Impairment occurs when the recoverable amount of an asset falls below its carrying value, requiring a reduction to reflect diminished value on the balance sheet. Write-off is the complete removal of an asset's carrying amount when it is deemed unrecoverable or obsolete, directly impacting the income statement by recognizing a loss. Understanding the distinction between impairment and write-off is crucial for accurate financial reporting and compliance with accounting standards.

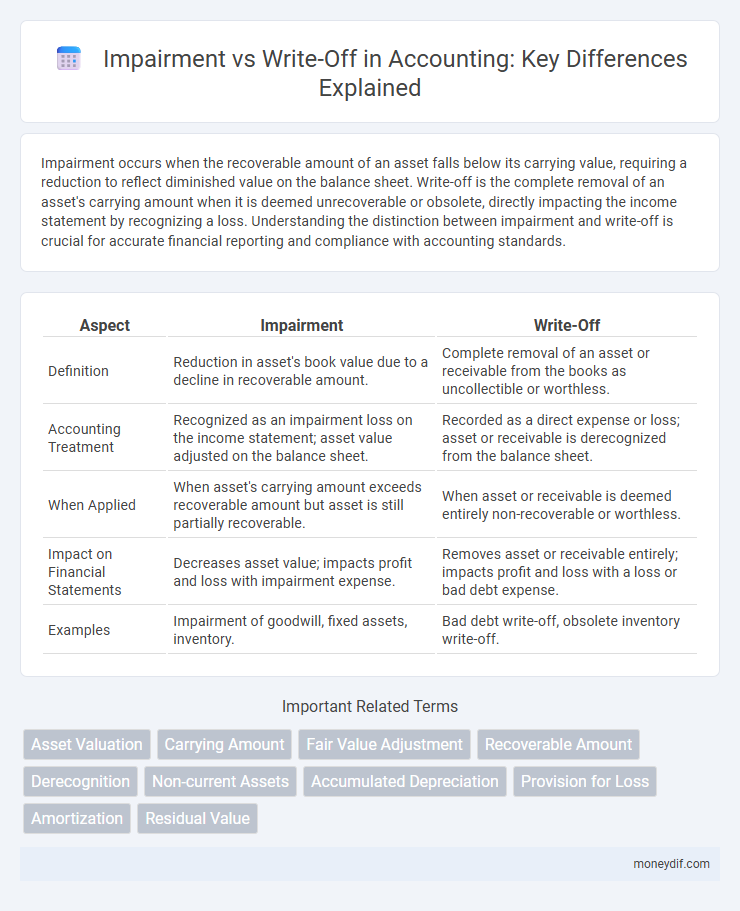

Table of Comparison

| Aspect | Impairment | Write-Off |

|---|---|---|

| Definition | Reduction in asset's book value due to a decline in recoverable amount. | Complete removal of an asset or receivable from the books as uncollectible or worthless. |

| Accounting Treatment | Recognized as an impairment loss on the income statement; asset value adjusted on the balance sheet. | Recorded as a direct expense or loss; asset or receivable is derecognized from the balance sheet. |

| When Applied | When asset's carrying amount exceeds recoverable amount but asset is still partially recoverable. | When asset or receivable is deemed entirely non-recoverable or worthless. |

| Impact on Financial Statements | Decreases asset value; impacts profit and loss with impairment expense. | Removes asset or receivable entirely; impacts profit and loss with a loss or bad debt expense. |

| Examples | Impairment of goodwill, fixed assets, inventory. | Bad debt write-off, obsolete inventory write-off. |

Understanding Impairment in Accounting

Impairment in accounting occurs when the carrying amount of an asset exceeds its recoverable amount, indicating a decline in its value that is not expected to be temporary. It requires recognizing an impairment loss to reduce the asset's book value on the balance sheet, reflecting a more accurate financial position. Unlike a write-off, which completely removes an asset from the records, impairment adjustments allow for partial value reductions while keeping the asset recorded.

What is a Write-Off?

A write-off in accounting refers to the formal recognition that an asset no longer holds value and is removed from the company's balance sheet. It typically occurs when the asset is deemed uncollectible or obsolete, resulting in a direct reduction of net income. Write-offs differ from impairments as they fully eliminate the asset's value rather than partially reducing it.

Key Differences: Impairment vs Write-Off

Impairment in accounting refers to the recognition of a permanent reduction in the recoverable value of an asset, necessitating an adjustment to its carrying amount on the balance sheet, while a write-off completely removes the asset's value due to its irrecoverability. An impairment loss indicates diminished future economic benefits expected from the asset, whereas a write-off signals the asset no longer holds any economic benefit or value to the company. Key differences include timing, with impairment being an interim step when value decline is identified, and write-off representing the final disposal of the asset from financial records.

Recognition Criteria for Impairment

Recognition criteria for impairment require an asset's carrying amount to exceed its recoverable amount, which is the higher of its fair value less costs to sell and its value in use. Indicators of impairment include significant declines in market value, adverse changes in the business environment, or evidence of obsolescence or physical damage. An impairment loss is recognized when these conditions demonstrate that the asset's recoverable amount is lower than its carrying value.

When Does a Write-Off Occur?

A write-off occurs when an asset's value is fully deemed uncollectible or worthless, requiring complete removal from the accounting records. This typically happens after all recovery efforts have failed, such as in cases of bad debts or obsolete inventory. Unlike impairment, which recognizes a partial loss in value, a write-off reflects a total loss and directly impacts the financial statements.

Accounting Standards: Impairment and Write-Off

Accounting standards such as IFRS and US GAAP provide specific guidance on impairment and write-off procedures, requiring entities to assess asset recoverability regularly. Impairment involves recognizing a loss when an asset's carrying amount exceeds its recoverable amount, whereas a write-off completely removes an asset when recovery is deemed impossible. Proper application of these standards ensures accurate financial reporting and compliance with regulatory frameworks.

Impact on Financial Statements

Impairment reduces the carrying amount of an asset on the balance sheet to reflect its recoverable value, resulting in an impairment loss that decreases net income on the income statement. A write-off completely eliminates the asset's book value, often indicating it has no future economic benefit, which immediately impacts both the balance sheet and the profit and loss statement. Both processes affect asset valuations and profitability metrics, influencing key financial ratios such as return on assets and equity.

Common Examples of Impairment and Write-Off

Common examples of impairment in accounting include reduced asset value due to physical damage, obsolescence, or market decline, such as machinery losing value from wear and tear. Write-offs frequently occur when receivables become uncollectible due to customer bankruptcy or prolonged nonpayment, leading to direct removal from accounts. Inventory write-offs happen when goods are spoiled, obsolete, or damaged, requiring adjustment to accurate financial values.

Disclosure Requirements and Reporting

Impairment requires detailed disclosure of the asset's carrying amount, the impairment loss recognized, and the basis for determining recoverable amount according to IAS 36. Write-offs must be reported by removing the asset from the balance sheet and disclosing the write-off amount and reason in financial statements under IFRS guidelines. Transparent reporting ensures compliance with accounting standards and provides stakeholders with clear insight into the financial impact of asset devaluation.

Best Practices for Managing Impairment and Write-Off

Implementing robust impairment and write-off policies involves regular asset reviews and accurate valuation adjustments to reflect true financial positions. Leveraging automated accounting software enhances the identification of impaired assets and ensures timely recognition of write-offs, reducing the risk of misstated financial statements. Consistent documentation and adherence to IFRS or GAAP guidelines support transparency and compliance in financial reporting.

Important Terms

Asset Valuation

Asset valuation involves assessing recoverable value to identify impairment losses that reduce book value without immediate full write-off, which eliminates the asset entirely from financial statements.

Carrying Amount

Carrying amount represents the asset's book value and is reduced by impairment losses when its recoverable amount falls below carrying amount, whereas a write-off completely eliminates the asset's carrying amount due to irrecoverable loss.

Fair Value Adjustment

Fair Value Adjustment reflects the change in an asset's value compared to its original cost, while impairment recognizes a significant and permanent decline in asset value, and write-off eliminates the asset entirely from the financial statements.

Recoverable Amount

Recoverable Amount represents the higher of an asset's fair value less costs to sell and its value in use, serving as a critical benchmark for impairment testing to determine if an asset's carrying amount exceeds what can be recovered. Write-offs occur when assets are deemed unrecoverable and removed from the balance sheet, reflecting a complete loss, whereas impairment recognizes a partial decline in asset value, adjusting it to its recoverable amount without full removal.

Derecognition

Derecognition occurs when an impaired asset's carrying amount is written off because it no longer meets recognition criteria under accounting standards.

Non-current Assets

Impairment of non-current assets occurs when their recoverable amount falls below carrying value, requiring a reduction on the balance sheet, while a write-off completely removes the asset's value due to irrecoverable loss.

Accumulated Depreciation

Accumulated depreciation reflects the total asset depreciation over time, while impairment reduces an asset's book value due to decreased recoverable amount, and write-off removes the asset entirely from the balance sheet.

Provision for Loss

Provision for loss reflects anticipated impairment of assets based on estimated recoverable amounts, whereas write-off occurs when the asset's carrying value is fully derecognized due to permanent loss or uncollectibility. Impairment adjustments reduce asset value gradually through provisions, while write-offs represent definitive removal from the financial statements.

Amortization

Amortization systematically allocates intangible asset costs over time, while impairment recognizes a significant decline in asset value, and write-off completely removes the asset from the financial statements.

Residual Value

Residual value represents the estimated recoverable amount of an asset after its useful life, serving as a key factor in calculating depreciation and impairment losses. Impairment occurs when an asset's carrying amount exceeds its recoverable amount, while a write-off completely derecognizes the asset due to a residual value falling to zero or becoming insignificant.

impairment vs write-off Infographic

moneydif.com

moneydif.com