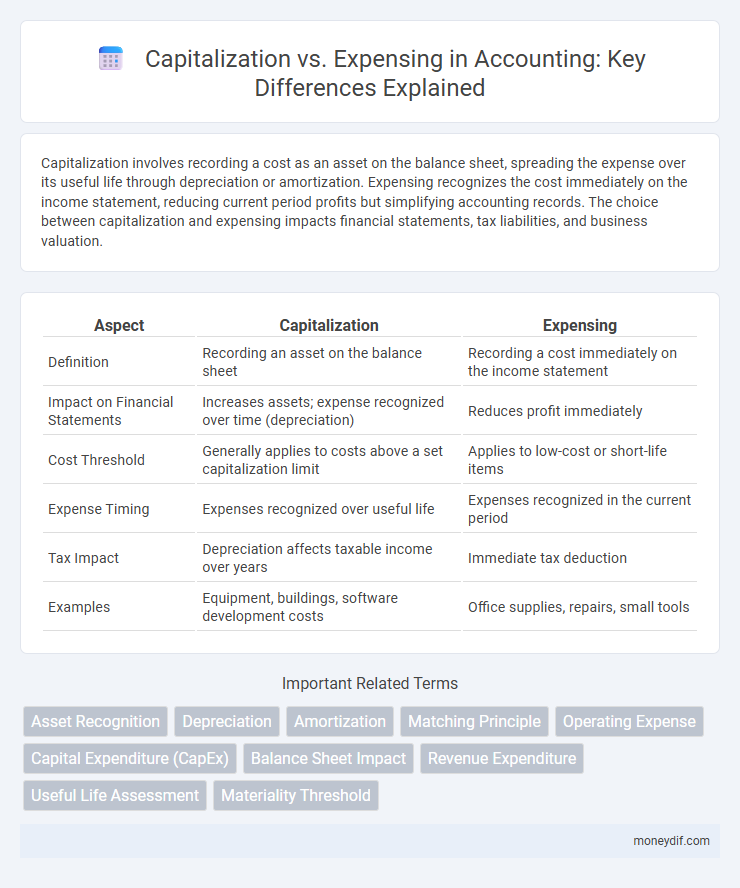

Capitalization involves recording a cost as an asset on the balance sheet, spreading the expense over its useful life through depreciation or amortization. Expensing recognizes the cost immediately on the income statement, reducing current period profits but simplifying accounting records. The choice between capitalization and expensing impacts financial statements, tax liabilities, and business valuation.

Table of Comparison

| Aspect | Capitalization | Expensing |

|---|---|---|

| Definition | Recording an asset on the balance sheet | Recording a cost immediately on the income statement |

| Impact on Financial Statements | Increases assets; expense recognized over time (depreciation) | Reduces profit immediately |

| Cost Threshold | Generally applies to costs above a set capitalization limit | Applies to low-cost or short-life items |

| Expense Timing | Expenses recognized over useful life | Expenses recognized in the current period |

| Tax Impact | Depreciation affects taxable income over years | Immediate tax deduction |

| Examples | Equipment, buildings, software development costs | Office supplies, repairs, small tools |

Definition of Capitalization and Expensing

Capitalization in accounting refers to the process of recording a cost as an asset on the balance sheet, recognizing it as an investment that provides future economic benefits. Expensing, on the other hand, involves immediately recognizing a cost on the income statement, reflecting its consumption within the current period. The key distinction lies in capitalization spreading the cost over multiple periods through depreciation or amortization, whereas expensing fully charges the cost in the period incurred.

Key Differences Between Capitalization and Expensing

Capitalization involves recording a cost as an asset on the balance sheet, spreading the expense over multiple periods through depreciation or amortization, while expensing charges the full cost to the income statement in the current period. Capitalized costs enhance future economic benefits and meet criteria such as materiality, useful life, and ownership, whereas expensed costs relate to immediate consumption or maintenance. Understanding these distinctions is crucial for accurate financial reporting, tax compliance, and cash flow management.

Criteria for Capitalizing Costs

Costs must be capitalized when they provide future economic benefits and extend the useful life or improve the value of an asset beyond its original condition. Capitalization criteria typically include costs associated with acquiring, constructing, or significantly enhancing property, plant, and equipment, rather than regular maintenance or repairs. Accounting standards such as GAAP and IFRS require consistent evaluation of whether an expense meets the capitalization threshold based on its nature and expected future benefits.

Criteria for Expensing Costs

Costs must be expensed when they do not meet the capitalization criteria, such as when the expenditures lack probable future economic benefits or when they pertain to routine repairs and maintenance. Expenses should be recognized immediately if the cost relates to services consumed within the current accounting period or if the asset's useful life is uncertain. The matching principle under GAAP requires these costs to be charged against revenue in the period incurred to ensure accurate financial reporting.

Impact on Financial Statements

Capitalization increases assets on the balance sheet, enhancing reported company value and deferring expense recognition, which boosts net income in the short term. Expensing immediately reduces net income on the income statement, reflecting the cost against current revenues and lowering taxable income. The choice between capitalization and expensing profoundly affects key financial ratios such as return on assets (ROA) and earnings before interest and taxes (EBIT), influencing investor perception and decision-making.

Short-term vs Long-term Financial Effects

Capitalization spreads the cost of an asset over its useful life, enhancing long-term financial stability by improving reported earnings and asset value. Expensing immediately reduces net income, impacting short-term profitability but providing clearer reflection of current operational costs. Companies balance these approaches to optimize tax benefits, cash flow, and investor perception based on financial strategy and asset type.

Examples of Capitalized vs Expensed Items

Capitalized items in accounting include purchases like machinery, buildings, and vehicles, which provide benefits over multiple periods and are recorded as assets on the balance sheet. Expensed items typically consist of office supplies, repair costs, and utilities, which are consumed within the current accounting period and directly reduce net income. Proper classification between capitalizing and expensing impacts financial statements by affecting asset values and expense recognition.

Accounting Standards and Guidelines

Accounting standards such as IFRS and GAAP provide clear guidelines for capitalization versus expensing based on the anticipated future economic benefits of an asset. Capitalization is required when costs meet the recognition criteria, involving significant expenditures that extend the asset's useful life or enhance its value. Expenses are recorded immediately for costs that do not meet these criteria, ensuring accurate financial reporting and compliance with accounting principles.

Common Pitfalls and Mistakes

Misclassifying expenses as capital expenditures can distort financial statements, leading to inflated asset values and understated expenses. Failure to adhere to established capitalization thresholds often results in inconsistent reporting and audit challenges. Overlooking the specific criteria for capitalization, such as the asset's useful life and future economic benefits, constitutes a frequent error with significant tax and compliance implications.

Best Practices for Decision-Making

Capitalization should be applied to expenditures that provide future economic benefits and meet the asset recognition criteria under relevant accounting standards, such as IAS 16 or ASC 360. Expensing is appropriate for costs related to normal operating expenses or assets that do not significantly extend the useful life or improve the asset's value. Best practices involve thorough analysis of cost materiality, consistent application of policies, and collaboration with finance and auditing teams to ensure accurate financial reporting and compliance.

Important Terms

Asset Recognition

Asset recognition requires capitalizing expenditures that provide future economic benefits and expensing costs that maintain current operations without extending asset life.

Depreciation

Capitalization allocates the cost of an asset over its useful life through depreciation, while expensing deducts the full cost immediately, impacting financial statements differently.

Amortization

Amortization allocates the capitalized cost of intangible assets over their useful life, contrasting with immediate expensing that records costs fully in the accounting period incurred.

Matching Principle

The Matching Principle requires companies to capitalize costs that provide future economic benefits and expense those costs in the same period as the related revenues to accurately reflect profitability.

Operating Expense

Operating expenses represent the ongoing costs required for the day-to-day functioning of a business, typically expensed immediately to reflect current period costs. In contrast, capitalization involves recording certain expenditures as assets on the balance sheet, allowing these costs to be amortized or depreciated over time, which affects financial ratios and impacts profitability metrics.

Capital Expenditure (CapEx)

Capital Expenditure (CapEx) refers to funds used by a company to acquire, upgrade, or maintain physical assets such as property, buildings, or equipment, which are capitalized and depreciated over their useful life, enhancing long-term value. In contrast, expenses are costs that are immediately expensed on the income statement, reducing net income for the period, impacting short-term profitability rather than asset valuation.

Balance Sheet Impact

Capitalizing expenses increases assets and equity on the balance sheet, while expensing reduces net income and retained earnings, directly impacting overall financial position and ratios.

Revenue Expenditure

Revenue expenditure refers to costs that are immediately expensed on the income statement because they do not improve or extend the useful life of an asset, unlike capitalization which involves recording expenditures as assets to be depreciated over time.

Useful Life Assessment

Accurate useful life assessment determines whether an asset's cost should be capitalized and depreciated over time or expensed immediately to optimize financial reporting and tax benefits.

Materiality Threshold

The materiality threshold determines whether expenditures are capitalized as assets or expensed immediately based on their financial significance to the company's overall financial statements.

capitalization vs expensing Infographic

moneydif.com

moneydif.com