Fund accounting categorizes resources into separate funds to ensure accountability and compliance with legal or donor restrictions, primarily used by non-profit organizations and government entities. Accrual accounting records financial transactions when they are incurred, regardless of cash flow, providing a comprehensive view of an organization's financial position and performance. Understanding the differences between fund accounting and accrual accounting is essential for accurate financial reporting and effective resource management.

Table of Comparison

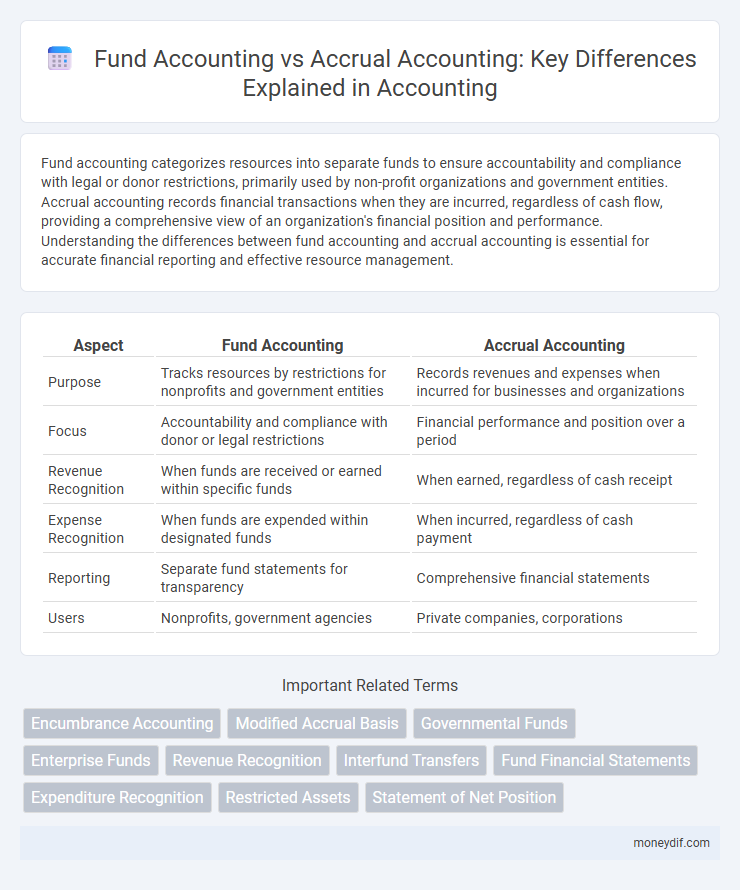

| Aspect | Fund Accounting | Accrual Accounting |

|---|---|---|

| Purpose | Tracks resources by restrictions for nonprofits and government entities | Records revenues and expenses when incurred for businesses and organizations |

| Focus | Accountability and compliance with donor or legal restrictions | Financial performance and position over a period |

| Revenue Recognition | When funds are received or earned within specific funds | When earned, regardless of cash receipt |

| Expense Recognition | When funds are expended within designated funds | When incurred, regardless of cash payment |

| Reporting | Separate fund statements for transparency | Comprehensive financial statements |

| Users | Nonprofits, government agencies | Private companies, corporations |

Introduction to Fund Accounting and Accrual Accounting

Fund accounting segregates resources into categories to ensure proper accountability and legal compliance, primarily used by nonprofit and governmental organizations. Accrual accounting records financial transactions when they occur, regardless of cash flow, providing a more accurate picture of an entity's financial position. Understanding these accounting methods is crucial for organizations to manage budgets, report finances, and comply with regulatory requirements effectively.

Definitions and Core Concepts

Fund accounting is a system used primarily by non-profit organizations and governments to track resources according to specific purposes, emphasizing accountability over profitability. Accrual accounting recognizes revenues and expenses when they are earned or incurred, regardless of cash flow, providing a comprehensive view of financial performance. Understanding these core concepts highlights fund accounting's focus on designated funds and restrictions, while accrual accounting offers a broader financial picture for all business types.

Historical Background and Evolution

Fund accounting originated in the early 20th century to meet the unique financial reporting needs of government and nonprofit organizations, emphasizing accountability over profitability. Accrual accounting, rooted in the double-entry bookkeeping system dating back to the 15th century, evolved to provide a comprehensive view of financial performance by recognizing revenues and expenses when they are incurred. The divergence in their historical development reflects their tailored applications: fund accounting prioritizes fund restrictions and compliance, while accrual accounting focuses on economic events and long-term financial health.

Key Differences Between Fund and Accrual Accounting

Fund accounting organizes financial resources into specific categories or funds to track the allocation and usage of money, primarily used by nonprofit and government entities. Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow, providing a comprehensive view of financial performance over time. The key distinction lies in fund accounting's emphasis on accountability for designated funds, whereas accrual accounting focuses on matching income and expenses to the correct reporting period for accurate financial statements.

Applicability in Different Sectors

Fund accounting is primarily used by government agencies, non-profits, and educational institutions to track and manage resources according to legal or donor restrictions, emphasizing accountability over profitability. Accrual accounting is widely applied in the private sector, including corporations and businesses, to record revenues and expenses when they are incurred, providing a more accurate financial position. Each method aligns with sector-specific reporting requirements and stakeholder needs, ensuring relevant financial transparency and compliance.

Recognition of Revenues and Expenses

In fund accounting, revenues and expenses are recognized based on the specific fund's purpose and constraints, emphasizing accountability and compliance rather than profitability. Accrual accounting records revenues when earned and expenses when incurred, regardless of cash flow, providing a comprehensive view of financial performance. This distinction ensures fund accounting prioritizes legal restrictions, while accrual accounting focuses on economic events.

Reporting Standards and Compliance

Fund accounting emphasizes accountability by segregating resources into funds according to legal or donor restrictions, adhering to standards like GASB for governmental entities. Accrual accounting recognizes revenues and expenses when they occur, following frameworks such as GAAP or IFRS for comprehensive financial reporting. Compliance in fund accounting ensures transparency in restricted fund usage, while accrual accounting compliance supports accurate performance measurement and financial position disclosure.

Financial Statement Presentation

Fund accounting presents financial resources categorized by purpose, emphasizing accountability and restrictions in governmental and nonprofit organizations, with separate fund statements highlighting sources and uses of funds. Accrual accounting records revenues and expenses when they are earned or incurred, regardless of cash flow timing, providing a comprehensive view of financial performance and position through accrual-based financial statements. Fund accounting financial presentations focus on fund balances and compliance, while accrual accounting emphasizes net income and changes in financial position on comprehensive financial statements.

Advantages and Disadvantages

Fund accounting enhances fiscal accountability by segregating resources according to legal restrictions, making it ideal for government and nonprofit organizations, but it lacks the comprehensive financial picture provided by accrual accounting. Accrual accounting offers a more accurate reflection of an entity's financial position by recognizing revenues and expenses when incurred, supporting better decision-making and financial analysis, yet it can be complex to implement and may require more advanced accounting expertise. The choice depends on organizational goals: fund accounting excels in transparency and compliance with external restrictions, while accrual accounting supports strategic planning and performance measurement through detailed financial insight.

Selecting the Right Accounting Method

Selecting the right accounting method depends on organizational goals and regulatory requirements, with fund accounting providing transparency for non-profit entities by tracking resources based on restrictions and purposes. In contrast, accrual accounting offers a comprehensive view of financial performance by recognizing revenues and expenses when they are incurred, making it ideal for businesses focused on long-term financial health. Careful evaluation of financial reporting needs and compliance obligations ensures the chosen method aligns with strategic objectives.

Important Terms

Encumbrance Accounting

Encumbrance accounting in fund accounting involves reserving budgeted funds to ensure spending stays within appropriations, enhancing fiscal control by tracking commitments before actual expenses occur. Unlike accrual accounting, which records revenues and expenses when earned or incurred, encumbrance accounting focuses on budgetary compliance and fund availability, supporting government and non-profit financial management.

Modified Accrual Basis

Modified accrual basis accounting, predominantly used in governmental fund accounting, recognizes revenues when they become both measurable and available, but expenditures are recorded when liabilities are incurred, blending elements of cash and accrual methods. This contrasts with full accrual accounting applied in proprietary funds, where transactions are recorded when earned or incurred, providing a comprehensive view of financial position and performance.

Governmental Funds

Governmental funds use modified accrual accounting focusing on current financial resources, recognizing revenues when measurable and available, and expenditures when liabilities are incurred; this contrasts with accrual accounting in proprietary funds, which records revenues and expenses when earned or incurred regardless of cash flow. Fund accounting in governmental funds emphasizes accountability and budget compliance by tracking restricted, committed, and assigned resources within specific funds.

Enterprise Funds

Enterprise Funds in fund accounting focus on measuring financial performance and position using the accrual basis, recording revenues when earned and expenses when incurred to provide a complete economic picture. Unlike cash-based fund accounting, this approach aligns with accrual accounting principles, supporting long-term asset management and liability recognition within governmental entities.

Revenue Recognition

Revenue recognition in fund accounting focuses on the measurement of financial resources available and restricted, emphasizing the timing of cash inflows and outflows within governmental or nonprofit fund structures. In contrast, accrual accounting recognizes revenue when earned, regardless of cash receipt, ensuring alignment with matching expenses to reflect the true financial performance and position of the entity.

Interfund Transfers

Interfund transfers in fund accounting represent the movement of resources between governmental funds to ensure compliance with legal restrictions and budgetary control, recorded as interfund receivables and payables without affecting overall net assets. In accrual accounting, these transfers are recognized as revenues and expenditures or expenses in the respective funds, reflecting economic events when earned or incurred, supporting a comprehensive view of financial performance and position.

Fund Financial Statements

Fund financial statements provide detailed insights into the financial position and performance of governmental and nonprofit entities by segregating resources into legally restricted funds, aligning with fund accounting principles. Unlike accrual accounting, which records revenues and expenses when they are earned or incurred regardless of cash flow timing, fund accounting emphasizes accountability and compliance by focusing on current financial resources and budgetary constraints.

Expenditure Recognition

Expenditure recognition in fund accounting occurs when cash is disbursed or liabilities are incurred, emphasizing budgetary control and fiscal accountability, whereas accrual accounting recognizes expenditures when they are incurred regardless of cash flow, focusing on matching expenses with related revenues. This difference affects financial reporting, with fund accounting providing a cash-based perspective ideal for governmental and nonprofit organizations, while accrual accounting offers a comprehensive view of financial position and performance for businesses.

Restricted Assets

Restricted assets in fund accounting refer to resources legally or contractually designated for specific purposes, ensuring compliance with donor or grant restrictions, while in accrual accounting, these assets are recognized as liabilities or deferred inflows until the related conditions are met, reflecting more precise matching of revenues and expenses. Fund accounting focuses on accountability and segregating resources, whereas accrual accounting emphasizes comprehensive financial position and performance reporting.

Statement of Net Position

Statement of Net Position in fund accounting focuses on financial resources by reporting assets, liabilities, and fund balances restricted to specific purposes, capturing short-term fiscal accountability. Accrual accounting presents a comprehensive view of all economic resources, recognizing revenues and expenses when incurred, thus providing a full picture of an entity's financial health and net assets.

fund accounting vs accrual accounting Infographic

moneydif.com

moneydif.com