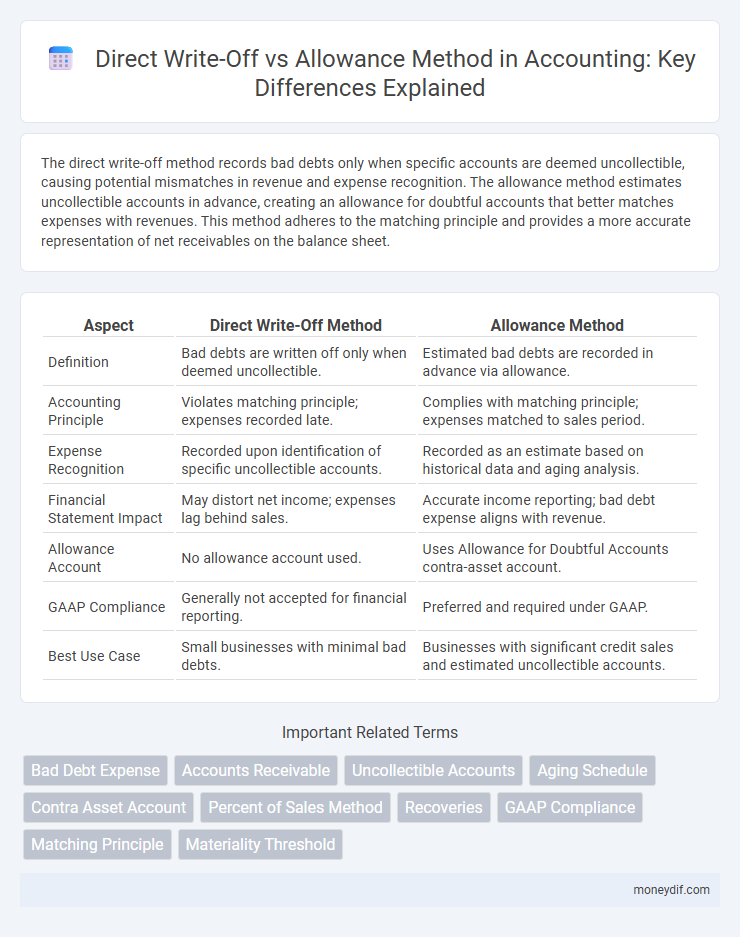

The direct write-off method records bad debts only when specific accounts are deemed uncollectible, causing potential mismatches in revenue and expense recognition. The allowance method estimates uncollectible accounts in advance, creating an allowance for doubtful accounts that better matches expenses with revenues. This method adheres to the matching principle and provides a more accurate representation of net receivables on the balance sheet.

Table of Comparison

| Aspect | Direct Write-Off Method | Allowance Method |

|---|---|---|

| Definition | Bad debts are written off only when deemed uncollectible. | Estimated bad debts are recorded in advance via allowance. |

| Accounting Principle | Violates matching principle; expenses recorded late. | Complies with matching principle; expenses matched to sales period. |

| Expense Recognition | Recorded upon identification of specific uncollectible accounts. | Recorded as an estimate based on historical data and aging analysis. |

| Financial Statement Impact | May distort net income; expenses lag behind sales. | Accurate income reporting; bad debt expense aligns with revenue. |

| Allowance Account | No allowance account used. | Uses Allowance for Doubtful Accounts contra-asset account. |

| GAAP Compliance | Generally not accepted for financial reporting. | Preferred and required under GAAP. |

| Best Use Case | Small businesses with minimal bad debts. | Businesses with significant credit sales and estimated uncollectible accounts. |

Introduction to Bad Debt Accounting

Bad debt accounting involves recognizing the uncollectible accounts receivable in financial statements, with two primary methods: the direct write-off method and the allowance method. The direct write-off method records bad debt expense only when specific accounts are deemed uncollectible, often resulting in mismatched revenue and expense timing. In contrast, the allowance method estimates bad debts in the same period as related sales, creating a contra-asset account called Allowance for Doubtful Accounts to better match expenses with revenues and adhere to the matching principle.

Overview of Direct Write-Off Method

The direct write-off method records bad debt expense only when specific accounts are identified as uncollectible, directly reducing accounts receivable. This approach does not involve estimating uncollectible amounts, resulting in less accurate matching of expenses with revenues. While simpler and compliant with tax regulations, it may distort financial statements by failing to adhere strictly to the matching principle under GAAP.

Overview of Allowance Method

The allowance method estimates uncollectible accounts receivable and records bad debt expense in the same period as the related sales revenue, adhering to the matching principle. It establishes an allowance for doubtful accounts as a contra-asset account, reducing the net accounts receivable reported on the balance sheet. This method provides more accurate financial statements by anticipating potential losses, unlike the direct write-off method, which records bad debts only when specific accounts are deemed uncollectible.

Key Differences Between Direct Write-Off and Allowance Methods

The direct write-off method records bad debt expense only when specific accounts are deemed uncollectible, causing potential mismatches between revenues and expenses and undermining the matching principle. The allowance method estimates uncollectible accounts based on historical data, creating an allowance for doubtful accounts to anticipate future losses and better align expenses with revenues. The allowance method complies with Generally Accepted Accounting Principles (GAAP) by providing a more accurate representation of net receivables on the balance sheet compared to the direct write-off method.

Impact on Financial Statements

The direct write-off method records bad debts only when specific accounts are deemed uncollectible, leading to an immediate expense recognition that may distort net income and overstate accounts receivable before the write-off. The allowance method estimates uncollectible accounts in advance, creating an allowance for doubtful accounts that better matches expenses to revenues and presents a more accurate net realizable value of receivables. This approach enhances the reliability of financial statements by adhering to the matching principle and improving the accuracy of reported earnings and asset valuation.

Compliance with GAAP and IFRS Standards

The allowance method complies with GAAP and IFRS by adhering to the matching principle, estimating bad debts in the same period as related revenues, ensuring accurate financial reporting. The direct write-off method is generally not compliant with GAAP and IFRS because it recognizes bad debt expense only when specific accounts become uncollectible, causing potential mismatches in revenue and expense recognition. Both frameworks favor the allowance method for aligning financial statements with true economic reality and enhancing comparability.

Advantages and Disadvantages of Each Method

The direct write-off method simplifies accounting by recording bad debts only when specific accounts become uncollectible, offering straightforward bookkeeping but potentially distorting financial statements due to delayed recognition of bad debt expense. The allowance method provides a more accurate matching of expenses and revenues by estimating bad debts in the same period as sales, enhancing financial statement reliability but requiring complex estimations and adjustments. While the direct write-off method is easier for small businesses with minimal bad debts, the allowance method is preferred under GAAP for large companies to ensure compliance and accurate financial reporting.

Practical Examples and Journal Entries

The direct write-off method records bad debt expense only when specific accounts are deemed uncollectible, such as writing off a $1,000 customer account with a journal entry debiting Bad Debt Expense and crediting Accounts Receivable. In contrast, the allowance method estimates uncollectible accounts at period-end, adjusting the Allowance for Doubtful Accounts through a journal entry debiting Bad Debt Expense and crediting the Allowance for Doubtful Accounts, for example, $5,000 based on 2% of $250,000 accounts receivable. When specific accounts become uncollectible under the allowance method, the journal entry debits the Allowance for Doubtful Accounts and credits Accounts Receivable, avoiding expense manipulation and providing better matching of expenses to revenues.

Industry-Specific Applications

The direct write-off method is commonly used in small retail businesses where uncollectible accounts are minimal and irregular, providing a straightforward approach to bad debt management. The allowance method is preferred in industries such as banking and telecommunications, where estimating bad debts across large volumes of accounts ensures more accurate financial statements and compliance with GAAP. Industry-specific credit risk factors and regulatory requirements heavily influence the choice between these methods for optimal financial reporting.

Choosing the Right Method for Your Business

Selecting between the direct write-off and allowance methods depends on the size and complexity of your business's accounts receivable. The allowance method aligns with Generally Accepted Accounting Principles (GAAP) by matching bad debt expenses to the same period as the related sales, providing a more accurate financial picture for larger or growing companies. Smaller businesses with minimal uncollectible accounts may opt for the direct write-off method due to its simplicity, despite its potential impact on financial statement accuracy.

Important Terms

Bad Debt Expense

Bad debt expense is recognized either through the direct write-off method, which records uncollectible accounts when identified, or the allowance method, which estimates bad debts in the same period as related revenues to match expenses accurately; the allowance method aligns with GAAP by using an allowance for doubtful accounts to reflect anticipated losses. Companies favor the allowance method for its adherence to the matching principle and improved financial statement accuracy, while the direct write-off method is simpler but can distort earnings and asset values due to delayed recognition.

Accounts Receivable

Accounts receivable management involves recognizing uncollectible accounts through either the direct write-off method, which records bad debt expenses only when specific accounts are deemed uncollectible, or the allowance method, which estimates and matches bad debt expenses against revenues in the same period by creating an allowance for doubtful accounts. The allowance method provides a more accurate reflection of net receivables on the balance sheet and complies with the matching principle under generally accepted accounting principles (GAAP).

Uncollectible Accounts

Uncollectible accounts are managed using either the direct write-off method, which records bad debt expense only when specific accounts are deemed uncollectible, or the allowance method, which estimates and records anticipated bad debts in the same period as related sales through an allowance for doubtful accounts. The allowance method improves matching of expenses with revenues and complies with GAAP by using historical data and receivables aging to adjust allowance balances.

Aging Schedule

The aging schedule categorizes receivables by the length of time outstanding, providing a detailed basis for estimating uncollectible accounts under the allowance method, while the direct write-off method ignores such classification and records bad debts only when specific accounts are deemed uncollectible. This schedule enhances the accuracy of bad debt expense estimation in the allowance method by aligning reserve amounts with the observed payment behavior trends over different aging periods.

Contra Asset Account

A Contra Asset Account, such as Allowance for Doubtful Accounts, is used in the allowance method to estimate and record potential bad debts, reducing accounts receivable without impacting actual sales. In contrast, the direct write-off method bypasses a contra asset account by directly charging uncollectible accounts to expense only when specific accounts are deemed uncollectible, often leading to less accurate matching of revenues and expenses.

Percent of Sales Method

The Percent of Sales Method estimates bad debt expense based on a fixed percentage of credit sales, aligning closely with the allowance method by matching expenses to related revenues and maintaining an accounts receivable reserve. In contrast, the direct write-off method records bad debts only when specific accounts are deemed uncollectible, lacking expense matching and potentially misstating financial performance within the same period.

Recoveries

Recoveries in accounting occur when amounts previously written off as bad debts under the direct write-off method are subsequently collected, resulting in an income recognition that increases net income in the period of recovery. In contrast, the allowance method estimates uncollectible accounts in advance by creating an allowance for doubtful accounts, so recoveries adjust the allowance account rather than affecting income directly, providing better matching of revenues and expenses.

GAAP Compliance

GAAP compliance mandates using the allowance method for accounting bad debts, ensuring expenses match revenues by estimating uncollectible accounts during the same period they are incurred. The direct write-off method violates GAAP since it records bad debt expense only when specific accounts are deemed uncollectible, distorting net income timing and financial statement accuracy.

Matching Principle

The Matching Principle requires expenses to be recorded in the same period as the revenues they help generate, favoring the allowance method for bad debts because it estimates and matches doubtful accounts expense to related sales. The direct write-off method violates the Matching Principle by recognizing bad debt expense only when specific accounts become uncollectible, causing a mismatch between expense and revenue periods.

Materiality Threshold

Materiality threshold determines whether a company uses the direct write-off method or allowance method for accounting bad debts, with smaller thresholds favoring direct write-offs due to immaterial impact on financial statements. Larger materiality thresholds typically necessitate the allowance method to estimate and match doubtful accounts expense to revenues, ensuring compliance with accrual accounting principles and accurate financial reporting.

direct write-off vs allowance method Infographic

moneydif.com

moneydif.com