Allocating in accounting refers to assigning whole amounts of expenses or revenues to specific cost centers or accounts based on a direct relationship. Apportioning involves dividing expenses or revenues proportionally among multiple cost centers or accounts based on a rational basis such as usage or benefit received. Both processes ensure accurate financial reporting and cost control by distributing costs appropriately across different departments or projects.

Table of Comparison

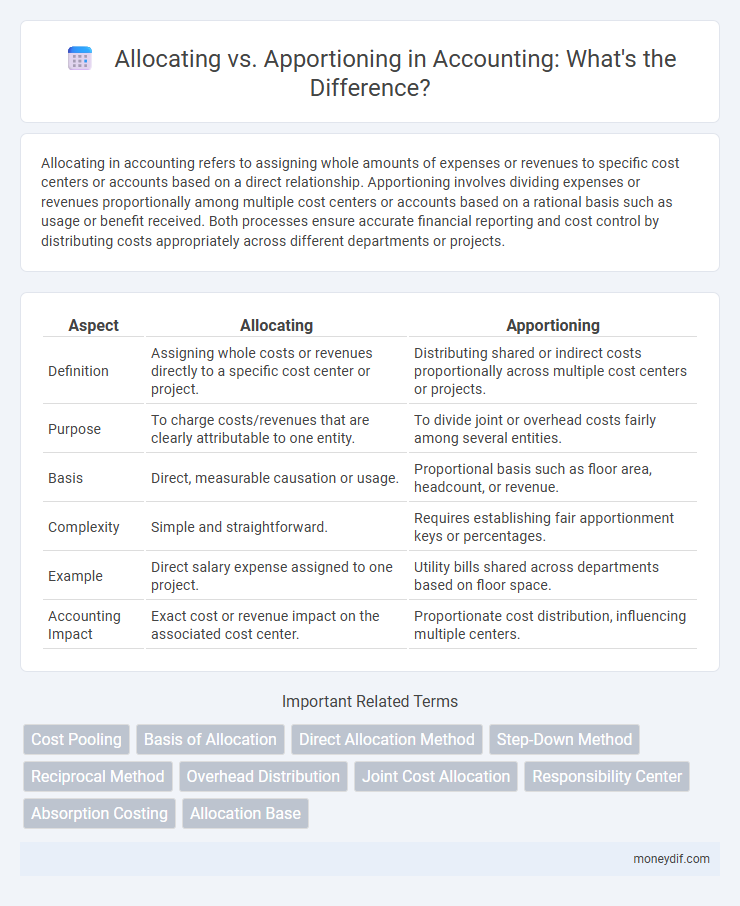

| Aspect | Allocating | Apportioning |

|---|---|---|

| Definition | Assigning whole costs or revenues directly to a specific cost center or project. | Distributing shared or indirect costs proportionally across multiple cost centers or projects. |

| Purpose | To charge costs/revenues that are clearly attributable to one entity. | To divide joint or overhead costs fairly among several entities. |

| Basis | Direct, measurable causation or usage. | Proportional basis such as floor area, headcount, or revenue. |

| Complexity | Simple and straightforward. | Requires establishing fair apportionment keys or percentages. |

| Example | Direct salary expense assigned to one project. | Utility bills shared across departments based on floor space. |

| Accounting Impact | Exact cost or revenue impact on the associated cost center. | Proportionate cost distribution, influencing multiple centers. |

Introduction to Allocating and Apportioning in Accounting

Allocating in accounting involves assigning specific costs or revenues directly to a particular department, project, or cost center based on actual consumption or usage. Apportioning refers to the process of distributing shared expenses or revenues across multiple departments or projects according to a predetermined basis or ratio. Both allocating and apportioning ensure accurate financial reporting and cost control by systematically attributing expenses and incomes to the relevant accounting entities.

Defining Allocation and Apportionment

Allocation involves assigning specific costs or revenues directly to particular departments, projects, or cost centers based on actual usage or benefits received. Apportionment refers to distributing common or indirect expenses among multiple departments or activities using a reasonable basis or ratio. Both methods ensure accurate cost distribution but differ in the precision of allocation and the nature of costs assigned.

Key Differences Between Allocation and Apportionment

Allocation involves assigning entire amounts or costs directly to specific accounts or cost centers based on actual usage or ownership, ensuring precise cost tracking. Apportionment distributes shared or common expenses proportionally across multiple departments or products according to predetermined criteria such as square footage or headcount. The key difference lies in allocation being absolute and direct, while apportionment is proportional and based on equitable distribution methods.

Importance of Proper Cost Distribution

Proper cost distribution through allocating and apportioning ensures accurate financial reporting and enhances decision-making by reflecting true expenses in specific departments or projects. Allocating assigns whole costs directly to cost centers, while apportioning divides shared costs based on relevant metrics like floor space or labor hours. Effective cost distribution prevents budget overruns, improves resource management, and supports compliance with accounting standards.

Methods of Allocation in Accounting

Methods of allocation in accounting include direct allocation, step-down allocation, and reciprocal allocation, each distributing costs based on specific criteria such as service usage or cost causality. Direct allocation assigns service department costs directly to production departments, while step-down allocation sequentially allocates costs, recognizing some interdepartmental services. Reciprocal allocation uses simultaneous equations to fully account for mutual services between departments, providing a more precise cost distribution.

Methods of Apportionment in Accounting

Methods of apportionment in accounting include the direct method, which allocates expenses based on actual usage or consumption, and the step-down method, which sequentially distributes service department costs to other departments. The reciprocal method uses simultaneous equations to allocate costs among reciprocal service departments accurately. These methods ensure precise cost distribution, aiding in accurate financial reporting and decision-making.

Common Examples of Allocating Expenses

Allocating expenses involves assigning specific costs directly to departments or projects based on actual usage, such as allocating rent to different branches according to square footage occupied. Common examples include allocating salaries of employees who work exclusively in one division or costs of raw materials used in a particular production line. This method ensures precise tracking of expenses tied to identifiable cost centers for accurate financial reporting.

Practical Scenarios for Apportioning Costs

In accounting, apportioning costs involves dividing expenses among multiple cost centers based on a rational basis, such as floor space or employee hours, to ensure accurate financial reporting. Practical scenarios include sharing utility bills across departments or allocating depreciation of shared assets where benefits are received over multiple functions. This method contrasts with allocating costs, which typically assigns direct expenses to a single cost center without division.

Impact on Financial Statements and Reporting

Allocating expenses directly assigns specific costs to particular departments or projects, resulting in precise financial statement entries that enhance expense tracking and profitability analysis. Apportioning spreads shared costs across multiple departments based on predetermined criteria, which can impact expense recognition and distort the accuracy of departmental financial performance. These methods influence financial reporting by affecting cost control visibility, budget comparisons, and the overall reliability of internal and external financial statements.

Best Practices for Efficient Cost Distribution

Allocating costs involves directly assigning expenses to specific cost centers or projects based on actual usage, ensuring precise tracking of expenditures. Apportioning distributes shared costs proportionally across multiple departments using a logical basis such as revenue or headcount to maintain fairness. Implementing automated accounting software enhances accuracy and efficiency, while regularly reviewing allocation bases ensures alignment with business activities and optimal resource utilization.

Important Terms

Cost Pooling

Cost pooling involves grouping similar costs to simplify allocation and analysis, enhancing precision in budgeting and financial reporting. Allocating assigns entire costs to a single cost object, while apportioning distributes costs proportionally across multiple cost objects based on relevant allocation bases.

Basis of Allocation

Basis of allocation determines the method used to assign costs or resources to specific cost centers or projects, focusing on direct cause-effect relationships. Allocating involves assigning whole costs to a single cost object, while apportioning divides costs proportionally across multiple cost objects based on a chosen criterion, optimizing resource distribution and financial accuracy.

Direct Allocation Method

The Direct Allocation Method assigns service department costs directly to production departments without allocating costs to other service departments, streamlining cost tracking and enhancing accuracy. Unlike apportioning, which divides costs among multiple departments based on usage ratios, direct allocation simplifies cost distribution by eliminating intermediate cost transfers.

Step-Down Method

The Step-Down Method allocates service department costs sequentially to production departments, partially recognizing interdepartmental services without full reciprocal cost allocation. This method differs from apportioning by focusing on hierarchical, stepwise cost distribution rather than simultaneous cost sharing across multiple departments.

Reciprocal Method

Reciprocal Method allocates costs by recognizing mutual services exchanged between departments, providing more accurate internal cost distribution compared to simple apportioning techniques. This method solves simultaneous equations to fully account for interdepartmental service flows, enhancing cost allocation precision in complex organizational structures.

Overhead Distribution

Overhead distribution involves assigning overhead costs directly to specific cost centers, while apportioning spreads those costs across multiple departments based on rational allocation criteria such as floor area or machine hours. Accurate overhead distribution ensures precise cost tracing, whereas apportioning facilitates equitable cost sharing among departments benefiting from shared services.

Joint Cost Allocation

Joint Cost Allocation involves assigning shared costs to multiple products or departments based on a rational basis, whereas apportioning refers to distributing costs across various cost centers according to specific criteria. Allocating typically focuses on tracing costs directly to cost objects, while apportioning spreads indirect costs proportionally to reflect consumption or usage.

Responsibility Center

A Responsibility Center allocates costs directly to specific departments or units based on actual usage or control, ensuring precise accountability for expenses. Apportioning distributes shared costs proportionally among multiple centers using predetermined bases, reflecting their relative consumption or benefit.

Absorption Costing

Absorption costing allocates all manufacturing costs, including fixed and variable overheads, to products, ensuring each unit reflects total production expenses. Unlike apportioning, which divides costs arbitrarily across departments, allocation in absorption costing assigns costs directly based on actual resource consumption.

Allocation Base

Allocation base refers to a measurable factor, such as direct labor hours or machine hours, used to assign costs to cost objects in cost accounting. Unlike apportioning, which distributes costs across multiple departments or cost centers, allocation allocates costs directly to a specific cost object based on its proportional use of the allocation base.

allocating vs apportioning Infographic

moneydif.com

moneydif.com