Book value represents a company's net asset value calculated by subtracting liabilities from total assets on the balance sheet, reflecting historical cost. Market value indicates the current price at which a company's shares trade on the stock market, influenced by investor perception and future growth potential. Understanding the difference between book value and market value is crucial for evaluating investment opportunities and assessing financial health.

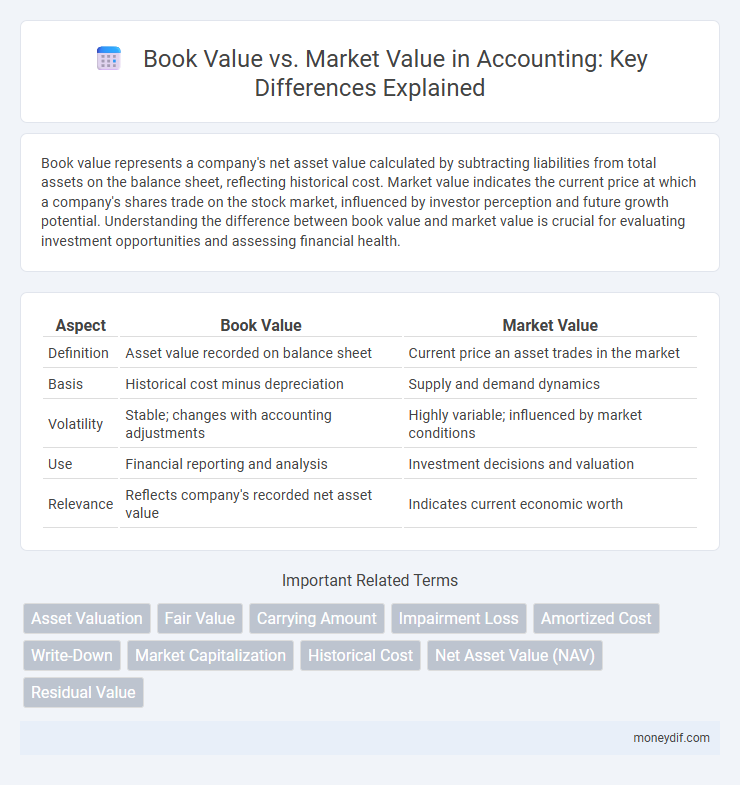

Table of Comparison

| Aspect | Book Value | Market Value |

|---|---|---|

| Definition | Asset value recorded on balance sheet | Current price an asset trades in the market |

| Basis | Historical cost minus depreciation | Supply and demand dynamics |

| Volatility | Stable; changes with accounting adjustments | Highly variable; influenced by market conditions |

| Use | Financial reporting and analysis | Investment decisions and valuation |

| Relevance | Reflects company's recorded net asset value | Indicates current economic worth |

Introduction to Book Value and Market Value

Book value represents an asset's original cost minus accumulated depreciation, reflecting its net worth on the balance sheet. Market value indicates the current price an asset would fetch in an open market, influenced by supply, demand, and economic conditions. Understanding the distinction between book value and market value is essential for accurate financial analysis and investment decisions.

Defining Book Value in Accounting

Book value in accounting represents the net asset value of a company as recorded on the balance sheet, calculated by subtracting total liabilities from total assets. It reflects the original cost of assets minus accumulated depreciation, providing a historical financial perspective rather than current market conditions. Book value is critical for investors and analysts to assess a company's intrinsic worth, distinct from market value, which fluctuates based on market perceptions and economic factors.

Understanding Market Value in Financial Terms

Market value represents the current price at which an asset or company can be bought or sold in the open market, reflecting real-time investor sentiment and economic conditions. Unlike book value, which is based on historical costs and accounting records, market value incorporates future growth potential, risks, and competitive factors. Understanding market value is crucial for investors and analysts to assess the true worth of assets beyond their reported accounting figures.

Key Differences Between Book Value and Market Value

Book value represents the original cost of an asset minus accumulated depreciation, reflecting the value recorded on the balance sheet, while market value indicates the current price an asset can fetch in the open market. Key differences include that book value is based on historical data and accounting principles, whereas market value fluctuates with supply, demand, and investor perception. Investors often compare these values to assess whether a stock is undervalued or overvalued, with book value providing a conservative estimate and market value reflecting real-time market conditions.

Importance of Book Value for Investors

Book value represents a company's net asset value, calculated as total assets minus total liabilities, providing investors with a conservative estimate of intrinsic worth. Investors use book value to assess whether a stock is undervalued or overvalued by comparing it to the market value, aiding in making informed investment decisions. Understanding the book value helps identify potential margin of safety and evaluate company stability during market fluctuations.

Significance of Market Value in Stock Analysis

Market value represents the current price at which an asset can be bought or sold in the open market, reflecting real-time investor sentiment and economic conditions. It is crucial for stock analysis as it provides a realistic measure of a company's worth compared to the book value, which is based on historical costs and accounting records. Investors rely on market value to assess potential returns, market trends, and risk factors, making it a fundamental indicator in portfolio management and financial decision-making.

Factors Affecting Book Value and Market Value

Book value is primarily influenced by historical cost, depreciation, amortization, and asset impairment recorded on financial statements, reflecting the net asset value under accounting principles. Market value fluctuates based on investor perception, market demand, company performance, economic conditions, and future growth potential, providing a real-time valuation in stock exchanges. Differences in accounting methods and external market factors create discrepancies between book value and market value for assets and companies.

Book Value vs. Market Value: Real-World Examples

Book value represents the net asset value recorded on a company's balance sheet, calculated as total assets minus total liabilities, providing a historical cost perspective. Market value reflects the current stock price multiplied by outstanding shares, capturing investor sentiment and future growth expectations. For example, tech companies like Amazon often exhibit market values far exceeding book values due to intangible assets and growth potential, whereas manufacturing firms may have closer book and market values because of tangible assets and stable earnings.

Implications for Financial Reporting and Decision-Making

Book value reflects the historical cost of an asset minus depreciation, providing a conservative measure on financial statements, while market value captures the current price an asset could fetch in a competitive marketplace. Financial reporting based on book value ensures consistency and compliance with accounting standards like GAAP or IFRS, but may understate or overstate asset worth during economic fluctuations. Decision-making relying on market value allows investors and managers to assess real-time asset performance and investment potential, enhancing strategic planning and risk management.

Conclusion: Choosing Between Book Value and Market Value

Choosing between book value and market value depends on the specific financial analysis or decision-making context. Book value provides a stable, historical measure based on accounting records, useful for assessing a company's net asset value and financial health. Market value reflects current investor perceptions and market conditions, offering a real-time valuation critical for investment decisions and market-driven strategies.

Important Terms

Asset Valuation

Asset valuation compares book value, based on historical cost minus depreciation, with market value, reflecting current price expectations and potential for future income.

Fair Value

Fair value represents the estimated price a knowledgeable buyer would pay, often differing from book value, which is based on historical cost, and market value, which reflects current investor sentiment.

Carrying Amount

Carrying amount represents the value of an asset recorded on the balance sheet, often aligned with the book value, which is based on historical cost minus accumulated depreciation. In contrast, market value reflects the current price an asset could fetch in an open market, potentially diverging significantly from the carrying amount due to changes in market conditions or asset utility.

Impairment Loss

Impairment loss occurs when the book value of an asset exceeds its recoverable market value, requiring a downward adjustment to reflect its diminished economic worth.

Amortized Cost

Amortized cost represents the book value of a financial asset, reflecting its initial cost adjusted for principal repayments and amortization, while market value indicates the asset's current price based on market conditions.

Write-Down

A write-down occurs when an asset's book value exceeds its market value, requiring a reduction in the asset's carrying amount on the balance sheet to reflect its impaired value.

Market Capitalization

Market capitalization reflects the total market value of a company's outstanding shares, often differing from its book value, which represents the company's net asset value recorded on financial statements.

Historical Cost

Historical cost represents the original purchase price of an asset, which differs from its current market value and influences the book value reported on financial statements.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the market value of a fund's assets minus its liabilities, often differing from the book value which reflects the historical cost recorded in financial statements.

Residual Value

Residual value represents the estimated market value of an asset at the end of its useful life, often differing from its book value recorded on financial statements.

book value vs market value Infographic

moneydif.com

moneydif.com