Amortization and depreciation are both methods of allocating the cost of an asset over its useful life, but amortization applies to intangible assets such as patents and copyrights, while depreciation is used for tangible assets like machinery and buildings. Depreciation expenses help businesses account for wear and tear or obsolescence of physical assets, whereas amortization involves systematically writing off intangible assets that have finite useful lives. Understanding the differences between amortization and depreciation ensures accurate financial reporting and compliance with accounting standards.

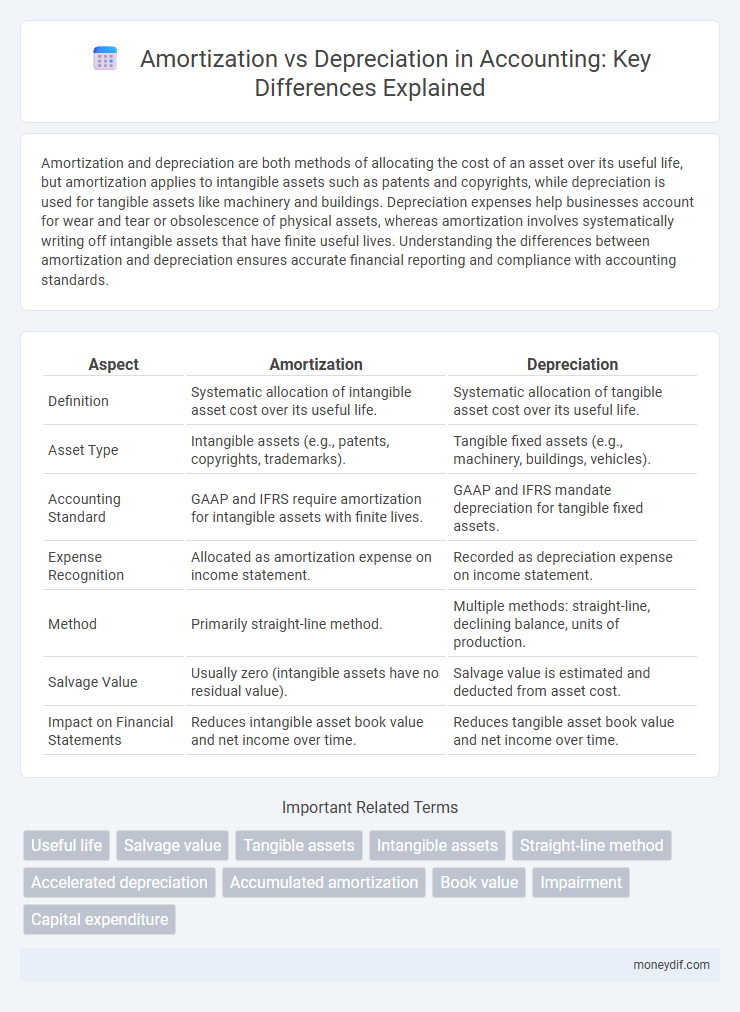

Table of Comparison

| Aspect | Amortization | Depreciation |

|---|---|---|

| Definition | Systematic allocation of intangible asset cost over its useful life. | Systematic allocation of tangible asset cost over its useful life. |

| Asset Type | Intangible assets (e.g., patents, copyrights, trademarks). | Tangible fixed assets (e.g., machinery, buildings, vehicles). |

| Accounting Standard | GAAP and IFRS require amortization for intangible assets with finite lives. | GAAP and IFRS mandate depreciation for tangible fixed assets. |

| Expense Recognition | Allocated as amortization expense on income statement. | Recorded as depreciation expense on income statement. |

| Method | Primarily straight-line method. | Multiple methods: straight-line, declining balance, units of production. |

| Salvage Value | Usually zero (intangible assets have no residual value). | Salvage value is estimated and deducted from asset cost. |

| Impact on Financial Statements | Reduces intangible asset book value and net income over time. | Reduces tangible asset book value and net income over time. |

Introduction to Amortization and Depreciation

Amortization allocates the cost of intangible assets such as patents or trademarks over their useful life, reflecting the asset's consumption and value decline. Depreciation spreads the expense of tangible fixed assets like machinery or buildings across their service period to match revenue generation. Both methods adhere to matching principles in accounting, ensuring accurate representation of asset value and expenses on financial statements.

Defining Amortization in Accounting

Amortization in accounting refers to the systematic allocation of the cost of intangible assets, such as patents or trademarks, over their useful lives. Unlike depreciation, which applies to tangible fixed assets, amortization spreads the expense of non-physical assets to match the revenue they help generate. This process ensures accurate financial reporting and compliance with accounting standards like GAAP and IFRS.

Understanding Depreciation Methods

Depreciation methods, including straight-line, declining balance, and unit of production, determine how an asset's cost is allocated over its useful life, impacting financial statements and tax calculations. Each method reflects different usage patterns and expense recognition timing, with straight-line spreading costs evenly, while declining balance accelerates depreciation in earlier years. Choosing the appropriate depreciation method enhances accuracy in matching expenses with revenues and supports informed business decision-making.

Key Differences Between Amortization and Depreciation

Amortization applies to intangible assets like patents or trademarks, spreading their cost over their useful life, while depreciation concerns tangible fixed assets such as machinery or buildings. Unlike depreciation, which can use various methods like straight-line or declining balance, amortization typically follows a straight-line approach. Both processes allocate asset costs systematically but differ fundamentally in asset type, accounting treatment, and tax implications.

Types of Assets: Intangible vs Tangible

Amortization applies to intangible assets such as patents, copyrights, and trademarks, systematically allocating their cost over their useful life. Depreciation is used for tangible assets like machinery, buildings, and equipment, reflecting wear and tear or obsolescence. Both methods ensure accurate financial reporting by matching asset costs with revenue generation periods.

Common Depreciation Methods Explained

Straight-line, declining balance, and sum-of-the-years'-digits are common depreciation methods used to allocate the cost of tangible assets over their useful lives. Straight-line depreciation evenly spreads the expense, while declining balance accelerates it by applying a constant rate to the reducing book value. Sum-of-the-years'-digits allocates higher expense in early years by applying a decreasing fraction, optimizing tax benefits and reflecting asset usage patterns.

Amortization Techniques and Calculation

Amortization techniques involve systematically allocating the cost of intangible assets over their useful life, commonly using the straight-line method which divides the asset's initial cost by its estimated lifespan. This calculation recognizes expense evenly across periods, ensuring accurate reflection of asset consumption and compliance with accounting standards like GAAP and IFRS. Unlike depreciation, which applies to tangible assets, amortization excludes salvage value, simplifying expense recognition in intangible asset management.

Accounting Standards and Compliance

Amortization and depreciation are accounting methods used to allocate the cost of intangible and tangible assets, respectively, over their useful lives in compliance with accounting standards such as IFRS and GAAP. Depreciation applies to physical assets like machinery and buildings, while amortization is used for intangible assets like patents and trademarks, ensuring accurate financial reporting and regulatory adherence. Consistent application of these methods aligns financial statements with standards like IAS 16 for property, plant, and equipment, and IAS 38 for intangible assets, facilitating transparency and compliance.

Impact on Financial Statements

Amortization and depreciation both reduce the value of assets over time, impacting the balance sheet by decreasing asset book values and reflecting allocation of cost. Depreciation affects tangible assets like equipment, causing periodic expense recognition that lowers net income on the income statement. Amortization applies to intangible assets such as patents, similarly reducing net income and asset value, but without physical wear and tear considerations.

Choosing the Right Approach for Your Business

Selecting the appropriate approach between amortization and depreciation depends on the nature of your business assets. Amortization applies to intangible assets such as patents and trademarks, while depreciation accounts for tangible fixed assets like machinery and buildings. Analyzing asset types and tax implications ensures accurate financial reporting and optimal tax benefits.

Important Terms

Useful life

Useful life determines the duration over which amortization applies to intangible assets and depreciation applies to tangible assets for systematic cost allocation.

Salvage value

Salvage value reduces the depreciable base in depreciation calculations but is less relevant in amortization, which typically applies to intangible assets without residual value.

Tangible assets

Tangible assets undergo depreciation to allocate their cost over useful life, whereas amortization primarily applies to intangible assets.

Intangible assets

Intangible assets undergo amortization, reflecting their finite useful life, while tangible assets are subject to depreciation based on wear and tear.

Straight-line method

The straight-line method evenly allocates the cost of an asset over its useful life, applying to both amortization of intangible assets and depreciation of tangible fixed assets. This method ensures consistent expense recognition, simplifying financial analysis and matching costs with revenue generation periods.

Accelerated depreciation

Accelerated depreciation reduces taxable income faster by allocating higher expenses early in an asset's life, while amortization systematically spreads intangible asset costs over time, both contrasting with straight-line depreciation's even expense distribution.

Accumulated amortization

Accumulated amortization represents the total expensed intangible asset cost over time, contrasting with accumulated depreciation, which applies to tangible fixed assets.

Book value

Book value reflects an asset's net worth after subtracting accumulated depreciation for tangible assets and amortization for intangible assets.

Impairment

Impairment reduces an asset's carrying amount immediately when its recoverable value falls below its book value, differing from amortization and depreciation which systematically allocate the asset's cost over its useful life.

Capital expenditure

Capital expenditure represents long-term asset investments whose costs are allocated through depreciation for tangible assets and amortization for intangible assets.

amortization vs depreciation Infographic

moneydif.com

moneydif.com