accounting for non-monetary items involves recognizing changes in value through impairment tests or revaluation, rather than translation adjustments common with monetary items.

Key Differences Between Monetary and Non-Monetary Items

Monetary items, such as cash, accounts receivable, and payable, represent fixed or determinable amounts of money, directly impacting an entity's cash flow and subject to foreign exchange risk. Non-monetary items include inventory, property, plant, and equipment, whose values are measured based on cost or fair value without fixed monetary amounts. The key differences lie in their liquidity, valuation methods, and exposure to inflation or currency fluctuations, making them critical for accurate financial reporting and analysis.

Examples of Monetary Items in Accounting

Monetary items in accounting include cash, accounts receivable, and accounts payable, as they represent fixed or determinable amounts of currency. Other examples are bank deposits, loans payable, and notes receivable, all of which directly impact an entity's liquidity and financial position. These items are measured at their nominal monetary value and are subject to inflation or exchange rate fluctuations in financial reporting.

Examples of Non-Monetary Items in Accounting

Examples of non-monetary items in accounting include inventory, property, plant, equipment, and intangible assets such as patents and trademarks. These items do not have a fixed monetary value and are reported at historical cost or fair value rather than at a specific currency amount. Unlike monetary items like cash and receivables, non-monetary items are subject to depreciation, amortization, or impairment adjustments over time.

Impact on Financial Statements

Monetary items, such as cash and receivables, are reported at their nominal value and are subject to foreign exchange gains or losses, directly impacting the income statement and balance sheet. Non-monetary items, including inventory and property, plant, and equipment, are recorded at historical cost or fair value, affecting the balance sheet without immediate income statement fluctuations. The distinction between these items influences financial ratios, asset valuation, and volatility in reported earnings.

Accounting Treatment and Measurement

Monetary items, such as cash, accounts receivable, and payables, are measured at nominal value and revalued using the closing exchange rate in foreign currency transactions, reflecting current financial position. Non-monetary items, including inventory, property, and equipment, are recorded at historical cost or fair value and are not adjusted for exchange rate fluctuations after initial recognition. Accounting treatment distinguishes monetary items for sensitivity to currency changes, while non-monetary items maintain cost basis to ensure consistent and reliable measurement.

Effects of Inflation on Monetary and Non-Monetary Items

Inflation erodes the value of monetary items by decreasing their purchasing power, causing monetary assets and liabilities to reflect nominal rather than real values. Non-monetary items, such as inventory and property, plant, and equipment, are recorded at historical cost and do not adjust for inflation, often resulting in an understatement of their current value. This divergence impacts financial reporting accuracy, necessitating adjustments or disclosures to reflect true economic conditions during periods of high inflation.

Relevant Accounting Standards and Guidelines

Monetary items, such as cash, receivables, and payables, are defined under IAS 21 as assets or liabilities that are fixed or determinable in currency units and are subject to foreign exchange rate changes. Non-monetary items include inventory, property, plant, and equipment, and are measured at historical cost or fair value per IAS 2 and IAS 16, without currency unit determinability. IFRS standards emphasize the distinction for accurate foreign currency translation and financial reporting, requiring monetary items to be remeasured at closing rates while non-monetary items remain at historical cost or fair value.

Practical Implications for Accountants

Monetary items, such as cash, receivables, and payables, are valued at their fixed or determinable amounts and subject to foreign exchange rate fluctuations, requiring continuous revaluation in financial statements. Non-monetary items, including inventory, property, plant, and equipment, are recorded at historical cost or fair value and typically do not fluctuate with currency changes, impacting depreciation and impairment calculations. Accountants must carefully differentiate between these item classes to ensure accurate reporting, compliance with accounting standards, and effective risk management in fluctuating currency environments.

Important Terms

Functional currency

Functional currency determines how monetary items, such as cash, receivables, and payables, are measured at the spot exchange rate, reflecting current exchange values, while non-monetary items like inventory and fixed assets are recorded using historical exchange rates or adjusted for impairment, ensuring consistent financial reporting. Accurate classification between monetary and non-monetary items under the functional currency framework is essential for appropriate foreign exchange gain or loss recognition in financial statements.

Historical cost

Historical cost for monetary items refers to the original amount of currency involved in a transaction, maintaining its value on the balance sheet despite inflation or currency fluctuations. Non-monetary items, recorded at historical cost, reflect the acquisition price of assets or liabilities whose value is not fixed in monetary terms and may be adjusted for depreciation or impairment over time.

Fair value

Fair value for monetary items reflects their current cash equivalent, typically measured by market exchange rates or cash flows, ensuring accurate valuation in financial statements. Non-monetary items are valued at fair value based on market prices or appraisal techniques, capturing changes in market conditions and assets' utility beyond fixed cash amounts.

Monetary assets

Monetary assets refer to cash or items convertible into a fixed amount of cash, such as receivables or cash equivalents, which are classified as monetary items; these provide precise value measurement and are unaffected by inflation. Non-monetary items, including inventory, property, and equipment, lack fixed cash value and are subject to valuation changes based on market fluctuations or depreciation.

Non-monetary liabilities

Non-monetary liabilities, such as accounts payable or deferred revenue, are obligations not fixed in currency units and are typically valued based on current market conditions or contractual terms, unlike monetary liabilities which involve a fixed amount of currency like loans or bonds payable. The distinction impacts accounting treatment and exchange rate adjustments, as monetary liabilities are subject to foreign exchange gains or losses, whereas non-monetary liabilities are recorded at historical cost or fair value without direct currency fluctuation effects.

Inflation accounting

Inflation accounting adjusts financial statements to reflect the impact of inflation on monetary items, such as cash and receivables, which are fixed in nominal terms, while non-monetary items like inventory and property are restated to current values using price indices. This distinction ensures accurate representation of purchasing power and asset values during periods of significant inflation.

Exchange gains and losses

Exchange gains and losses on monetary items arise from changes in exchange rates between the transaction date and settlement date, impacting cash, receivables, and payables denominated in foreign currency. Non-monetary items are recorded at historical exchange rates, and exchange differences on these assets or liabilities generally do not affect profit or loss unless remeasured or impaired under specific accounting standards like IFRS or GAAP.

Purchasing power

Purchasing power directly affects monetary items such as cash, receivables, and payables, whose values are fixed in nominal terms and require adjustment for inflation or deflation to reflect true economic value. Non-monetary items like inventory, property, plant, and equipment are recorded at historical cost or fair value and are less impacted by fluctuations in purchasing power over time.

Current cost accounting

Current cost accounting distinguishes between monetary items, such as cash and receivables, which are recorded at nominal value, and non-monetary items, like inventory and property, which are revalued at current market prices to reflect true economic value. This approach provides more accurate financial reporting by capturing inflation effects and changes in purchasing power on non-monetary assets.

Monetary unit assumption

The monetary unit assumption requires financial statements to be recorded and reported in a stable currency, distinguishing monetary items such as cash, receivables, and payables from non-monetary items like inventory or property, plant, and equipment, which are measured at historical cost or fair value. Monetary items are not adjusted for inflation, while non-monetary items may be subject to revaluation, affecting asset valuation and financial analysis.

monetary item vs non-monetary item Infographic

moneydif.com

moneydif.com