Share premium represents the amount received by a company over the nominal value of its shares during an equity issuance, reflecting extra paid-in capital from shareholders. Retained earnings consist of accumulated net profits that have been reinvested in the business rather than distributed as dividends. While share premium is a component of equity arising from external financing, retained earnings are generated internally through operational success.

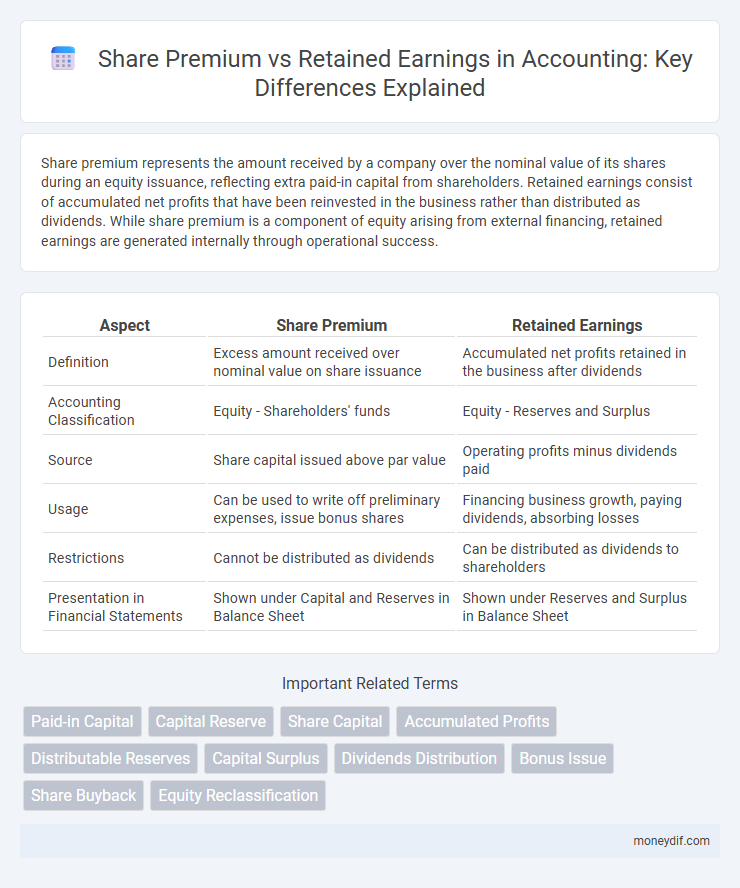

Table of Comparison

| Aspect | Share Premium | Retained Earnings |

|---|---|---|

| Definition | Excess amount received over nominal value on share issuance | Accumulated net profits retained in the business after dividends |

| Accounting Classification | Equity - Shareholders' funds | Equity - Reserves and Surplus |

| Source | Share capital issued above par value | Operating profits minus dividends paid |

| Usage | Can be used to write off preliminary expenses, issue bonus shares | Financing business growth, paying dividends, absorbing losses |

| Restrictions | Cannot be distributed as dividends | Can be distributed as dividends to shareholders |

| Presentation in Financial Statements | Shown under Capital and Reserves in Balance Sheet | Shown under Reserves and Surplus in Balance Sheet |

Introduction to Share Premium and Retained Earnings

Share premium represents the excess amount received by a company over the nominal value of its shares during issuance, recorded separately in the equity section of the balance sheet. Retained earnings consist of accumulated net profits that a company reinvests instead of distributing as dividends, reflecting internal financing from operational success. Both accounts are critical components of shareholders' equity but serve distinct purposes: share premium arises from external capital infusion, while retained earnings reflect internal profit retention.

Definition of Share Premium

Share premium refers to the amount received by a company over and above the nominal value of its shares during a share issuance. This excess amount is recorded in the share premium account, which forms part of shareholders' equity but cannot be distributed as dividends. Retained earnings, in contrast, represent accumulated profits that have been retained in the business and are available for dividend distribution or reinvestment.

Definition of Retained Earnings

Retained earnings refer to the cumulative net income that a company retains after paying dividends to shareholders, serving as a key source of internal financing for business growth. Unlike share premium, which represents the excess amount received over the par value of issued shares, retained earnings reflect profits reinvested in the company rather than distributed. This financial metric is critical for assessing a firm's profitability and sustainability over time.

Key Differences Between Share Premium and Retained Earnings

Share premium represents the amount received by a company over the par value of its shares during issuance, while retained earnings reflect accumulated net profits retained in the business after dividends. Share premium is recorded in the equity section under a separate reserve and is often restricted from distribution as dividends, whereas retained earnings are available for dividend distribution and reinvestment. The primary distinction lies in their origin--share premium arises from capital transactions, whereas retained earnings result from operational profitability.

Legal and Regulatory Framework

Share premium represents the amount received by a company over the par value of its issued shares, governed strictly by corporate law and securities regulations to ensure proper disclosure and usage. Retained earnings are accumulated net profits retained within the company, subject to accounting standards and legal restrictions on distribution as dividends. Regulatory frameworks like the Companies Act and IFRS set clear guidelines on the treatment, presentation, and restrictions associated with share premium and retained earnings to protect shareholders and creditors.

Accounting Treatment and Reporting

Share premium represents the excess amount received over the par value of shares issued, recorded in a separate equity account and not available for dividend distribution. Retained earnings reflect accumulated net profits retained in the business, shown under equity and used for dividends or reinvestment. Accounting standards mandate that share premium is credited to a capital reserve and retained earnings accumulate profits after expenses and dividends, both disclosed distinctly in the statement of changes in equity.

Usage and Restrictions on Share Premium

Share premium represents the amount received by a company above the nominal value of its shares and is primarily used for specific purposes such as issuing bonus shares, writing off preliminary expenses, or covering underwriting commissions. Unlike retained earnings, share premium cannot be distributed as dividends and is subject to legal restrictions to protect creditors and maintain company capital. The usage of share premium is regulated under company law to ensure it supports the company's financial stability rather than serving as a source of discretionary payouts.

Usage and Distribution of Retained Earnings

Share premium arises from the amount received over the nominal value of shares issued and is used primarily for specific purposes like issuing bonus shares or writing off preliminary expenses, with restrictions on distribution as dividends. Retained earnings represent accumulated profits retained in the company after dividends, available for reinvestment, debt repayment, or dividend distribution to shareholders. The distribution of retained earnings is subject to legal restrictions ensuring company solvency, while share premium funds are generally not distributable as dividends but enhance equity capital.

Implications for Shareholders and Investors

Share premium represents the extra amount paid by shareholders over the nominal value of shares, reflecting investors' willingness to pay a premium due to the company's perceived value or growth prospects. Retained earnings denote accumulated profits reinvested in the company, influencing future dividend potential and financial stability. For shareholders, share premium indicates initial investment premiums, while retained earnings impact long-term value through reinvestment and dividend distribution policies.

Share Premium vs Retained Earnings: Summary Table

Share premium represents the excess amount received by a company over the par value of its shares during issuance, recorded under equity but not distributable as dividends. Retained earnings reflect accumulated net profits retained in the business after dividend payments, serving as a key source for reinvestment and shareholder equity growth. The summary table distinguishes share premium as capital reserve funds, while retained earnings indicate operational profit reinvestment capacity.

Important Terms

Paid-in Capital

Paid-in capital represents the total amount investors have contributed to a company through the purchase of shares, including both the par value of the shares and the share premium, which is the amount paid over the par value. Unlike retained earnings, which accumulate from net profits reinvested into the business, paid-in capital reflects direct equity investments from shareholders and does not originate from operational profits.

Capital Reserve

Capital reserve, created from share premium or other capital profits, serves to strengthen a company's financial stability without impacting dividend distribution, unlike retained earnings, which derive from accumulated net profits and are available for dividends. Share premium arises when shares are issued above their nominal value, enhancing capital reserves, while retained earnings reflect operational profitability and liquidity for reinvestment or shareholder payouts.

Share Capital

Share capital represents the funds raised by a company through the issuance of shares, forming the core equity plus any share premium paid above their nominal value, which is recorded separately from retained earnings. Retained earnings reflect accumulated profits reinvested in the business, distinct from share premium that arises from shareholder contributions exceeding share par value, impacting equity structure and financial analysis.

Accumulated Profits

Accumulated profits represent the total net earnings retained by a company, primarily reflected in retained earnings, while share premium accounts for excess amounts received over the par value of shares issued and does not directly impact accumulated profits.

Distributable Reserves

Distributable reserves include retained earnings but exclude share premium, as share premium is generally non-distributable under company law.

Capital Surplus

Capital surplus primarily arises from share premium accounts reflecting excess payment over par value during stock issuance, whereas retained earnings represent accumulated net income retained for reinvestment or debt reduction.

Dividends Distribution

Dividends distribution can be paid from retained earnings but not from share premium, as share premium is generally restricted to capital transactions and legal reserves.

Bonus Issue

A bonus issue is typically funded from retained earnings to distribute additional shares to existing shareholders without involving share premium, which is reserved for issuing shares above their nominal value.

Share Buyback

Share buybacks reduce outstanding shares, often funded from retained earnings or, less commonly, share premium, with the latter requiring adherence to legal restrictions to protect creditors. Utilizing share premium for buybacks involves capital reduction procedures, whereas retained earnings can be used more flexibly but impact future dividend capacity.

Equity Reclassification

Equity reclassification involves transferring amounts between share premium and retained earnings accounts to comply with accounting standards and reflect accurate shareholder equity structure.

share premium vs retained earnings Infographic

moneydif.com

moneydif.com