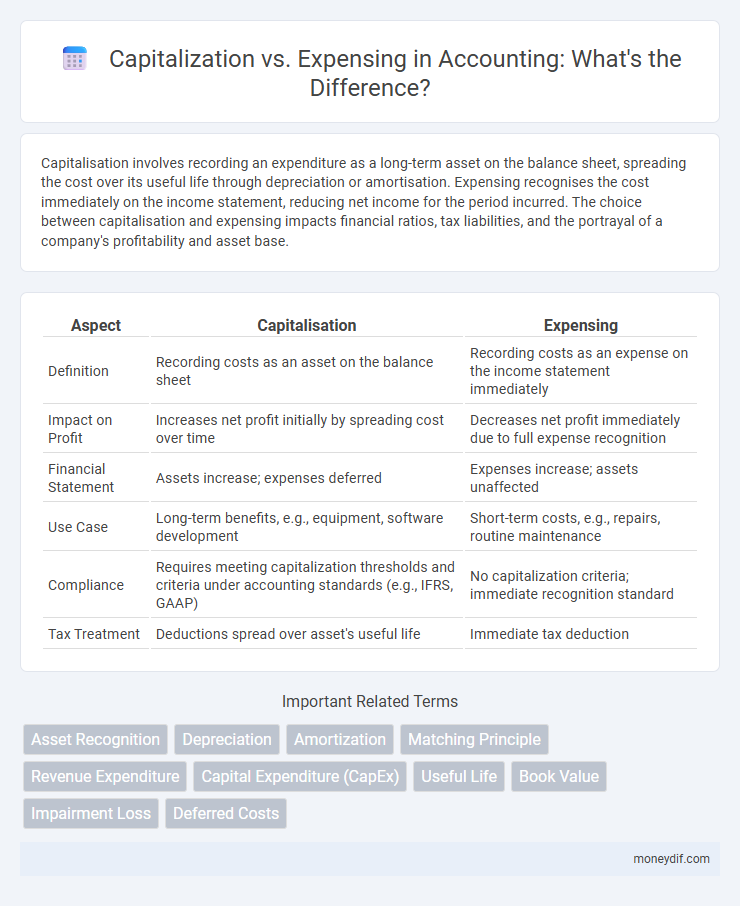

Capitalisation involves recording an expenditure as a long-term asset on the balance sheet, spreading the cost over its useful life through depreciation or amortisation. Expensing recognises the cost immediately on the income statement, reducing net income for the period incurred. The choice between capitalisation and expensing impacts financial ratios, tax liabilities, and the portrayal of a company's profitability and asset base.

Table of Comparison

| Aspect | Capitalisation | Expensing |

|---|---|---|

| Definition | Recording costs as an asset on the balance sheet | Recording costs as an expense on the income statement immediately |

| Impact on Profit | Increases net profit initially by spreading cost over time | Decreases net profit immediately due to full expense recognition |

| Financial Statement | Assets increase; expenses deferred | Expenses increase; assets unaffected |

| Use Case | Long-term benefits, e.g., equipment, software development | Short-term costs, e.g., repairs, routine maintenance |

| Compliance | Requires meeting capitalization thresholds and criteria under accounting standards (e.g., IFRS, GAAP) | No capitalization criteria; immediate recognition standard |

| Tax Treatment | Deductions spread over asset's useful life | Immediate tax deduction |

Definition of Capitalisation and Expensing

Capitalisation in accounting refers to the process of recording a cost or expense on the balance sheet as an asset, rather than immediately recognizing it as an expense on the income statement, allowing the cost to be allocated over the useful life of the asset. Expensing involves recording a cost as an expense on the income statement in the period it is incurred, reflecting immediate recognition of the cost against revenues. Proper distinction between capitalisation and expensing affects financial reporting, tax treatment, and key financial metrics such as net income and asset base.

Key Differences Between Capitalising and Expensing

Capitalisation records an asset's cost on the balance sheet, spreading expenses over its useful life through depreciation or amortization, enhancing long-term financial accuracy. Expensing immediately deducts costs from revenues on the income statement, reducing current taxable income but not affecting assets. Key differences include timing of cost recognition, impact on financial ratios, and adherence to accounting standards like GAAP or IFRS.

Criteria for Capitalising Expenditures

Expenditures must meet specific criteria to be capitalised, including extending the asset's useful life, enhancing its value, or adapting it to new uses beyond the original condition. Costs that do not provide future economic benefits or merely maintain the asset's current state should be expensed immediately. Proper assessment of these criteria ensures compliance with accounting standards such as IFRS and GAAP, preventing misstatement of financial statements.

When to Expense Costs in Accounting

Costs should be expensed in accounting when they provide benefits only within the current accounting period or when their future economic benefits are uncertain. Routine maintenance and repair expenses, office supplies, and small equipment purchases typically qualify for immediate expensing. Properly identifying these costs ensures accurate financial reporting and compliance with accounting standards like GAAP and IFRS.

Impact on Financial Statements

Capitalisation increases assets and equity on the balance sheet, reflecting future economic benefits by recording expenditures as long-term investments instead of immediate expenses. Expensing reduces net income on the income statement by recognizing costs immediately, thereby lowering taxable income and retained earnings. This distinction affects key financial metrics such as return on assets (ROA) and earnings before interest and taxes (EBIT), influencing investor perception and company valuation.

Effects on Profitability and Taxation

Capitalisation of expenses increases asset value on the balance sheet and spreads costs over multiple periods, enhancing short-term profitability by reducing immediate expenses. Expensing costs immediately lowers taxable income in the current period, potentially decreasing tax liabilities but reducing net profit. The choice between capitalisation and expensing significantly impacts financial ratios, tax planning strategies, and investor perceptions of company performance.

Real-world Examples: Capitalisation vs Expensing

Real-world examples of capitalisation include purchasing machinery, where costs are recorded as assets and depreciated over time, improving balance sheet accuracy. In contrast, expensing applies to routine maintenance costs, immediately reducing net income but simplifying financial reporting. Companies often capitalise software development costs meeting specific criteria, while expensing smaller office supplies to align with accounting standards.

Relevant Accounting Standards (IFRS & GAAP)

IFRS IAS 16 and ASC 360 govern capitalisation of property, plant, and equipment, requiring costs that provide future economic benefits to be recognised as assets. Expenses must be capitalised when they enhance asset value or extend useful life, while ordinary repairs and maintenance are expensed immediately according to IFRS and GAAP guidelines. Consistent application of these standards ensures accurate financial reporting and compliance with regulatory frameworks.

Common Challenges and Errors

Common challenges in capitalisation versus expensing include misclassifying costs that should be capitalised as expenses, leading to inaccurate financial statements. Errors often arise from unclear company policies or lack of understanding regarding thresholds and asset life, causing inconsistent treatment of expenditures. This misapplication can result in misstated asset values and distorted profit margins, impacting compliance with accounting standards like IFRS and GAAP.

Best Practices for Decision-Making

Best practices for decision-making in capitalisation versus expensing involve evaluating the asset's useful life and materiality to the financial statements. Capitalise expenditures that provide future economic benefits beyond the current period, while expensing costs that pertain to current operational activities or repairs. Consistently applying accounting standards such as IFRS or GAAP ensures accuracy and comparability in financial reporting.

Important Terms

Asset Recognition

Asset recognition involves identifying and recording an expenditure as a capital asset when it provides future economic benefits, thereby leading to capitalization on the balance sheet. Expenses that do not meet recognition criteria are recorded as costs in the income statement immediately through expensing, impacting profit and loss for the current period.

Depreciation

Depreciation accounts for the systematic allocation of an asset's capitalized cost over its useful life, reflecting its wear and tear or obsolescence. Capitalizing an asset allocates costs to future periods, while expensing records the entire cost immediately, impacting net income and tax liabilities differently.

Amortization

Amortization allocates the cost of intangible assets over their useful life, reflecting capitalized expenses on the balance sheet rather than immediate expensing on the income statement. Choosing capitalization over expensing improves profitability metrics short-term by deferring expense recognition, while amortization ensures consistent cost matching with revenue generation.

Matching Principle

The Matching Principle requires businesses to record expenses in the same period as the revenues they help generate, ensuring accurate financial reporting by aligning costs with corresponding income. Capitalization involves recording an expense as an asset to be amortized over time, while expensing deducts costs immediately, reflecting their impact in the current period's profit and loss statement.

Revenue Expenditure

Revenue expenditure refers to costs incurred for maintaining day-to-day operations and is charged to the profit and loss account immediately, contrasting with capital expenditures that are capitalized as assets and amortized over time. Proper differentiation between revenue expenditure and capitalisation impacts financial reporting accuracy and tax treatments, affecting profitability and asset valuation.

Capital Expenditure (CapEx)

Capital Expenditure (CapEx) refers to funds used by a company to acquire, upgrade, or maintain physical assets like property, industrial buildings, or equipment, with costs capitalized and depreciated over the asset's useful life. In contrast, expensing immediately deducts the cost in the current period, affecting operating expenses and net income, impacting financial statements and tax calculations differently.

Useful Life

Useful life determines the period over which an asset's cost is capitalized and depreciated rather than expensed immediately, directly impacting financial statements and tax deductions. Accurately estimating useful life ensures compliance with accounting standards like GAAP or IFRS and optimizes asset management and reporting accuracy.

Book Value

Book value reflects the net asset value of a company, calculated by subtracting liabilities from total assets, where capitalization involves recording expenditures as assets to be depreciated over time, enhancing book value, while expensing immediately reduces net income by recognizing costs as expenses in the current period. Capitalization improves long-term financial metrics and asset base, whereas expensing directly impacts profitability and reduces book value on financial statements.

Impairment Loss

Impairment loss occurs when the carrying amount of a capitalized asset exceeds its recoverable amount, necessitating a write-down to reflect reduced value, whereas expensing those costs immediately reflects them as incurred without capitalization. Accurate impairment assessment ensures financial statements present a realistic asset value, impacting profit and loss recognition and compliance with accounting standards like IAS 36.

Deferred Costs

Deferred costs represent expenses initially recorded as assets on the balance sheet, reflecting future economic benefits expected from capitalization. Capitalizing deferred costs spreads the expense over multiple periods through amortization, while expensing recognizes the cost immediately, impacting short-term profitability.

capitalisation vs expensing Infographic

moneydif.com

moneydif.com