Revenue expenditure refers to the costs incurred for the day-to-day functioning of a business, such as maintenance, salaries, and utilities, which are fully expensed in the accounting period they occur. Capital expenditure involves spending on acquiring or upgrading long-term assets like machinery, buildings, or equipment, which are capitalized and depreciated over their useful life. Understanding the distinction between revenue and capital expenditures is crucial for accurate financial reporting and tax treatment.

Table of Comparison

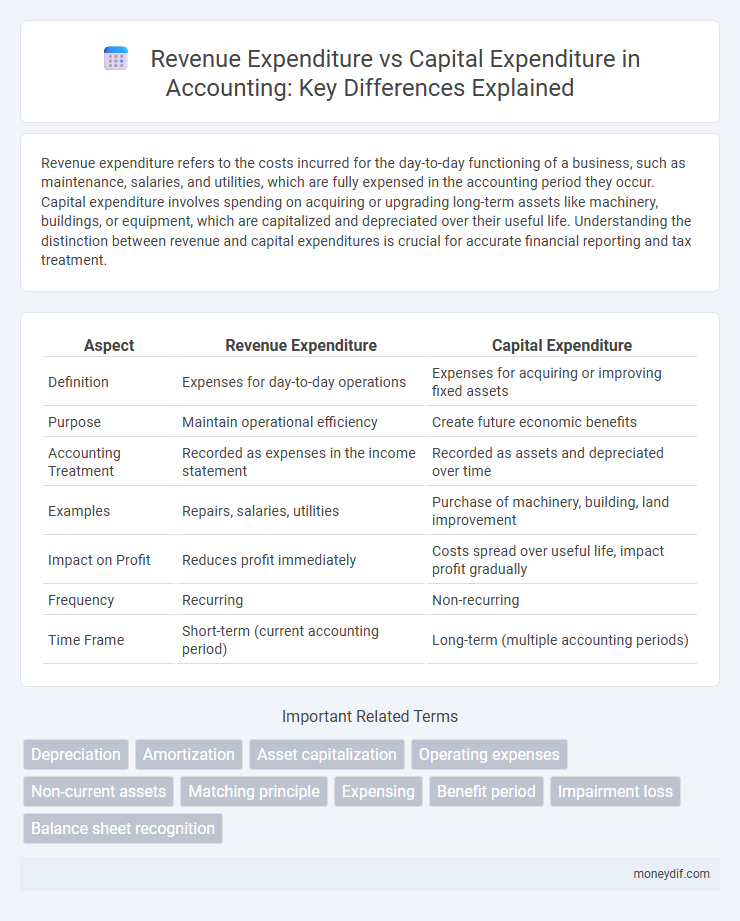

| Aspect | Revenue Expenditure | Capital Expenditure |

|---|---|---|

| Definition | Expenses for day-to-day operations | Expenses for acquiring or improving fixed assets |

| Purpose | Maintain operational efficiency | Create future economic benefits |

| Accounting Treatment | Recorded as expenses in the income statement | Recorded as assets and depreciated over time |

| Examples | Repairs, salaries, utilities | Purchase of machinery, building, land improvement |

| Impact on Profit | Reduces profit immediately | Costs spread over useful life, impact profit gradually |

| Frequency | Recurring | Non-recurring |

| Time Frame | Short-term (current accounting period) | Long-term (multiple accounting periods) |

Introduction to Revenue and Capital Expenditure

Revenue expenditure refers to the costs incurred for the day-to-day operations of a business, such as repairs, maintenance, and utility expenses that are fully expensed in the accounting period. Capital expenditure involves investments in acquiring or improving fixed assets like machinery, buildings, or equipment, and these costs are capitalized and depreciated over their useful life. Understanding the distinction between revenue and capital expenditure is crucial for accurate financial reporting and tax treatment.

Definition of Revenue Expenditure

Revenue expenditure refers to the costs incurred in the day-to-day functioning of a business, aimed at maintaining operational efficiency without enhancing the asset's value or extending its useful life. These expenses are fully charged to the income statement in the accounting period they occur, directly impacting the profit and loss account. Common examples of revenue expenditure include repair and maintenance costs, wages, utilities, and office supplies.

Definition of Capital Expenditure

Capital expenditure refers to funds used by a business to acquire, upgrade, or maintain physical assets such as property, industrial buildings, or equipment that provide benefits over multiple accounting periods. Unlike revenue expenditure, which covers day-to-day operational costs, capital expenditure results in the creation of fixed assets recorded on the balance sheet. This investment enhances the company's productive capacity and is depreciated over the asset's useful life.

Key Differences Between Revenue and Capital Expenditure

Revenue expenditure refers to the costs incurred for day-to-day operations and maintenance, which are fully expensed in the accounting period they occur. Capital expenditure involves investments in acquiring or upgrading fixed assets, recorded as assets on the balance sheet and depreciated over their useful life. Key differences include their impact on financial statements, timing of expense recognition, and purpose, with revenue expenses affecting the income statement immediately and capital expenditures enhancing the company's asset base for long-term benefit.

Examples of Revenue Expenditure

Revenue expenditure includes expenses such as rent, utilities, salaries, repairs, and maintenance costs that are necessary for the day-to-day operations of a business but do not improve or extend the life of an asset. Examples include office supplies, advertising costs, and routine vehicle servicing. These expenditures are fully charged to the income statement in the accounting period they are incurred.

Examples of Capital Expenditure

Examples of capital expenditure include purchasing land, buildings, machinery, and equipment necessary for business operations. These investments improve the productive capacity or extend the useful life of assets, such as acquiring computers, vehicles, or factory upgrades. Capital expenditures are recorded on the balance sheet and depreciated over time, contrasting with revenue expenditures that are expensed immediately.

Impact on Financial Statements

Revenue expenditure affects the income statement by reducing net profit immediately, as these costs are recorded as expenses in the accounting period they occur. In contrast, capital expenditure is capitalized on the balance sheet, increasing asset value and depreciated over time, which spreads the expense impact across multiple periods. This distinction influences key financial ratios, such as profitability and asset turnover, impacting stakeholders' assessment of company performance.

Importance in Financial Decision Making

Revenue expenditure is critical for maintaining daily operations and ensuring short-term profitability, directly impacting cash flow management and expense tracking. Capital expenditure, involving investments in long-term assets, influences strategic growth, asset valuation, and depreciation schedules, thereby shaping long-term financial planning. Distinguishing these expenditures enables accurate financial reporting, tax treatment, and informed budgeting decisions, which are essential for sustainable business development.

Tax Implications of Expenditures

Revenue expenditure is fully deductible in the year it is incurred, reducing taxable income immediately. Capital expenditure, on the other hand, is not deductible outright but must be capitalized and depreciated over the asset's useful life, spreading the tax benefit over multiple years. Proper classification of expenditures is crucial for tax compliance and optimizing tax liabilities under prevailing accounting standards and tax regulations.

Common Mistakes and Best Practices

Confusing revenue expenditure with capital expenditure often leads to misclassification, affecting financial statements and tax calculations. Common mistakes include treating maintenance costs as capital expenses or capitalizing routine operational expenses, which distorts asset valuation and profitability analysis. Best practices involve strict adherence to accounting standards like IFRS or GAAP, using clear criteria for expense recognition, and thorough documentation to ensure accurate financial reporting and compliance.

Important Terms

Depreciation

Depreciation is an accounting method that allocates the cost of a tangible fixed asset over its useful life, reflecting capital expenditure since it improves or acquires long-term assets. In contrast, revenue expenditure refers to short-term expenses for day-to-day operations and does not get depreciated but is fully expensed in the period incurred.

Amortization

Amortization is the systematic allocation of the cost of intangible assets over their useful lives, classifying such costs as capital expenditure since they provide long-term benefits. Revenue expenditure relates to day-to-day operational costs and is expensed immediately, whereas capital expenditure, including amortization, is capitalized and gradually charged against revenue.

Asset capitalization

Asset capitalization involves recording a purchase as a fixed asset on the balance sheet rather than an expense on the income statement, linking directly to capital expenditures, which improve or extend the life of an asset. Revenue expenditures, contrastingly, are costs for maintaining assets and are expensed immediately, not capitalized, thereby affecting the income statement directly.

Operating expenses

Operating expenses, primarily classified as revenue expenditures, represent the day-to-day costs necessary for running a business, such as rent, utilities, and salaries, directly impacting the income statement and reducing taxable income. In contrast, capital expenditures involve investments in long-term assets like machinery and buildings, recorded on the balance sheet and depreciated over time, reflecting their extended benefit to the company's operational capacity.

Non-current assets

Non-current assets represent long-term investments recorded on the balance sheet, where capital expenditure enhances asset value or extends its useful life by acquiring or improving these assets. Revenue expenditure pertains to costs that maintain the asset's operational efficiency without increasing its value, typically recorded as expenses in the profit and loss statement.

Matching principle

The matching principle requires that expenses be recorded in the same period as the revenues they help generate, distinguishing capital expenditures as long-term asset investments amortized over time, while revenue expenditures are fully expensed in the period incurred. This ensures accurate financial reporting by aligning expenses with corresponding income, enhancing the reliability of profit measurement.

Expensing

Expensing involves recognizing costs as expenses in the income statement, typically related to revenue expenditures, which are short-term costs necessary for day-to-day operations such as repairs and maintenance. In contrast, capital expenditures refer to long-term investments in assets like machinery or buildings, which are capitalized and depreciated over their useful life.

Benefit period

The benefit period distinguishes revenue expenditure from capital expenditure by determining the duration over which an asset provides economic value; revenue expenditures are incurred for expenses that benefit only the current accounting period, while capital expenditures generate benefits extending beyond one fiscal year. Accurately classifying expenses based on their respective benefit periods ensures proper matching of costs with revenues and compliant financial reporting.

Impairment loss

Impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount, typically recognized as a revenue expenditure because it relates to a reduction in asset value reflecting current financial performance rather than future economic benefits. In contrast, capital expenditure involves costs incurred to acquire or enhance long-term assets, which are capitalized and depreciated over time, not immediately impacting profit and loss as impairment losses do.

Balance sheet recognition

Balance sheet recognition distinguishes capital expenditure as assets recorded on the balance sheet, reflecting future economic benefits, while revenue expenditure is expensed immediately on the income statement, affecting current profit and loss. Proper classification ensures accurate financial reporting by capitalizing costs that extend asset life or enhance value, versus expensing costs that maintain routine operations.

revenue expenditure vs capital expenditure Infographic

moneydif.com

moneydif.com