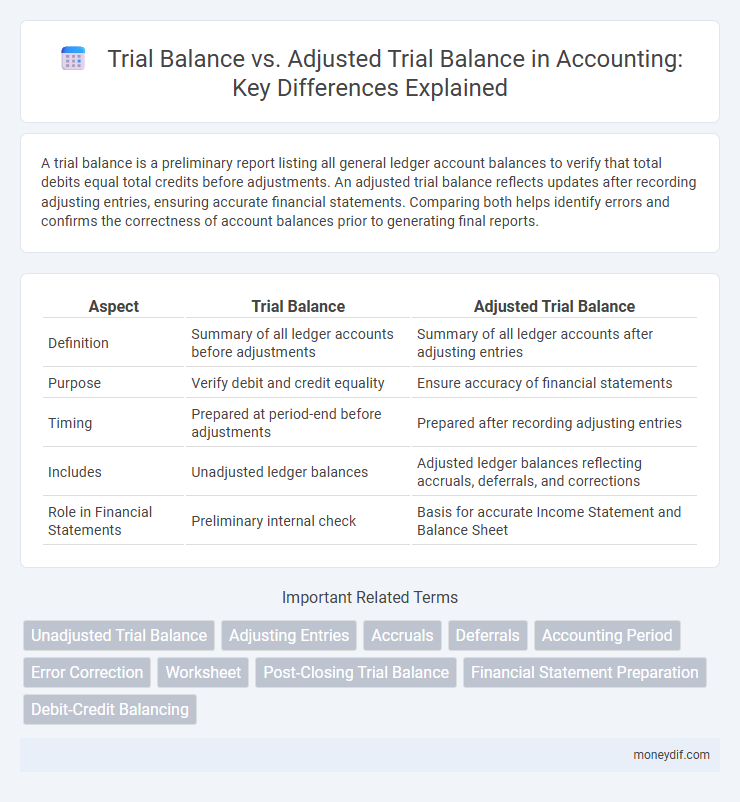

A trial balance is a preliminary report listing all general ledger account balances to verify that total debits equal total credits before adjustments. An adjusted trial balance reflects updates after recording adjusting entries, ensuring accurate financial statements. Comparing both helps identify errors and confirms the correctness of account balances prior to generating final reports.

Table of Comparison

| Aspect | Trial Balance | Adjusted Trial Balance |

|---|---|---|

| Definition | Summary of all ledger accounts before adjustments | Summary of all ledger accounts after adjusting entries |

| Purpose | Verify debit and credit equality | Ensure accuracy of financial statements |

| Timing | Prepared at period-end before adjustments | Prepared after recording adjusting entries |

| Includes | Unadjusted ledger balances | Adjusted ledger balances reflecting accruals, deferrals, and corrections |

| Role in Financial Statements | Preliminary internal check | Basis for accurate Income Statement and Balance Sheet |

Introduction to Trial Balance and Adjusted Trial Balance

Trial balance lists all general ledger account balances to verify total debits equal total credits before adjustments. Adjusted trial balance includes updated balances after recording adjusting entries, ensuring accurate financial statements. This process helps identify errors and confirms the accuracy of account balances at the end of an accounting period.

Purpose of a Trial Balance

A trial balance serves as a preliminary check to ensure that total debits equal total credits in the ledger, helping detect arithmetic errors before preparing financial statements. It summarizes all ledger account balances at a specific point in time, providing a snapshot of the company's financial position. Unlike the adjusted trial balance, it does not include adjustments for accrued or deferred items, making it less accurate for final reporting purposes.

Purpose of an Adjusted Trial Balance

An adjusted trial balance serves to verify the accuracy of account balances after accounting for all necessary adjustments such as accrued expenses, prepaid items, and depreciation. It ensures that debits and credits remain balanced before preparing financial statements, providing a more precise reflection of a company's financial position. This step is crucial for identifying errors and making adjustments to maintain compliance with accounting principles.

Key Differences Between Trial Balance and Adjusted Trial Balance

The trial balance is an initial report listing all general ledger accounts with their debit and credit balances, used to verify that total debits equal total credits. The adjusted trial balance incorporates adjustments for accrued expenses, depreciation, and prepaid items, reflecting more accurate and updated account balances before financial statements are prepared. Key differences include the timing of preparation and inclusion of adjusting entries, which ensure compliance with accrual accounting principles.

Construction of a Trial Balance

The construction of a trial balance involves listing all ledger account balances to verify that total debits equal total credits, ensuring accuracy in the accounting records. An adjusted trial balance is prepared after recording adjusting entries, reflecting updated account balances that include accrued expenses, depreciation, and other adjustments. This adjustment process is critical for producing accurate financial statements and ensuring compliance with accounting standards.

Steps to Prepare an Adjusted Trial Balance

Steps to prepare an adjusted trial balance begin with listing all unadjusted trial balance accounts and their balances to ensure total debits equal credits. Next, make necessary adjusting entries such as accrued expenses, prepaid expenses, depreciation, and unearned revenues, updating the account balances accordingly. Finally, prepare the adjusted trial balance by incorporating these adjustments, verifying the debits still equal credits, and ensuring accuracy for financial statement preparation.

Common Errors Detected by Trial Balances

Trial balances often reveal common errors such as transposition mistakes, where digits are reversed, and omission of transactions, which cause discrepancies between debit and credit balances. Adjusted trial balances further identify errors like incorrect accruals and amortizations that trial balances cannot detect due to their reliance on unadjusted data. These adjustments ensure the financial statements reflect true financial positions by correcting misstatements in accounts.

Importance of Adjustments in Accounting

Adjustments in accounting ensure that the trial balance reflects accurate financial data by correcting errors and updating account balances for accrued revenues, expenses, and deferrals. The adjusted trial balance provides a more precise snapshot of a company's financial position before preparing financial statements, enabling compliance with GAAP and enhancing decision-making. Without these adjustments, financial reports could be misleading, affecting the reliability of profit measurement and asset valuation.

Impact on Financial Statements

The trial balance compiles all ledger account balances to verify that total debits equal total credits before adjustments, providing an initial snapshot of a company's financial position. The adjusted trial balance incorporates all necessary corrections and accruals, ensuring accurate reflection of revenues and expenses for the period. This adjustment process critically impacts financial statements by aligning reported figures with accounting principles, resulting in precise net income, asset valuations, and liability amounts.

Final Thoughts: Choosing the Right Balance for Reporting

Choosing the right balance for reporting hinges on the purpose of the financial statements, where the trial balance offers a preliminary overview while the adjusted trial balance reflects corrections and accruals ensuring accuracy. The adjusted trial balance is essential for generating reliable financial reports as it incorporates all necessary adjustments from journal entries to comply with accounting principles. Accurate financial decision-making depends on utilizing the adjusted trial balance, which provides a true representation of the company's financial position.

Important Terms

Unadjusted Trial Balance

Unadjusted trial balance lists all ledger accounts and their balances before adjustments, while adjusted trial balance reflects updated balances after recording adjusting entries to ensure accurate financial statements.

Adjusting Entries

Adjusting entries ensure all revenues and expenses are recorded accurately, converting the trial balance into the adjusted trial balance to reflect true financial positions before preparing financial statements.

Accruals

Accruals increase expenses or revenues in the adjusted trial balance compared to the trial balance by recognizing earned or incurred amounts not yet recorded in financial statements.

Deferrals

Deferrals affect the trial balance by initially recording revenues or expenses in unearned or prepaid accounts, which are then adjusted in the adjusted trial balance to reflect the correct financial period recognition.

Accounting Period

The accounting period defines the timeframe for which the trial balance is prepared, while the adjusted trial balance reflects corrections and accruals made after adjusting entries within the same period.

Error Correction

Error correction ensures discrepancies between the trial balance and adjusted trial balance are identified and rectified to maintain accurate financial records.

Worksheet

The worksheet facilitates the comparison of the trial balance and adjusted trial balance by organizing account balances and adjustments to ensure accurate financial statement preparation.

Post-Closing Trial Balance

A post-closing trial balance lists only permanent accounts with zero balances in temporary accounts after adjustments, distinguishing it from the trial balance, which includes all accounts before adjustments, and the adjusted trial balance, which reflects updated balances following adjustments.

Financial Statement Preparation

Accurate financial statement preparation relies on transferring correct balances from the adjusted trial balance, which reflects all necessary adjustments, rather than the initial trial balance.

Debit-Credit Balancing

Debit-credit balancing ensures that the total debits equal total credits in both the trial balance and the adjusted trial balance, which verifies the accuracy of financial records before and after adjustments.

trial balance vs adjusted trial balance Infographic

moneydif.com

moneydif.com