FIFO (First-In, First-Out) accounting assumes that the oldest inventory items are sold first, which often results in lower cost of goods sold and higher net income during periods of rising prices. LIFO (Last-In, First-Out) assumes the newest inventory is sold first, leading to higher cost of goods sold and lower taxable income in inflationary environments. Choosing between FIFO and LIFO impacts financial statements, tax liabilities, and inventory valuation strategies.

Table of Comparison

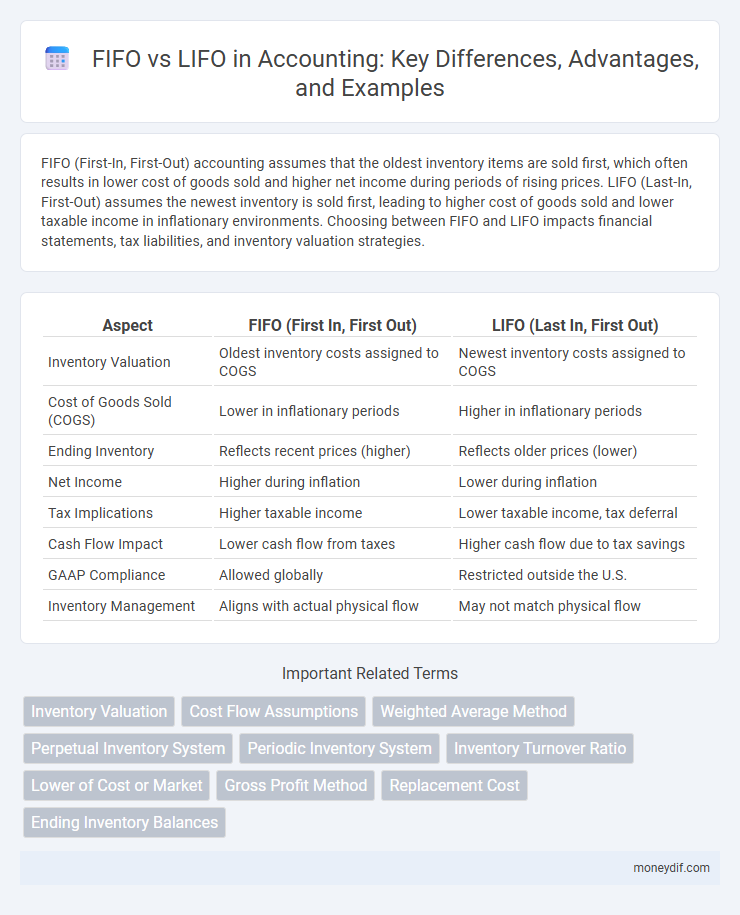

| Aspect | FIFO (First In, First Out) | LIFO (Last In, First Out) |

|---|---|---|

| Inventory Valuation | Oldest inventory costs assigned to COGS | Newest inventory costs assigned to COGS |

| Cost of Goods Sold (COGS) | Lower in inflationary periods | Higher in inflationary periods |

| Ending Inventory | Reflects recent prices (higher) | Reflects older prices (lower) |

| Net Income | Higher during inflation | Lower during inflation |

| Tax Implications | Higher taxable income | Lower taxable income, tax deferral |

| Cash Flow Impact | Lower cash flow from taxes | Higher cash flow due to tax savings |

| GAAP Compliance | Allowed globally | Restricted outside the U.S. |

| Inventory Management | Aligns with actual physical flow | May not match physical flow |

Introduction to Inventory Valuation Methods

FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, resulting in lower cost of goods sold and higher ending inventory during inflation. LIFO (Last-In, First-Out) assumes the newest inventory items are sold first, leading to higher cost of goods sold and lower taxable income during rising prices. Both methods impact financial statements and tax liabilities differently, making the choice critical for accurate inventory valuation and profitability analysis.

Understanding FIFO: First-In, First-Out

FIFO (First-In, First-Out) is an inventory valuation method where the oldest inventory items are recorded as sold first, reflecting the chronological order of stock usage. This approach closely mirrors actual physical flow for many businesses and results in ending inventory values that are closer to current market costs. FIFO can lead to higher net income during periods of inflation because older, lower-cost items are matched against current revenues.

Exploring LIFO: Last-In, First-Out

LIFO (Last-In, First-Out) is an inventory valuation method where the most recently acquired items are expensed first, which can result in higher cost of goods sold and lower taxable income during periods of rising prices. Companies using LIFO often experience reduced tax liabilities but may report lower net income compared to FIFO (First-In, First-Out). This approach aligns expenses with current market conditions but can lead to outdated inventory values on the balance sheet.

Key Differences Between FIFO and LIFO

FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, reflecting current costs on the balance sheet and older costs on the income statement, potentially resulting in higher net income during inflationary periods. LIFO (Last-In, First-Out) assumes the newest inventory is sold first, matching recent costs with revenues and often yielding lower taxable income in rising cost environments due to higher cost of goods sold. The choice between FIFO and LIFO impacts financial statements, tax liabilities, and inventory valuation approaches, influencing profitability and cash flow analysis.

Impact on Cost of Goods Sold (COGS)

FIFO accounting typically results in lower Cost of Goods Sold (COGS) during periods of rising prices because older, cheaper inventory costs are matched against current revenues. In contrast, LIFO accounting increases COGS by using the most recent, higher-priced inventory costs, reducing taxable income. This difference directly affects gross profit and tax liabilities, influencing financial analysis and decision-making.

Effects on Financial Statements

FIFO method results in higher ending inventory values and lower cost of goods sold during periods of rising prices, which increases net income and assets on the balance sheet. LIFO decreases inventory values and increases cost of goods sold, reducing taxable income and net income but providing tax benefits. The choice between FIFO and LIFO significantly affects earnings, tax liabilities, and key financial ratios, impacting stakeholders' analysis.

Tax Implications of FIFO and LIFO

FIFO (First-In, First-Out) typically results in higher taxable income during periods of rising prices since older, lower-cost inventory is expensed first, increasing reported profits and tax liability. LIFO (Last-In, First-Out), conversely, matches recent higher inventory costs against revenues, lowering taxable income and deferring tax payments. Businesses often choose LIFO to minimize current tax burdens, especially in inflationary environments, but must consider potential future tax impacts and compliance with accounting standards.

Industry Applications and Preferences

In industries with rapidly changing inventory costs, such as retail and manufacturing, FIFO is preferred for its alignment with actual inventory flow and accurate balance sheet representation. LIFO is favored in sectors like oil and gas for tax advantages during inflationary periods, as it matches recent higher costs against current revenues. Preference depends on regulatory environment and financial strategy, with FIFO offering clearer profit margins and LIFO providing potential tax deferral benefits.

Advantages and Disadvantages of Each Method

FIFO (First-In, First-Out) provides advantages such as more accurate reflection of current market prices on the balance sheet and typically higher net income during inflationary periods, but it can result in higher tax liabilities. LIFO (Last-In, First-Out) offers tax advantages by matching recent higher costs with current revenues, reducing taxable income in times of rising prices, yet it may undervalue inventory and provide less relevant balance sheet information. Both methods impact financial analysis differently, with FIFO favoring profitability metrics and LIFO benefiting tax optimization strategies.

Choosing the Right Inventory Method for Your Business

Selecting the appropriate inventory valuation method, such as FIFO or LIFO, significantly impacts financial statements and tax liabilities. FIFO (First-In, First-Out) aligns with actual physical flow for businesses with perishable goods, resulting in higher net income during inflation. LIFO (Last-In, First-Out) can reduce taxable income by matching recent higher costs against revenues, beneficial in rising price environments but may not reflect current inventory value.

Important Terms

Inventory Valuation

FIFO inventory valuation reflects current market costs by valuing ending inventory with recent purchases, while LIFO matches recent costs to revenue by assigning older inventory costs to ending stock, impacting tax liability and profit reporting.

Cost Flow Assumptions

Cost flow assumptions such as FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) significantly impact inventory valuation and cost of goods sold, with FIFO assigning older costs to COGS and newer costs to ending inventory, while LIFO does the opposite. FIFO typically results in higher net income and inventory values during inflation, whereas LIFO reduces taxable income by matching recent higher costs against revenue.

Weighted Average Method

The Weighted Average Method calculates inventory costs by averaging all units available during the period, offering a middle ground between FIFO's assumption of oldest costs first and LIFO's assumption of newest costs first, impacting financial reporting and tax outcomes.

Perpetual Inventory System

The Perpetual Inventory System updates inventory records continuously, making FIFO more accurate for reflecting current costs, while LIFO can distort inventory valuation due to delayed cost recognition.

Periodic Inventory System

The Periodic Inventory System calculates cost of goods sold at period-end using either FIFO, which assumes oldest inventory is sold first, or LIFO, which assumes newest inventory is sold first, impacting profit and tax reporting.

Inventory Turnover Ratio

Inventory turnover ratio typically appears higher under FIFO than LIFO during periods of rising prices due to lower cost of goods sold.

Lower of Cost or Market

Lower of Cost or Market (LCM) valuation ensures inventory is reported at the lower amount between historical cost and current market value, affecting FIFO and LIFO differently due to their cost flow assumptions. FIFO typically results in higher inventory values and lower cost of goods sold during inflation, while LIFO aligns market value adjustments more closely with recent costs, potentially leading to greater LCM write-downs.

Gross Profit Method

The Gross Profit Method estimates inventory cost by applying a historical gross profit rate to sales, which varies significantly under FIFO and LIFO accounting due to differing cost flow assumptions affecting inventory valuation and gross profit margins.

Replacement Cost

Replacement cost reflects the current market price needed to replace inventory, which under FIFO typically results in higher ending inventory values during inflation, whereas LIFO assigns the most recent costs to cost of goods sold, often matching replacement cost more closely. Understanding the impact on financial statements is crucial, as FIFO can overstate profits and inventory values in rising markets, while LIFO aligns expenses with current replacement prices but may undervalue inventory.

Ending Inventory Balances

Ending inventory balances under FIFO reflect the most recent purchase costs resulting in higher values during inflation, while LIFO assigns older costs, typically producing lower ending inventory valuations.

FIFO vs LIFO Infographic

moneydif.com

moneydif.com