Capitalizing involves recording a cost as an asset on the balance sheet, spreading the expense over its useful life through depreciation or amortization. Expensing requires recognizing the entire cost immediately on the income statement, reducing net income in the current period. Choosing between capitalizing and expensing impacts financial ratios, tax liabilities, and reported profitability.

Table of Comparison

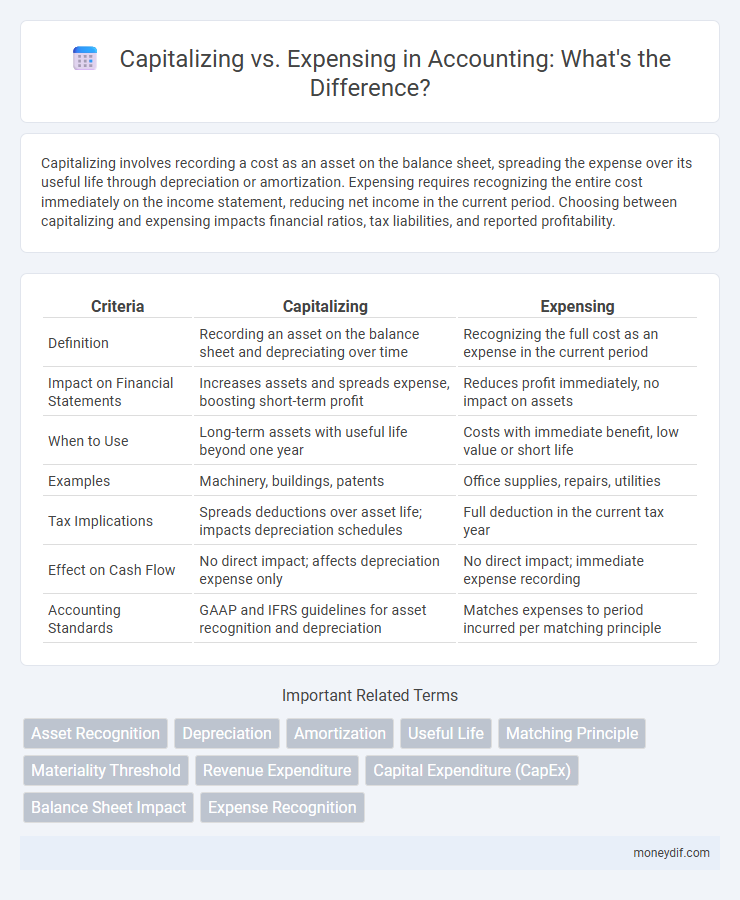

| Criteria | Capitalizing | Expensing |

|---|---|---|

| Definition | Recording an asset on the balance sheet and depreciating over time | Recognizing the full cost as an expense in the current period |

| Impact on Financial Statements | Increases assets and spreads expense, boosting short-term profit | Reduces profit immediately, no impact on assets |

| When to Use | Long-term assets with useful life beyond one year | Costs with immediate benefit, low value or short life |

| Examples | Machinery, buildings, patents | Office supplies, repairs, utilities |

| Tax Implications | Spreads deductions over asset life; impacts depreciation schedules | Full deduction in the current tax year |

| Effect on Cash Flow | No direct impact; affects depreciation expense only | No direct impact; immediate expense recording |

| Accounting Standards | GAAP and IFRS guidelines for asset recognition and depreciation | Matches expenses to period incurred per matching principle |

Understanding Capitalizing and Expensing

Capitalizing involves recording a cost as an asset on the balance sheet, spreading the expense over its useful life through depreciation or amortization, which improves short-term profitability metrics. Expensing requires recognizing the cost immediately in the income statement, directly reducing the current period's net income but simplifying financial reporting. Understanding the distinction is crucial for accurate financial analysis, tax compliance, and aligning with accounting standards such as GAAP or IFRS.

Key Differences Between Capitalizing and Expensing

Capitalizing involves recording a cost as an asset on the balance sheet, spreading its expense over multiple periods through depreciation or amortization, while expensing records the entire cost immediately on the income statement, reducing net income for the current period. Key differences hinge on the timing of expense recognition, impact on financial statements, and adherence to accounting standards such as GAAP or IFRS. Capitalizing benefits long-term asset management and financial ratios, whereas expensing affects short-term profitability and tax obligations.

Accounting Standards for Capitalization and Expense Recognition

Accounting standards such as IAS 16 and ASC 360 establish clear criteria for capitalizing assets, emphasizing the asset's future economic benefits and reliable cost measurement. Expenses must be recognized immediately when costs do not meet capitalization thresholds, aligning with the matching principle to accurately reflect period-specific profitability. Proper application of these standards ensures compliance and enhances the precision of financial reporting by distinguishing between capital expenditures and operational expenses.

Criteria for Capitalizing Costs

Capitalizing costs requires that expenditures create future economic benefits and are directly attributable to acquiring, constructing, or enhancing a long-term asset. Costs must be measurable, reliably determined, and expected to provide utility beyond the current accounting period. Key criteria include enhancing asset value, extending useful life, or adapting the asset for a new use, distinguishing capital expenditures from routine maintenance expenses that should be expensed immediately.

When to Expense Costs in Accounting

Expense costs in accounting when expenditures do not provide future economic benefits or when the benefits are short-term, such as routine maintenance or office supplies. Immediate recognition of these costs in the income statement aligns expenses with the revenue they help generate, adhering to the matching principle. Properly expensing ensures accurate financial reporting and avoids overstating assets on the balance sheet.

Impact on Financial Statements

Capitalizing an asset results in the recognition of the asset on the balance sheet, increasing total assets and depreciation expenses over time, which smooths out profit impact. Expensing costs immediately reduces net income on the income statement and does not affect the balance sheet beyond the current period. The choice between capitalizing and expensing significantly influences financial ratios such as return on assets (ROA) and earnings before interest and taxes (EBIT), affecting investor and creditor analysis.

Effects on Profitability and Taxes

Capitalizing expenditures increases asset value on the balance sheet, spreading costs over time through depreciation, which enhances short-term profitability by reducing immediate expenses. Expensing costs immediately lowers taxable income, resulting in reduced tax liabilities in the current period but decreases net profit. Firms must balance capitalizing to improve profitability with expensing to optimize tax benefits, impacting cash flow and financial ratios differently.

Examples of Capitalized vs Expensed Items

Capitalized items in accounting include purchases like machinery, buildings, and land improvements, which are recorded as assets and depreciated over time. Expensed items typically consist of routine maintenance, office supplies, and utility bills, recognized immediately in the income statement. Proper classification affects financial statements, with capitalized costs enhancing long-term asset values and expenses reducing current profits.

Implications for Financial Analysis

Capitalizing expenses as assets increases reported earnings by deferring cost recognition, impacting key financial ratios such as EBITDA and return on assets (ROA). Expensing costs immediately reduces net income but improves cash flow transparency and avoids overstating asset values on the balance sheet. Analysts must adjust for these accounting policies to accurately assess a company's profitability, asset efficiency, and operational performance.

Best Practices for Accountants

Accountants should consistently apply the criteria outlined in accounting standards such as GAAP or IFRS to differentiate between capitalizing and expensing costs, ensuring accurate financial reporting. Best practices include thorough documentation of the nature and expected benefits of expenditures, regular review of capitalization policies, and collaboration with auditors to maintain compliance and prevent misstatements. Precise classification improves asset valuation, impacts tax liabilities, and supports informed decision-making by stakeholders.

Important Terms

Asset Recognition

Asset recognition involves determining whether costs meet criteria to be capitalized as assets or expensed immediately, based on future economic benefits and useful life. Capitalizing costs spreads expenses over time via depreciation or amortization, whereas expensing recognizes costs in the current period, impacting financial statements differently.

Depreciation

Depreciation reflects the systematic allocation of a capitalized asset's cost over its useful life, contrasting with expensing where costs are immediately charged to the income statement. Capitalizing spreads the expense impact over multiple periods, enhancing asset valuation and matching expenses with revenue generation.

Amortization

Amortization involves gradually writing off the cost of an intangible asset over its useful life, distinguishing between capitalizing the asset on the balance sheet and expensing its cost immediately. Capitalizing amortization spreads the expense across periods, improving matching of costs with revenue, while expensing recognizes the entire cost in the current period, impacting profitability directly.

Useful Life

Useful life determines the period over which an asset's cost is capitalized and systematically depreciated, rather than being expensed immediately. Accurately estimating useful life ensures compliance with accounting standards like GAAP or IFRS, affecting financial statements and tax calculations.

Matching Principle

The Matching Principle requires expenses to be recognized in the same period as the revenues they help generate, influencing decisions on capitalizing versus expensing costs. Capitalizing allocates expenses over multiple periods as assets, while expensing recognizes costs immediately, ensuring accurate financial performance measurement.

Materiality Threshold

Materiality threshold determines whether an expenditure should be capitalized as an asset or expensed immediately, based on the significance of the amount relative to a company's financial statements. Setting an appropriate materiality threshold ensures accurate financial reporting by capitalizing costs that provide future economic benefits while expensing smaller, insignificant expenses to avoid inflating asset values.

Revenue Expenditure

Revenue expenditure refers to the costs incurred for day-to-day operations or maintenance that are expensed immediately, impacting the income statement within the current accounting period. Capitalizing expenditure, on the other hand, involves recording costs as assets on the balance sheet, spreading the expense over multiple periods through depreciation or amortization.

Capital Expenditure (CapEx)

Capital Expenditure (CapEx) involves purchasing or upgrading physical assets, which are capitalized on the balance sheet and depreciated over the asset's useful life, enhancing long-term financial planning. Expensing, in contrast, records costs immediately on the income statement, impacting short-term profitability without affecting asset values or future depreciation.

Balance Sheet Impact

Capitalizing costs on the balance sheet increases asset value and equity while deferring expense recognition, enhancing short-term profitability metrics; expensing immediately reduces net income but provides a more conservative and transparent financial position. The choice between capitalizing and expensing affects key financial ratios such as return on assets (ROA) and debt-to-equity, influencing investor perception and compliance with accounting standards like GAAP or IFRS.

Expense Recognition

Expense recognition dictates that costs directly related to generating future economic benefits should be capitalized as assets and amortized over their useful life, while expenses that provide benefit solely within the current period must be immediately recognized on the income statement. Capitalizing expenditures such as equipment or software development costs aligns expenses with the periods benefiting from the asset, enhancing accurate financial reporting and compliance with GAAP or IFRS standards.

capitalizing vs expensing Infographic

moneydif.com

moneydif.com