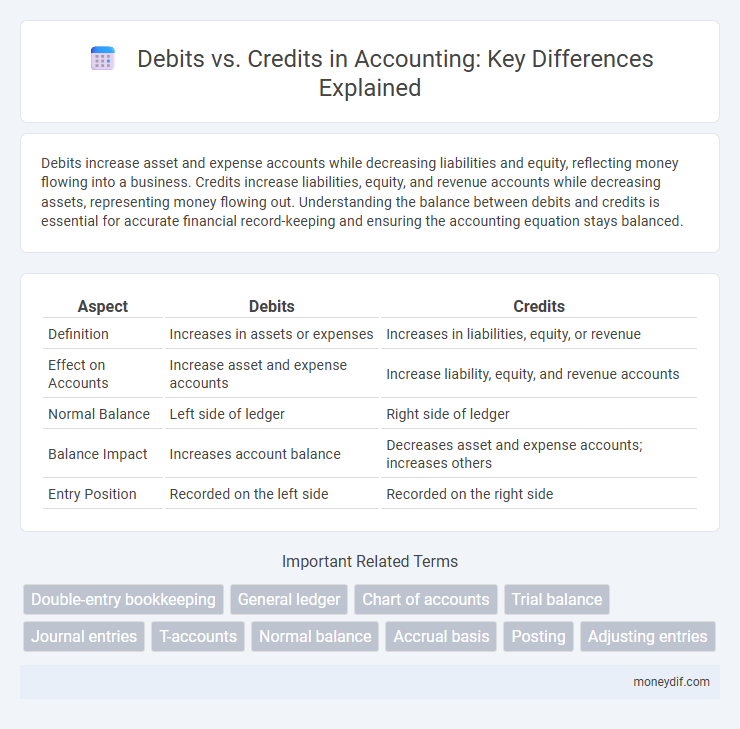

Debits increase asset and expense accounts while decreasing liabilities and equity, reflecting money flowing into a business. Credits increase liabilities, equity, and revenue accounts while decreasing assets, representing money flowing out. Understanding the balance between debits and credits is essential for accurate financial record-keeping and ensuring the accounting equation stays balanced.

Table of Comparison

| Aspect | Debits | Credits |

|---|---|---|

| Definition | Increases in assets or expenses | Increases in liabilities, equity, or revenue |

| Effect on Accounts | Increase asset and expense accounts | Increase liability, equity, and revenue accounts |

| Normal Balance | Left side of ledger | Right side of ledger |

| Balance Impact | Increases account balance | Decreases asset and expense accounts; increases others |

| Entry Position | Recorded on the left side | Recorded on the right side |

Introduction to Debits and Credits

Debits and credits are fundamental accounting concepts used to record financial transactions in the double-entry system, where every debit entry has a corresponding credit entry. Debits increase asset and expense accounts, while credits increase liability, equity, and revenue accounts. Understanding the distinction between debits and credits is essential for accurate financial reporting and maintaining balanced accounting records.

The Double-Entry Accounting System

The Double-Entry Accounting System requires that every financial transaction impacts at least two accounts, with debits recorded on the left and credits on the right. This method ensures the accounting equation--Assets = Liabilities + Equity--remains balanced after each entry. Accurate use of debits and credits within this system provides a clear, verifiable record of financial activities and supports error detection during accounting reconciliations.

Definition of Debits

Debits represent entries on the left side of a ledger that increase asset or expense accounts and decrease liabilities, equity, or revenue accounts. They are fundamental in double-entry bookkeeping to ensure that every financial transaction is balanced by corresponding credits. Understanding debits is essential for accurate financial statement preparation and maintaining balanced accounting records.

Definition of Credits

Credits represent entries that increase liabilities, equity, and revenue accounts while decreasing assets and expenses in accounting records. They are essential for maintaining the balance in double-entry bookkeeping, ensuring that every debit has a corresponding credit. Understanding credits is crucial for accurate financial reporting and analysis.

Key Differences Between Debits and Credits

Debits increase asset and expense accounts while decreasing liabilities and equity, whereas credits increase liabilities, equity, and revenue accounts while decreasing assets and expenses. Debits are recorded on the left side of a ledger, and credits appear on the right, ensuring the accounting equation remains balanced. Understanding these fundamental differences is crucial for accurate financial record-keeping and maintaining the integrity of double-entry bookkeeping.

Debits and Credits in Common Accounts

Debits increase asset and expense accounts while decreasing liabilities, equity, and revenue accounts, reflecting the dual-entry accounting principle. Credits have the opposite effect, increasing liabilities, equity, and revenue, and decreasing assets and expenses. Understanding how debits and credits impact common accounts such as cash, accounts payable, and sales revenue is essential for accurate financial record-keeping and reporting.

Examples of Debits and Credits Transactions

Debits increase asset and expense accounts, such as when purchasing office supplies for $500, which is recorded as a debit to office supplies. Credits increase liability, revenue, or equity accounts, exemplified by recording a $1,000 loan from the bank as a credit to notes payable. In sales revenue, a $2,000 transaction credits sales revenue while debiting cash or accounts receivable, reflecting the dual effect on financial statements.

The Impact on Financial Statements

Debits increase asset and expense accounts while decreasing liabilities, equity, and revenue accounts, directly affecting the balance sheet and income statement. Credits reverse this effect by decreasing assets and expenses but increasing liabilities, equity, and revenues, thereby influencing the financial position and profitability reported. The proper application of debits and credits ensures accurate representation of a company's financial health and compliance with accounting standards.

Common Mistakes with Debits and Credits

Common mistakes with debits and credits often include confusing their impact on different account types, such as debiting an expense account versus crediting a revenue account. Another frequent error is misclassifying normal balances, leading to inaccurate financial statements and misrepresented company performance. Understanding the fundamental rules of double-entry bookkeeping ensures accurate ledger entries and prevents these costly accounting errors.

Best Practices for Recording Debits and Credits

Accurately recording debits and credits requires adhering to the fundamental accounting principle of double-entry bookkeeping, where every debit entry must have a corresponding credit entry to maintain balanced financial statements. Best practices include consistently classifying accounts by type--assets and expenses increase with debits, while liabilities, revenues, and equity increase with credits--and maintaining detailed documentation for each transaction to ensure audit readiness and error reduction. Utilizing accounting software with real-time validation features enhances accuracy and helps prevent common mistakes such as incorrect sign entries or unbalanced ledger accounts.

Important Terms

Double-entry bookkeeping

Double-entry bookkeeping records each financial transaction with equal debit and credit entries to maintain balanced accounting ledgers. Debits increase asset or expense accounts, while credits increase liability, equity, or revenue accounts, ensuring accurate financial reporting.

General ledger

General ledger records all financial transactions by categorizing entries into debits and credits, maintaining the accounting equation's balance: Assets = Liabilities + Equity. Debits increase asset and expense accounts, while credits increase liability, equity, and revenue accounts, ensuring accurate financial reporting.

Chart of accounts

A chart of accounts categorizes and organizes financial transactions, distinguishing between debit and credit entries to maintain accurate ledger balances. Debits increase asset and expense accounts, while credits increase liabilities, equity, and revenue accounts, ensuring precise double-entry bookkeeping.

Trial balance

A trial balance is a financial report that lists all ledger accounts' debit and credit balances to ensure total debits equal total credits, verifying the accuracy of bookkeeping entries. Discrepancies between debits and credits in the trial balance indicate errors in journalizing or posting, requiring correction before financial statements are prepared.

Journal entries

Journal entries record financial transactions by listing debits and credits, ensuring each entry maintains the accounting equation's balance, with debits increasing assets or expenses and credits increasing liabilities, equity, or revenue. Accurate classification of debits and credits in journal entries is essential for precise financial reporting and audit trail consistency.

T-accounts

T-accounts graphically represent ledger accounts where debits are recorded on the left side and credits on the right, facilitating clear visualization of financial transactions. Understanding the debit and credit rules is essential for maintaining accurate double-entry bookkeeping and ensuring balanced accounting records.

Normal balance

Normal balance refers to the expected debit or credit side where an account typically carries its balance, with assets and expenses usually having a debit normal balance, while liabilities, equity, and revenue accounts have a credit normal balance. Understanding the normal balance aids in accurate transaction recording and financial statement preparation by ensuring debits and credits are applied correctly according to account type.

Accrual basis

Accrual basis accounting records revenues when earned and expenses when incurred, regardless of cash flow, using debits to increase asset or expense accounts and credits to increase liabilities, equity, or revenue accounts. This method ensures accurate matching of financial transactions, providing a clear depiction of financial performance by balancing debits and credits according to accrual recognition principles.

Posting

Posting is the process of transferring debit and credit amounts from journal entries to individual ledger accounts, ensuring accurate financial tracking. Proper posting distinguishes debits, which increase asset or expense accounts, from credits, which increase liabilities, equity, or revenue accounts, maintaining the accounting equation's balance.

Adjusting entries

Adjusting entries ensure that revenues and expenses are recorded in the correct accounting period by updating debit and credit balances for accrued or deferred accounts. Debits increase asset or expense accounts, while credits increase liabilities, equity, or revenue accounts, maintaining the accounting equation's balance.

debits vs credits Infographic

moneydif.com

moneydif.com