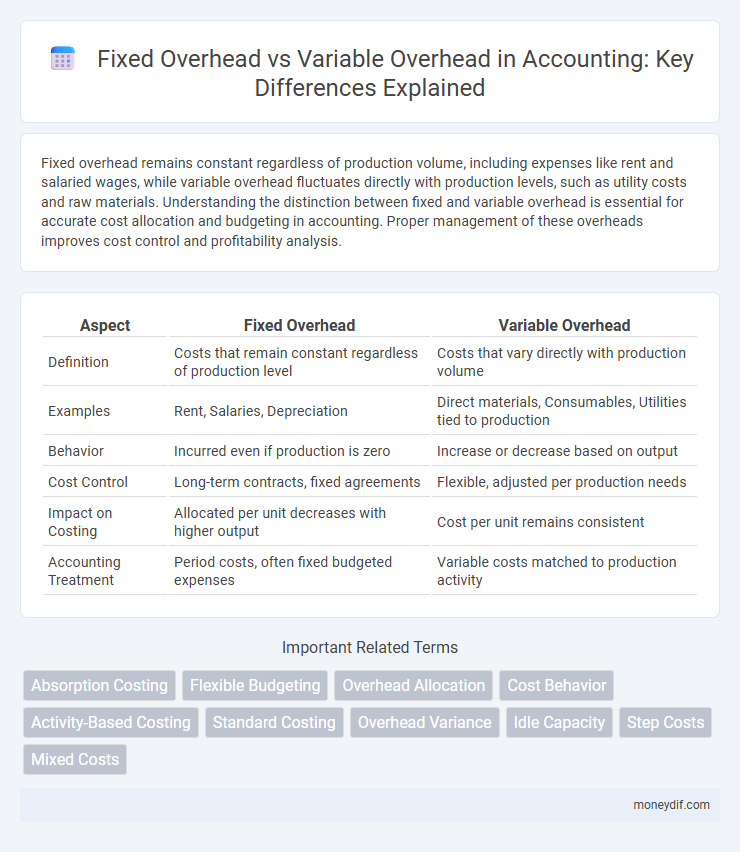

Fixed overhead remains constant regardless of production volume, including expenses like rent and salaried wages, while variable overhead fluctuates directly with production levels, such as utility costs and raw materials. Understanding the distinction between fixed and variable overhead is essential for accurate cost allocation and budgeting in accounting. Proper management of these overheads improves cost control and profitability analysis.

Table of Comparison

| Aspect | Fixed Overhead | Variable Overhead |

|---|---|---|

| Definition | Costs that remain constant regardless of production level | Costs that vary directly with production volume |

| Examples | Rent, Salaries, Depreciation | Direct materials, Consumables, Utilities tied to production |

| Behavior | Incurred even if production is zero | Increase or decrease based on output |

| Cost Control | Long-term contracts, fixed agreements | Flexible, adjusted per production needs |

| Impact on Costing | Allocated per unit decreases with higher output | Cost per unit remains consistent |

| Accounting Treatment | Period costs, often fixed budgeted expenses | Variable costs matched to production activity |

Understanding Fixed Overhead in Accounting

Fixed overhead in accounting refers to business expenses that remain constant regardless of production volume, such as rent, salaries, and depreciation. These costs are crucial for budgeting and cost control because they do not fluctuate with changes in output, making it easier to predict financial performance. Understanding fixed overhead helps managers allocate costs accurately and set pricing strategies that ensure profitability.

Defining Variable Overhead Costs

Variable overhead costs fluctuate directly with production levels, encompassing expenses such as indirect materials, indirect labor, and utility costs tied to manufacturing activities. Unlike fixed overhead, which remains constant regardless of output, variable overhead adjusts proportionally to changes in production volume. Accurately tracking variable overhead is crucial for precise product costing and effective budgeting in cost accounting.

Key Differences Between Fixed and Variable Overheads

Fixed overhead costs remain constant regardless of production volume, including expenses such as rent, salaries of permanent staff, and depreciation of equipment. Variable overhead costs fluctuate directly with production levels, encompassing expenditures like indirect materials, utilities, and maintenance associated with machinery usage. Understanding the distinction between fixed and variable overhead is crucial for accurate budgeting, cost control, and pricing strategies in accounting.

Examples of Fixed Overhead Expenses

Fixed overhead expenses in accounting include costs such as rent for factory buildings, salaried employees' wages, and insurance premiums that remain constant regardless of production levels. Depreciation on manufacturing equipment and property taxes are also typical fixed overheads, as they do not fluctuate with output volume. These expenses contrast with variable overheads, which change in direct proportion to production activity.

Common Variable Overhead Cost Categories

Common variable overhead cost categories in accounting typically include indirect materials, indirect labor, and utility expenses that fluctuate with production levels. These costs vary directly with the volume of goods or services produced, such as power consumption for machinery and maintenance supplies. Proper allocation of variable overhead is critical for accurate product costing and financial analysis.

Impact of Overhead Types on Profit Margins

Fixed overhead costs, such as rent and salaries, remain constant regardless of production volume, causing profit margins to fluctuate more significantly with changes in sales. Variable overhead costs, including utilities and direct materials, increase proportionally with production levels, allowing for more predictable profit margins as costs align closely with revenue. Understanding the balance between fixed and variable overhead is crucial for accurate budgeting, cost control, and maximizing profitability in accounting.

Fixed vs Variable Overhead in Budget Planning

Fixed overhead in budget planning consists of consistent costs such as rent, salaries, and insurance that remain stable regardless of production levels, allowing predictable financial forecasting. Variable overhead fluctuates with production volume, including expenses like utilities and indirect materials, necessitating flexible budget adjustments to accurately control costs. Understanding the distinction between fixed and variable overhead enables more precise budget allocation, enhances cost management, and improves profitability analysis.

Allocation Methods for Overhead Costs

Fixed overhead allocation methods often use predetermined rates based on estimated activity levels such as machine hours or labor hours to assign costs consistently across periods. Variable overhead is typically allocated using flexible budgeting techniques that adjust according to actual production volume, ensuring cost alignment with operational efficiency. Activity-based costing (ABC) provides a refined approach by tracing overhead costs to specific activities, improving accuracy in both fixed and variable overhead allocation.

Overhead Analysis for Managerial Decision-Making

Fixed overhead remains constant regardless of production levels, providing stability in cost forecasting, while variable overhead fluctuates directly with activity volume, impacting cost control strategies. Analyzing the behavior of these overheads enables managers to allocate resources efficiently and make informed pricing, budgeting, and production decisions. Effective overhead analysis supports cost-volume-profit assessment, enhancing managerial decision-making by identifying which costs are controllable and which contribute to operational leverage.

Strategies to Control Overhead Costs

Implementing activity-based costing can sharpen the accuracy of fixed overhead allocations, enabling targeted cost control efforts. Leveraging technology and automation reduces variable overhead by streamlining repetitive tasks and improving operational efficiency. Regular variance analysis helps identify discrepancies in overhead costs, facilitating timely adjustments to budget and resource allocation strategies.

Important Terms

Absorption Costing

Absorption costing allocates both fixed overhead and variable overhead to product costs, ensuring all manufacturing expenses are included in inventory valuation. Fixed overhead is spread across units produced, affecting per-unit cost, while variable overhead varies directly with production volume, impacting cost behavior analysis.

Flexible Budgeting

Flexible budgeting adjusts costs based on actual activity levels, segregating fixed overhead--which remains constant regardless of production volume--and variable overhead, which fluctuates proportionally with output. This budgeting approach enhances cost control and performance evaluation by accurately reflecting overhead behavior under different operational scenarios.

Overhead Allocation

Overhead allocation involves distributing fixed overhead costs, such as rent and salaries, evenly across units of production regardless of output levels, while variable overhead fluctuates with production volume, including expenses like utilities and indirect materials. Accurate allocation between fixed and variable overhead improves cost control, pricing strategies, and profitability analysis.

Cost Behavior

Fixed overhead costs remain constant regardless of production volume, including expenses like rent and salaries, while variable overhead costs fluctuate proportionally to output, such as utilities and indirect materials. Understanding cost behavior is essential for budgeting, forecasting, and analyzing the impact of production changes on overall manufacturing expenses.

Activity-Based Costing

Activity-Based Costing (ABC) allocates fixed overhead costs to products based on activities that drive resource consumption, providing more accurate cost information compared to traditional methods that often assign fixed overhead using a single volume-based driver. Variable overhead costs are traced directly to activities, allowing ABC to differentiate between fixed and variable costs for more precise product costing and improved decision-making.

Standard Costing

Standard costing allocates fixed overhead based on predetermined rates tied to expected production levels, ensuring consistent cost control, while variable overhead is assigned proportionally to actual activity, reflecting real-time changes in resource usage. This distinction aids in variance analysis, with fixed overhead variances highlighting efficiency and spending deviations, and variable overhead variances pinpointing activity level and rate differences.

Overhead Variance

Overhead variance analyzes the difference between actual and budgeted overhead costs, separating fixed overhead, which remains constant regardless of production volume, from variable overhead, which fluctuates with production levels. Understanding fixed overhead variance helps monitor spending on rent or salaries, while variable overhead variance focuses on indirect costs tied to manufacturing activity, such as utilities or materials.

Idle Capacity

Idle capacity occurs when fixed overhead costs remain constant despite underutilization of production resources, leading to higher per-unit fixed overhead expenses. Variable overhead, by contrast, fluctuates directly with production volume, so idle capacity does not impact these costs as significantly.

Step Costs

Step costs are expenses that remain fixed over a range of production but increase in discrete increments when activity surpasses certain thresholds, bridging the characteristics of fixed overhead and variable overhead. Unlike fixed overhead, which stays constant regardless of production volume, step costs rise abruptly at specific capacity levels, and unlike variable overhead, they do not change continuously with each unit produced.

Mixed Costs

Mixed costs combine fixed overhead, which remains constant regardless of production volume, with variable overhead that fluctuates directly with activity levels; accurately separating these components is essential for effective cost control and budgeting. Analyzing mixed costs through methods like the high-low technique or regression analysis enables better forecasting and decision-making by isolating fixed overhead's stability from the variability of overhead driven by production changes.

fixed overhead vs variable overhead Infographic

moneydif.com

moneydif.com