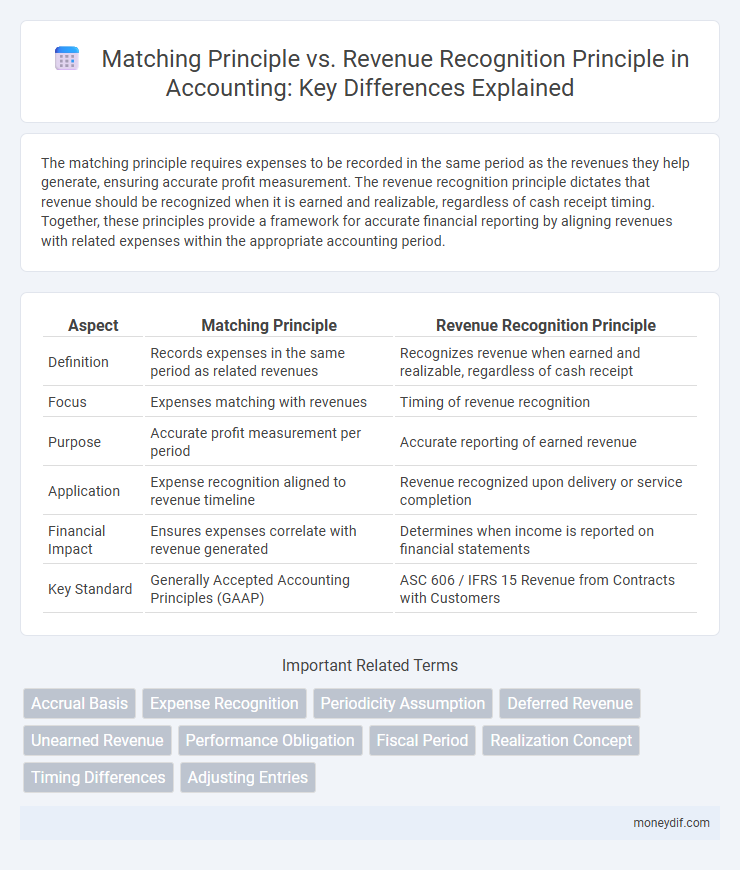

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. The revenue recognition principle dictates that revenue should be recognized when it is earned and realizable, regardless of cash receipt timing. Together, these principles provide a framework for accurate financial reporting by aligning revenues with related expenses within the appropriate accounting period.

Table of Comparison

| Aspect | Matching Principle | Revenue Recognition Principle |

|---|---|---|

| Definition | Records expenses in the same period as related revenues | Recognizes revenue when earned and realizable, regardless of cash receipt |

| Focus | Expenses matching with revenues | Timing of revenue recognition |

| Purpose | Accurate profit measurement per period | Accurate reporting of earned revenue |

| Application | Expense recognition aligned to revenue timeline | Revenue recognized upon delivery or service completion |

| Financial Impact | Ensures expenses correlate with revenue generated | Determines when income is reported on financial statements |

| Key Standard | Generally Accepted Accounting Principles (GAAP) | ASC 606 / IFRS 15 Revenue from Contracts with Customers |

Introduction to Accounting Principles

The matching principle requires expenses to be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. The revenue recognition principle mandates that revenue is recognized when it is earned, regardless of cash receipt timing. Together, these principles provide a consistent framework for preparing financial statements that reflect true business performance.

Overview of the Matching Principle

The Matching Principle requires expenses to be recorded in the same accounting period as the revenues they help generate, ensuring accurate profit measurement. This principle aligns with accrual accounting, promoting a clear association between expenses and income for financial reporting. By recognizing expenses concurrently with related revenues, it provides a more precise depiction of a company's financial performance.

Understanding the Revenue Recognition Principle

The revenue recognition principle dictates that revenue must be recorded when it is earned and realizable, regardless of when cash is received, ensuring accurate financial reporting. It contrasts with the matching principle, which emphasizes aligning expenses with the related revenues in the same period to measure profitability correctly. Proper application of the revenue recognition principle is essential for compliance with GAAP and provides stakeholders with a clear view of a company's financial performance.

Key Differences Between Matching and Revenue Recognition

The matching principle requires expenses to be recorded in the same period as the revenues they helped generate, ensuring accurate profit measurement. The revenue recognition principle dictates that revenue is recognized when earned, regardless of when cash is received, emphasizing the timing of income reporting. Key differences center on timing and focus: matching aligns expenses with revenue, while revenue recognition determines when revenue enters the accounting records.

Importance in Financial Reporting

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, providing a more accurate depiction of profitability. The revenue recognition principle determines the exact timing of revenue recording, ensuring income is recognized when earned, not necessarily when received. Together, these principles enhance the reliability and comparability of financial statements, critical for informed decision-making by investors and stakeholders.

Impact on Income Statement Timing

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, directly impacting the accuracy of net income on the income statement. The revenue recognition principle dictates that revenue is recognized when it is earned, regardless of cash flow, affecting the timing of income reporting. Together, these principles provide a framework for recognizing revenues and expenses in the appropriate accounting periods, enhancing the income statement's reliability for financial analysis.

Common Challenges and Misapplications

Common challenges in applying the matching principle include accurately aligning expenses with related revenues, often leading to premature or delayed expense recognition that distorts financial statements. Misapplications of the revenue recognition principle frequently arise from recognizing revenue before the delivery of goods or completion of services, violating the principle's requirement that revenue be recognized when earned and realizable. Both principles demand precise judgment in timing and measurement, with errors potentially resulting in misstated profits and misleading financial reports.

Matching Principle: Examples and Applications

The matching principle in accounting dictates that expenses must be recorded in the same period as the revenues they help generate, ensuring accurate profit measurement. For example, depreciation expense is matched with the revenue generated from using the asset over time, and salaries paid to production workers are recorded in the same period as the related product sales. This principle is crucial for precise financial reporting and aligns with accrual accounting by linking costs directly to earned revenues.

Revenue Recognition Principle: Examples and Applications

The Revenue Recognition Principle dictates that revenue is recorded when it is earned and realizable, regardless of when cash is received, ensuring accurate financial reporting. For example, a software company recognizes revenue upon delivery and installation of its product, even if payment occurs later. This principle is applied across industries such as construction, where long-term contracts require recognizing revenue based on project milestones rather than cash inflows.

Conclusion and Best Practices

The matching principle ensures expenses are recorded in the same period as the related revenues, promoting accurate profit measurement and financial clarity. The revenue recognition principle dictates revenue is recognized when earned, regardless of cash receipt, facilitating consistent and reliable financial reporting. Best practices involve aligning both principles by carefully timing expense recognition and revenue reporting to reflect the true economic events, enhancing transparency and compliance with accounting standards like GAAP and IFRS.

Important Terms

Accrual Basis

The accrual basis of accounting records expenses and revenues in the period they are incurred or earned, aligning with the matching principle to match expenses with related revenues and adhering to the revenue recognition principle by recognizing revenue when it is earned, regardless of cash flow.

Expense Recognition

Expense recognition follows the matching principle by recording expenses in the same period as the related revenues, ensuring accurate profit measurement, whereas revenue recognition principle determines when revenue is earned and recorded regardless of cash flow timing.

Periodicity Assumption

The Periodicity Assumption divides financial reporting into consistent time periods, enabling the matching principle to accurately align expenses with revenues, which complements the revenue recognition principle by timing revenue reporting when earned within those periods.

Deferred Revenue

Deferred revenue reflects cash received for goods or services not yet delivered, aligning with the matching principle by postponing revenue recognition until earned, in contrast to the revenue recognition principle that records revenue when realized or realizable.

Unearned Revenue

Unearned revenue is recorded as a liability under the matching principle, deferring revenue recognition until services are performed or goods delivered, aligning with the revenue recognition principle that mandates recognizing revenue when earned.

Performance Obligation

Performance obligation requires recognizing revenue when control of promised goods or services transfers to the customer, aligning with the revenue recognition principle rather than the matching principle.

Fiscal Period

The fiscal period determines the timeframe in which revenues and expenses are recorded according to the matching principle, ensuring expenses are aligned with the revenues they generate, while the revenue recognition principle mandates recognizing revenue when it is earned, regardless of cash flow timing.

Realization Concept

The realization concept in accounting ensures revenue is recorded when earned and measurable, aligning with the matching principle, which mandates expenses be recognized in the same period as the related revenues under the revenue recognition principle.

Timing Differences

Timing differences arise because the matching principle requires expenses to be recorded when incurred to generate revenue, while the revenue recognition principle dictates revenue recognition when earned, leading to discrepancies in reporting periods.

Adjusting Entries

Adjusting entries ensure revenues and expenses are recorded in the correct accounting period by aligning with the matching principle and adhering to the revenue recognition principle.

matching principle vs revenue recognition principle Infographic

moneydif.com

moneydif.com