Realization refers to the process of converting assets into cash or cash equivalents, typically through the sale of goods or services, which confirms that revenue can be reliably measured. Recognition occurs when revenue or expenses are formally recorded in the financial statements, reflecting the moment these economic events meet specific criteria under accounting standards. Understanding the distinction between realization and recognition ensures accurate financial reporting and compliance with generally accepted accounting principles (GAAP).

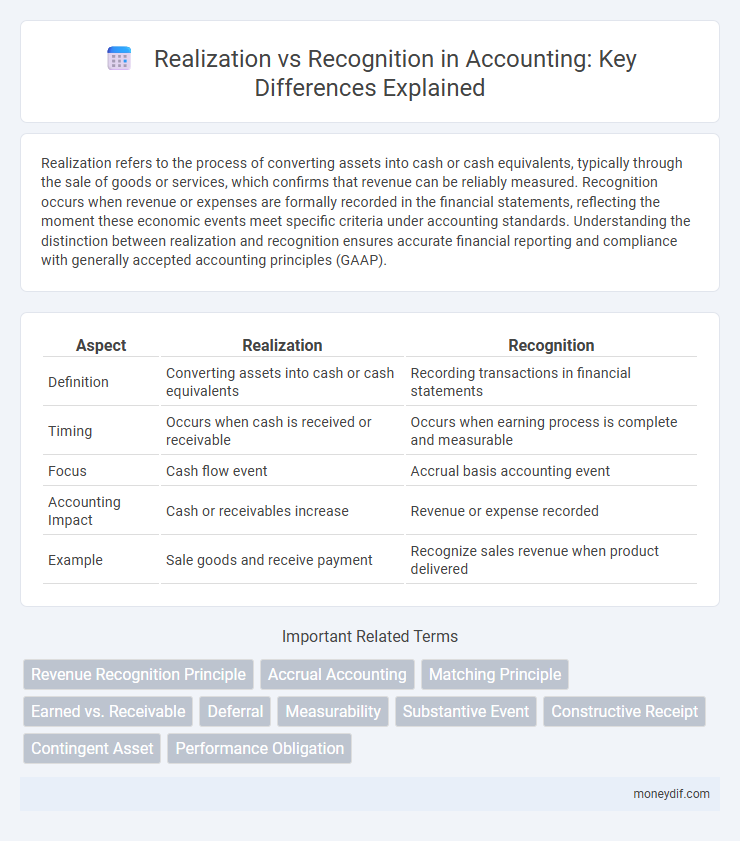

Table of Comparison

| Aspect | Realization | Recognition |

|---|---|---|

| Definition | Converting assets into cash or cash equivalents | Recording transactions in financial statements |

| Timing | Occurs when cash is received or receivable | Occurs when earning process is complete and measurable |

| Focus | Cash flow event | Accrual basis accounting event |

| Accounting Impact | Cash or receivables increase | Revenue or expense recorded |

| Example | Sale goods and receive payment | Recognize sales revenue when product delivered |

Introduction to Realization and Recognition

Realization in accounting refers to the process of converting non-cash resources or claims into cash or cash equivalents, typically when goods or services are delivered and payment is reasonably assured. Recognition involves formally recording revenues and expenses in the financial statements when they meet specific criteria defined by accounting principles, regardless of when the cash flows occur. Understanding the distinction between realization and recognition is essential for accurate revenue measurement and compliance with accrual accounting standards.

Defining Realization in Accounting

Realization in accounting refers to the process of converting non-cash resources into cash or a claim to cash, often through the completion of a sale or service. It marks the point when revenue is considered earned and measurable, irrespective of actual cash receipt. This concept is essential for accurately reflecting financial performance according to accrual accounting principles.

Defining Recognition in Accounting

Recognition in accounting refers to the process of formally recording and reporting an economic event or transaction in the financial statements when it meets specific criteria of measurability and relevance. It ensures that revenues, expenses, assets, and liabilities are reflected accurately and timely according to accounting standards like IFRS or GAAP. Recognition differs from realization, which pertains to when the actual receipt or payment of cash occurs, highlighting the accrual basis of accounting.

Key Differences Between Realization and Recognition

Realization refers to the process of converting non-cash assets into cash or cash equivalents, typically occurring when revenue is earned and assets are received or liquidated. Recognition involves formally recording revenues or expenses in the financial statements when they meet specific criteria defined by accounting standards, regardless of cash movement. Key differences include that realization emphasizes the timing of cash inflow, while recognition focuses on the accurate reporting of financial performance according to accrual accounting principles.

Importance of Realization in Financial Reporting

Realization is crucial in financial reporting as it determines when revenue is considered earned and thus can be recorded in the financial statements, ensuring accuracy and reliability. It prevents premature revenue recognition, which can mislead stakeholders and distort a company's financial position. Accurate realization aligns reported income with actual cash flows and obligations, enhancing transparency and compliance with accounting standards like GAAP and IFRS.

Importance of Recognition in Financial Statements

Recognition in financial statements ensures that revenues and expenses are accurately recorded when they are earned or incurred, providing a true and fair view of a company's financial performance. Proper recognition directly impacts the reliability and comparability of financial reports, which is crucial for stakeholders' decision-making processes. Failure to recognize transactions appropriately can lead to misstated financial results and distorted business valuations.

Realization Principle: Core Concepts

The Realization Principle in accounting dictates that revenue is recognized when goods or services are delivered to the customer, ensuring that earnings are recorded only upon completion of the earning process. This principle emphasizes the transfer of ownership or risk, aligning revenue recognition with actual sales transactions rather than cash receipt. It serves as a foundation for accurate financial reporting, distinguishing realized revenue from mere expectations or accruals.

Recognition Criteria: Accounting Standards

Recognition criteria in accounting standards require that an item meets the definitions of an asset, liability, equity, revenue, or expense and that its cost or value can be measured reliably. According to IFRS and GAAP, recognition occurs when it is probable that future economic benefits will flow to or from the entity and the item has a faithful representation. This ensures financial statements accurately reflect transactions and events impacting the entity's financial position and performance.

Impact on Revenue and Expense Reporting

Realization impacts revenue reporting by determining when revenue is earned through the completion of earning activities, ensuring income is recorded when it is realizable and collectible. Recognition affects expense reporting by matching expenses to the periods in which they help generate revenue, adhering to the matching principle for accurate financial statements. Together, these concepts ensure that financial reports reflect true economic events, improving the reliability of income and expense data.

Practical Examples of Realization vs Recognition

Realization occurs when revenue is received in cash or claims to cash, such as accounts receivable, while recognition involves recording revenue in the accounting books when earned, regardless of cash flow. For example, a company sells goods on credit, realizing revenue upon delivery (realization) but recognizing it in the financial statements when the sale is made (recognition). Another instance is accrued expenses, where costs are recognized in the period incurred but realized upon actual payment.

Important Terms

Revenue Recognition Principle

The Revenue Recognition Principle mandates recognizing revenue when it is earned and realizable, distinguishing the realization of revenue from its actual receipt to ensure accurate financial reporting.

Accrual Accounting

Accrual accounting records revenues and expenses when they are earned or incurred, aligning recognition with the realization principle that revenue is recognized when it is earned, regardless of cash receipt. This method ensures financial statements reflect economic events accurately by matching revenues to the period they are realized and expenses to the period they are recognized.

Matching Principle

The Matching Principle ensures expenses are recognized in the same accounting period as the related revenues are realized, optimizing accurate financial reporting.

Earned vs. Receivable

Earned revenue reflects realized income when goods or services are delivered, while receivables represent recognized claims awaiting cash collection.

Deferral

Deferral involves postponing the recognition of revenue or expenses until the related realization criteria are met, ensuring accurate matching of financial events.

Measurability

Measurability in accounting determines whether an item should be recognized in financial statements based on the reliability of its measurement and the likelihood of realization or settlement.

Substantive Event

A substantive event is recognized in financial statements when its realization occurs, evidencing measurable impact on an entity's financial position.

Constructive Receipt

Constructive receipt occurs when income is made available to a taxpayer without restrictions, triggering realization for tax purposes even if actual recognition of income is deferred.

Contingent Asset

A contingent asset represents a potential economic benefit arising from past events, which is disclosed but not recognized in financial statements until its realization is virtually certain.

Performance Obligation

Performance obligation is satisfied and revenue is recognized when control of the promised goods or services is transferred to the customer, aligning realization with recognition under IFRS 15 and ASC 606 standards.

realization vs recognition Infographic

moneydif.com

moneydif.com