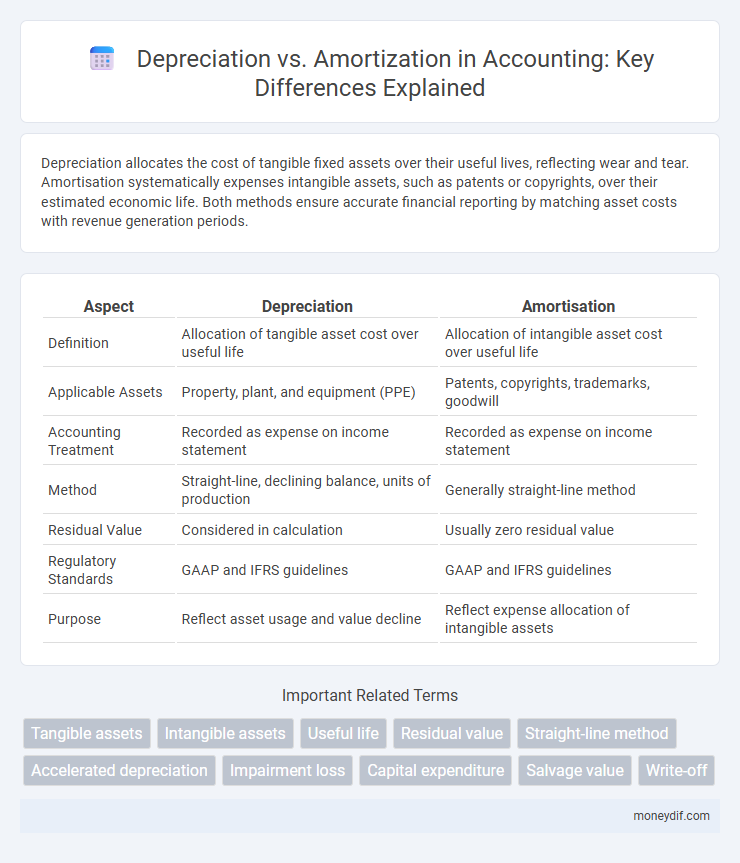

Depreciation allocates the cost of tangible fixed assets over their useful lives, reflecting wear and tear. Amortisation systematically expenses intangible assets, such as patents or copyrights, over their estimated economic life. Both methods ensure accurate financial reporting by matching asset costs with revenue generation periods.

Table of Comparison

| Aspect | Depreciation | Amortisation |

|---|---|---|

| Definition | Allocation of tangible asset cost over useful life | Allocation of intangible asset cost over useful life |

| Applicable Assets | Property, plant, and equipment (PPE) | Patents, copyrights, trademarks, goodwill |

| Accounting Treatment | Recorded as expense on income statement | Recorded as expense on income statement |

| Method | Straight-line, declining balance, units of production | Generally straight-line method |

| Residual Value | Considered in calculation | Usually zero residual value |

| Regulatory Standards | GAAP and IFRS guidelines | GAAP and IFRS guidelines |

| Purpose | Reflect asset usage and value decline | Reflect expense allocation of intangible assets |

Definition of Depreciation and Amortisation

Depreciation refers to the systematic allocation of the cost of tangible fixed assets, such as machinery and buildings, over their useful lives to reflect wear and tear or obsolescence. Amortisation involves the gradual write-off of intangible assets, like patents, copyrights, and trademarks, spreading their cost over the estimated period of economic benefit. Both methods ensure accurate matching of expenses to revenue periods, enhancing financial statement reliability.

Key Differences Between Depreciation and Amortisation

Depreciation applies to tangible fixed assets like machinery and buildings, while amortisation is related to intangible assets such as patents and copyrights. Depreciation expense is calculated using methods like straight-line or reducing balance, whereas amortisation typically uses the straight-line method over the asset's useful life. The treatment of residual value also differs: depreciation often accounts for salvage value, but amortisation generally assumes no residual value at the end of the asset's useful life.

Types of Assets: Tangible vs Intangible

Depreciation applies to tangible assets such as machinery, vehicles, and buildings, reflecting the wear and tear or obsolescence over time. Amortisation relates to intangible assets like patents, trademarks, and copyrights, allocating the cost over the asset's useful life. Understanding these distinctions helps in accurate financial reporting and asset management.

Methods of Calculating Depreciation

Depreciation methods include straight-line, declining balance, and units of production, each allocating asset cost over its useful life based on usage or time. Straight-line depreciation divides the asset's cost evenly across its estimated useful life, while declining balance applies a fixed percentage to the decreasing book value annually. The units of production method ties depreciation expense directly to asset activity, recording higher expenses in periods of greater use.

Methods of Calculating Amortisation

Methods of calculating amortisation primarily include the straight-line method, where the asset's cost is evenly allocated over its useful life, and the reducing balance method, which applies a fixed percentage to the diminishing book value. Another approach is the sum-of-the-years'-digits method, accelerating expense recognition at the start of the asset's life. These methods impact financial statements by systematically reducing intangible asset values and matching expenses with revenues.

Impact on Financial Statements

Depreciation reduces the value of tangible fixed assets on the balance sheet while allocating expense over their useful life, directly decreasing net income on the income statement. Amortization functions similarly for intangible assets, systematically expensing costs associated with patents, trademarks, or goodwill, impacting both the balance sheet and income statement. Both processes enhance financial reporting accuracy by matching asset costs with related revenues, influencing tax liabilities and investor evaluations.

Accounting Standards and Regulatory Guidelines

Depreciation and amortisation are governed by specific accounting standards such as IAS 16 for property, plant, and equipment, and IAS 38 for intangible assets under IFRS. Regulatory guidelines require systematic allocation of the depreciable or amortisable amount over the asset's useful life consistent with the matching principle. Compliance with standards like US GAAP ASC Topic 360 for depreciation ensures accurate financial reporting and asset valuation.

Tax Implications: Depreciation vs Amortisation

Depreciation allows businesses to allocate the cost of tangible assets over their useful life, reducing taxable income through annual deductions, while amortisation applies to intangible assets and follows similar tax deduction principles. Tax authorities often have specific guidelines on the rates and methods permissible for depreciation and amortisation, affecting the timing and amount of tax benefits. Understanding these differences is crucial for optimizing tax liabilities and financial reporting accuracy.

Common Mistakes in Applying Depreciation and Amortisation

Common mistakes in applying depreciation and amortisation include incorrectly classifying assets, leading to the wrong method or useful life being used. Failing to review and adjust asset useful lives periodically results in inaccurate expense recognition and financial statements. Another frequent error is not distinguishing between tangible assets for depreciation and intangible assets for amortisation, causing compliance issues with accounting standards.

Best Practices for Recording and Reporting Depreciation and Amortisation

Best practices for recording and reporting depreciation and amortisation include consistently applying the chosen method, such as straight-line or declining balance, to ensure accurate asset valuation. Maintaining detailed schedules for both depreciation of tangible assets and amortisation of intangible assets supports transparent financial reporting and compliance with accounting standards like GAAP or IFRS. Regularly reviewing asset useful lives and salvage values prevents misstated expenses, enhancing the reliability of financial statements.

Important Terms

Tangible assets

Tangible assets such as machinery, buildings, and vehicles undergo depreciation, which systematically allocates their cost over useful life to reflect wear and tear. Amortisation applies to intangible assets like patents and trademarks, spreading their expense over the period they generate economic benefits.

Intangible assets

Intangible assets, such as patents, trademarks, and copyrights, undergo amortization instead of depreciation because they lack physical substance and have finite useful lives. Amortization systematically allocates the cost of these intangible assets over their estimated useful life, contrasting with depreciation, which applies to tangible fixed assets like machinery and buildings.

Useful life

Useful life represents the estimated duration an asset is expected to generate economic benefits, directly impacting depreciation for tangible assets and amortization for intangible assets. Depreciation systematically allocates the cost of physical assets such as machinery over their useful life, while amortization applies to intangible assets like patents and copyrights, reflecting their consumption of value over time.

Residual value

Residual value is the estimated amount an asset is expected to be worth at the end of its useful life, playing a critical role in calculating depreciation, which systematically allocates the asset's cost minus residual value over its useful life. In contrast, amortization typically applies to intangible assets without residual value, spreading the cost evenly over their useful life without considering salvage value.

Straight-line method

The straight-line method evenly allocates an asset's cost over its useful life, commonly applied to tangible assets for depreciation and intangible assets for amortization. This approach ensures consistent expense recognition, reflecting gradual loss of value for both physical property and intangible rights.

Accelerated depreciation

Accelerated depreciation allows faster cost recovery of tangible assets compared to straight-line methods, enhancing tax benefits by front-loading expense recognition. Unlike amortisation, which systematically allocates the cost of intangible assets over their useful life, accelerated depreciation applies exclusively to physical assets such as machinery and equipment.

Impairment loss

Impairment loss occurs when the carrying amount of an asset exceeds its recoverable amount, impacting both depreciation for tangible fixed assets and amortisation for intangible assets. This loss requires an immediate write-down, reducing the asset's book value on the balance sheet and is separate from routine depreciation or amortisation expenses.

Capital expenditure

Capital expenditure (CapEx) refers to funds used by a company to acquire or upgrade physical assets such as property, plant, and equipment, which are then depreciated over their useful life to allocate the asset's cost systematically. In contrast, amortization applies to intangible assets like patents or trademarks, spreading their expense over time to match the asset's revenue-generating period.

Salvage value

Salvage value represents the estimated residual worth of a tangible asset after its useful life and is primarily used in calculating depreciation, whereas amortisation deals with intangible assets and typically does not involve salvage value. In depreciation schedules, salvage value reduces the depreciable base, while amortisation spreads the cost of intangible assets evenly without consideration for a residual amount.

Write-off

Write-off involves removing an asset's carrying value from the balance sheet due to obsolescence or impairment, distinct from depreciation which allocates the cost of tangible assets over their useful life, and amortization which similarly allocates the cost of intangible assets. Unlike systematic depreciation or amortization, write-offs reflect immediate recognition of loss when the asset's value is deemed unrecoverable.

depreciation vs amortisation Infographic

moneydif.com

moneydif.com