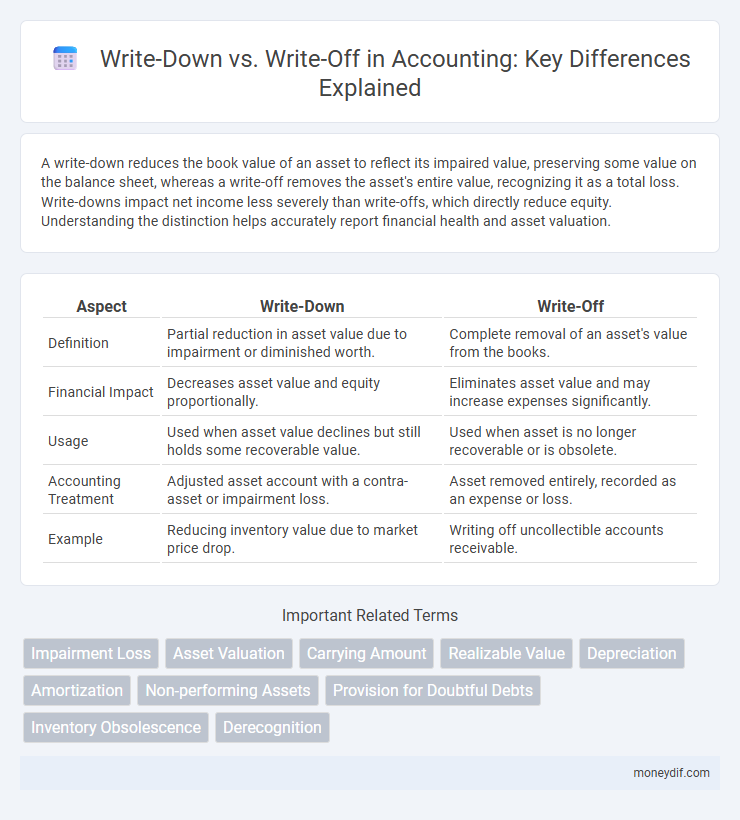

A write-down reduces the book value of an asset to reflect its impaired value, preserving some value on the balance sheet, whereas a write-off removes the asset's entire value, recognizing it as a total loss. Write-downs impact net income less severely than write-offs, which directly reduce equity. Understanding the distinction helps accurately report financial health and asset valuation.

Table of Comparison

| Aspect | Write-Down | Write-Off |

|---|---|---|

| Definition | Partial reduction in asset value due to impairment or diminished worth. | Complete removal of an asset's value from the books. |

| Financial Impact | Decreases asset value and equity proportionally. | Eliminates asset value and may increase expenses significantly. |

| Usage | Used when asset value declines but still holds some recoverable value. | Used when asset is no longer recoverable or is obsolete. |

| Accounting Treatment | Adjusted asset account with a contra-asset or impairment loss. | Asset removed entirely, recorded as an expense or loss. |

| Example | Reducing inventory value due to market price drop. | Writing off uncollectible accounts receivable. |

Understanding Write-Downs in Accounting

Write-downs in accounting involve reducing the book value of an asset to reflect its current market value without removing it entirely from the accounts. This adjustment acknowledges impairment or decline in asset value, impacting financial statements by decreasing asset balances and net income. Understanding write-downs is crucial for accurate financial reporting and asset management, distinguishing them from write-offs, which eliminate asset value completely.

What is a Write-Off?

A write-off occurs when a company recognizes that an asset's value is no longer recoverable, removing it from the balance sheet as an expense. It reflects a permanent reduction, often applied to uncollectible receivables or obsolete inventory, impacting net income directly. Write-offs help maintain accurate financial statements by aligning reported asset values with their true economic worth.

Key Differences Between Write-Down and Write-Off

Write-downs reduce the book value of an asset to reflect its current market value without completely removing it from the balance sheet, whereas write-offs eliminate the asset's value entirely after it is deemed unrecoverable. Write-downs impact the income statement through impairment losses but maintain asset presence for potential future value, while write-offs result in a direct expense and asset removal, signaling full asset impairment. The timing and financial reporting treatment of write-downs and write-offs influence key financial ratios, such as return on assets and net income trends.

When to Apply a Write-Down

A write-down is applied when an asset's fair market value declines but still retains some recoverable value, reflecting a partial reduction in book value to match current conditions. Businesses should implement a write-down when evidence shows impairment but the asset is expected to generate future economic benefits. This approach aligns financial statements with realistic valuations without removing the asset entirely, unlike a write-off used when an asset has no recoverable value.

When Does a Write-Off Occur?

A write-off occurs when an asset's value is deemed unrecoverable, such as uncollectible accounts receivable or obsolete inventory, leading to its complete removal from the balance sheet. This accounting action reflects the recognition of a permanent loss and directly impacts net income by increasing expenses. Write-offs are enforced when recoverability is no longer feasible, distinguishing them from partial impairments or write-downs where asset values are only reduced.

Accounting Treatment for Write-Downs

Accounting treatment for write-downs involves reducing the carrying amount of an asset on the balance sheet to reflect its impaired value. This adjustment is recorded as an expense in the income statement, directly impacting net income while maintaining the asset on the books at its revised value. Write-downs differ from write-offs as they represent partial reductions in asset value rather than a complete removal.

Accounting Procedure for Write-Offs

The accounting procedure for write-offs involves formally removing an uncollectible asset from the balance sheet by debiting an expense account, such as bad debt expense, and crediting the corresponding asset account. This process requires thorough documentation, including approval from management and supporting evidence that the asset is no longer recoverable. Accurate write-off procedures help ensure financial statements reflect a true and fair view of the company's financial position by eliminating overstated assets.

Impact of Write-Downs vs Write-Offs on Financial Statements

Write-downs reduce the carrying value of an asset on the balance sheet, reflecting a decline in its recoverable amount without completely removing it, which results in a lower asset value and a corresponding expense on the income statement, thereby moderately decreasing net income. Write-offs eliminate an asset's book value entirely when it is deemed worthless, directly reducing assets and increasing expenses, leading to a more significant immediate impact on net income and equity. Both adjustments affect key financial ratios, such as return on assets (ROA) and debt-to-equity, but write-offs typically produce a sharper decline in profitability and asset base.

Real-World Examples: Write-Down vs Write-Off

A write-down reduces the book value of an asset due to partial impairment, such as a company adjusting the value of inventory after market prices decline, whereas a write-off completely removes the asset from the books, often exemplified by uncollectible accounts receivable being expensed. For example, a retailer lowering inventory value after damage incurs a write-down, while a business eliminating bad debt after failed collection attempts records a write-off. These accounting treatments directly impact financial statements by reflecting the asset's true value or loss recognition.

Best Practices for Managing Write-Downs and Write-Offs

Effective management of write-downs and write-offs requires accurate asset valuation and regular financial review to ensure adjustments reflect true market conditions. Implementing clear internal controls and documentation policies minimizes errors and supports compliance with accounting standards such as GAAP or IFRS. Consistent monitoring of asset performance and timely recognition of impairments enhance financial statement reliability and inform strategic decision-making.

Important Terms

Impairment Loss

Impairment loss occurs when an asset's carrying amount exceeds its recoverable amount, leading to a write-down that reduces the asset's value on the balance sheet without completely removing it. A write-off, by contrast, eliminates the asset's value entirely, reflecting a total loss when the asset is deemed unrecoverable or obsolete.

Asset Valuation

Asset valuation involves estimating the recoverable amount of an asset to determine if a write-down is necessary when its book value exceeds fair value but still retains some recoverable amount; a write-off occurs when the asset's value is completely impaired, requiring full removal from the balance sheet. Proper differentiation between write-downs and write-offs ensures accurate financial reporting and compliance with accounting standards such as IFRS and GAAP.

Carrying Amount

The carrying amount represents the value of an asset recorded on the balance sheet after accounting for depreciation or amortization, serving as a basis for write-downs when the asset's recoverable amount falls below this value. A write-down reduces the carrying amount to reflect impairment losses, whereas a write-off removes the asset's remaining carrying amount entirely from the books, typically when the asset is deemed unrecoverable or disposed of.

Realizable Value

Realizable value represents the estimated net amount a company expects to recover from an asset's sale or use, crucial in determining whether a write-down is necessary to reflect impairment loss by reducing its book value. A write-off occurs when the asset's value drops to zero, indicating it is no longer recoverable, whereas a write-down partially reduces the asset's value to its realizable value without entirely eliminating it from the balance sheet.

Depreciation

Depreciation allocates the cost of an asset over its useful life, whereas a write-down reduces an asset's book value due to impairment without removing it entirely from the balance sheet. Write-offs eliminate the asset's value completely, reflecting a total loss when the asset is deemed worthless or disposed of.

Amortization

Amortization systematically allocates the cost of intangible assets over their useful lives, while a write-down reduces the asset's book value to reflect partial impairment without complete removal from the balance sheet. A write-off eliminates the asset's value entirely, indicating it is no longer recoverable or usable in operations.

Non-performing Assets

Non-performing assets (NPAs) require financial institutions to either write down or write off the value, where a write-down reduces the asset's book value to reflect impaired recoverability, while a write-off removes the asset entirely from the books as a loss. The distinction impacts the bank's financial statements and regulatory capital, with write-downs signaling partial recovery potential and write-offs indicating confirmed losses.

Provision for Doubtful Debts

Provision for Doubtful Debts is an estimated allowance on accounts receivable that reflects potential credit losses, enabling businesses to write down receivables to their recoverable value. A write-down reduces the carrying amount of doubtful debts on the balance sheet, while a write-off removes specific uncollectible accounts from the books entirely.

Inventory Obsolescence

Inventory obsolescence occurs when stock becomes outdated or unsellable, necessitating financial adjustments through either write-downs or write-offs. Write-downs reduce inventory value on the balance sheet to reflect diminished market value, while write-offs completely remove obsolete inventory from accounting records, impacting both profit and loss statements.

Derecognition

Derecognition involves removing an asset or liability from the balance sheet when control is lost or obligations are extinguished, with write-downs reducing the asset's carrying amount due to impairment, while write-offs completely eliminate the asset as uncollectible or worthless. Write-downs affect net income through impairment losses, whereas write-offs directly remove the asset, impacting financial statements by reflecting irreversible loss.

write-down vs write-off Infographic

moneydif.com

moneydif.com