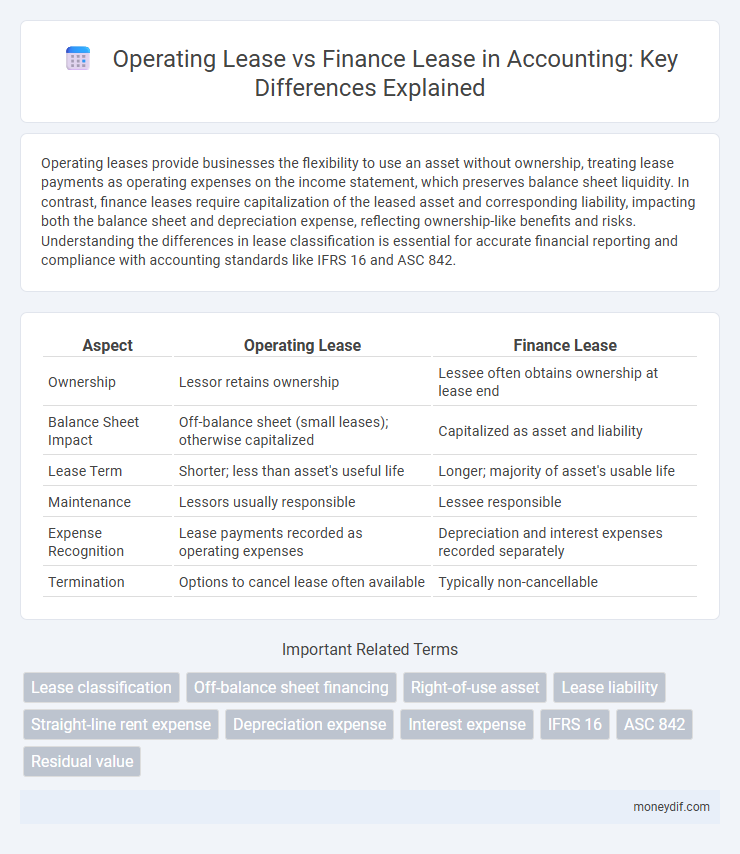

Operating leases provide businesses the flexibility to use an asset without ownership, treating lease payments as operating expenses on the income statement, which preserves balance sheet liquidity. In contrast, finance leases require capitalization of the leased asset and corresponding liability, impacting both the balance sheet and depreciation expense, reflecting ownership-like benefits and risks. Understanding the differences in lease classification is essential for accurate financial reporting and compliance with accounting standards like IFRS 16 and ASC 842.

Table of Comparison

| Aspect | Operating Lease | Finance Lease |

|---|---|---|

| Ownership | Lessor retains ownership | Lessee often obtains ownership at lease end |

| Balance Sheet Impact | Off-balance sheet (small leases); otherwise capitalized | Capitalized as asset and liability |

| Lease Term | Shorter; less than asset's useful life | Longer; majority of asset's usable life |

| Maintenance | Lessors usually responsible | Lessee responsible |

| Expense Recognition | Lease payments recorded as operating expenses | Depreciation and interest expenses recorded separately |

| Termination | Options to cancel lease often available | Typically non-cancellable |

Introduction to Operating and Finance Leases

Operating leases involve renting assets for a short term without ownership transfer, allowing companies to keep leases off the balance sheet under certain accounting standards. Finance leases, also known as capital leases, resemble asset purchases where the lessee assumes risks and rewards of ownership, leading to asset capitalization and liability recognition. Both lease types impact financial statements differently, influencing balance sheet metrics, cash flow treatment, and key performance ratios.

Definition of Operating Lease

An operating lease is a rental agreement where the lessee uses an asset for a specific period without ownership transfer, typically shorter than the asset's useful life. The lessor retains ownership and is responsible for maintenance, while rental expenses are recorded as operating expenses on the lessee's income statement. This lease type does not appear on the lessee's balance sheet under previous accounting standards but requires disclosure under IFRS 16 and ASC 842 with right-of-use asset and lease liability recognition.

Definition of Finance Lease

A finance lease is a contractual agreement where the lessee assumes substantially all the risks and rewards of ownership for a leased asset, reflected as an asset and liability on the balance sheet. Under IFRS 16 and ASC 842 accounting standards, the lease term typically covers the majority of the asset's useful life, often with a purchase option at lease end. This classification affects financial ratios and cash flow presentation due to the capitalization of right-of-use assets and lease liabilities.

Key Differences Between Operating and Finance Leases

Operating leases do not transfer ownership rights and are treated as off-balance-sheet financing, with lease payments recorded as operating expenses. Finance leases, also known as capital leases, effectively transfer ownership risks and rewards to the lessee, requiring asset capitalization and liability recognition on the balance sheet. The distinction impacts financial ratios, tax treatment, and cash flow classification, influencing decision-making for asset management and funding strategies.

Accounting Treatment Under IFRS and US GAAP

Operating leases under IFRS 16 require lessees to recognize a right-of-use asset and lease liability on the balance sheet, eliminating off-balance-sheet treatment, while under US GAAP (ASC 842), operating leases also must be recorded on the balance sheet but retain lease expense recognition in the income statement on a straight-line basis. Finance leases (or capital leases under US GAAP) are capitalized as assets and liabilities on the balance sheet with amortization of the asset and interest expense recognized separately in both frameworks. The key difference lies in the income statement presentation, where IFRS combines amortization and interest into a single lease expense for operating leases, whereas US GAAP separates lease expense components.

Impact on Balance Sheet and Income Statement

Operating leases are recorded off-balance sheet, resulting in no asset or liability recognition, while lease payments are expensed in the income statement, reducing net income gradually. Finance leases appear on the balance sheet as both an asset and a liability, reflecting the leased asset's value and lease obligation, with interest expense and depreciation impacting the income statement. The classification significantly influences financial ratios, asset turnover, and debt levels, affecting stakeholders' assessment of a company's financial health.

Tax Implications of Leases

Operating leases allow lessees to deduct lease payments as operating expenses, reducing taxable income without capitalizing the asset on the balance sheet. Finance leases, classified as capital leases under tax law, require recording the leased asset and corresponding liability, enabling depreciation and interest expense deductions separately. Understanding the tax treatment of each lease type is crucial for optimizing cash flow and minimizing tax liabilities.

Advantages and Disadvantages of Each Lease Type

Operating leases offer off-balance-sheet financing, preserving company liquidity and flexibility by avoiding asset ownership, but they provide no equity buildup and may result in higher long-term costs. Finance leases record leased assets and liabilities on the balance sheet, enhancing transparency and matching expenses with asset usage, though they reduce financial ratios and limit operational flexibility due to ownership responsibilities. Choosing between operating and finance leases depends on considerations of balance sheet impact, tax treatment, and asset management goals.

Criteria for Lease Classification

Operating lease classification requires that the lease does not transfer ownership and the lease term is significantly less than the asset's economic life, with lease payments not covering the asset's fair value. Finance lease classification occurs when the lease transfers ownership at the end, contains a bargain purchase option, or the lease term covers the major part of the asset's economic life, typically 75% or more. Other criteria include present value of lease payments equating to substantially all of the asset's fair value and the asset being specialized with no alternative use to the lessor.

Choosing Between Operating and Finance Lease

Choosing between operating and finance leases depends largely on asset ownership desires and financial reporting impacts. Finance leases transfer ownership risks and rewards, capitalizing the asset and liability on the balance sheet, while operating leases keep assets off-balance sheet with rental expense recognition. Key considerations include lease term relative to asset life, present value of lease payments, and impact on financial ratios for clearer decision-making.

Important Terms

Lease classification

Lease classification distinguishes operating leases, which do not transfer ownership risks or benefits and keep assets off the lessee's balance sheet, from finance leases that effectively transfer ownership risks and rewards, requiring asset capitalization and liability recognition under accounting standards like IFRS 16 and ASC 842. Key criteria such as lease term, present value of lease payments, and ownership transfer determine classification, impacting financial reporting and lease management strategies.

Off-balance sheet financing

Off-balance sheet financing often involves operating leases, allowing companies to use assets without recording them as liabilities, thereby keeping debt levels lower and improving financial ratios. In contrast, finance leases require lessees to recognize leased assets and liabilities on the balance sheet, increasing transparency but impacting leverage and debt covenants.

Right-of-use asset

A right-of-use asset represents the lessee's control over a leased asset during the lease term, recognized on the balance sheet for both operating and finance leases under IFRS 16; in finance leases, the asset and liability reflect ownership-like risks and rewards, while in operating leases, the asset reflects the right to use without ownership transfer. Measurement and amortization differ, with finance leases requiring depreciation of the asset and interest expense on the lease liability, whereas operating leases record a single lease expense in the income statement over the lease term.

Lease liability

Lease liability represents the present value of future lease payments a lessee is obligated to make, distinguished between operating and finance leases based on the classification criteria outlined in IFRS 16 or ASC 842 standards. In finance leases, the lease liability is recognized alongside a right-of-use asset reflecting ownership-like control, whereas operating leases record lease liabilities with corresponding right-of-use assets but impact the income statement as lease expense on a straight-line basis over the lease term.

Straight-line rent expense

Straight-line rent expense for operating leases involves recognizing equal rental expenses over the lease term, reflecting consistent usage costs, whereas finance leases allocate expenses based on interest expense and amortization of the lease asset, aligning with asset ownership. This approach impacts financial statements by smoothing operating lease expenses while front-loading expenses in finance leases due to interest and depreciation components.

Depreciation expense

Depreciation expense for operating leases is typically not recorded on the lessee's balance sheet, as the asset remains with the lessor, while finance leases require the lessee to capitalize the leased asset and recognize depreciation over its useful life. Under finance leases, the leased asset appears as a right-of-use asset, leading to systematic depreciation expense that impacts net income and asset valuation.

Interest expense

Interest expense for operating leases is typically embedded within lease payments and not separately disclosed, reflecting the use of the asset rather than financing costs. In contrast, finance leases recognize interest expense explicitly on the lease liability, calculated using the effective interest method over the lease term, affecting both the income statement and balance sheet.

IFRS 16

IFRS 16 requires lessees to recognize nearly all leases on the balance sheet as right-of-use assets and lease liabilities, effectively eliminating the distinction between operating and finance leases for lessees. This standard enhances financial transparency by capturing lease obligations, impacting key ratios such as debt-to-equity and EBITDA.

ASC 842

ASC 842 requires lessees to recognize assets and liabilities for most operating leases on the balance sheet, improving transparency compared to previous standards. Finance leases under ASC 842 are capitalized similarly but differ by transferring ownership risks and rewards, impacting amortization and interest expense recognition.

Residual value

Residual value in operating leases represents the estimated asset worth at lease-end, impacting lease payments and return risks, while in finance leases, the lessee assumes residual value risk due to ownership transfer options. Accurate residual value estimation optimizes lease structuring, financial reporting, and asset management strategies for both lease types.

operating lease vs finance lease Infographic

moneydif.com

moneydif.com