Impairment in accounting refers to a sudden decline in the recoverable amount of an asset below its carrying value, necessitating a write-down to reflect its diminished worth. Obsolescence occurs when an asset becomes outdated or no longer useful due to technological advances or market changes, leading to a decrease in its value over time. Both impairment and obsolescence require adjustments to asset values but differ in their causes and timing.

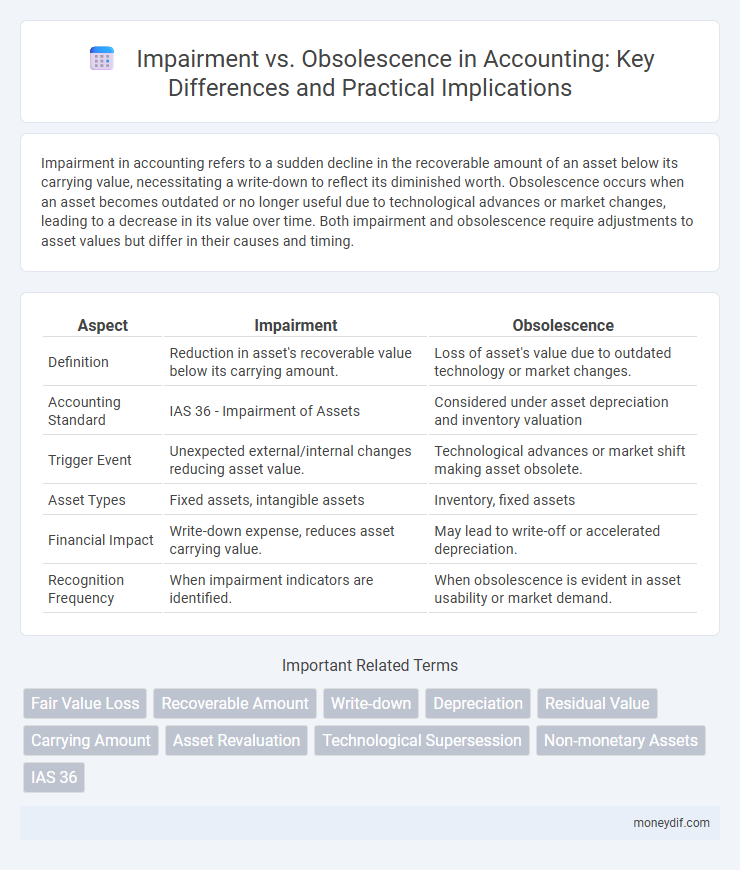

Table of Comparison

| Aspect | Impairment | Obsolescence |

|---|---|---|

| Definition | Reduction in asset's recoverable value below its carrying amount. | Loss of asset's value due to outdated technology or market changes. |

| Accounting Standard | IAS 36 - Impairment of Assets | Considered under asset depreciation and inventory valuation |

| Trigger Event | Unexpected external/internal changes reducing asset value. | Technological advances or market shift making asset obsolete. |

| Asset Types | Fixed assets, intangible assets | Inventory, fixed assets |

| Financial Impact | Write-down expense, reduces asset carrying value. | May lead to write-off or accelerated depreciation. |

| Recognition Frequency | When impairment indicators are identified. | When obsolescence is evident in asset usability or market demand. |

Definition of Impairment in Accounting

Impairment in accounting refers to a permanent reduction in the recoverable amount of a fixed asset below its carrying value on the balance sheet. It occurs when the asset's market value, usage capability, or future cash flows decline significantly due to damage, technological changes, or market conditions. Recognizing impairment ensures financial statements accurately reflect the asset's diminished economic value.

Understanding Obsolescence in Financial Reporting

Obsolescence in financial reporting refers to the reduction in the value of an asset due to technological advancements, market changes, or product life cycle decline, impacting its utility and profitability. Unlike impairment, which indicates a sudden decline in asset value, obsolescence is often a gradual process that requires continuous assessment to ensure accurate asset valuation. Proper recognition of obsolescence affects depreciation methods and helps maintain compliance with accounting standards such as IAS 36 and ASC 360.

Key Differences Between Impairment and Obsolescence

Impairment refers to a permanent reduction in the recoverable amount of an asset below its carrying value, often triggered by external events or changes in market conditions. Obsolescence occurs when an asset becomes outdated or no longer useful due to technological advancements or market shifts, leading to diminished value. The key difference lies in impairment being related to asset value decline captured through impairment tests, while obsolescence is a cause or condition that may lead to impairment or depreciation adjustments.

Causes of Asset Impairment

Asset impairment arises primarily from unexpected events such as physical damage, legal changes, or significant declines in market value that reduce an asset's recoverable amount below its carrying value. Technological advancements, market shifts, and economic downturns also drive asset impairment by diminishing future cash flows or usefulness. Obsolescence specifically relates to assets becoming outdated due to innovation or market preferences, contributing to impairment when the asset no longer generates expected economic benefits.

Factors Leading to Obsolescence of Assets

Factors leading to obsolescence of assets include technological advancements that render equipment outdated, shifts in market demand reducing the utility of products, and regulatory changes imposing new standards or restrictions. Physical wear and tear combined with the inability to upgrade existing assets also contribute significantly to obsolescence. Companies must regularly assess these factors to accurately value their assets and recognize impairment losses.

Recognition and Measurement of Impairment Losses

Impairment losses are recognized when the carrying amount of an asset exceeds its recoverable amount, which is the higher of fair value less costs of disposal and value in use. Measurement of impairment involves estimating future cash flows discounted at the asset's original effective interest rate to determine value in use. Obsolescence affects asset valuation indirectly by decreasing expected future benefits, potentially triggering impairment recognition if recoverable amount falls below carrying value.

Accounting Treatment for Obsolete Inventory

Accounting treatment for obsolete inventory involves writing down the inventory to its net realizable value, reflecting its reduced usefulness or marketability. This write-down is recorded as an expense in the income statement, impacting profit margins directly. Inventory obsolescence is monitored through regular reviews and adjustments in inventory valuation methods to ensure accurate financial reporting.

Impact on Financial Statements: Impairment vs. Obsolescence

Impairment results in a direct write-down of asset value on the balance sheet, reducing the carrying amount to its recoverable amount and leading to a corresponding loss on the income statement. Obsolescence affects inventory valuation, requiring companies to write down inventory to net realizable value, which impacts cost of goods sold and reduces gross profit margins. Both impairment and obsolescence lower asset values but differ in timing and type of assets affected, influencing financial ratios and stakeholders' perception of financial health.

Disclosure Requirements for Impairment and Obsolescence

Disclosure requirements for impairment and obsolescence in accounting mandate that companies clearly report the nature and amount of asset write-downs in financial statements. Entities must disclose the circumstances leading to impairment or obsolescence, the method of measurement, and the carrying amounts before and after the write-down. Detailed notes should also include the impact on profitability and any changes in assumptions affecting the estimates.

Best Practices to Prevent Asset Impairment and Obsolescence

Implementing regular asset valuations and monitoring technological advancements are critical best practices to prevent asset impairment and obsolescence. Establishing a robust asset management system with periodic reviews ensures early identification of potential value declines and operational inefficiencies. Integrating cross-departmental communication between finance, operations, and IT enhances proactive decision-making to maintain asset relevance and optimize financial reporting accuracy.

Important Terms

Fair Value Loss

Fair value loss due to impairment occurs when an asset's recoverable amount falls below its carrying value, reflecting a decline in expected economic benefits, while obsolescence specifically refers to the loss in asset value caused by technological or market changes rendering the asset outdated. Both impairment and obsolescence require recognition of fair value loss to accurately reflect the asset's diminished utility and recoverable value on financial statements.

Recoverable Amount

The recoverable amount represents the higher of an asset's fair value less costs to sell and its value in use, serving as a critical benchmark in impairment testing to determine if the asset's carrying amount exceeds this threshold. Unlike obsolescence, which refers to the asset's loss of utility due to technological advancements or market changes, impairment specifically measures the asset's recoverable amount to identify a decline in its economic value.

Write-down

A write-down occurs when the carrying value of an asset is reduced due to impairment, reflecting a permanent decline in its recoverable amount below the book value. Obsolescence, a form of impairment, specifically relates to assets losing value because they become outdated or no longer useful, necessitating a write-down to align the asset's value with its diminished utility.

Depreciation

Depreciation systematically allocates the cost of tangible assets over their useful lives, whereas impairment reflects a sudden decline in asset value due to unexpected events, and obsolescence occurs when assets lose utility or market value because of technological advancements or changes in market demand. Understanding the distinction between impairment and obsolescence is crucial for accurate financial reporting and asset valuation.

Residual Value

Residual value represents the estimated remaining worth of an asset after depreciation, playing a crucial role in impairment assessments by determining if an asset's carrying amount exceeds its recoverable amount. Obsolescence, often driven by technological advancements or market changes, can significantly reduce residual value, triggering impairment losses when the asset's future economic benefits decline.

Carrying Amount

The carrying amount reflects an asset's book value after accounting for accumulated depreciation and impairment losses, which reduce its recoverable amount due to physical damage or diminished market value. Obsolescence, often driven by technological advancements or market shifts, impacts carrying amount by necessitating impairment recognition when the asset's utility or economic benefits decline below its recorded value.

Asset Revaluation

Asset revaluation involves adjusting the book value of assets to reflect their current market value, often impacting the financial statements by recognizing impairment losses when the recoverable amount falls below the carrying value. Unlike obsolescence, which refers to the decline in asset usefulness due to technological advancements or market changes, impairment focuses on evidence-based reductions in asset value from market or physical damages.

Technological Supersession

Technological supersession occurs when new innovations replace existing technologies, leading to impairment by reducing an asset's utility or revenue-generating ability, unlike obsolescence which often reflects a gradual decline in value due to market or regulatory changes rather than direct technological replacement. This distinction helps firms accurately assess asset impairments under accounting standards like IAS 36, ensuring financial statements reflect true economic conditions.

Non-monetary Assets

Non-monetary assets, including property, plant, and equipment, are subject to impairment when their carrying amount exceeds recoverable value, reflecting a permanent decline in asset utility or market value. Obsolescence specifically relates to technological or functional redundancy, which can accelerate impairment recognition by reducing future economic benefits.

IAS 36

IAS 36 mandates that impairment tests assess an asset's recoverable amount to recognize impairment losses when carrying amounts exceed recoverable amounts, whereas obsolescence relates to physical or technological factors that may trigger such impairment. Impairment under IAS 36 requires quantitative evaluation, while obsolescence often signals the need for that impairment review due to asset value decline.

impairment vs obsolescence Infographic

moneydif.com

moneydif.com