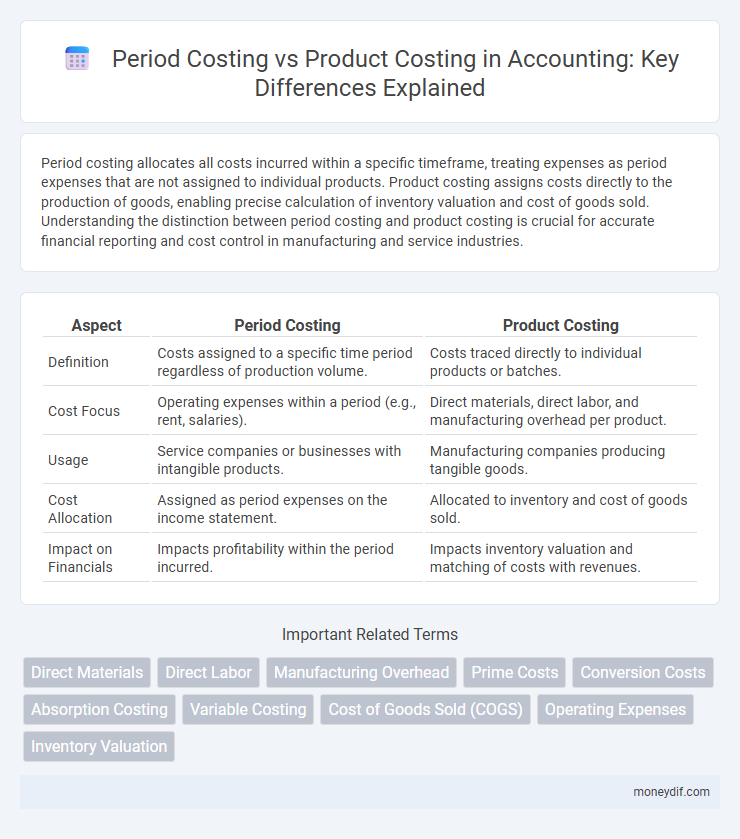

Period costing allocates all costs incurred within a specific timeframe, treating expenses as period expenses that are not assigned to individual products. Product costing assigns costs directly to the production of goods, enabling precise calculation of inventory valuation and cost of goods sold. Understanding the distinction between period costing and product costing is crucial for accurate financial reporting and cost control in manufacturing and service industries.

Table of Comparison

| Aspect | Period Costing | Product Costing |

|---|---|---|

| Definition | Costs assigned to a specific time period regardless of production volume. | Costs traced directly to individual products or batches. |

| Cost Focus | Operating expenses within a period (e.g., rent, salaries). | Direct materials, direct labor, and manufacturing overhead per product. |

| Usage | Service companies or businesses with intangible products. | Manufacturing companies producing tangible goods. |

| Cost Allocation | Assigned as period expenses on the income statement. | Allocated to inventory and cost of goods sold. |

| Impact on Financials | Impacts profitability within the period incurred. | Impacts inventory valuation and matching of costs with revenues. |

Introduction to Period Costing and Product Costing

Period costing assigns expenses to specific time periods regardless of production volume, focusing on costs such as selling, general, and administrative expenses incurred during that timeframe. Product costing, by contrast, tracks all costs--direct materials, direct labor, and manufacturing overhead--associated with the production of goods to determine the cost per unit. Understanding the distinction between period and product costing is essential for accurate financial reporting and effective cost control in manufacturing and service industries.

Definition of Period Costing

Period costing refers to the accounting method where costs are charged as expenses in the period in which they are incurred, regardless of production levels. It is commonly used for non-manufacturing costs such as selling, general, and administrative expenses that do not directly relate to product creation. This approach contrasts with product costing, where expenses are assigned to specific products and inventoried until sold.

Definition of Product Costing

Product costing refers to the process of determining the total expenses involved in producing a specific product, including direct materials, direct labor, and manufacturing overhead costs. It enables businesses to assign precise costs to individual units, facilitating accurate inventory valuation and profitability analysis. This method contrasts with period costing, which aggregates costs by time periods rather than by products.

Key Differences Between Period and Product Costing

Period costing allocates expenses to specific time intervals, such as months or quarters, capturing costs not directly tied to production, whereas product costing assigns costs directly to manufactured goods to determine their unit cost. Product costing includes direct materials, direct labor, and manufacturing overhead, essential for inventory valuation and cost of goods sold calculation. Period costing primarily involves non-manufacturing expenses like selling, general, and administrative costs, impacting financial reporting through period expense recognition.

Components of Product Costs

Product costs consist of direct materials, direct labor, and manufacturing overhead, all of which are essential components for determining the total cost of goods produced. Period costing, in contrast, treats non-manufacturing expenses such as selling and administrative costs as period costs, expensed in the period incurred rather than assigned to products. Understanding the distinction between product costs and period costs is crucial for accurate cost allocation and financial reporting in managerial accounting.

Components of Period Costs

Period costs primarily include selling, general, and administrative expenses such as salaries, rent, and office supplies that are not directly tied to production. These costs are expensed in the period incurred and do not form part of inventory valuation. Unlike product costs, period costs exclude direct materials, direct labor, and manufacturing overhead associated with production.

Impact on Financial Statements

Period costing directly affects the income statement by expensing all costs within the accounting period, leading to immediate recognition of expenses and potentially fluctuating net income. Product costing allocates costs to inventory on the balance sheet, deferring expense recognition until product sales occur, which can stabilize reported profits. The choice between period and product costing impacts asset valuation, cost of goods sold, and income measurement, influencing financial statement accuracy and decision-making.

Period vs Product Costing in Managerial Decision-Making

Period costing allocates expenses to specific time periods, aiding managerial decision-making by providing clear insights into operational efficiency and expense control during a fiscal period. Product costing assigns costs directly to products, supporting managers in pricing, inventory valuation, and profitability analysis by linking expenses to specific goods or services. Understanding the distinction between period and product costing enables managers to optimize resource allocation, set competitive prices, and improve financial forecasting accuracy.

Examples of Period and Product Costs

Period costs include selling expenses such as advertising, sales salaries, and office rent, which are expensed in the period incurred regardless of production levels. Product costs consist of direct materials like raw materials, direct labor such as assembly wages, and manufacturing overhead including factory utilities and depreciation, all capitalized as inventory until sold. Differentiating these costs helps in accurate financial reporting and cost control within managerial accounting.

Best Practices for Cost Classification

Effective cost classification in period costing emphasizes grouping expenses by time intervals, such as monthly or quarterly, to accurately match costs with revenues for financial reporting and budgeting. Product costing requires detailed identification of direct materials, direct labor, and manufacturing overhead tied specifically to each product, enabling precise inventory valuation and cost control. Best practices involve consistent allocation methods, thorough documentation, and the use of activity-based costing to enhance accuracy and decision-making in both cost systems.

Important Terms

Direct Materials

Direct materials are classified as product costs because they are integral to manufacturing finished goods, directly impacting inventory valuation and cost of goods sold under absorption costing. In contrast, period costing treats direct materials as expenses within the accounting period they are incurred, emphasizing expense recognition over inventory capitalization.

Direct Labor

Direct labor costs are treated as period costs when they cannot be directly traced to specific products, instead being expensed in the period incurred, whereas in product costing, direct labor is assigned directly to products as part of the manufacturing costs. Accurate allocation of direct labor under product costing enhances inventory valuation and cost of goods sold calculation, while period costing focuses on expense recognition in periods for activities like administrative tasks.

Manufacturing Overhead

Manufacturing overhead includes indirect costs such as factory rent, utilities, and maintenance, which are allocated differently in period costing and product costing methods; period costing treats overhead as an expense of the period incurred, while product costing assigns overhead to products based on allocated cost drivers like machine hours or labor time. Accurate allocation of manufacturing overhead in product costing ensures precise product cost determination essential for pricing and profitability analysis.

Prime Costs

Prime costs, comprising direct materials and direct labor, serve as a key metric in product costing by directly attributing expenses to manufacturing specific goods; conversely, period costing excludes prime costs by focusing on non-manufacturing expenses incurred within a time period, such as administrative and selling costs. Differentiating between prime costs in product costing and period costs helps businesses accurately assess production efficiency and financial performance over defined accounting intervals.

Conversion Costs

Conversion costs, comprising direct labor and manufacturing overhead, are crucial in product costing as they are inventoried as part of the cost of goods manufactured, whereas in period costing, these costs are expensed in the period incurred since they do not relate directly to production. Accurate allocation of conversion costs in product costing enhances cost control and pricing decisions, contrasting with period costing where such costs impact only the operating expenses on the income statement.

Absorption Costing

Absorption costing allocates both fixed and variable manufacturing overhead to product costs, distinguishing it from period costing, which expenses all manufacturing overhead in the period incurred. This method ensures inventory valuation includes all production costs, aligning with product costing principles and enhancing profitability analysis.

Variable Costing

Variable costing assigns only variable manufacturing costs to products, treating fixed manufacturing overhead as a period cost expensed in the period incurred. This contrasts with absorption costing, where both fixed and variable manufacturing costs are product costs, thus affecting inventory valuation and net income differently during periods of production change.

Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) varies significantly between period costing and product costing, with product costing allocating direct materials, labor, and overhead costs to specific products, while period costing assigns expenses to the time period incurred regardless of production levels. Accurate COGS calculation improves financial analysis and profitability assessment by reflecting either production-specific costs or general period expenses.

Operating Expenses

Operating expenses in period costing are treated as fixed costs and expensed entirely within the accounting period they occur, whereas in product costing, operating expenses are allocated to products as part of manufacturing overhead, influencing unit product costs and inventory valuation. Understanding the distinction is critical for accurate financial analysis, budgeting, and cost control in managerial accounting.

Inventory Valuation

Inventory valuation impacts period costing by expensing costs in the period incurred, whereas product costing capitalizes costs into inventory, affecting asset valuation and cost of goods sold; accurate differentiation improves financial reporting precision and inventory management. Effective inventory valuation methods, such as FIFO or weighted average in product costing, align costs with revenues, contrasting with period costing's immediate expense recognition, essential for precise profit analysis.

period costing vs product costing Infographic

moneydif.com

moneydif.com